Market Morsel: Further glyphosate pain?

Market Morsel

The past twelve months have been a real pain in the input markets for farmers. Fuel, fertiliser, labour, freight and chemicals have all gone through the roof. There might be more bad news on the way.

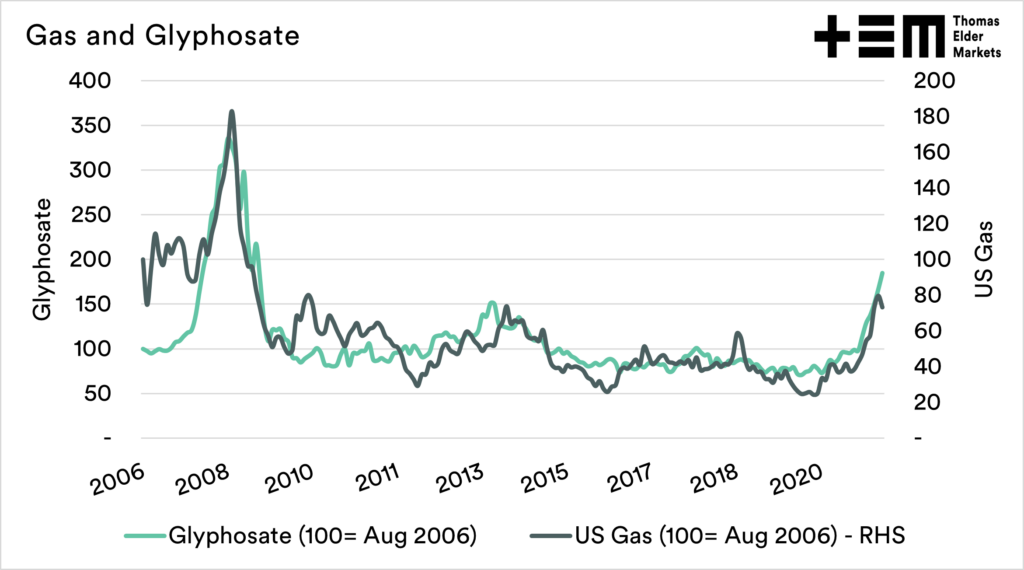

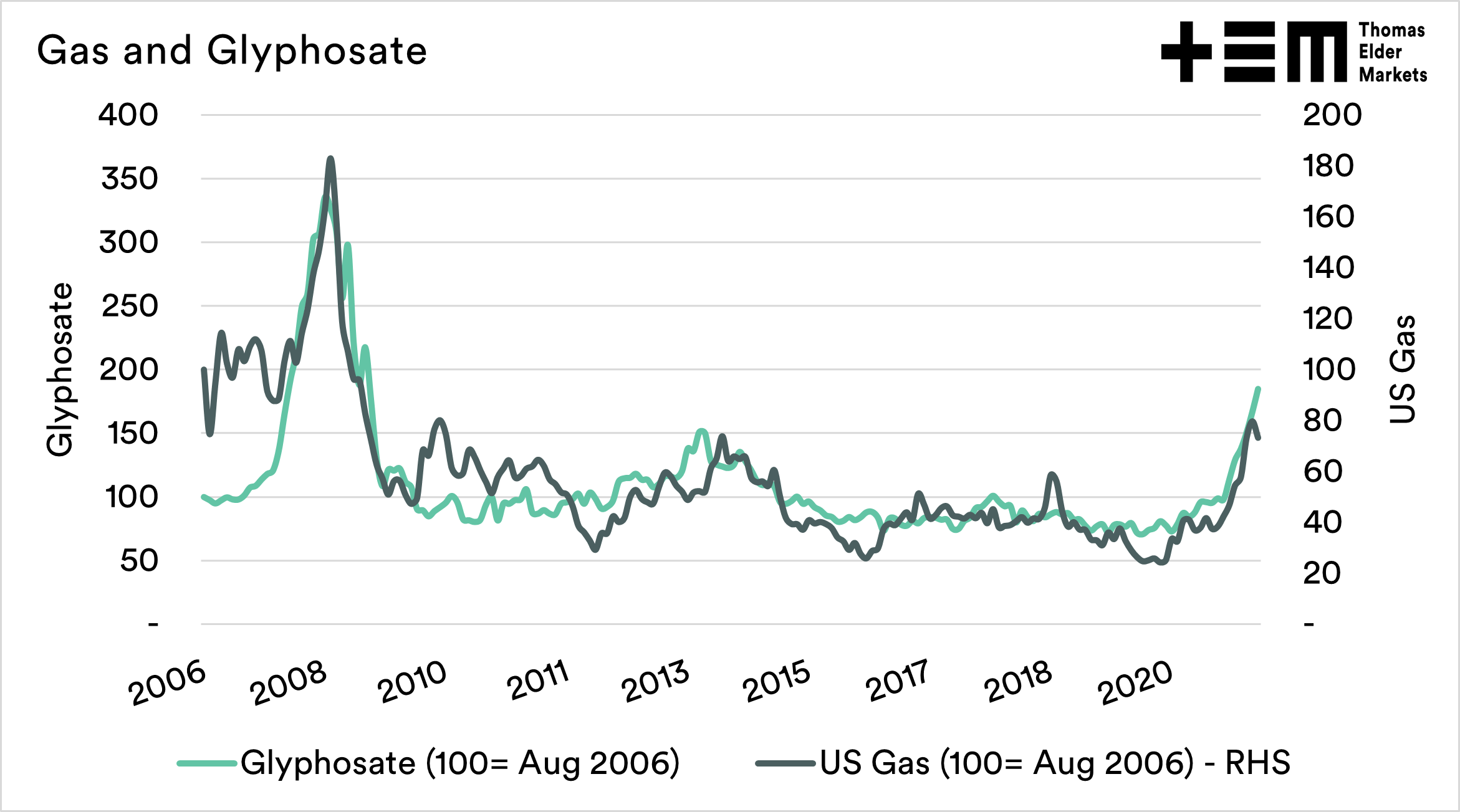

Glyphosate pricing levels have risen in strongly during 2021. There have been disruptions caused by covid, but one of the big drivers of the price of glyphosate is energy costs. In the chart below I have created an index of glyphosate and US gas pricing from 2006 to present (100=August 2006).

We can see that prices of both tend to follow a similar trend. Different energy sources tend to follow similar patterns, and we have seen an increase in crude values (see here) due to a combination of increased demand and geopolitical issues. So if energy prices continue to rise, we could see more pain – but there is more.

It is reported that Bayer, the worlds largest supplier of glyphosate has announced a force majeure. A major supplier of a key raw material has experienced a major mechanical failure, leading to substantial drops in production.

It is anticipated that Bayer will have difficulty meeting customer demand until repairs are made, which are anticipated to take around three months. However, they will be working with customers to attempt deliveries. This letter is currently circulating, but no official statement appears on the Bayer website.

If these reports are true, it isn’t good news when prices are already high. The supply chain is unlikely to be holding onto large stockpiles whilst prices have remained high.

Update 14/2/2022: This article was first published at 9am on 14/2/22. It has now been confirmed that reports and letter were genuine.

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.