The real price of wheat

The Snapshot

- Wheat prices are high in nominal terms, that is, without taking into account inflation.

- A dollar in 1960 is worth more than a dollar today.

- When we take into account inflation, a picture of declining prices emerges.

- Farmers have become far more efficient and produce more per hectare, which has allowed them to stay ahead of the degradation of real pricing.

The Detail

There is a lot of debate about grain prices at present (see here and here). They are strong but not strong. We have been discussing our discount to both futures and overseas physical prices for some time. How do they compare to the past?

The new CPI figures were released, and this allows us to look back at the price of various agricultural commodities to see how they compare to the past. Therefore, we can give a better view to see the performance of our pricing.

When examining long term pricing, it is important to take into account inflation. A dollar in 1960 is worth more than a dollar today. Prices which do not take into account inflation are termed ‘nominal’, and prices with inflation ‘real’.

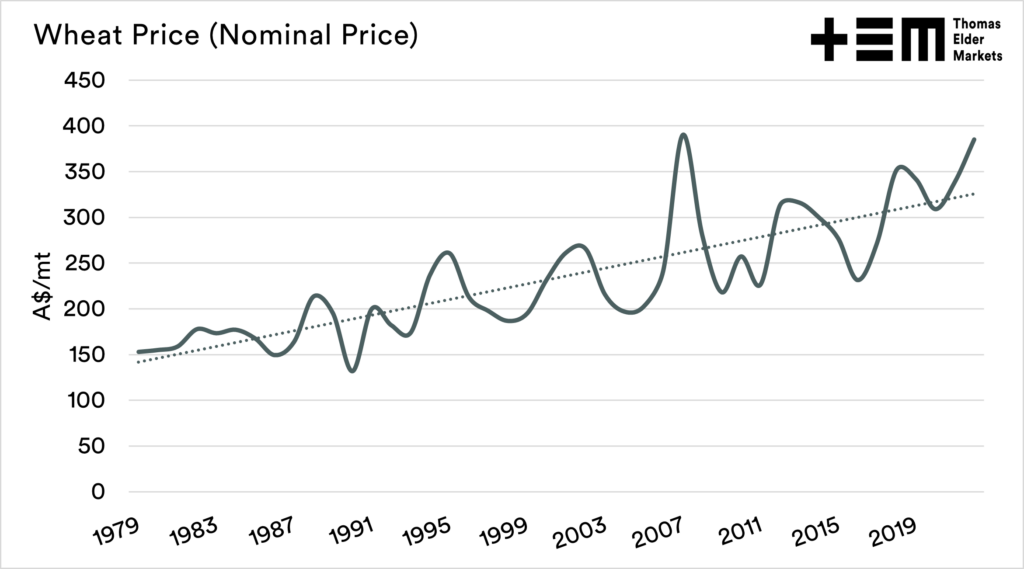

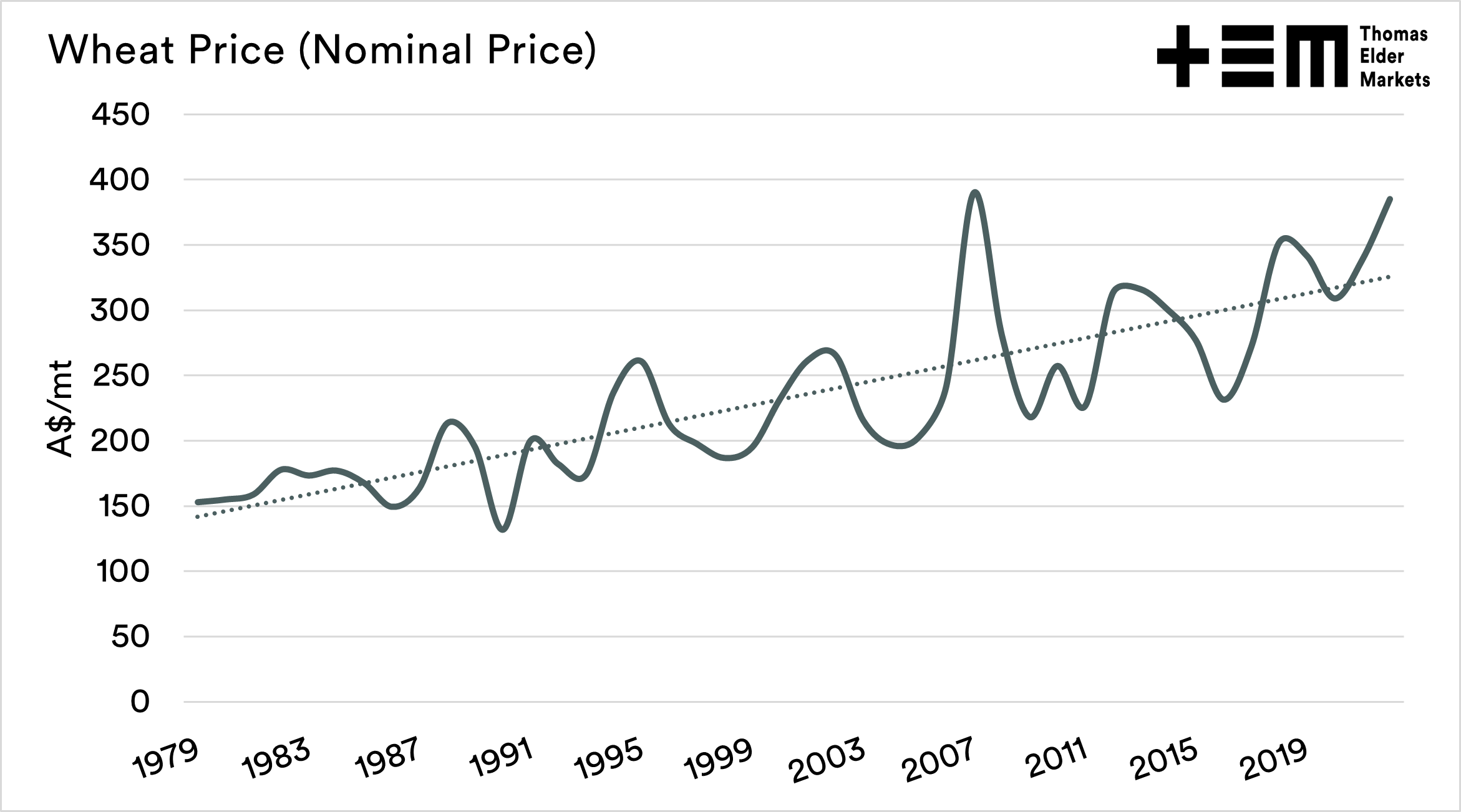

The chart above shows the wheat price on an annual basis from 1979 to the present. At first glance it looks quite good. Prices have been trending higher over the decades. In 1979 farmers were paid around A$150/mt, and this year we are averaging A$385.

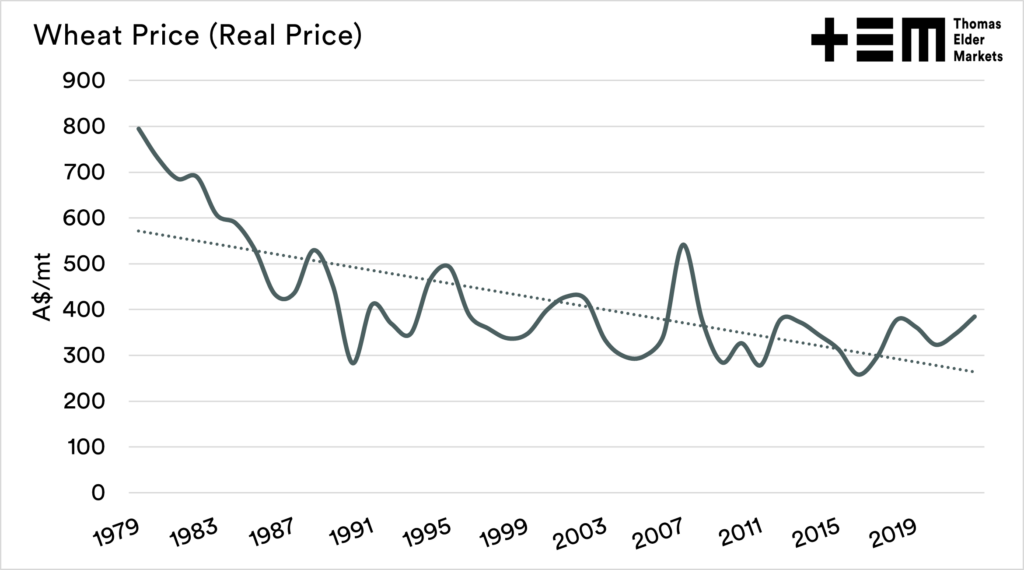

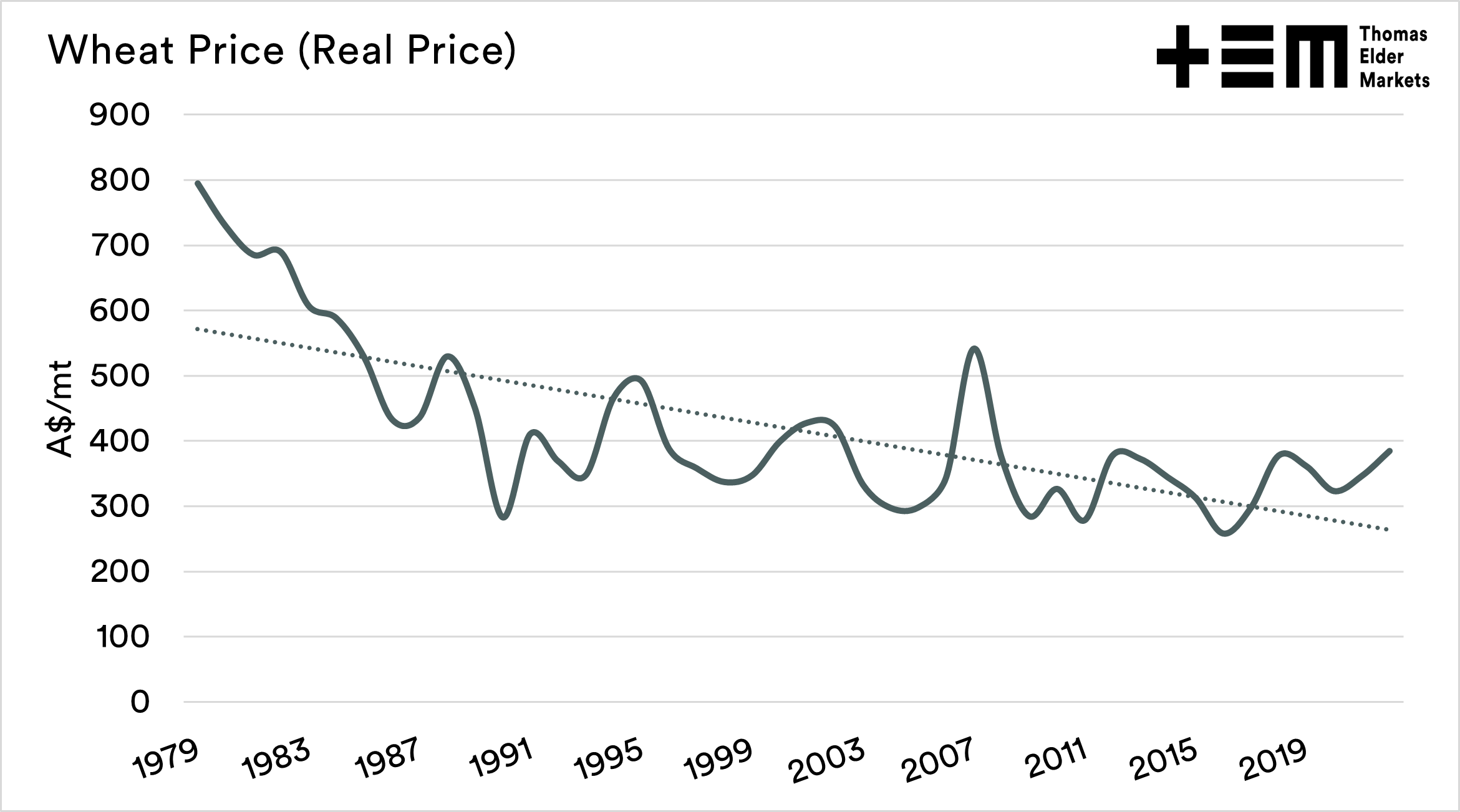

Although the picture is very different when we take into account inflation.

Although it will probably not come as a surprise to many, grain prices in real terms have been in a downward trend over the period 1979 to present.

In real terms, we do not make as much per tonne of wheat that we produce. One of the reasons for this is that farmers have become far more productive. We produce more per hectare, in a piece last year, we discussed this in relation to the purchase of a Hilux (see here).

In recent decades it has taken the same number of hectares to purchase a Hilux, despite the price of a Hilux increasing at a greater rate than grain pricing.

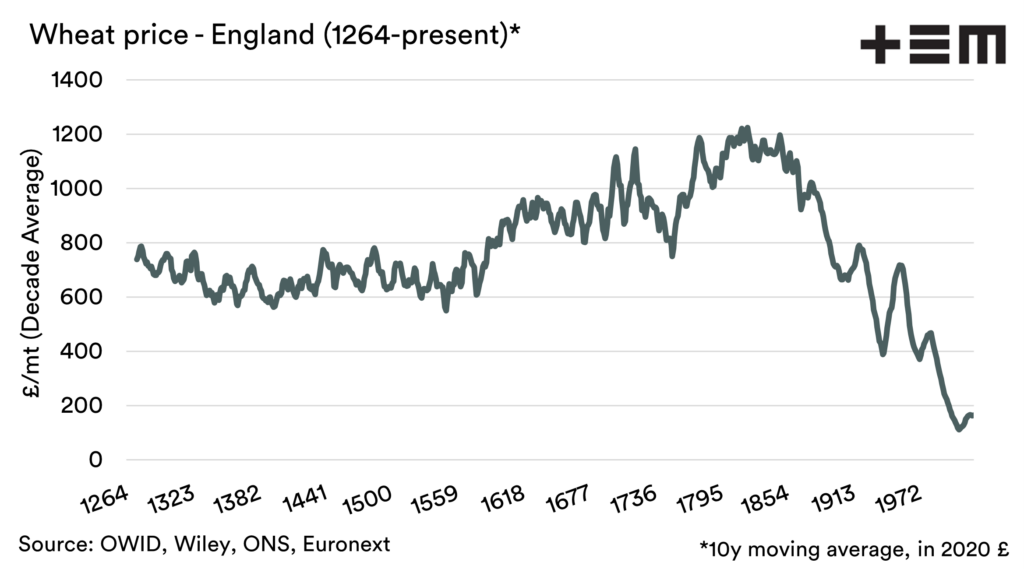

This is not necessarily a new phenomenon. Since the industrial revolution and the opening up of vast acreages of the ‘new world’, a declining wheat price environment when taking into account inflation has been evident.

The good point is that pricing on an ultra long term basis has been improving since the lows. So maybe that is a good long term indicator for the coming century?

Last year we also conducted a similar analysis of fertilizer pricing since the 1960s, which can be read here.

The summary is that our productivity gains have curtailed our price gains.