What happens if China bans Aussie wheat?

The Snapshot

- There are rumours of China banning a whole host of Australian commodities, this time including wheat.

- China is not a huge market for Australian wheat, at an average of 6% of the national export program.

- Barley is far less diversified, with the industry being China-focused for the last half of the 2010s.

- Whilst China is not a vast wheat customer of Australia, we have been a substantial supplier of imported wheat (& barley).

- At the moment these are just rumours. If this comes to fruition, then we will be able to find alternate destinations without the same concerns as the barley market.

The Detail

In mid-September, I spoke about the risk of potential setbacks to our wheat trade with China. At that point in time, the Chinese customs agency was reportedly increasing the surveillance on cargos of wheat from Australia.

This was a warning shot. If an inspector wants to find an issue with cargo, it is very easy to do. The previous article is ‘China strikes at Australian wheat?’.

The rumours are seemingly cementing, and more details will emerge in the coming days. At present reports are that copper, wheat, wool, wine, lobster, coal and sugar will be impacted. My view is that this list seems a bit exhaustive, and is still in the rumour category until we hear from an official channel.

For the time being, let us assume that China is no longer a market for Australian wheat.

Is this as bad as the barley tariff?

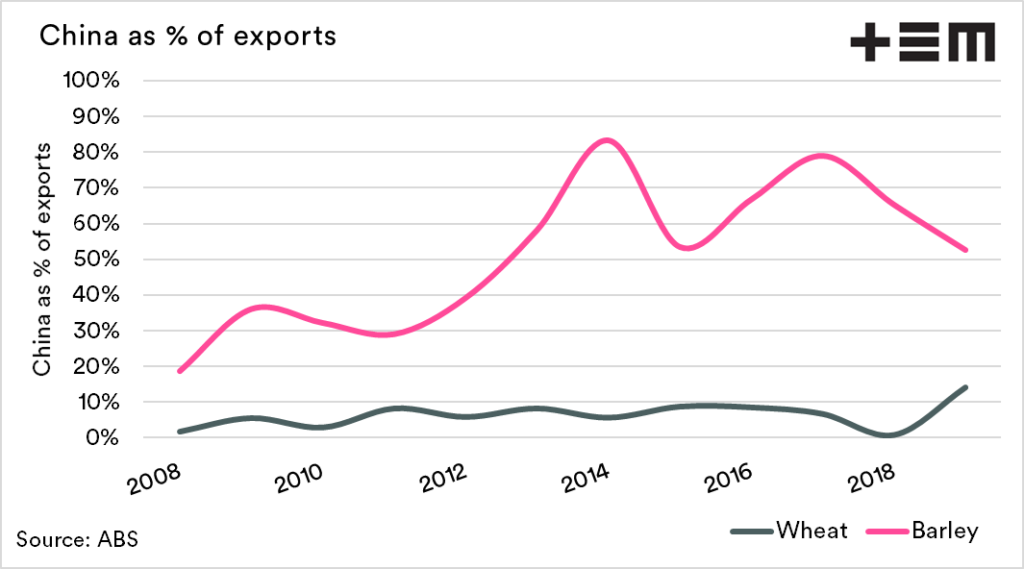

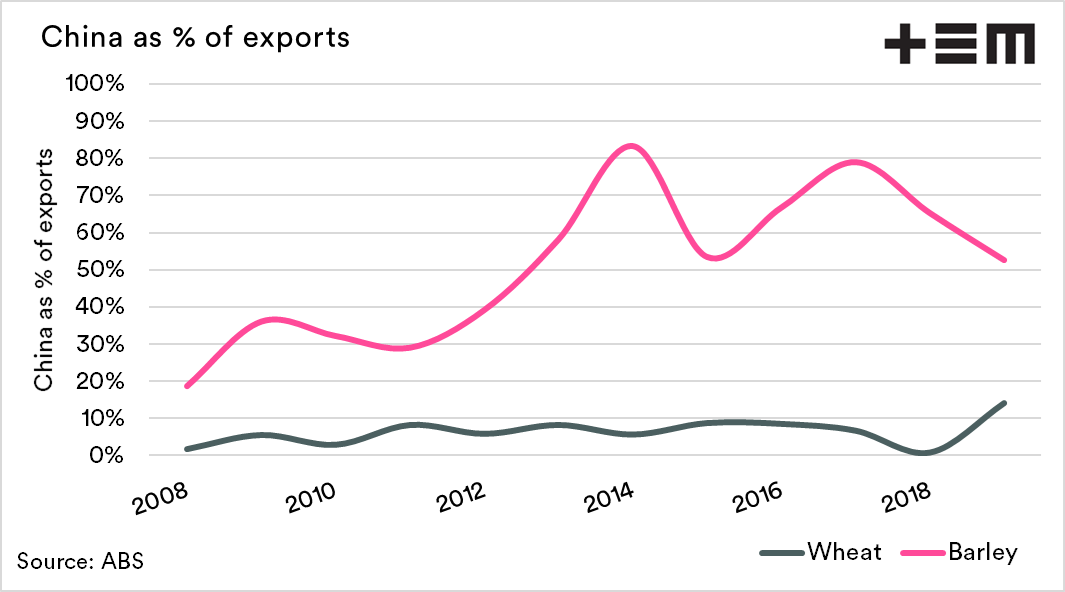

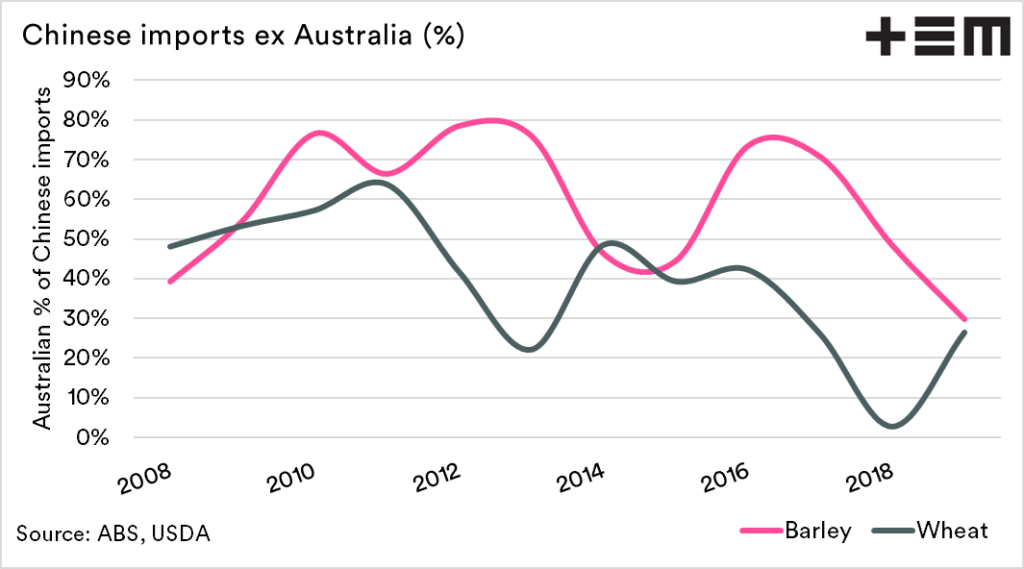

The simple answer is no, but let us go a little deeper. The chart below displays the percentage of our wheat and barley export programs which make it into China.

The obvious and glaring point is how reliant Australia has been on barley during the second half of the last decade. On average, 63% of our barley exports were destined for China. This wasn’t considered a bad thing, as China was paying the best price.

Wheat, on the other hand, has only once seen more than 10% (2019/20) of our wheat exports going to China. This, therefore, points to a market where we have other destinations.

What about value?

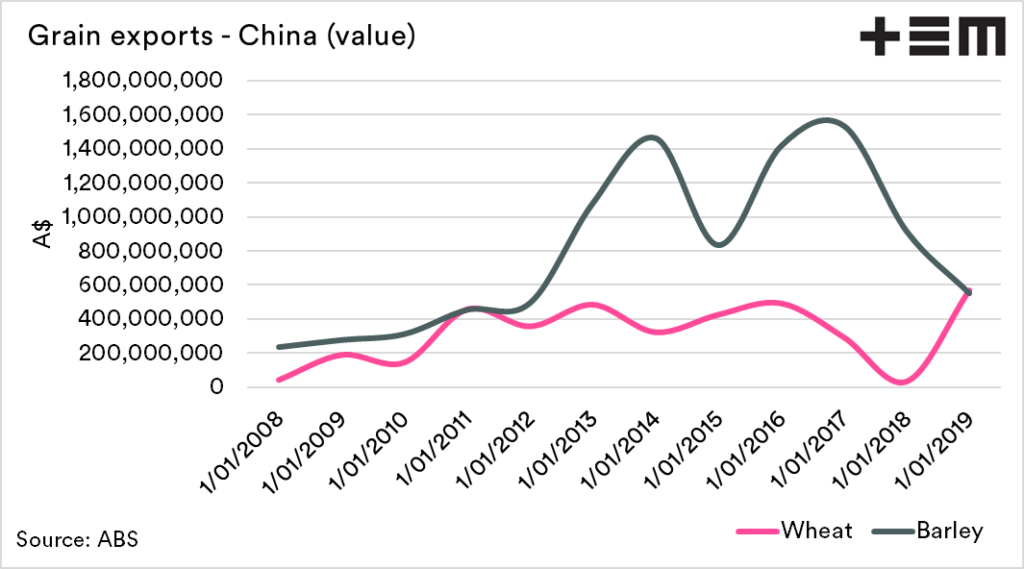

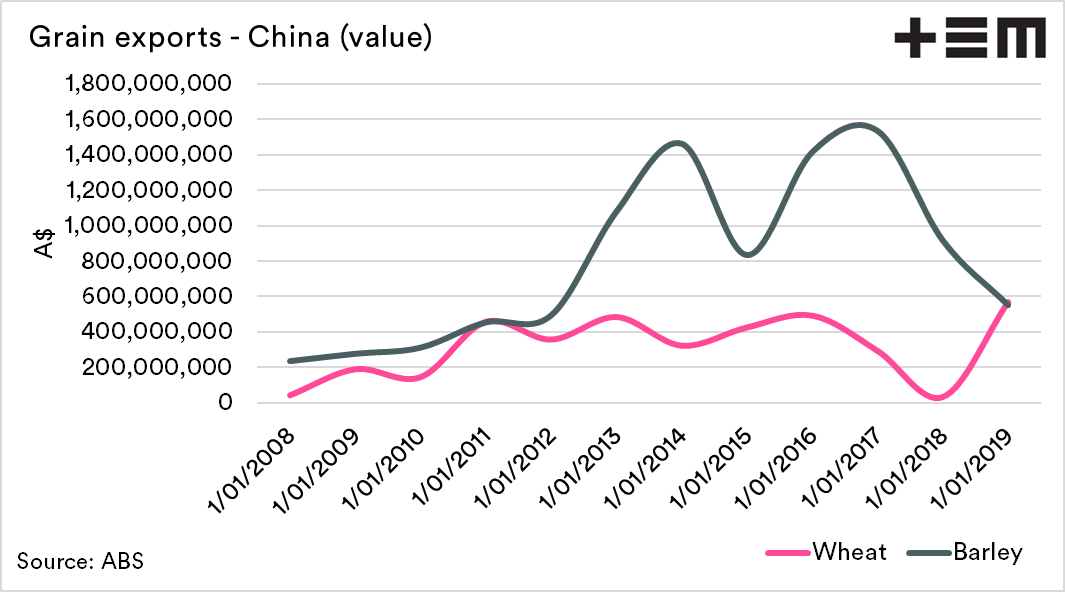

It is important to note that the wheat export market is considerably more valuable than the barley market. Therefore losing a market the size of China is not a minor issue; it can have an impact on our options.

The value of the wheat which goes to China is considerable. During 2019/20, it was slightly more valuable than the barley trade, albeit at a time when tariffs were a risk.

What about the risk to China?

China is currently hoovering up grains. In an article last week, ‘Chinese imports Part 1 – Grains’, we discussed how the current wheat import program was their largest in recent years.

This is a fantastic opportunity for Australia at a time when we are going to have a considerable export program. Whilst Australia has not been reliant on China. They are an important customer. In the case of China, we have been a considerable source of barley/wheat imports.

As an example, during 2011, we provided 64% of their wheat import program. At this time, China was only 8% of our market.

We have, therefore been a very important partner for China, and it is unfortunate to see the relationship sour so quickly.

Final thoughts

Whilst the concerns are just that; there is no point speculating too much further. The Australian grain trade will survive without China as a partner for wheat exports. Still, it is always better to have as many open doors as possible.

However, suppose the rumours of a ban on Australian wool is true. In that case, that will be a more significant impact on a single industry than barley.