US Drought puts a spring in our step.

The Snapshot

- The US spring wheat crop is currently in the planting phase.

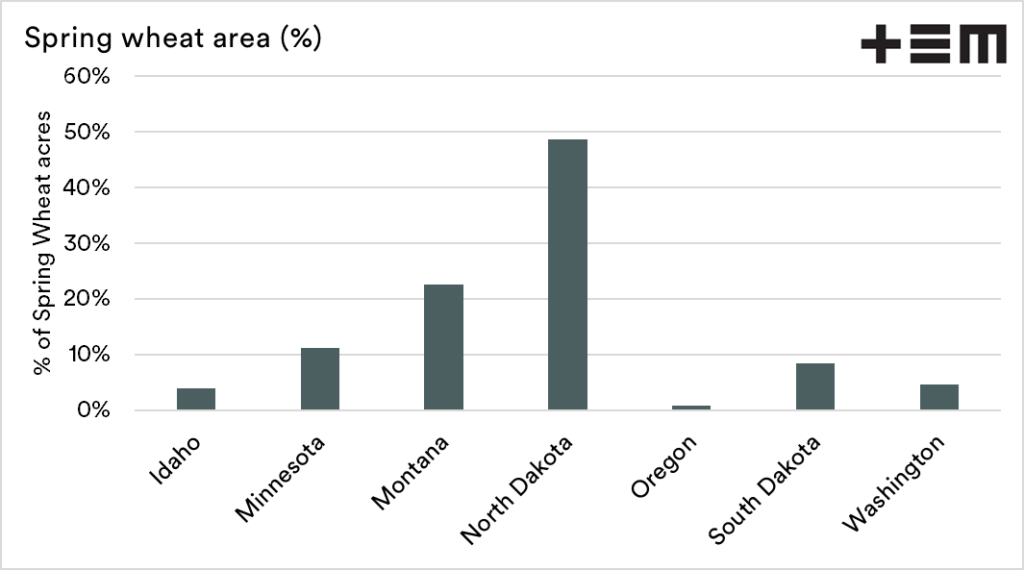

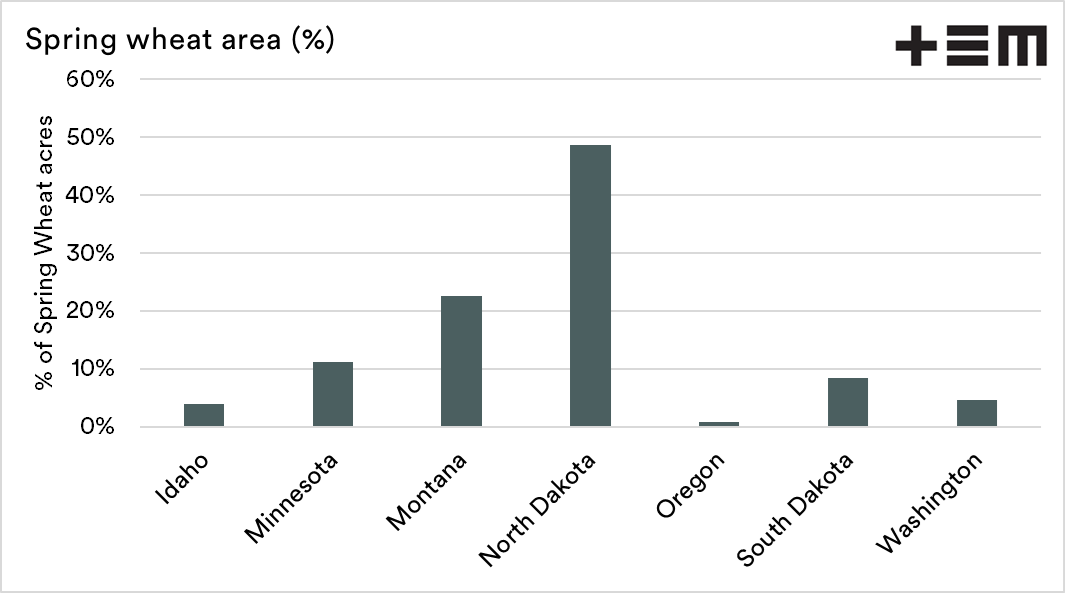

- The majority of the spring wheat crop is grown in North Dakota. 49% of spring wheat area over the past decade was sown in North Dakota

- 82% of the US spring wheat area is suffering some form of drought.

- North Dakota is especially hard hit. 86% of the state is in extreme drought, and 11% in severe drought.

- The Minneapolis spring wheat contract has outperformed Chicago and Kansas in recent months.

- If the US spring crop fails, it diminishes global stocks of high protein wheat.

- A reduced high protein stockpile is beneficial for Australia.

The Detail

It seems that we are always showing a positive view on the grain market at present, but it’s hard not to with current conditions around the world. In its early stages, the spring wheat crop is in a poor state – and that could help us.

The US wheat crop is comprised of winter and a spring crop. As of the 2nd of May, around 48% of the US spring wheat crop has been planted, and it’s dry.

A large percentage of the United States spring wheat crop is sown in North Dakota – 49% on average over the past decade.

At the moment, 82% of the US spring wheat area is currently experiencing some form of drought, with 54% in extreme drought.

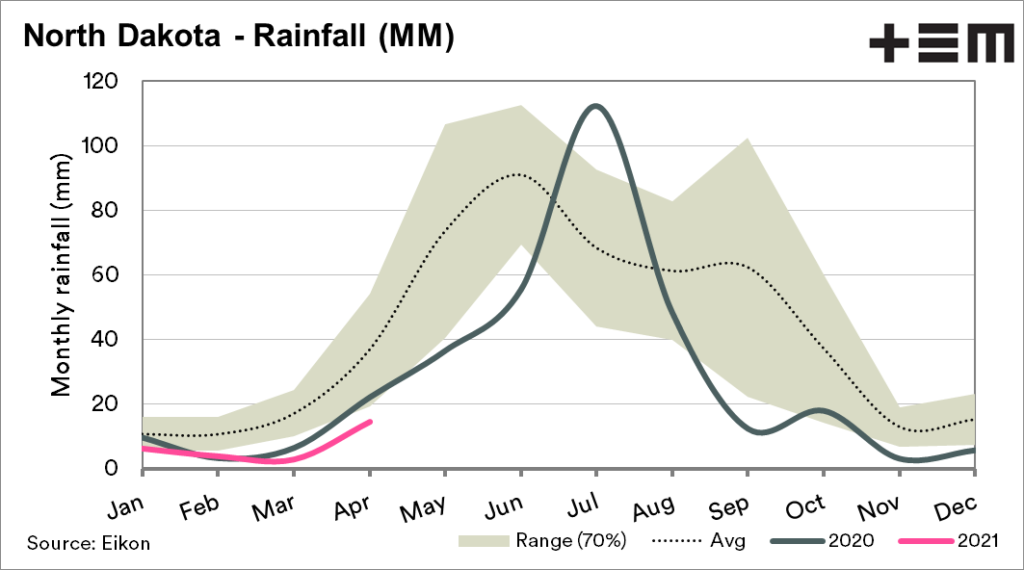

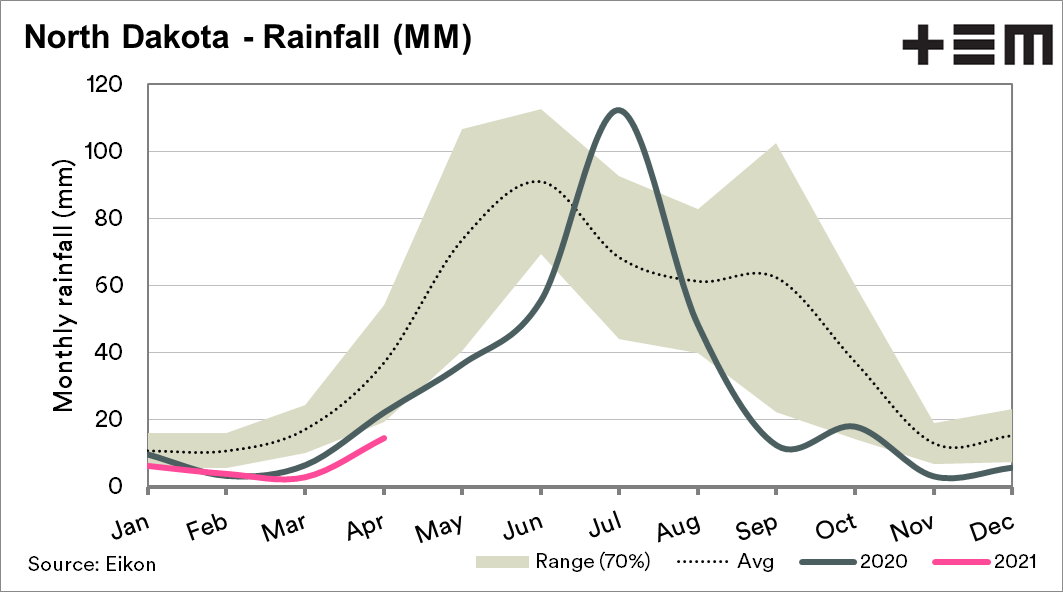

The North Dakota area which is responsible for much of the nation’s production, is in a very sorry state. At present, 86% of the state is in extreme drought, and 11% in severe drought (Source USDA).

This poses a significant concern. If North Dakota falls over, then that has a significant impact on high protein spring wheat production.

Pricing impact

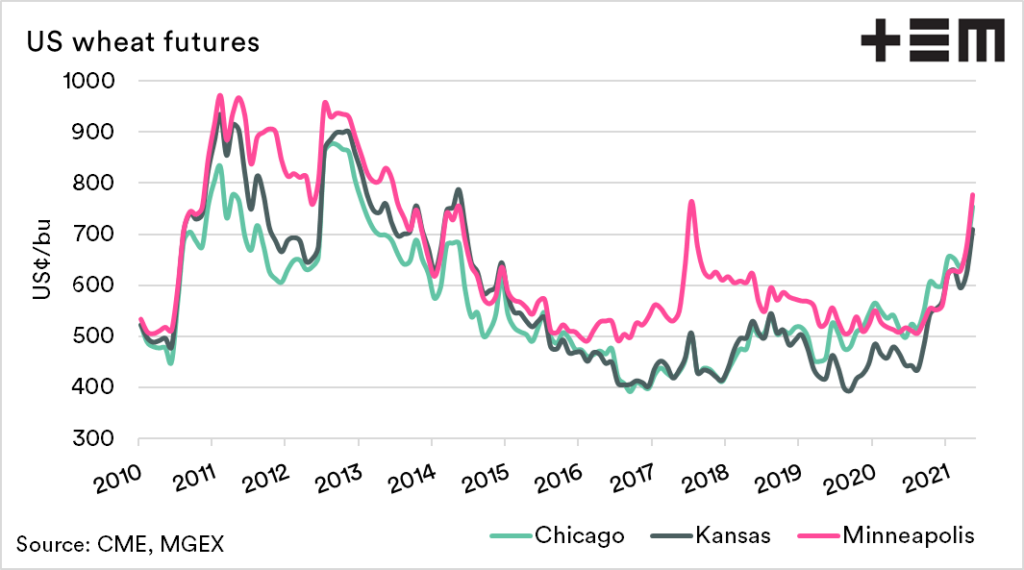

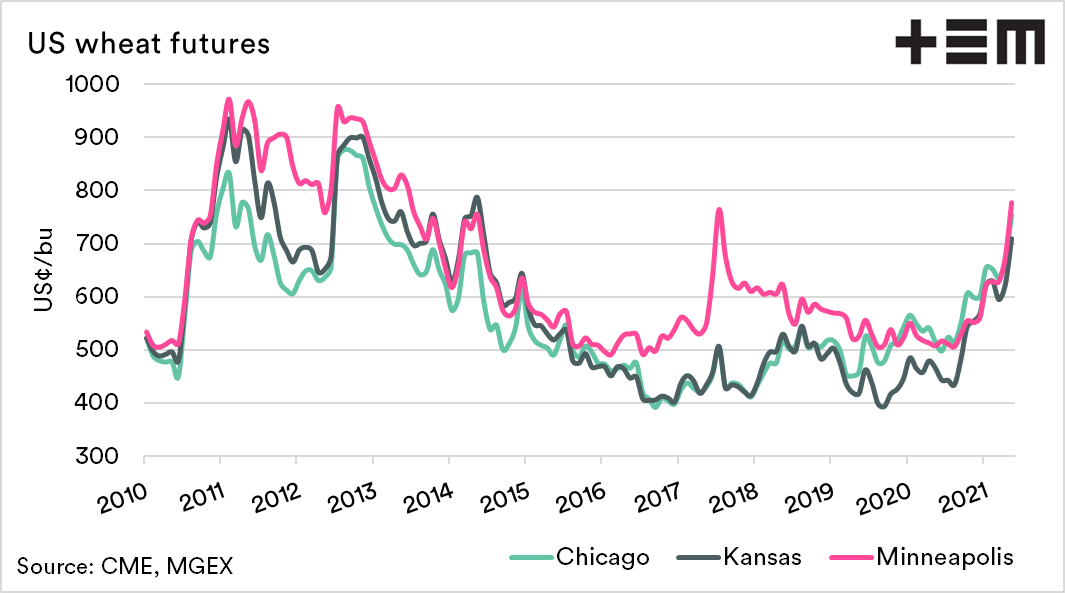

The three wheat futures contracts in the USA are Minneapolis, Kansas and Chicago. The Minneapolis contract represents spring wheat.

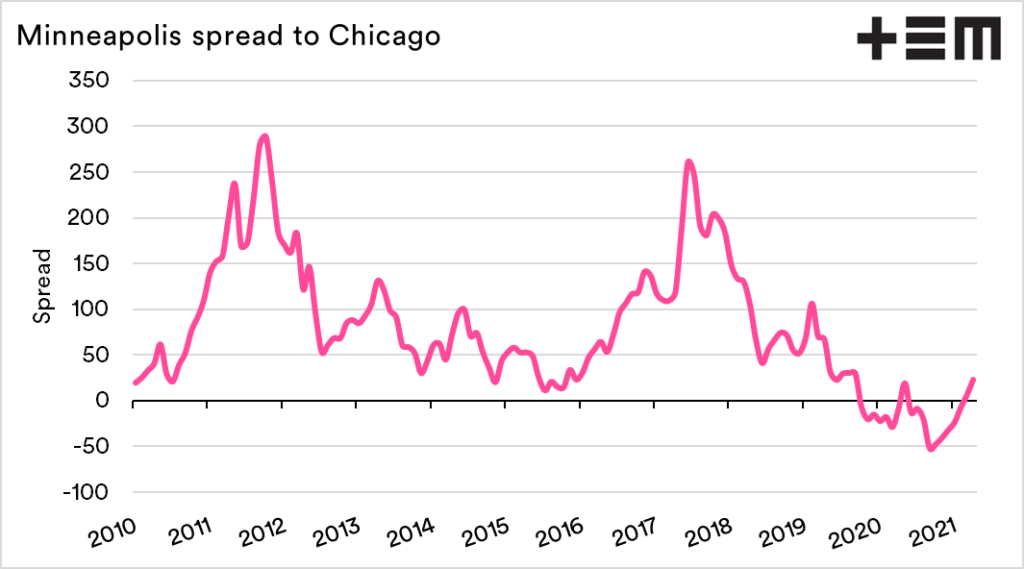

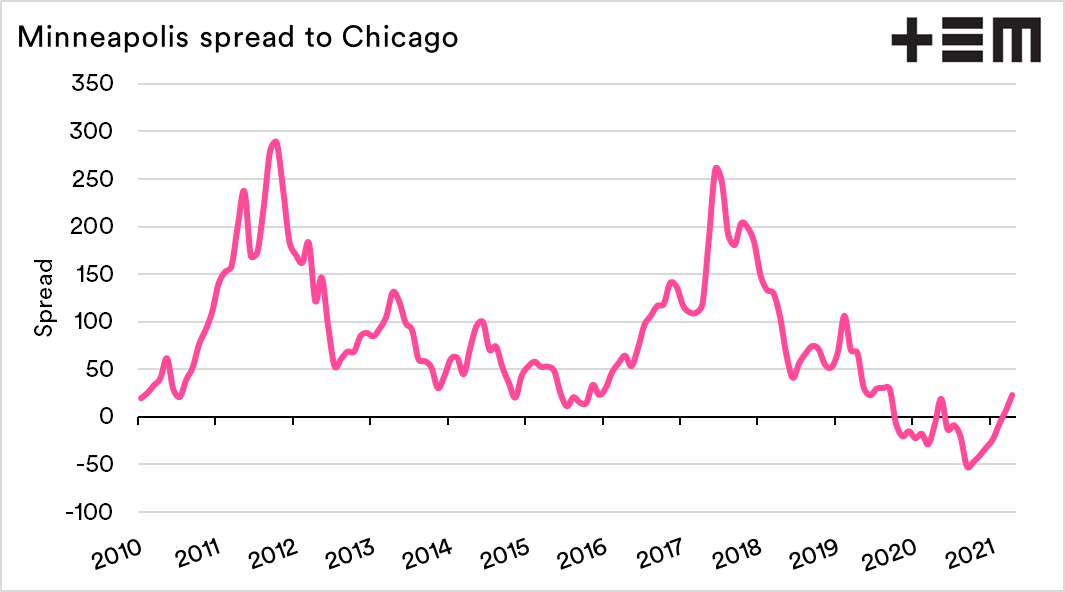

Whilst all contracts have been showing solid gains for most of the past six months. The Minneapolis contract has been outperforming both Chicago and Kansas. As recently as March, the spot contract for Minneapolis was trading at a discount to Chicago; it has now moved into a premium for April and May.

During the past decade, there have been periods when Minneapolis has extended its premium to Chicago to very strong levels. This has occurred when the spring growing region has been in a rainfall deficit.

At the time of writing, spring wheat futures are far from the heady levels of 2011-2013 or 2017-2018 deficit periods. However, suppose we see a continuation of poor conditions. In that case, this will cause a rise in pricing levels, or at the least, an increase in the premium for Minneapolis.

From an Australian export point of view, we generally produce high quality and high protein wheat. If the US spring wheat crop is diminished, then it leaves us in a good spot.