Market Morsel: Fertilizer Price Falling

Market Morsel

Early in December and in January, I wrote about the energy price being the major determinant of fertilizer pricing (here & here). The market has started to come under some pressure for the start of 2022. Energy prices have started to fall, but it’s not the main reason for falling fertilizer pricing at present. The current fall in pricing is largely driven by a lethargic start to the year, with buyers reluctant to make new orders.

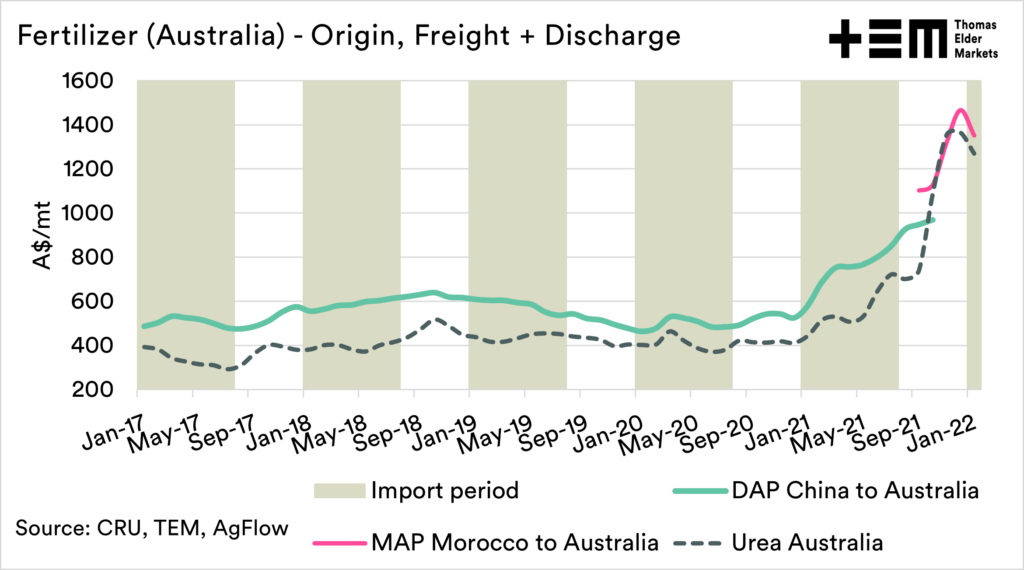

So let’s have a look at the situation in Australia with fertilizer pricing. In Australia, it is hard to get a handle on fertilizer pricing data, so we decided to do the next best thing, a model to work out what roughly fertilizer pricing should be in Australia.

EP3 was the first organization to publish the CFR+ model publicly, and over time we hope it helps farmers and the broader industry get better insights into pricing levels for one of their most essential inputs.

The CFR+ utilizes data from two independent data sources – CRU & AgFlow

The CFR+ model sounds more complex than it is. It is basically a simple addition of factors* that drive the price:

- The cost of purchase at origin – loaded onto the boat.

- The freight cost to destination (Australia).

- The cost of discharging

The fertilizer price has fallen since our last update of the landed Australia pricing. The landed price of Urea is now back at a range of A$1260 to 1300, and DAP/MAP at A$1350 to 1400. Whilst this is a decent fall, it is clearly still a price remaining at very high levels.

It is important to note that this is a theoretical price based on the spot market. The fall in global price might not necessarily be passed on by importers.

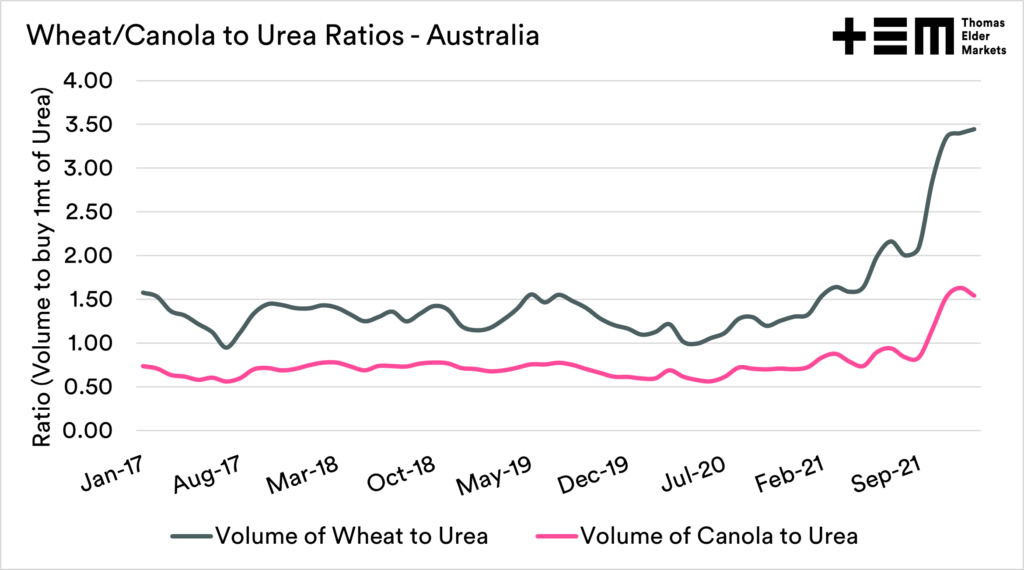

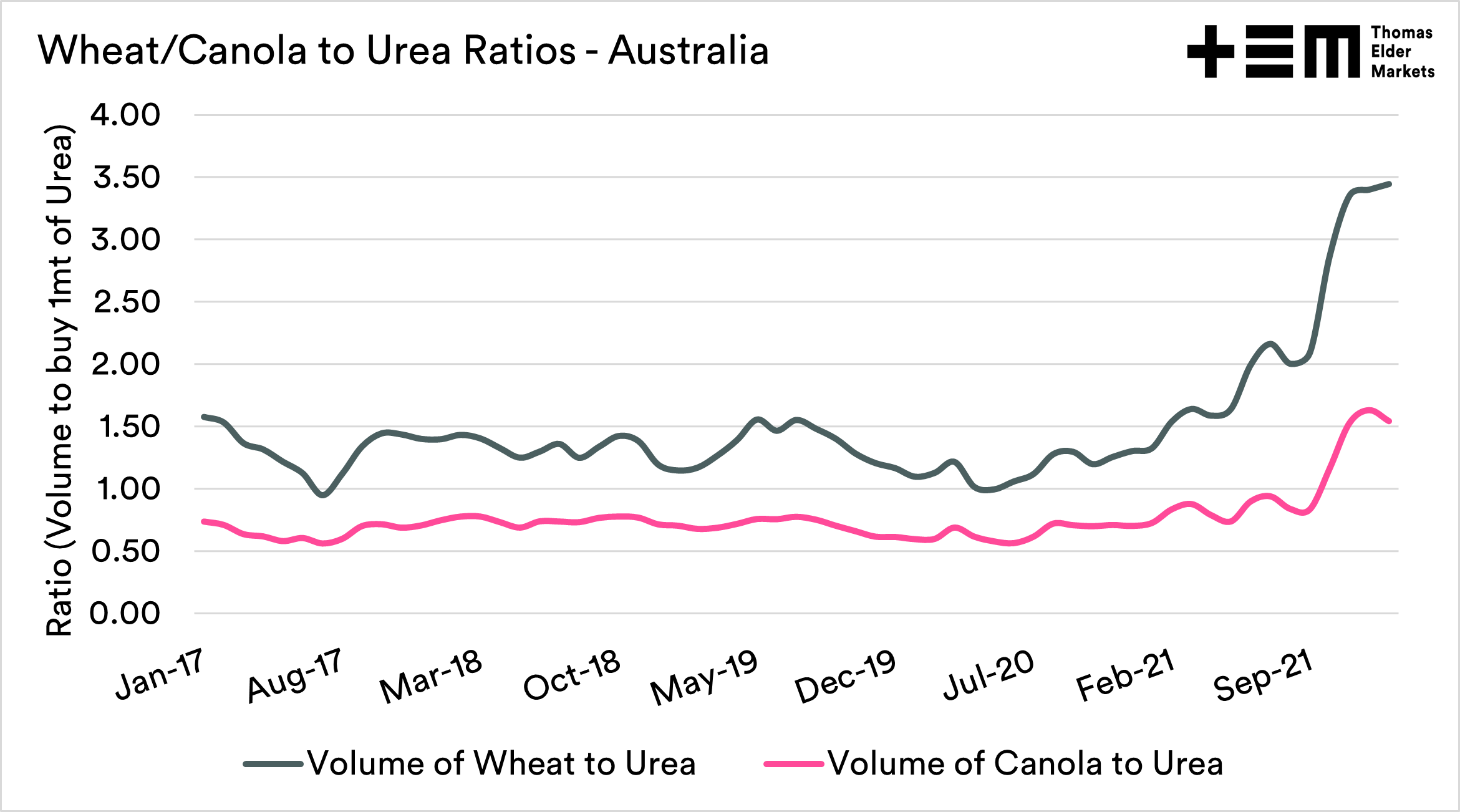

The second chart below shows the ratio of wheat/canola to Urea. This chart represents how many tonnes of each commodity needs to be sold to purchase a tonne of Urea. This shows the extent of the cost-price squeeze at a time when everything from chemicals to fuel is at high priced levels.

If you want to be kept abreast of what is happening in the agriculture markets, make sure to sign up for the free EP3 email update here.

You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.

*It is important to note that this price does not include margins, administration or internal Australian logistics costs. It does provide a good overview of the trend, and roughly where the price should sit before these additional costs are added.