The good news or the bad news?

The Snapshot

- Australia is set to rebound and will likely produce a top 3rd wheat crop.

- Basis levels are generally driven by supply

- In recent years consumers paid a handsome premium over futures levels in order to gain access to grain.

- This premium will be heavily eroded from previous years.

- Although basis levels are likely to be lower, we will continued to be influenced by moves offshore.

- For many, the high basis levels of recent years were irrelevant as they had nothing to sell, at least this year there will be volume.

The Detail

An analyst of markets must be objective when it comes to providing market intelligence. It is of no use for us to tell you what you want to hear; we provide what we view as facts. This sometimes means we have to give bad news. We have some bad news about basis.

Australia is on course to rebound from the recent years of drought, with all likelihood a top 3 finish for overall wheat production. This comes with a downside, prices will react to this supply, and it will be felt most on the basis levels received.

Read a quick explanation of basis here

A large proportion of domestic demand is largely inelastic, meaning that they cannot, in many cases, immediately reduce their intake. During the drought, consumers had to ensure that they had access to grain. They, therefore, paid premiums to avoid volume being exported. This caused basis to rise dramatically.

The rise in basis, or Australian premium was felt throughout the nation as a flow-on effect of the drought.

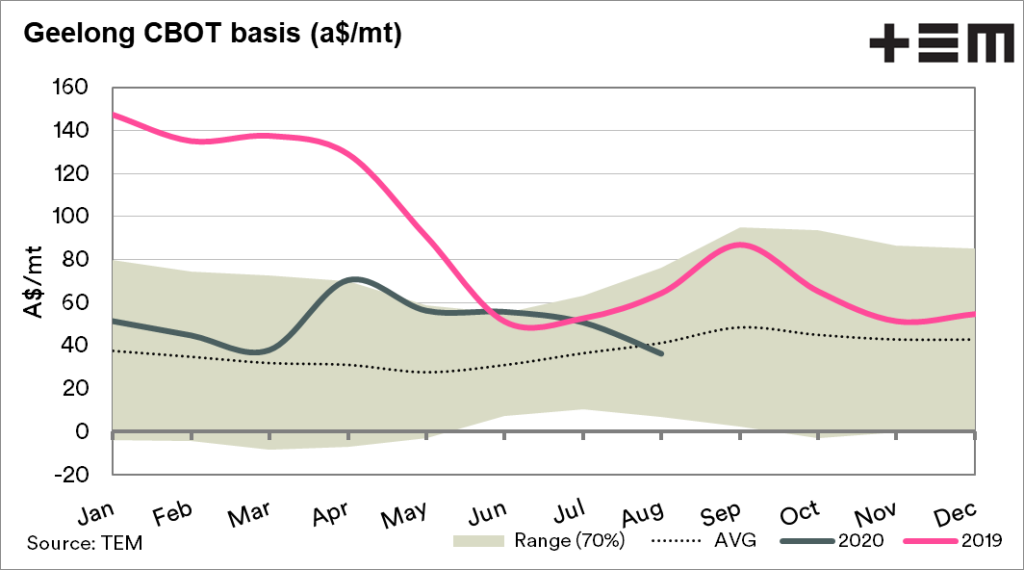

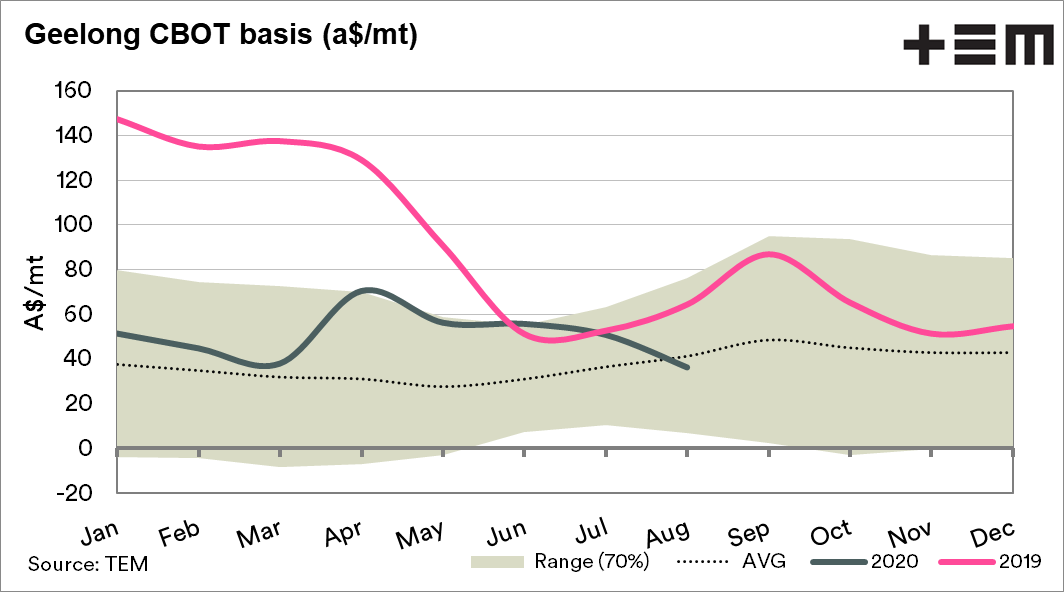

The chart below shows the seasonality of basis in Geelong. On average basis throughout the year is approx A$ 37 over Chicago.

Seasonally the basis level tends to increase during the latter half of the year. This makes logical sense, as if there are supply issues, then they will generally be evident to the market from August onwards. In recent years we saw basis levels rise to extraordinary levels.

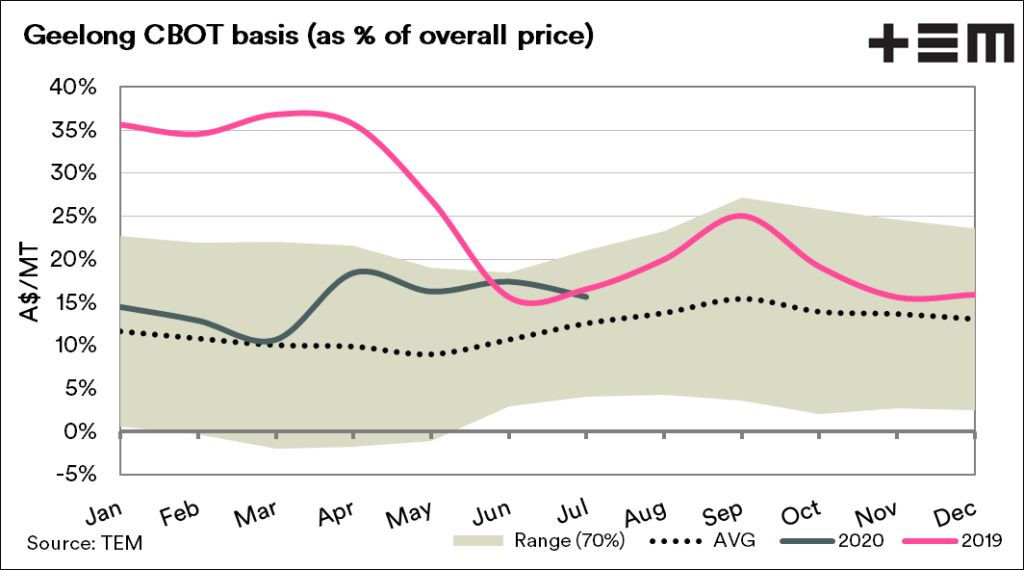

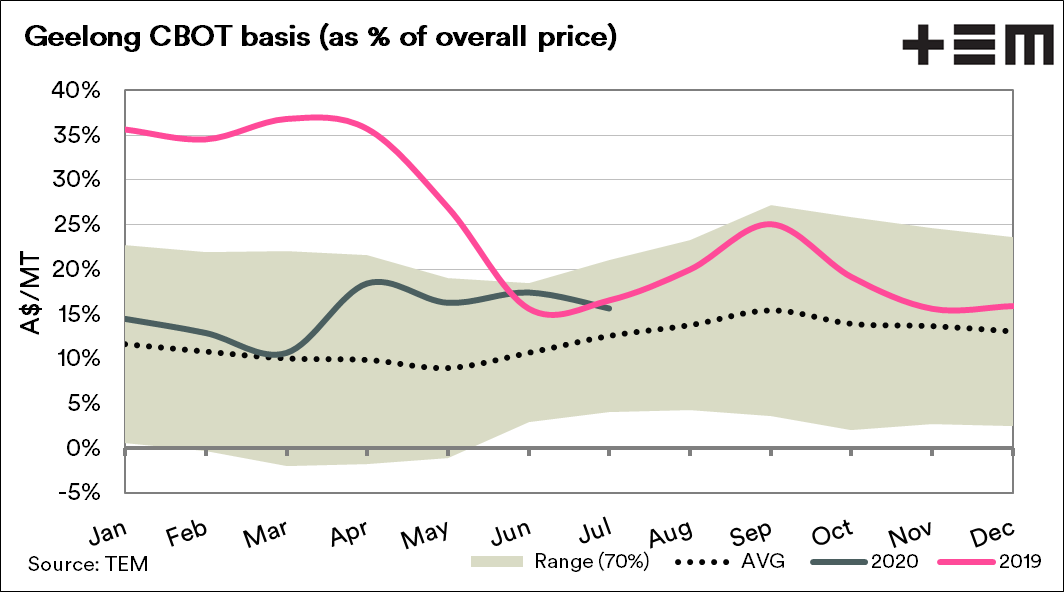

At EP3, we take data and examine it from many angles, to see what additional insights we can glean. One way to examine basis is through the A$/mt, but another is by looking at what percentage of the overall price is comprised of basis.

The chart below displays the percentage which basis makes up of the overall price. The basis level rose close to 40% of the overall price in 2018/19.

As supply increases the basis will become a less critical component of the price received. The premiums of recent years will likely be gone, and what happens overseas will influence our price more heavily.

Although prices are liable to be lower, unless we see significant movement offshore, we will at least have more volume to sell.