The two-year review of the Chinese ‘Ban’ on Aussie Barley

The Snapshot

- The effective ban on Australian barley to China is now 2 years old.

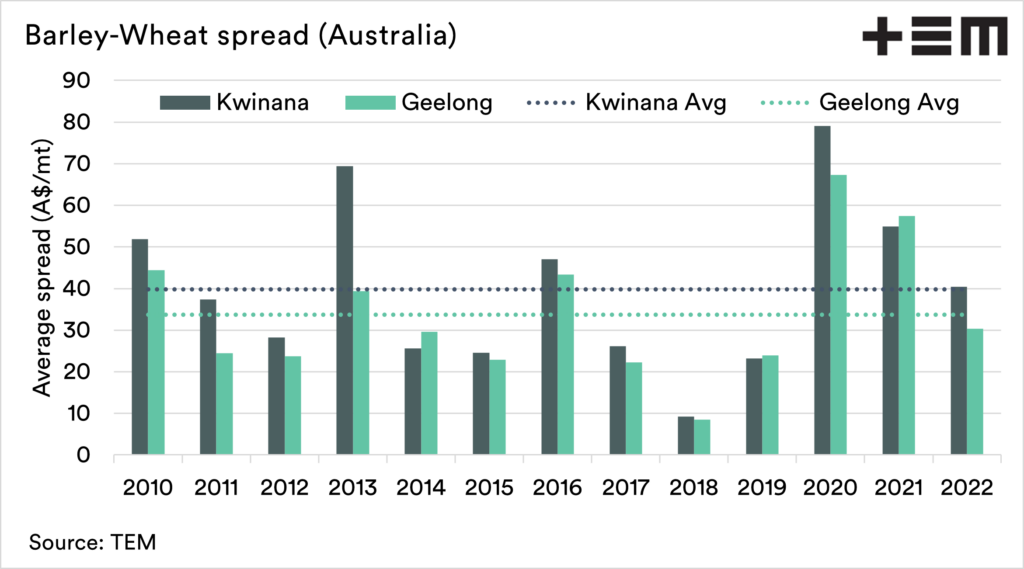

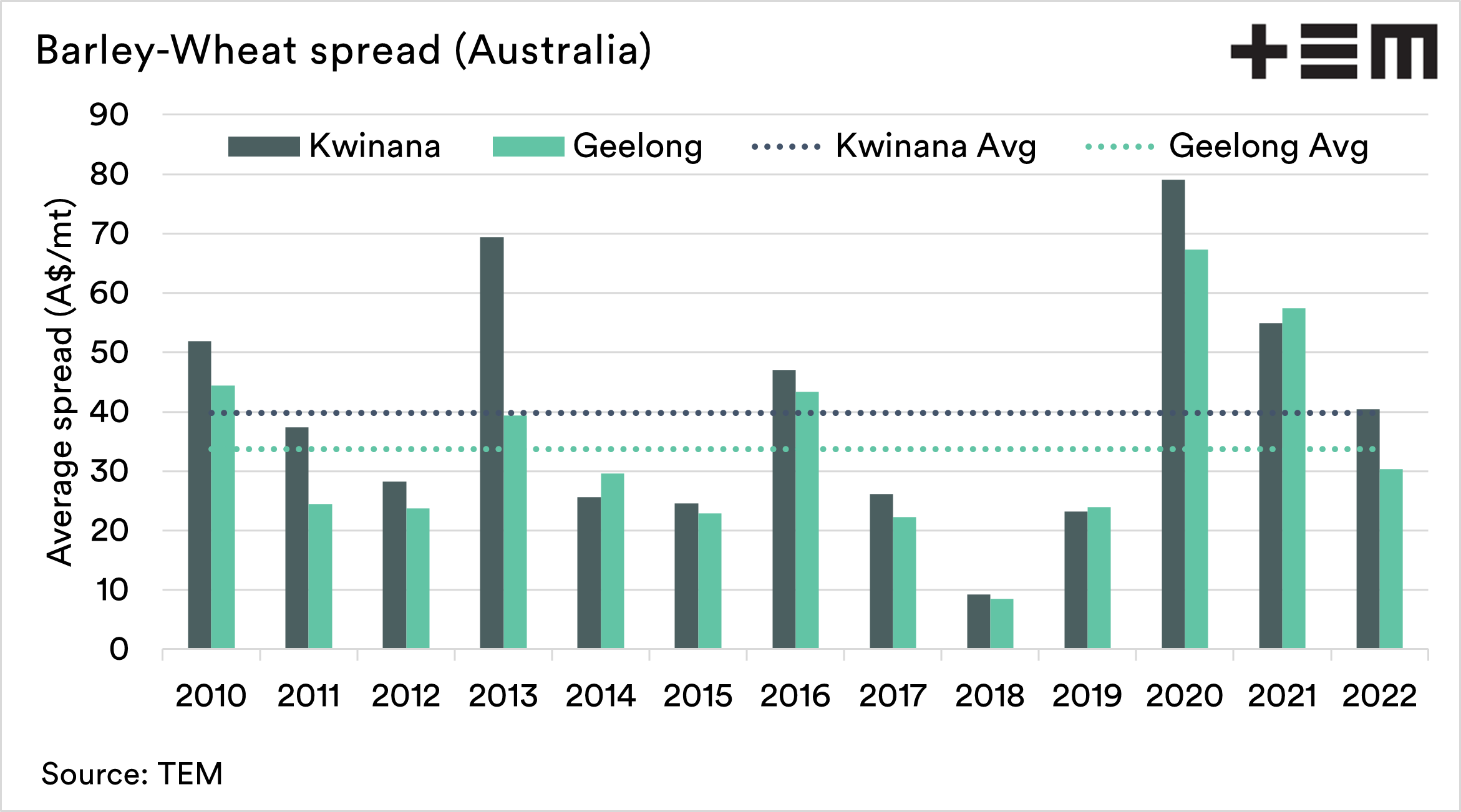

- Barley rose to a large discount against wheat but fallen back to average levels in recent months.

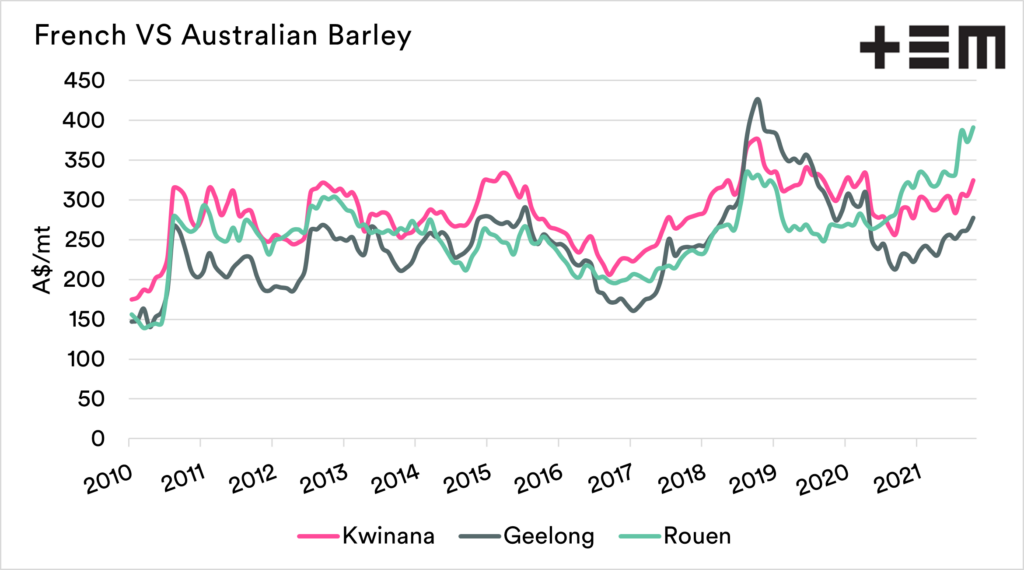

- Australian barley remains heavily discounted to France.

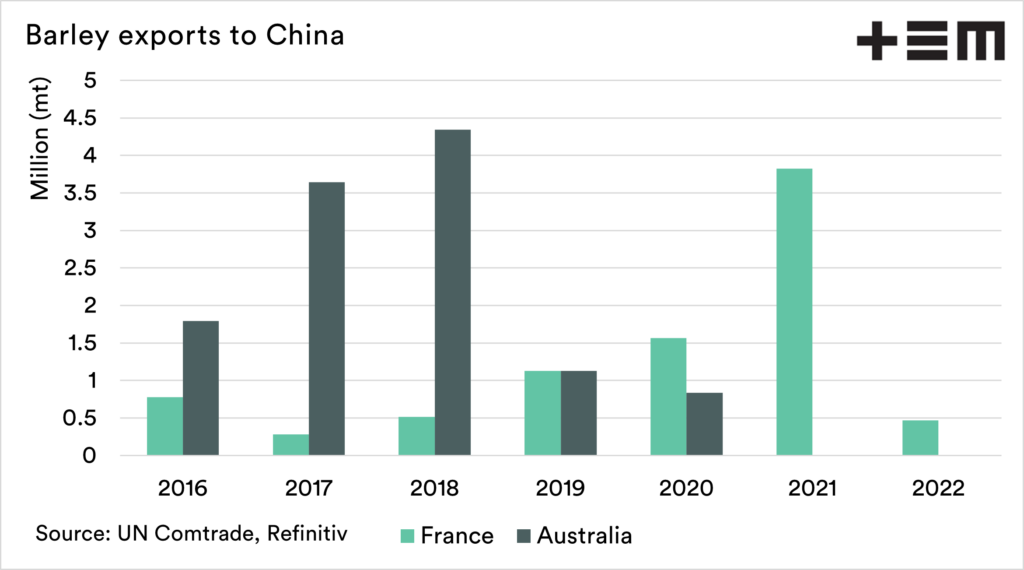

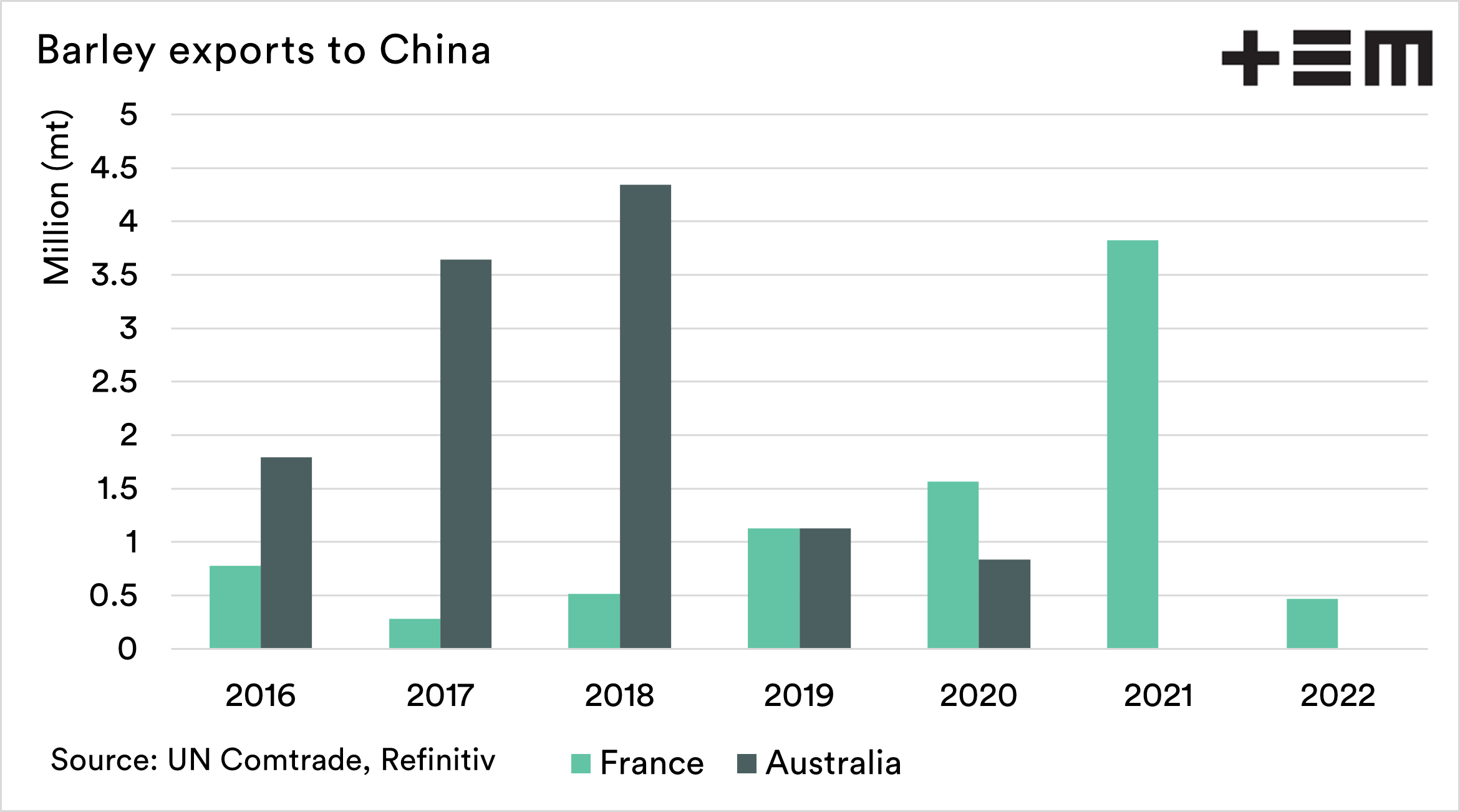

- France has won larger volumes of trade with China.

- Australian barley exports have won more volume into other countries.

- China continues to import large volumes of barley, just not from Australia.

- Prices in Australia for barley are historically high, however, are lower than if China had been in our market.

The Detail

It is now more than two years since China placed a tariff on Australian barley, which effectively closed off our trade with the middle kingdom.

We are now more than 2/5’s of the way through the tariff. It’s probably time to take a look at the situation.

Australian barley vs wheat.

The first factor to examine is the spread between wheat and barley. Typically the barley will trade at a discount to wheat.

The reason for this discount is that wheat is considered nutritionally superior when it comes to feeding. In 2020, the barley discount rose to its highest level at the time of the tariff introduction. It remained at a large discount until recent months.

The discount has remained well above the long term average until recent months. A significant part of this larger discount is attributable to the lack of one of the world’s largest barley markets.

Australian vs French Barley

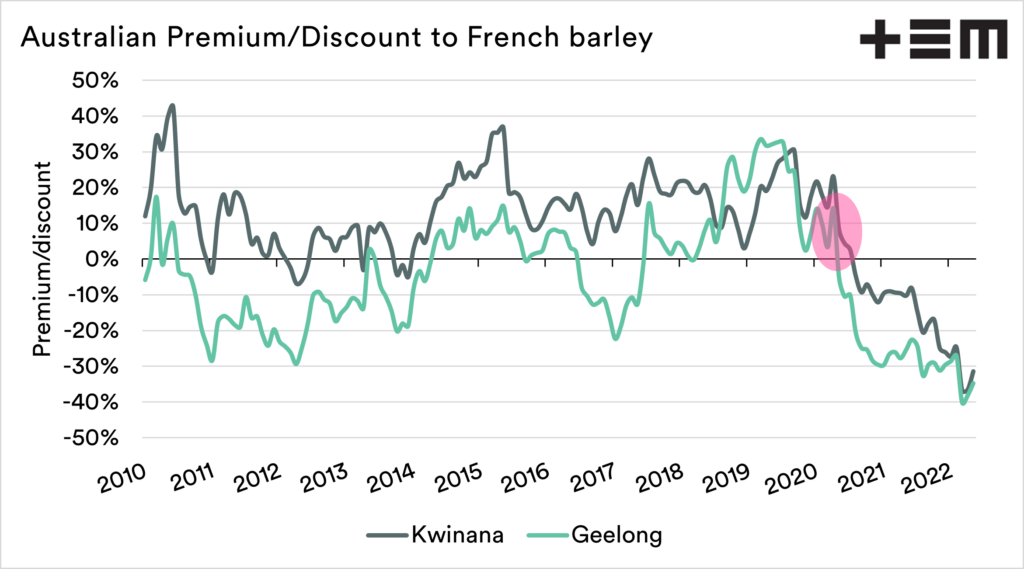

France was one of the main beneficiaries of the effective ban on Australian exports. In 2020/2021, larger volumes of barley flowed from France to China than would be the case if Australia was still in the mix. This is shown in the first chart below.

The second chart below shows the premium/discount between Australian and French barley. I have highlighted when the tariff on Australian barley was introduced. The discount increased from this point onwards and remained large.

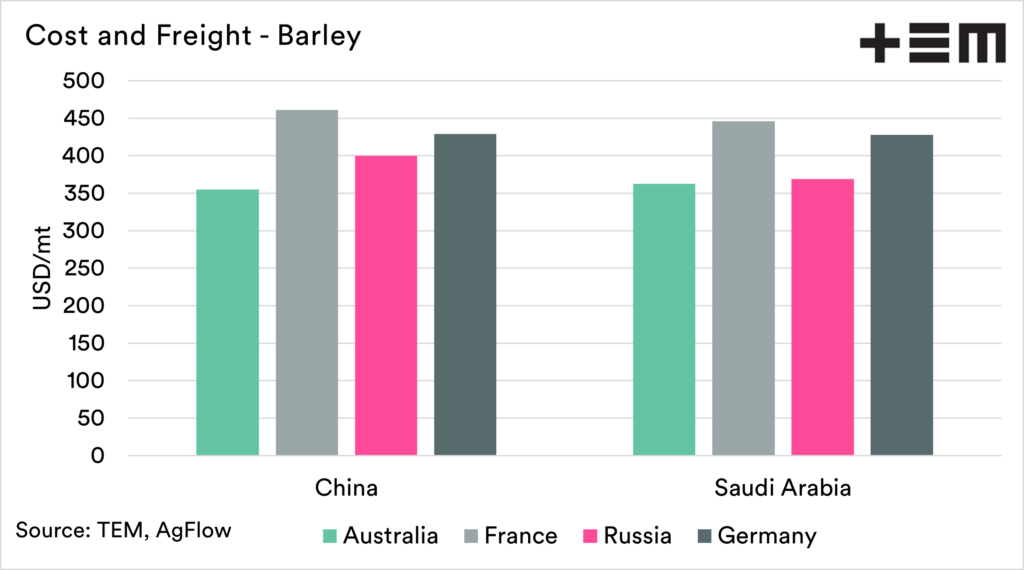

The third chart below shows the cost and freight for barley into the two major largest barley buyers. This data is provided through our partnership with AgFlow.

The purpose is to give an indication of the cost of sending barley from origin to destination. In the case of Australia, we have used a modelled price of the grower bid converted to destination. As we can see, we are largely behind the major origins.

Where is our barley going?

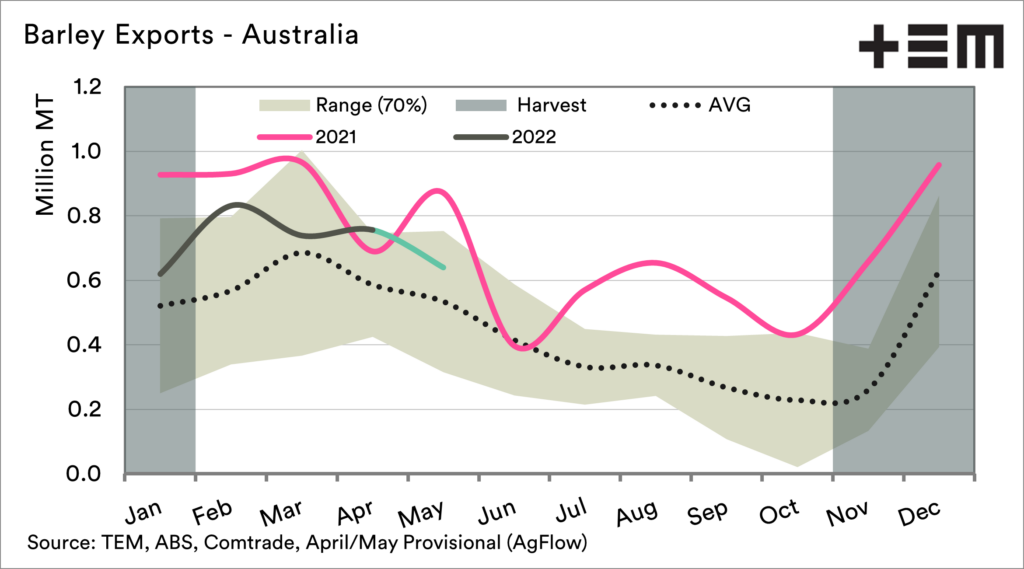

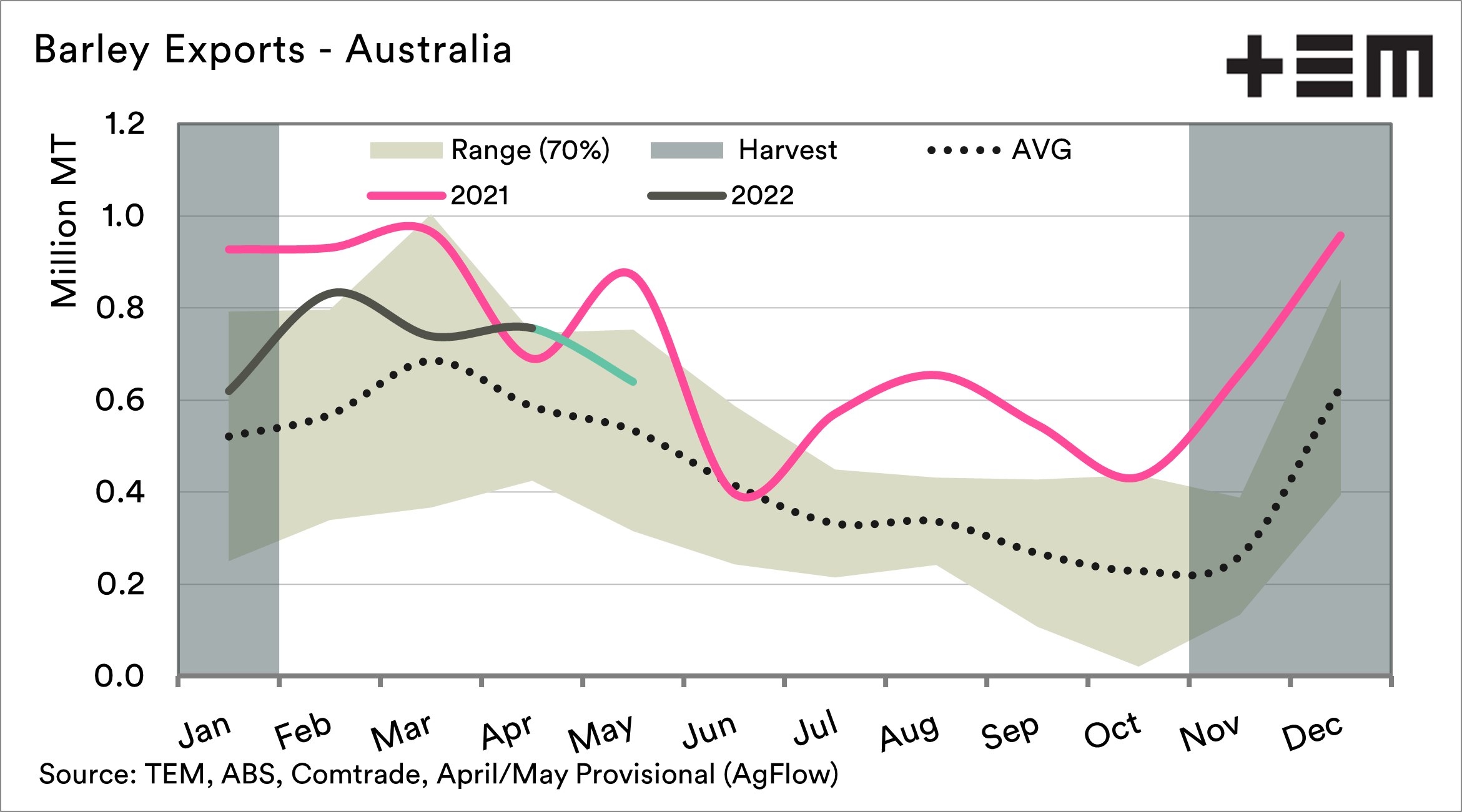

Australia has clearly still been exporting large volumes of barley over the past two years. So far this season, volumes on barley have been lower than 2021.

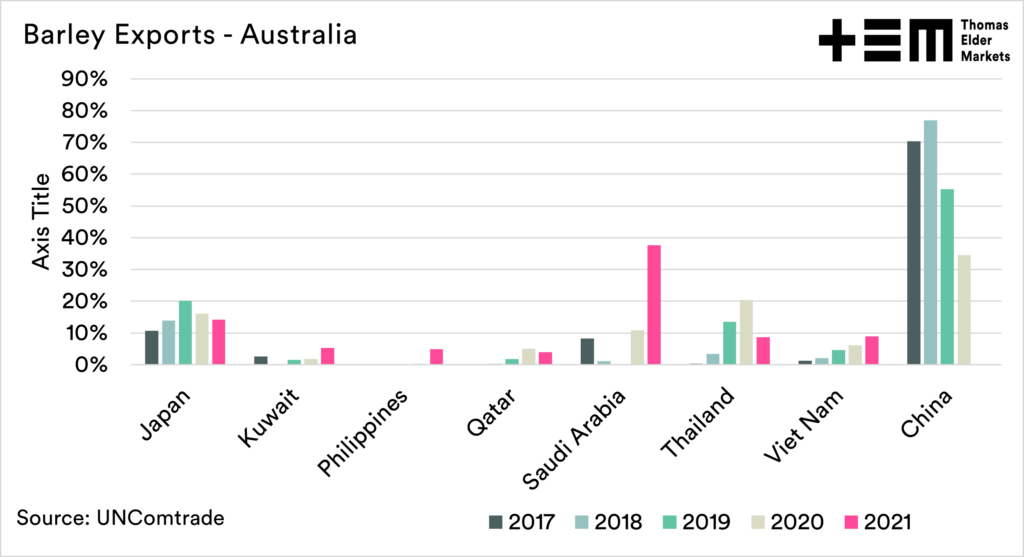

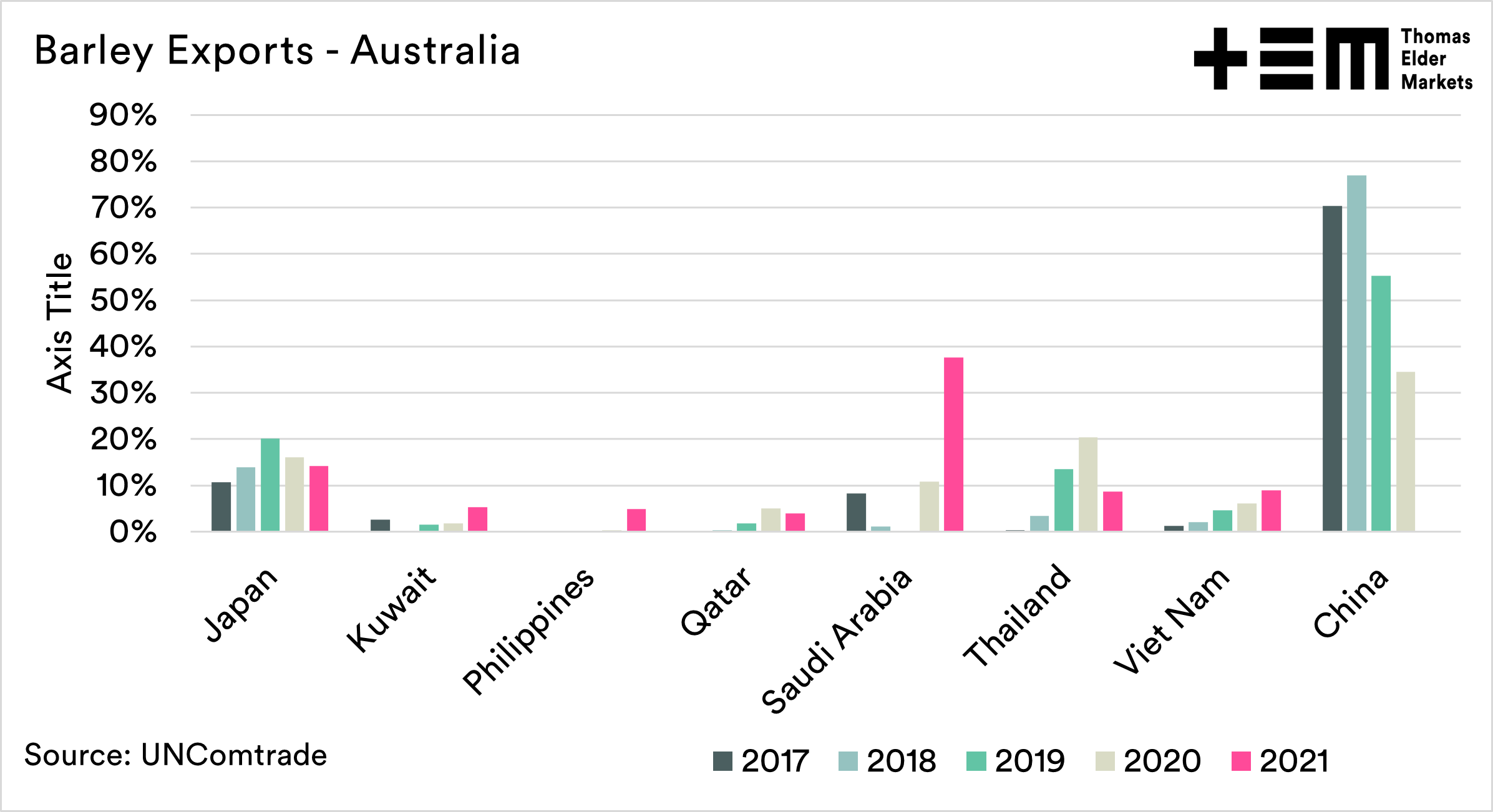

Who is buying our barley? The second chart below shows which percentage of our barley has headed to each country. These countries make up the majority of our export program.

Australia’s notable win was our exports to Saudi Arabia, rising to first place. Vietnam has also been on a steady rise, from just over 1% of exports in 2017 to 9%.

The silver lining of the removal of China has been a slight diversification of our barley export markets. However, I will put A$50 down that within a year or two of China’s door being open; they will be the vast majority of our barley trade again.

What has China been doing?

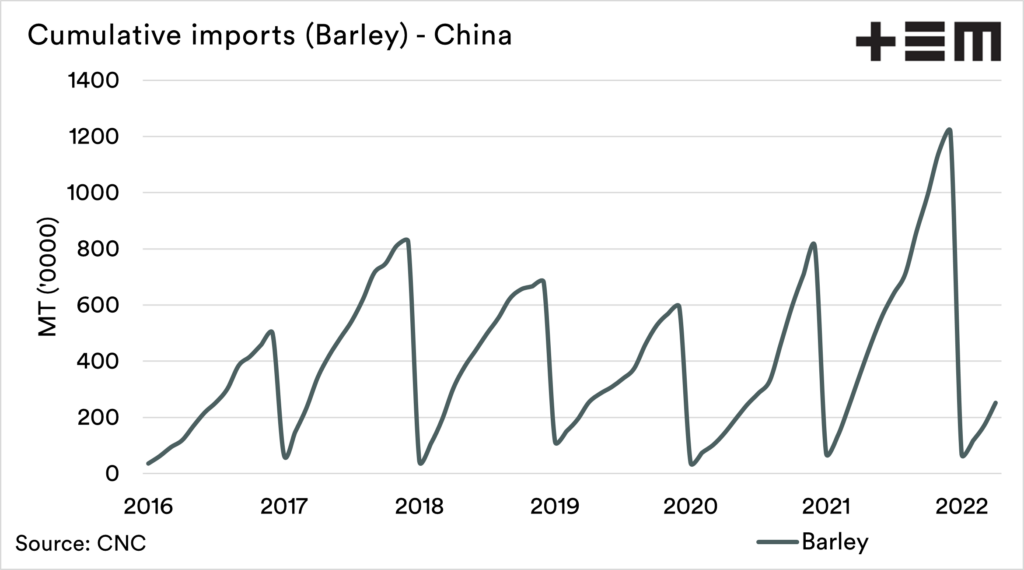

Australia is one of the biggest exporters of barley, but losing access to us hasn’t stopped them from importing. Their import program in 2021 was record large. In recent years, they have been hoovering up large volumes of all grains (see here), and the question remains how long this program of imports will last.

China has limited access to barley due to the black sea conflict. They are cutting their nose to spite their face more so than ever.

It would be in the best interest of the Chinese consumer to accept Australian barley.

The review

All in all, the effective ban on Australian barley has been damaging. It has not been business as usual.

In Australia, we may think the barley price is good. If we compare barley prices to the past ten years, they are high prices, especially for a non-drought period.

That is only looking at one side of the story. It is the lost value that is important. We are getting paid well, but we’d likely be receiving a more substantial return if China was open.

We have diversified somewhat from China which may be beneficial in the long run. In all likelihood, our export markets in the future, when China is back on board, will be determined by who is the best buyer.

We are 2/5’s of the way through this tariff. GrainGrowers have some information on their website about the attempt to review the tariff through the WTO. Hopefully, this shortens the length of time that this tariff is in place.

Maybe the new government will be able to negotiate with China to open up the doors to Australian barley.

Support EP3

Remember to sign up to make sure you don’t miss any of our updates, these are free to access. If you want to support this service, remember to share with your network.