The good old days of fertiliser pricing.

The Snapshot

- When examining long term pricing data, it is important to consider inflation.

- Global fertiliser prices are getting high in current (nominal) dollars.

- When we take into account inflation, the 1973/4 period was the record by a long shot.

- During this period, there was a huge increase in the energy prices caused by OPEC embargoes.

- The current wheat price is at the low end of the scale when inflation is taken into account.

- Farmers are going to be paying a lot for fertiliser in at least the next six months, but its nowhere near as bad as the extent of the fertiliser pricing in 1973/74

The Detail

The fertiliser price has driven through the roof in recent times. I thought it was time to find a positive, however small, on the fertiliser market. Are things the worst they have ever been?

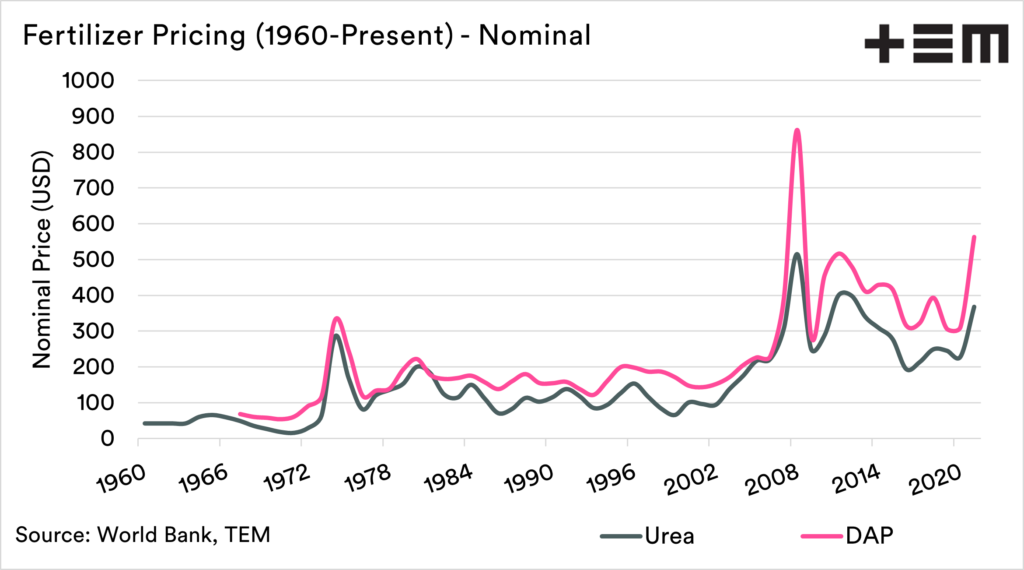

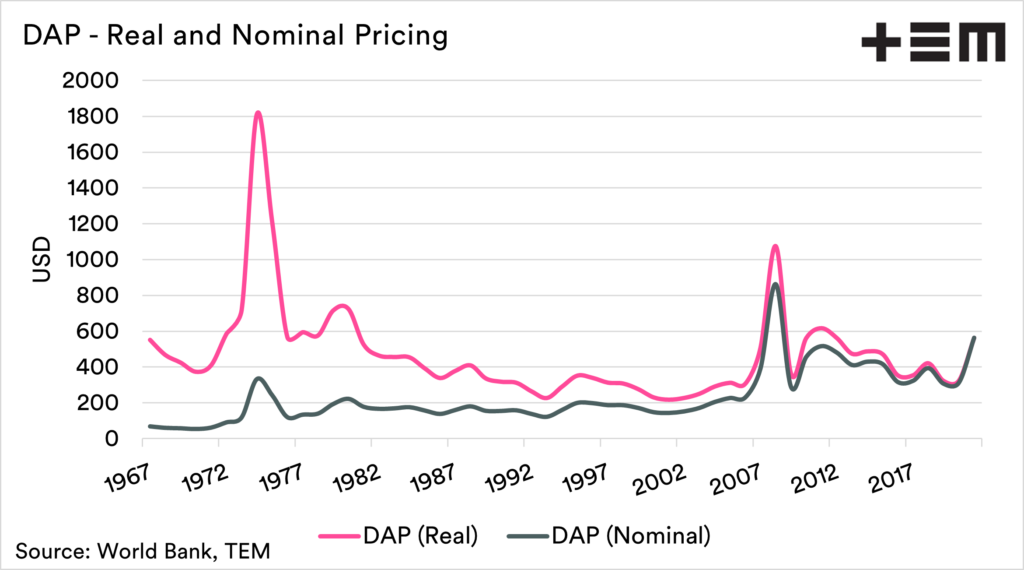

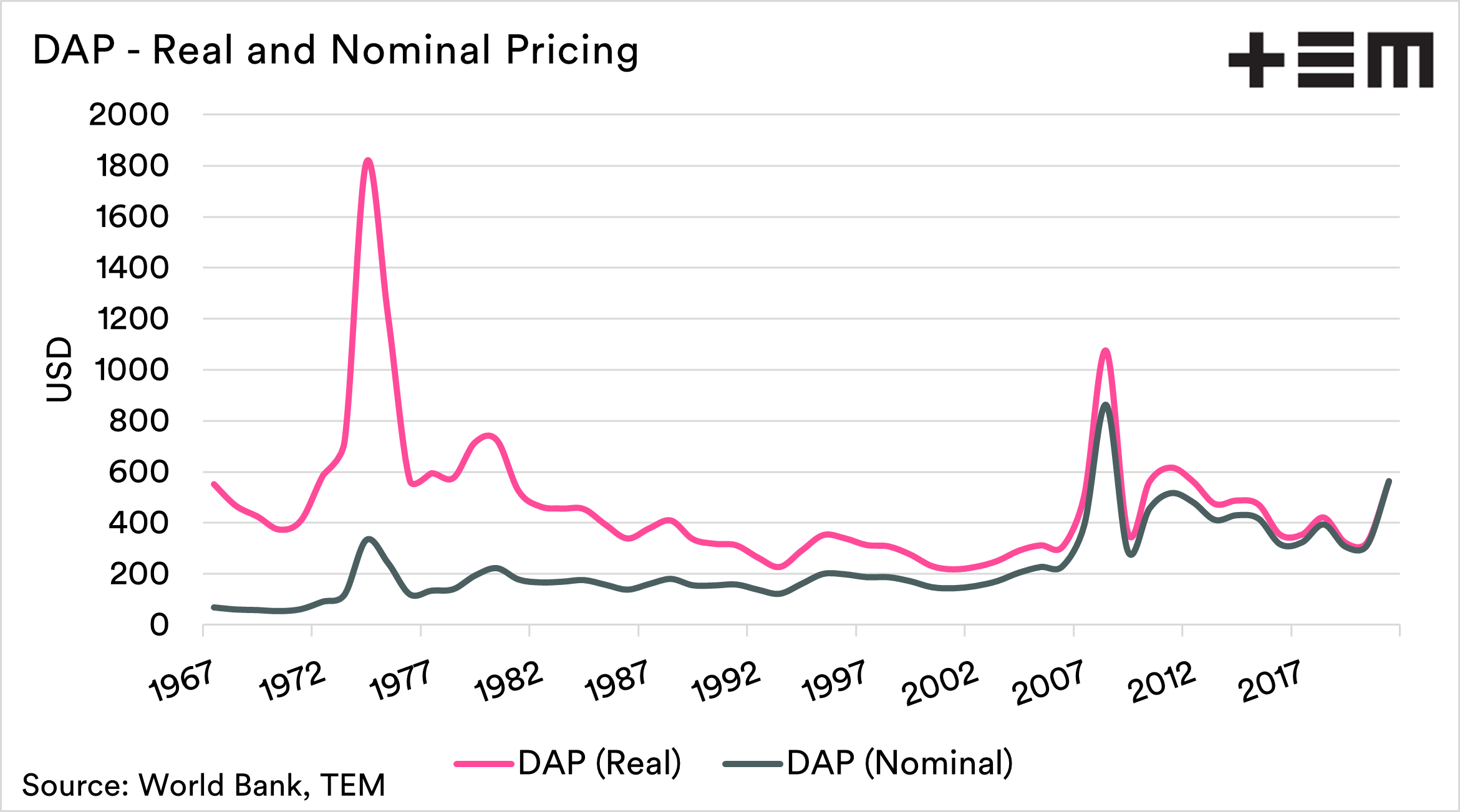

The first chart below shows the nominal price of fertiliser from the 1960s to the present. This is annualised data and shows that fertiliser pricing is starting to head towards the heady prices of the mid-2000s. This data doesn’t take into account inflation.

A subscriber asked us to have a look at the long term pricing, but with taking inflation into account. So let’s get into it and see what difference it makes.

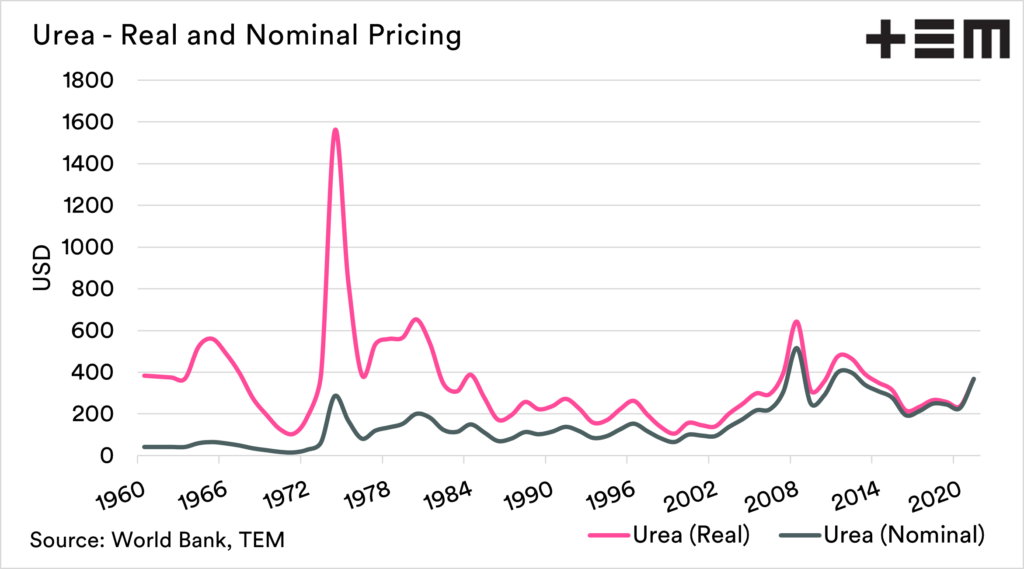

When looking at really long datasets, it is worthwhile deflating them to take into account inflation. A dollar spent in 1960 is worth more than a dollar in 2021.

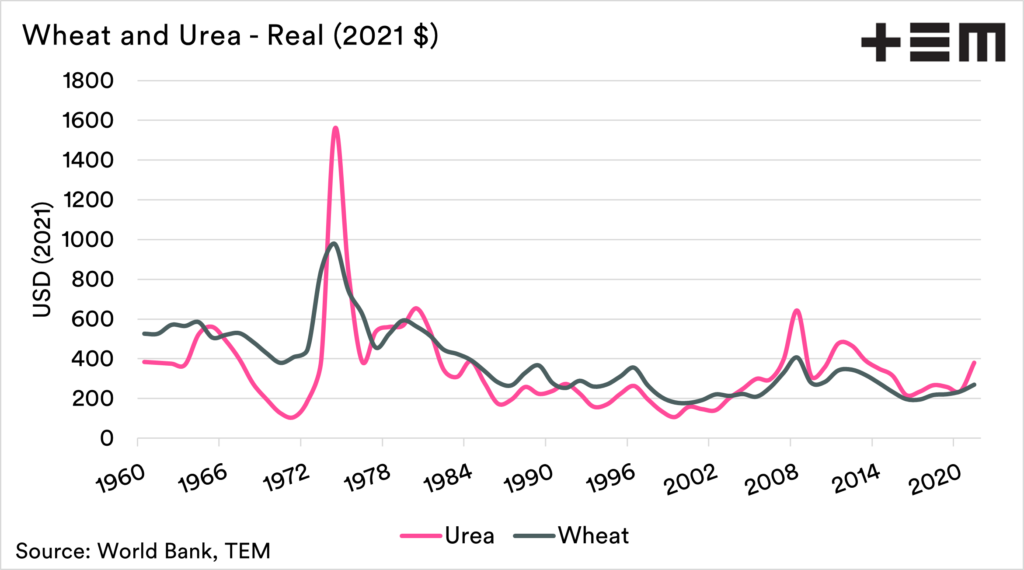

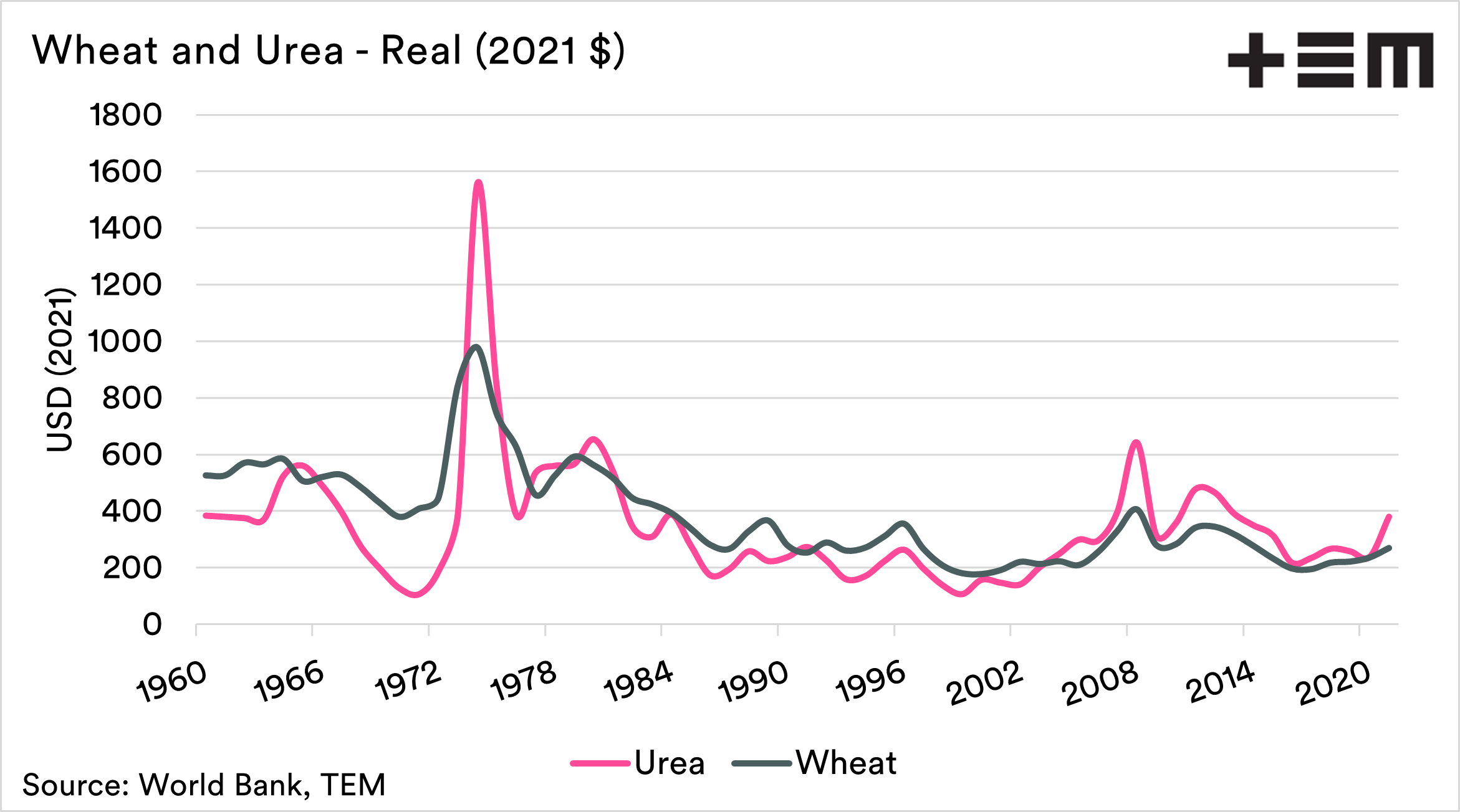

The charts below show the real and nominal prices for Urea and DAP since 1960. As mentioned previously, these values are starting to ride up.

However, if we look at the values taking into account inflation, we can see that even the 2008 rise is nowhere near the same levels which were experienced in 1974. What drove prices to those levels in 1974?

Another energy crisis

We have covered in great depth what is causing the current fertiliser woes (see here, here & here). The primary reason is the current energy crisis.

Energy was the primary driver during the largest rise in fertiliser pricing during 1977. Whilst I personally was only a twinkle in my father’s eye during this period, it was a time of great upheaval in energy costs.

The 1973 oil crisis resulted from an embargo by OPEC on nations that had supported Israel in the Yom Kippur war.

Fertiliser is produced through energy-intensive processes. A supply shock and increasing energy cost caused fertiliser prices to go rampant.

At the moment, we are nowhere near facing the same level of energy issues as the world experienced during 1973.

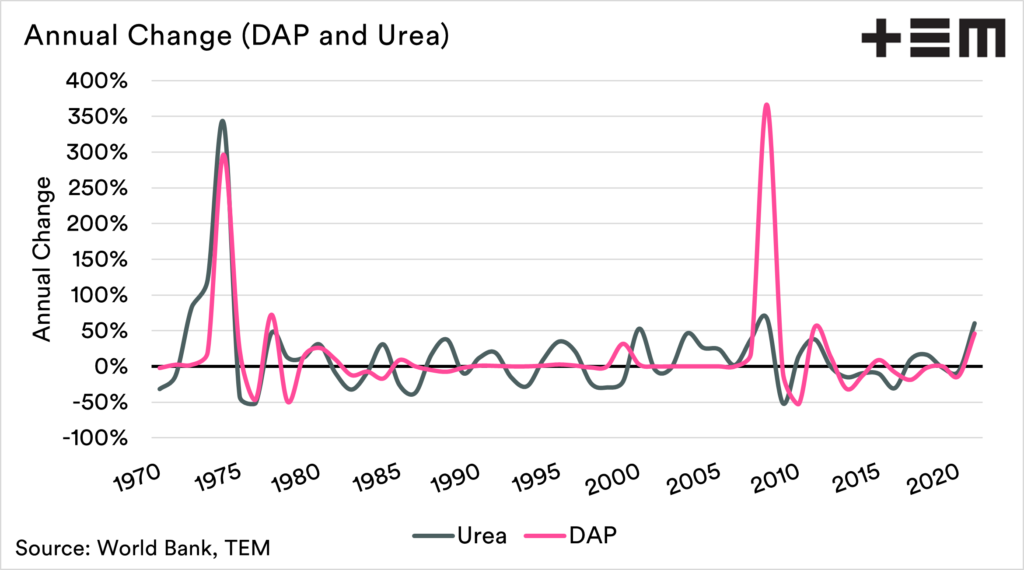

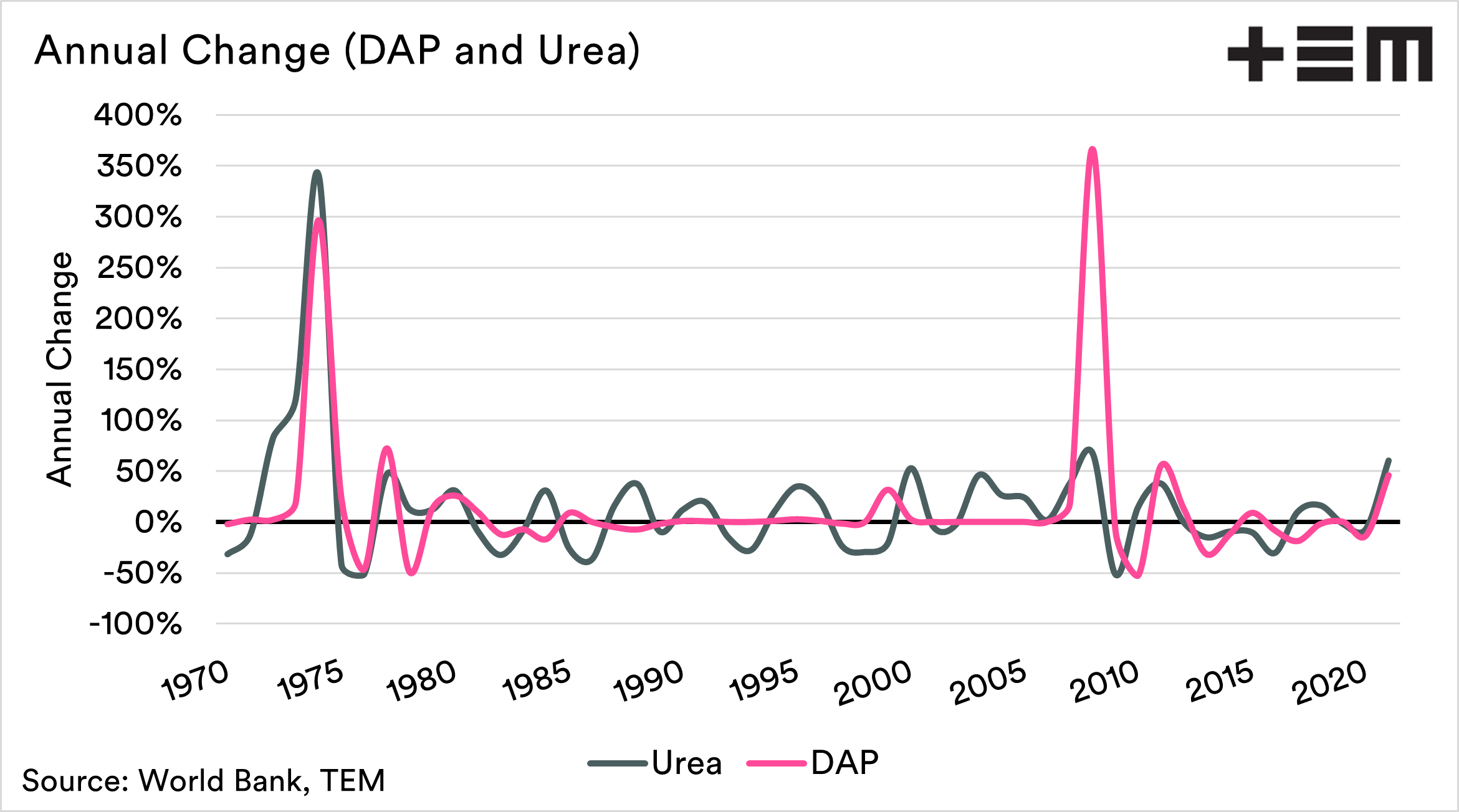

The chart below shows the annual change in fertiliser pricing for DAP and Urea is shown in the chart below. It is important to note that the pricing data used is the annual average. We will see the value for 2021 increase as the pricing continues to remain high.

The high prices that we experience this year will hurt farmers, but in real terms, they aren’t yet as high on an annual basis as in the past. All this doesn’t really help the fact that in nominal terms, prices are still high.

If we look at wheat as an example (below), pricing levels in real terms are not far off the lowest since the early 60s. It is going to be a tough time on the fertiliser front, but just imagine how bad it would be if the situation was as bad as the early 1970s.

My big concern at the moment is not for the short term. Prices will revert back to normal (hopefully) in the goodness of time.

My major concern is about the transition to renewables. While I support clean energy sources, the transition to renewables has to be conducted with a planned approach. Currently, the world is a long way off being prepared to switch off coal and gas. If we switched to 100% renewables too quickly, then we could expect higher fertiliser pricing. I spoke briefly about this to our friends at The Weekly Times last week (see here).

If you liked reading this article and you haven’t already done so, make sure to sign up for the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.