Three factors in 2023 for Grain

End of Year

2022 has been fun. Well for an analyst, its been fun; we’ve had loads to talk about. The theme for the past couple of years has been uncertainty; I don’t think that will change in 2023.

As a truly independent analyst, we’ll be here for you in 2023, but in the meantime, I thought it would jot down the three big things to look out for in the coming year.

The Invasion of Ukraine

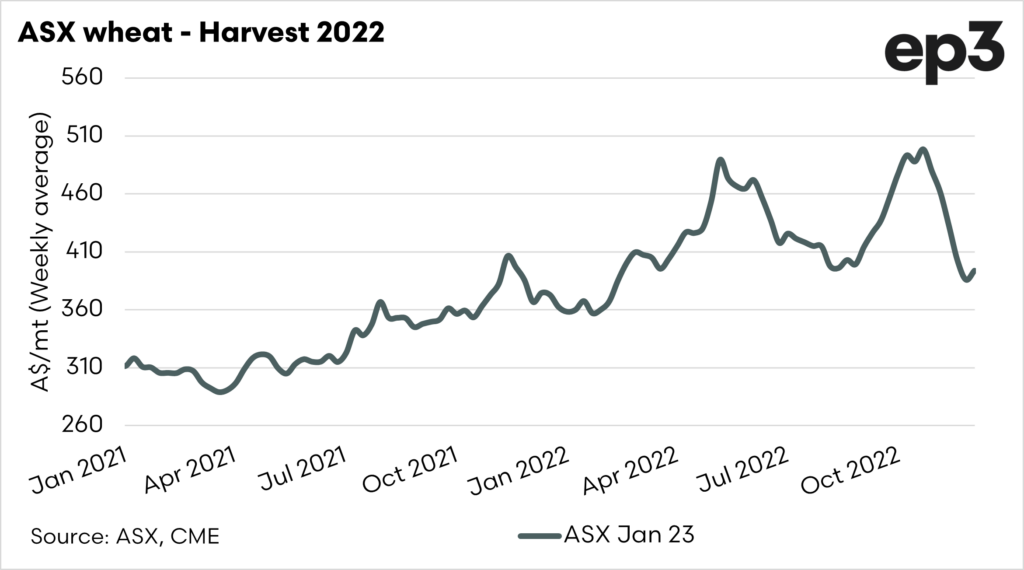

The story that drove the grain markets in 2022 was clearly the invasion of Ukraine. This caused a huge degree of uncertainty.

The global trade was unsure of the impact of a conflict between two of the largest grain-exporting nations. Exports from Ukraine were curtailed, with only overland possible until August; subsequently, an agreement was made for exports via the black sea. Exports are still behind normal levels due to the slow nature of inspections and risk.

It doesn’t seem like the conflict is ending any time soon. However, the impact might yet to be fully felt. The Ukrainian farmer is planting much less winter wheat acreage.

The cost of inputs is one of the factors, but also low local grain pricing and access to financing are barriers. Wheat production in Ukraine will decline in 2023, and there is uncertainty about Russian production.

This could cause another round of fireworks in the market, especially if other areas in the northern hemisphere experience concerns.

We spoke with Elena Neroba, a Ukrainian grains analyst, about this on the AgWatchers podcast, as sister to EP3 (click here to listen)

If you want to donate grain to assist with humanitarian efforts in Ukraine, click here for information on the #grain4ukraine scheme.

Above Average Input costs

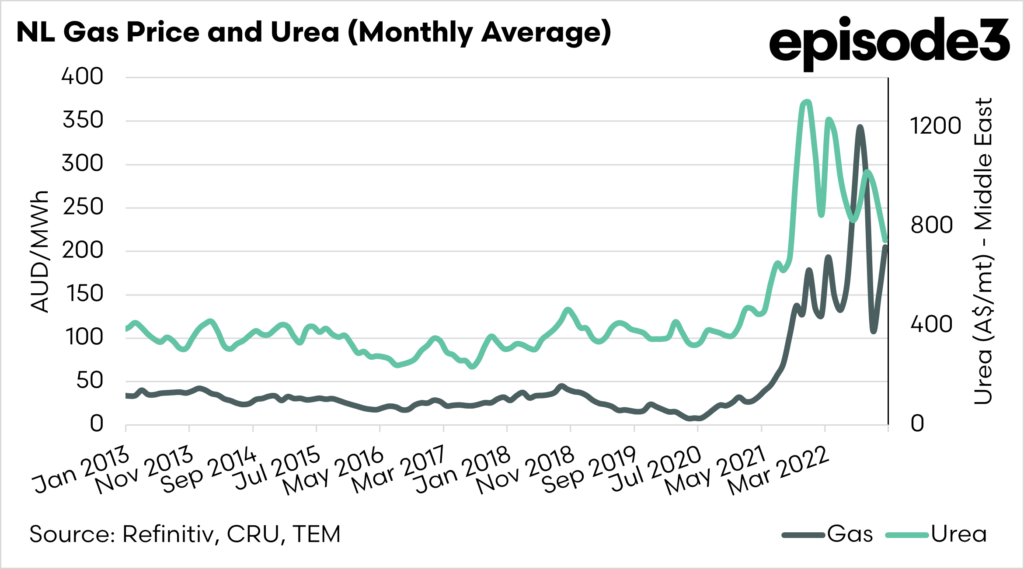

Growing grain is much like any other business activity. It is a process of inputs and outputs. We purchase our inputs (fert, chem, diesel etc), and sell our outputs (wheat, barley, canola etc), and hope to make a margin.

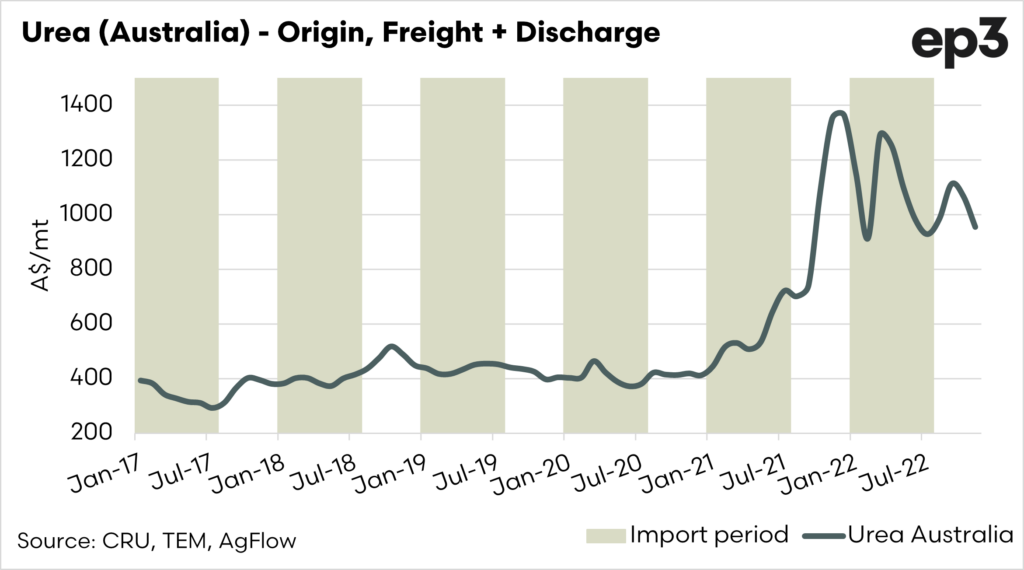

Input costs have been high for at least the past year. The biggest driver of input costs during thepast year has been increased energy costs.

Agriculture, especially grain, arises from energy. We see this in the relationship between fertilizer and gas pricing. There is no clear sign that the war in Ukraine will end any time soon, and as such we expect gas pricing to remain elevated, maintaining pricing levels in Australia above the long-term average.

There are welcome signs of falling prices overseas, however, when that flows through fully to Australian pricing levels.

Remember, if you want to assist in improving fertilizer price transparency – help us with our fert price census by clicking here.

The wider world.

I’m Scottish. We are a naturally dour people, but we also invented modern economics. I have been calling for a global recession for quite some time, and it seems that sentiment is now becoming mainstream.

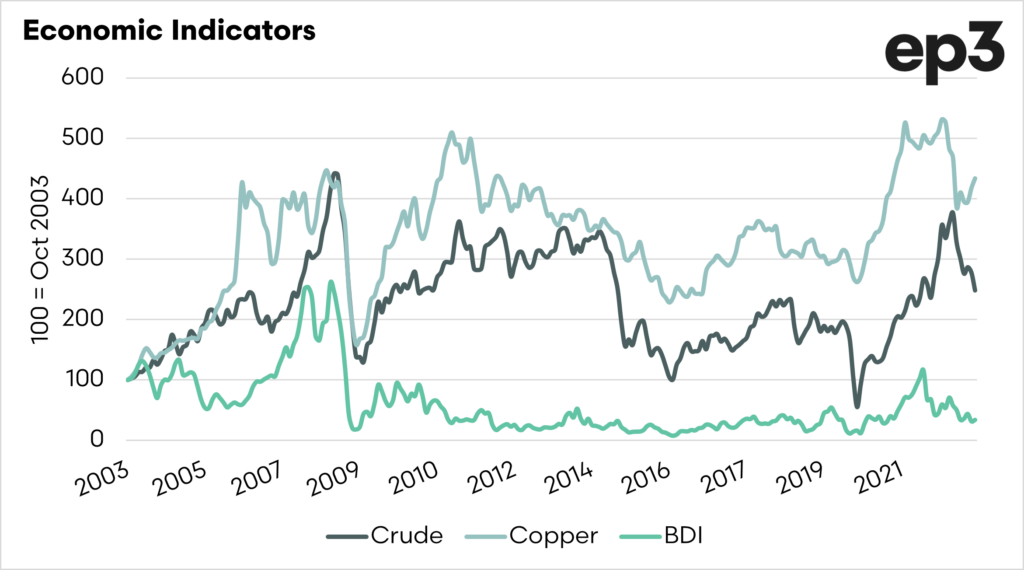

I have selected a few indicators below, which I consider to be economic indicators. Crude, Copper and the baltic dry index. When these are falling, it is a sign of reduced consumer demand, and vice versa when rising.

These indicators have all fallen from their recent peaks, and could be a portent of slow global growth in 2023.

Inflation has been high, and consumers are reducing their spending on gadgets and gizmos. Agriculture is not immune from this effect.

I believe that the biggest impact may be felt on higher-end goods, but it flows right through the supply chain.

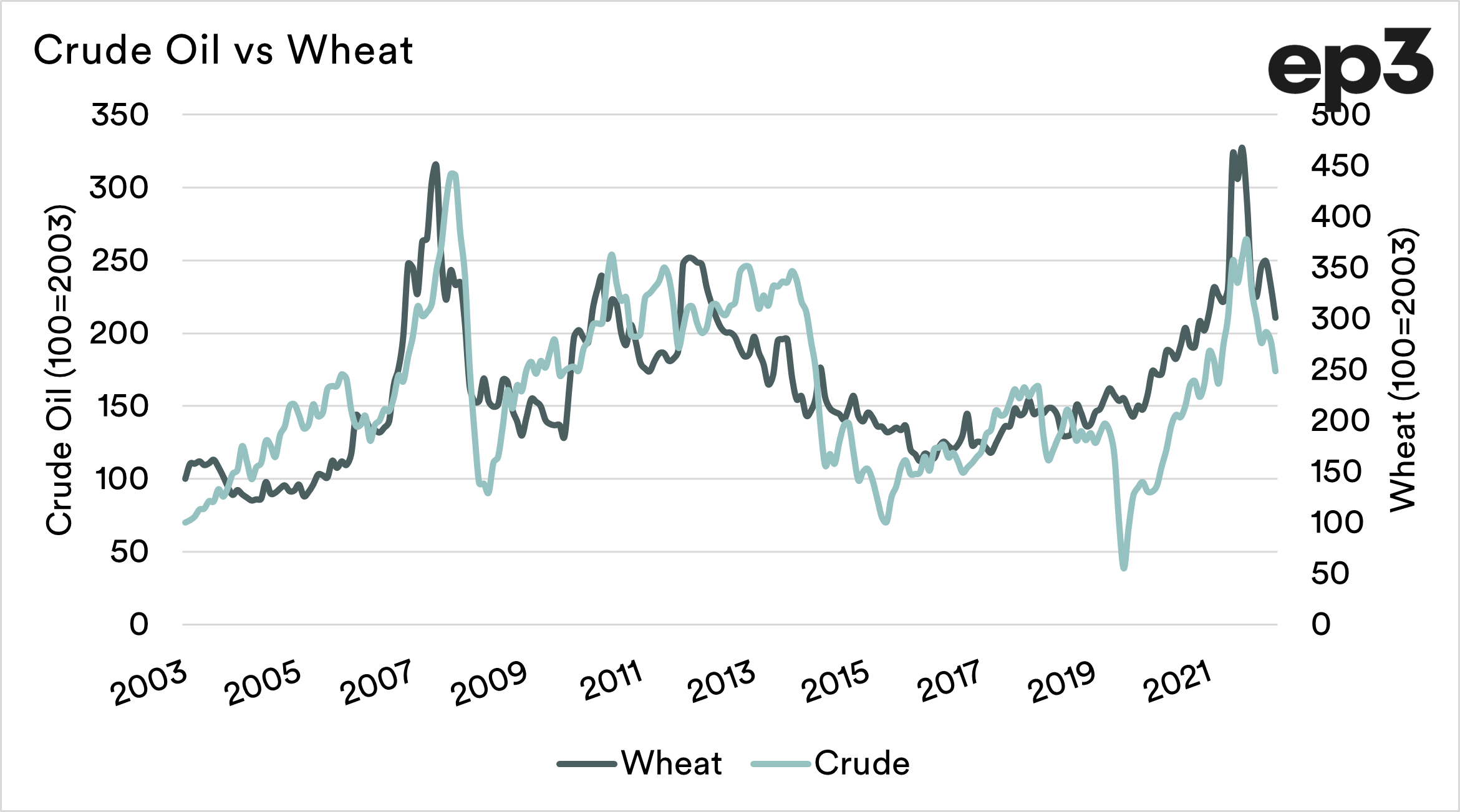

If we take wheat as an example, it has a high degree of correlation of movement with crude oil. In part this is due to the use of corn for ethanol production. If people drive less, especially in the US, it can flow through to reducing corn demand for ethanol.

This results in a glut of corn available for feed, competing with wheat and barley. We could also see a reduction in meat demand, especially if an Asian recession occurs. This would also have a detrimental effect on grain demand for feed.

So in 2023, we’d be keeping a close eye on the global economy.