The Global Grain Game

The Snapshot

- The world is sitting on quite healthy stocks of wheat.

- However, if you start to delve into the data, we see that China holds large stockpiles.

- The worlds top exporters have the smallest stockpiles since 2007.

- The available wheat in the world is low.

- The stage is set for a strong market if there are production issues overseas next year.

The Detail

We didn’t cover this month WASDE report, as it was pretty much a fizzer. It’s only really worth covering when there are substantive changes, such as in August when there were major downward revisions (see here).

However, I thought it was probably time to have a look at the global wheat picture, as I haven’t published anything on that in a while.

Let’s start with the big picture – Global stocks

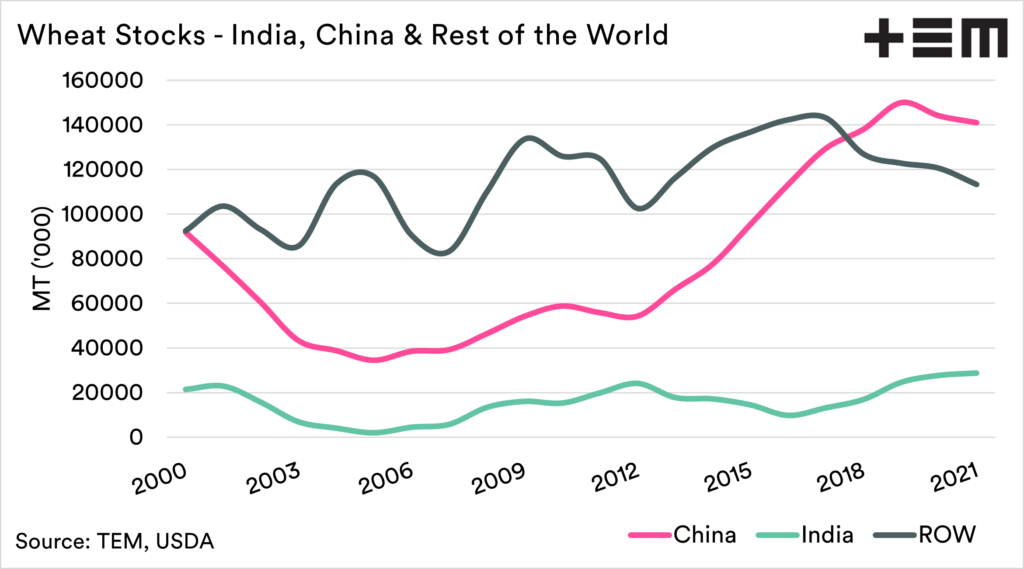

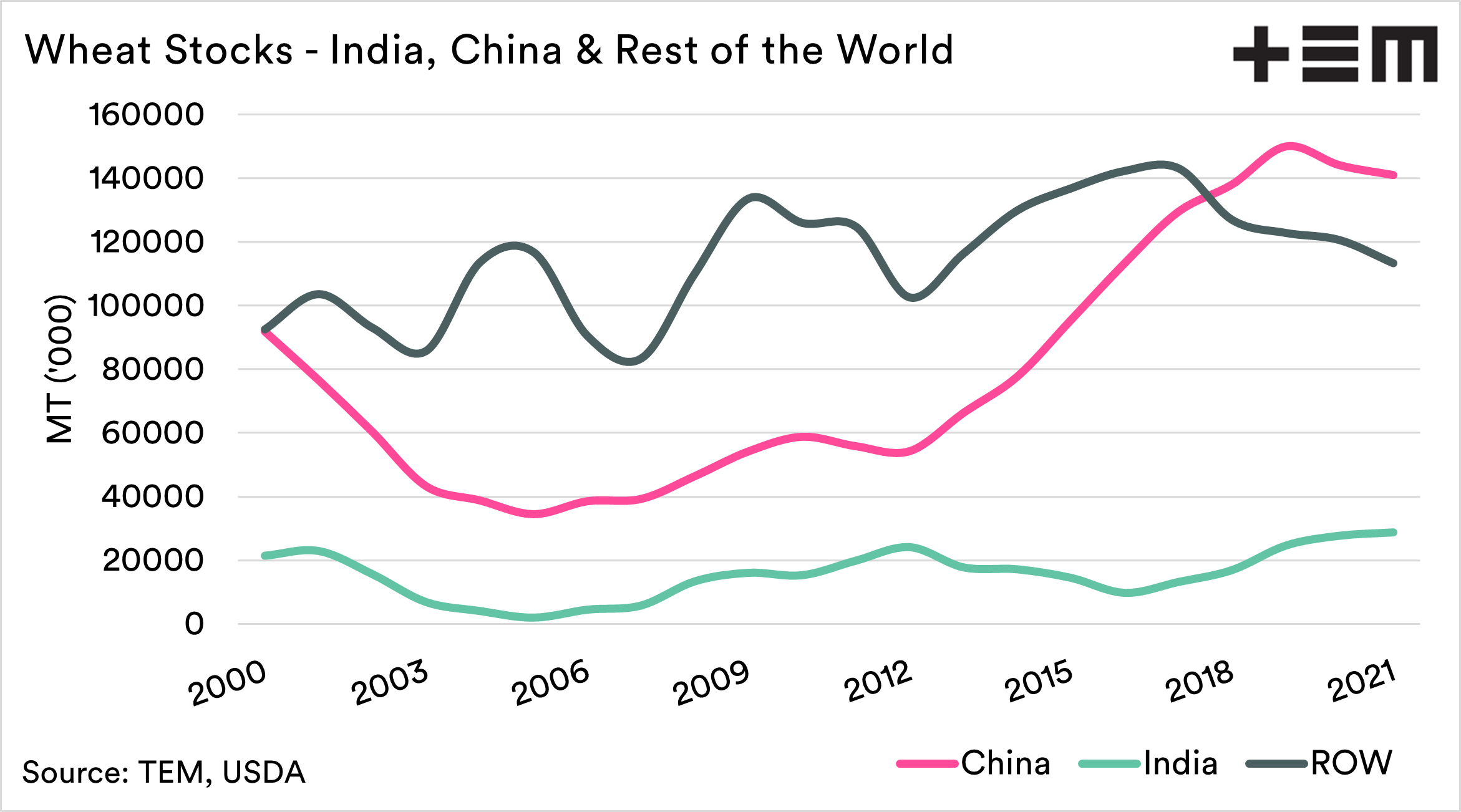

Global wheat stocks are an interesting picture that has to be delved into to get the full story.

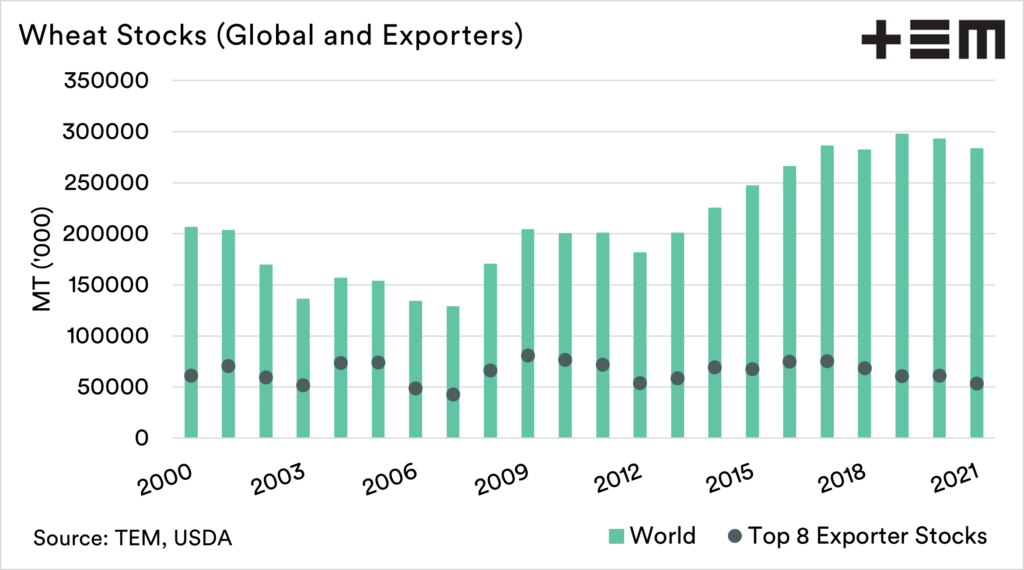

The chart below shows the global stocks of wheat. If we concentrate solely on the worldwide picture, then things look quite healthy and well supplied.

As an analyst, we always delve further into the data, and when analysing the global wheat picture, you have to take consideration of China (and India).

On paper, according to the USDA, China holds a vast stockpile of grain, I wrote about this back in March, in an article looking at how much of the world’s stockpile of various grains they are holding (see here).

If we exclude China and India from stocks, we can see that the rest of the world is sitting on the lowest stockpile of wheat since 2012. If we include China and India, we are sitting on the 4th largest stocks on record.

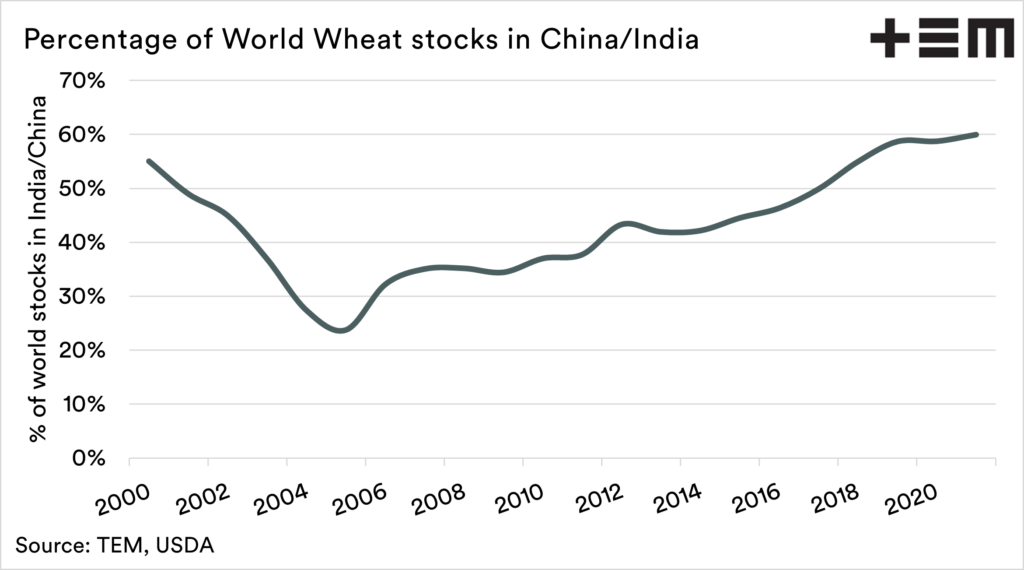

The volume of stocks held in China/India as a percentage of global stocks has been rising steadily since the mid-2000s.

At present, these two nations account for 60% of the global stockpile of wheat, according to USDA data. Do these stocks exist? More on that later.

India is a ‘sometimes’ exporter of wheat, but China is largely absent from export markets. By discounting these two nations, we get a much better indication of the available stocks to the world.

So what is available?

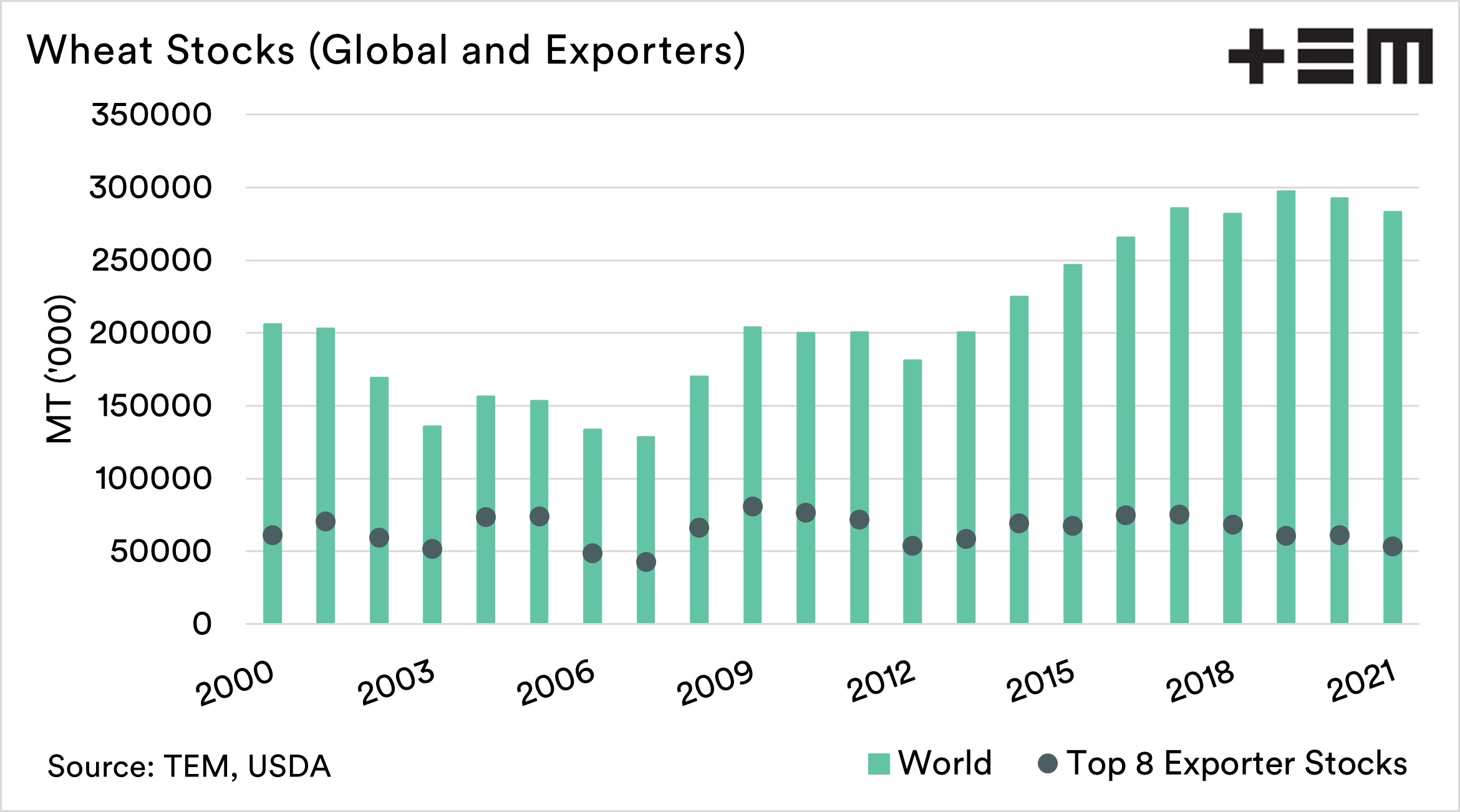

The chart below shows the global wheat stocks, and the dots show the end stocks of the top 8 exporters*

The world’s exporters are forecast to have end stocks of 53.1mmt. This is on a par with 2012, but is the lowest since 2007.

This shows that the world is quite tight when it comes to available stocks at the end of this year. If there are any major production issues in the coming season, the stage is quite well set for a strong performance.

*Argentina, Australia, Canada, EU, Kazakhstan, Russia, Ukraine & USA

Do the stocks in China exist?

If we ignore Chinese stocks, world supplies get a little bit tighter. One of the big questions is whether those stocks exist (and in what state if they do). Over the past year (and before), we have talked in depth about Chinese imports of grains.

Imports tend to increase for one of two reasons.

- Increasing demand: This tends to be quite linear and slow increases in demand over time. Demand doesn’t generally increase by huge amounts.

- Decreasing supply: This tends to be quicker. If a country has a supply issue (drought/flood etc), then imports have to increase in a very short period.

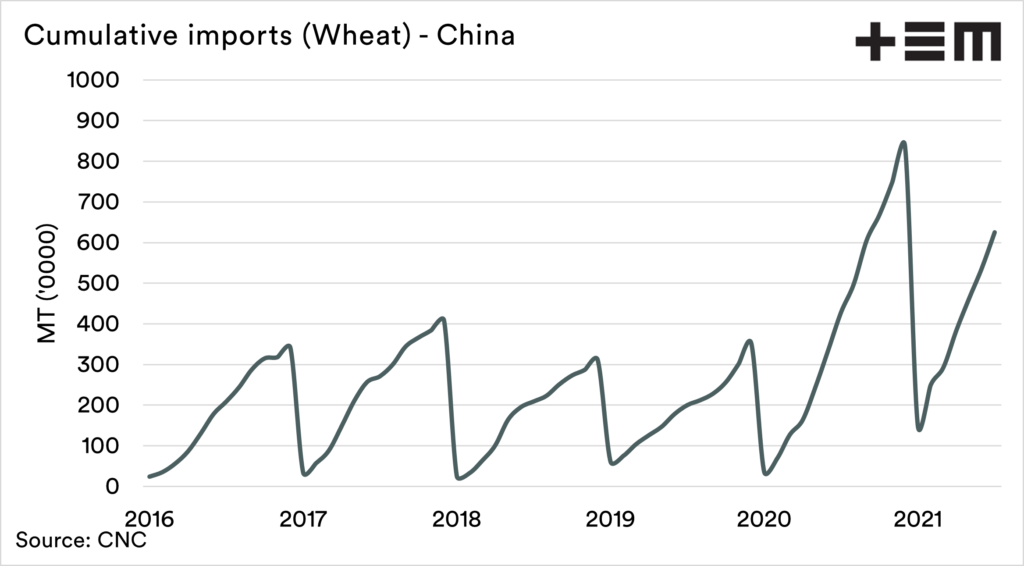

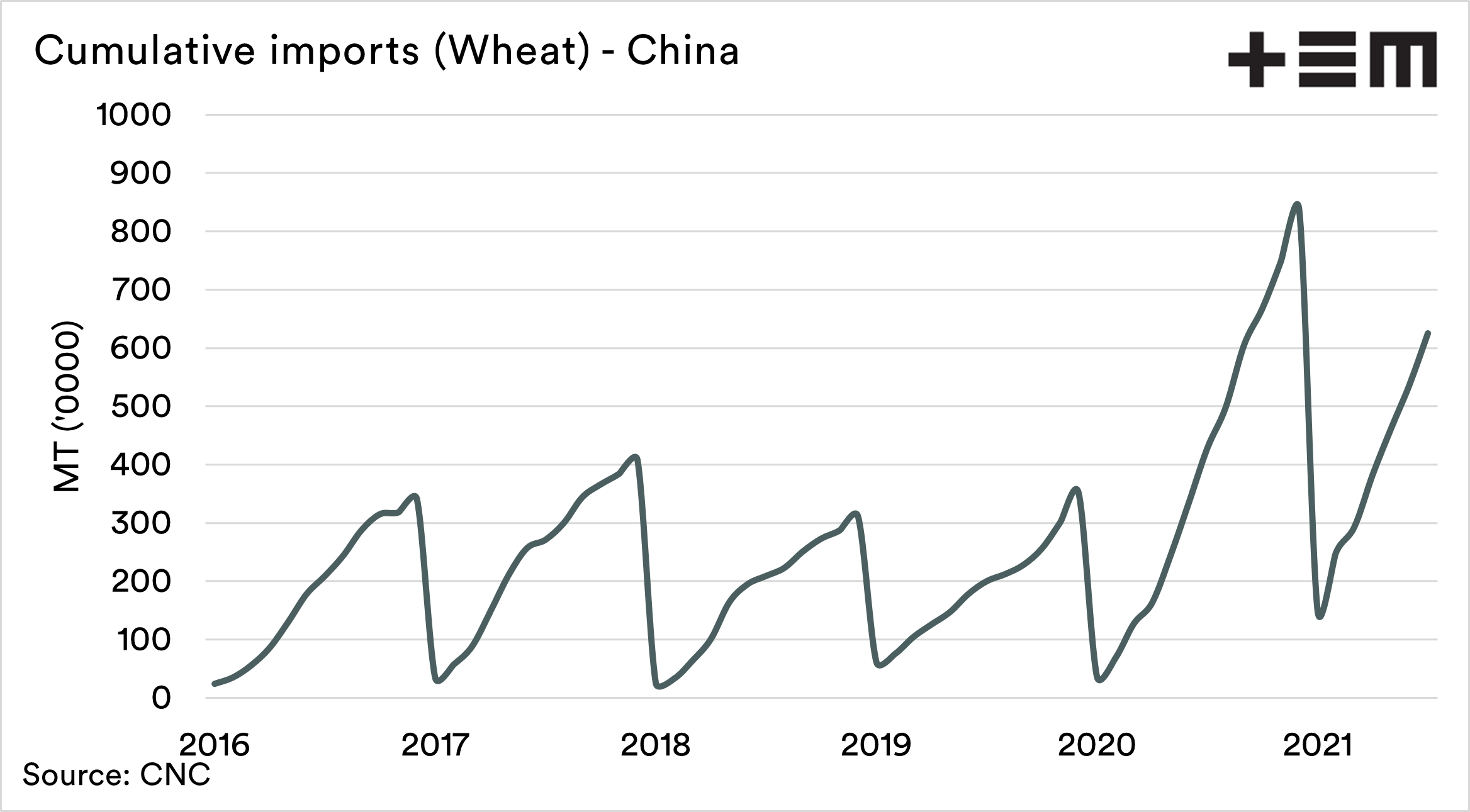

The chart below shows the cumulative monthly imports of wheat into China (all countries), and we can see that 2020 and 2021 have been strong.

Despite huge stocks of wheat (on paper), China has been importing in vast volumes. Will this continue into the future? Are the high imports a sign that the stocks are not there?

If they start decreasing their imports, that will have an impact on pricing, especially the barley market, if they reduce corn/barley imports.

If you liked reading this article and you haven’t already done so, make sure to sign up for the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.