The weight of the WASDE

The Snapshot

- The WASDE is released every month and provides an overview of supply and demand for the major agricultural commodities.

- Although heavily criticised at times, it provides a valuable role in informing the market and can move the market.

- Australian wheat was held at 26mmt.

- Russian wheat was increased to 78mmt, although lower than many analyst forecasts. At this forecast, this remains the 2nd largest Russian crop.

- Brazil is set to produce its record wheat crop, which will reduce its import program.

- The weight of corn is set to continue with record production in the US, and end stocks increase to the largest level since the mid ’80s

The Detail

Every month the US Department of Agriculture (USDA) release their monthly World agricultural supply and demand estimates report (WASDE). This report is a comprehensive examination of agricultural commodities covering grains, livestock and dairy, with data on every region.

The USDA is regularly criticised for their outlooks, as people start to pick apart the numbers. It, however, remains an essential source of information, and regardless of the view on the integrity of the data. It does have the potential to move markets.

Wheat

The report released overnight had very few surprises, with most anticipating where the numbers would lie concerning wheat. At EP3, we believe it is important not to waste your time going into indepth detail on every facet of the industry, and highlight the vital factors.

Australia had production maintained at 26mmt; at present, I feel that this is as appropriate a number as any to use. The range that we believe is possible at this point in time is between 25-28mmt, which clearly could vary drastically depending upon the climate.

The Russian juggernaut continues, with an increase in production from 76.5 to 78mmt. This increase is based on more significant acreage, however, remains lower than several trade estimates (see here).

The output in Brazil was increased to 6.8mmt, 100kmt higher than the previous record, the range of estimates at present rises as high as 7.3mmt. Brazil consumes far more wheat than it produces, and a larger crop will likely reduce the import program.

On the flip side, there were downgrades to the European Union. The conglomerate of states has seen its production forecast fall to the lowest level since 2012 as a result of poor weather. In between July and August, the forecast was dropped 4mmt.

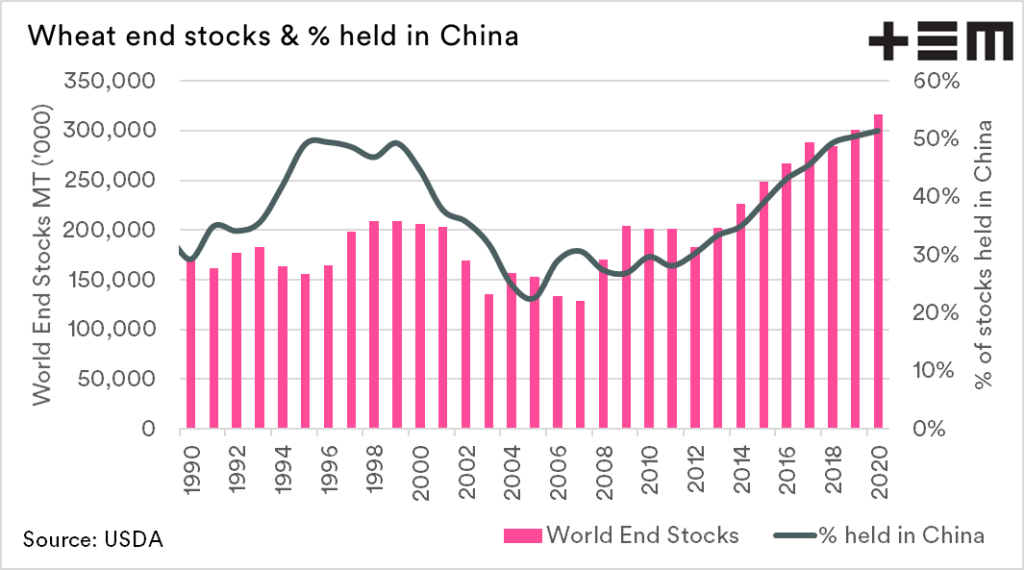

On a global level, wheat stocks are at record levels of 317mmt. It is crucial, however, to note that the majority of these stocks are contained within China (51% of global stocks). These stocks are unlikely (but not impossible) to be offered to the international market.

Corn

Australia doesn’t grow much corn; however, what happens to the corn market will influence the price of wheat around the world. This is briefly touched upon in the article ‘Can cars drive the wheat price?’.

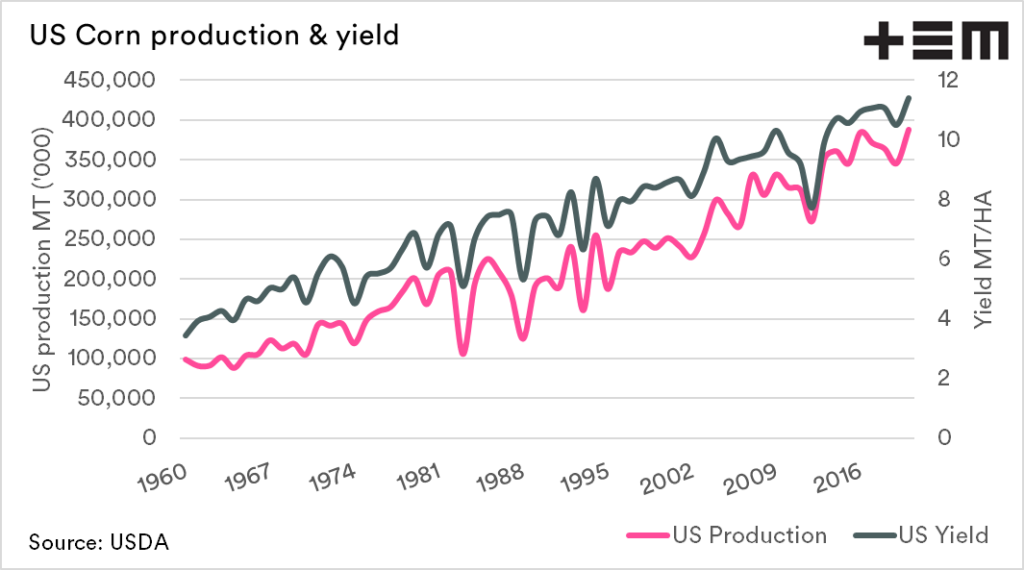

The progress in corn yields has been astronomical, and this year they are forecast to hit records levels of 11.41mt/ha, leading to record production. In recent times China has been making large corn purchases to meet their phase 1 obligations. Despite these purchases, end stocks are expected to rise to levels not seen since the mid ’80s.

It must be noted that the USDA report was prepared prior to the large storm front last weekend, which has caused damage to the corn crop. It is unknown at this stage how much of a dent this could make in stocks.