Market Morsel: ‘Putin’ a floor in fert pricing

Market Morsel

Another problem that we can lay firmly at the feet of Putin is the rising cost of fertilizer. It’s like a broken record at the moment. Events in Ukraine, in some way, drive nearly everything related to markets.

Prior to the invasion of Ukraine, fertilizer prices were starting to come under pressure as energy costs around the world had fallen from high levels in late 2021. We had a short reprieve in global pricing at the start of the year, which was starting to flow through to local pricing.

The invasion of Ukraine has caused energy prices to rise, all the fossil fuels hitting high levels rapidly during the past month. This has impacted our fuel pricing, but also impacted our fertilizer.

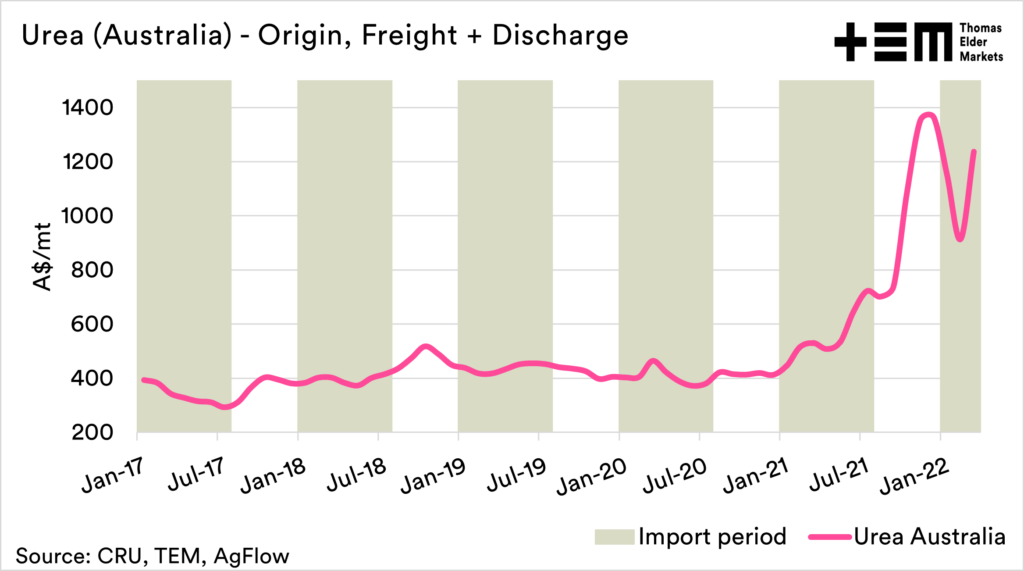

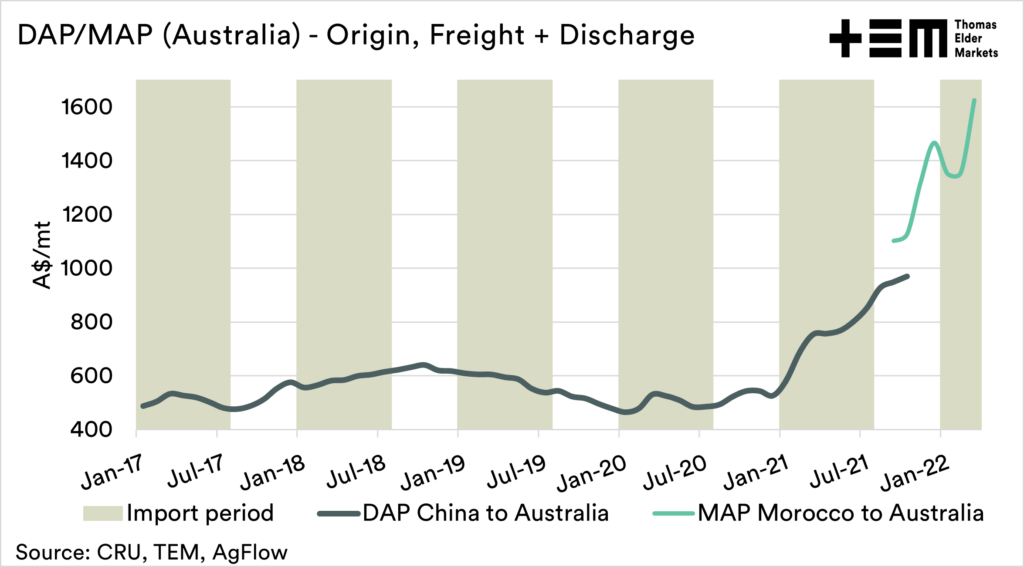

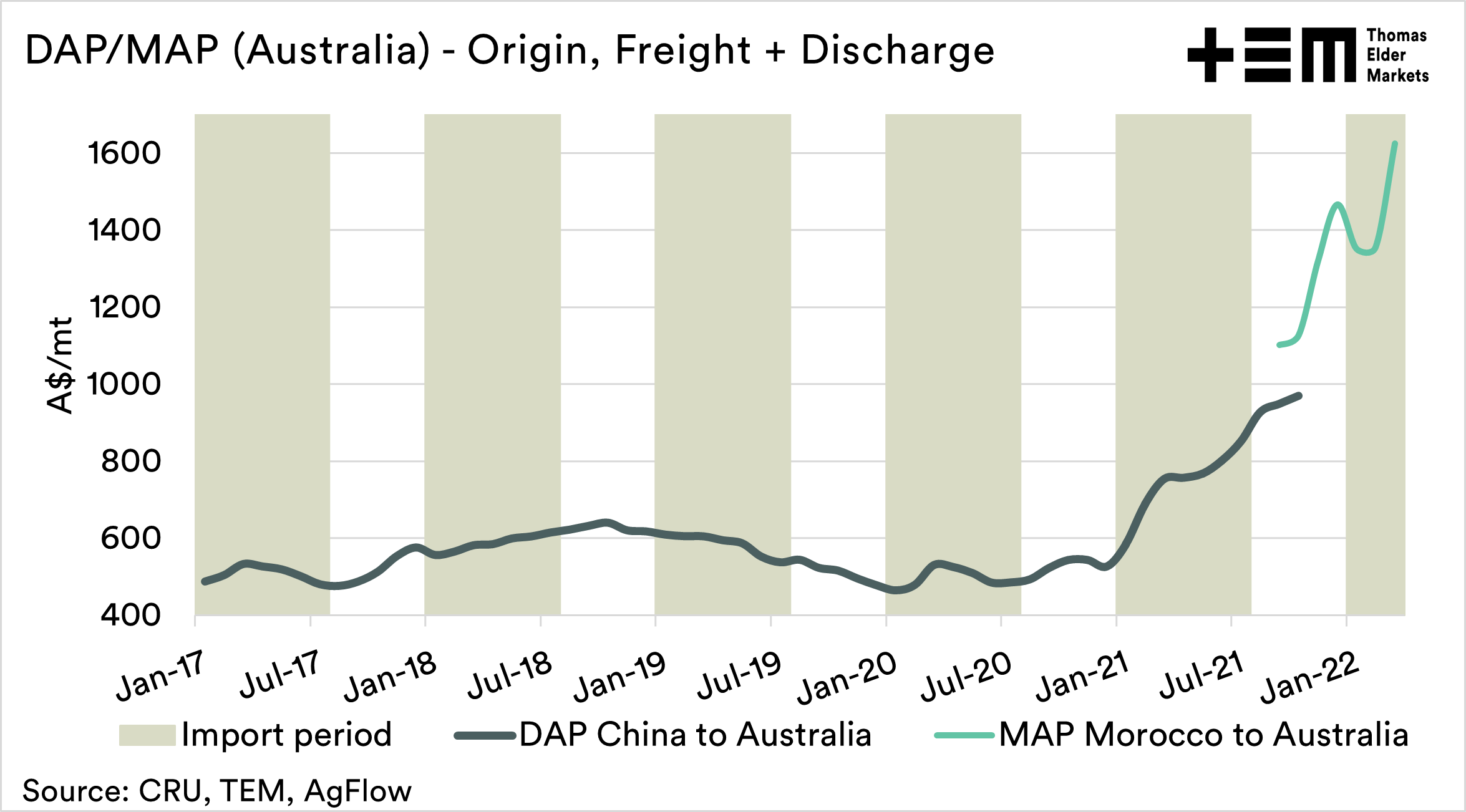

The first two charts show our cost, freight and discharge models. These are intended to introduce some transparency into the fertilizer space. Unfortunately, there are no public prices quoted, and this is a way of showing the trend of approximate Australian values.

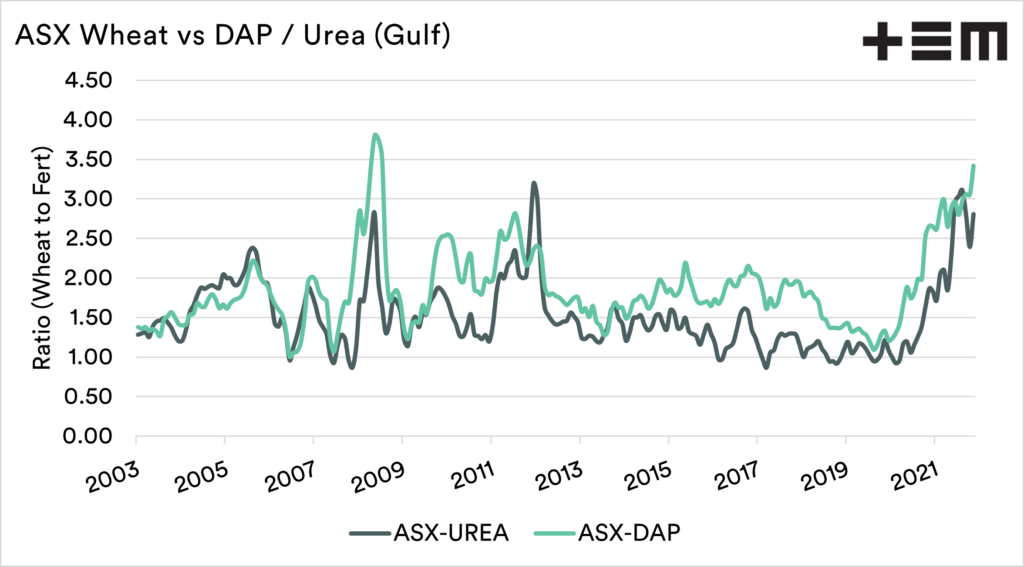

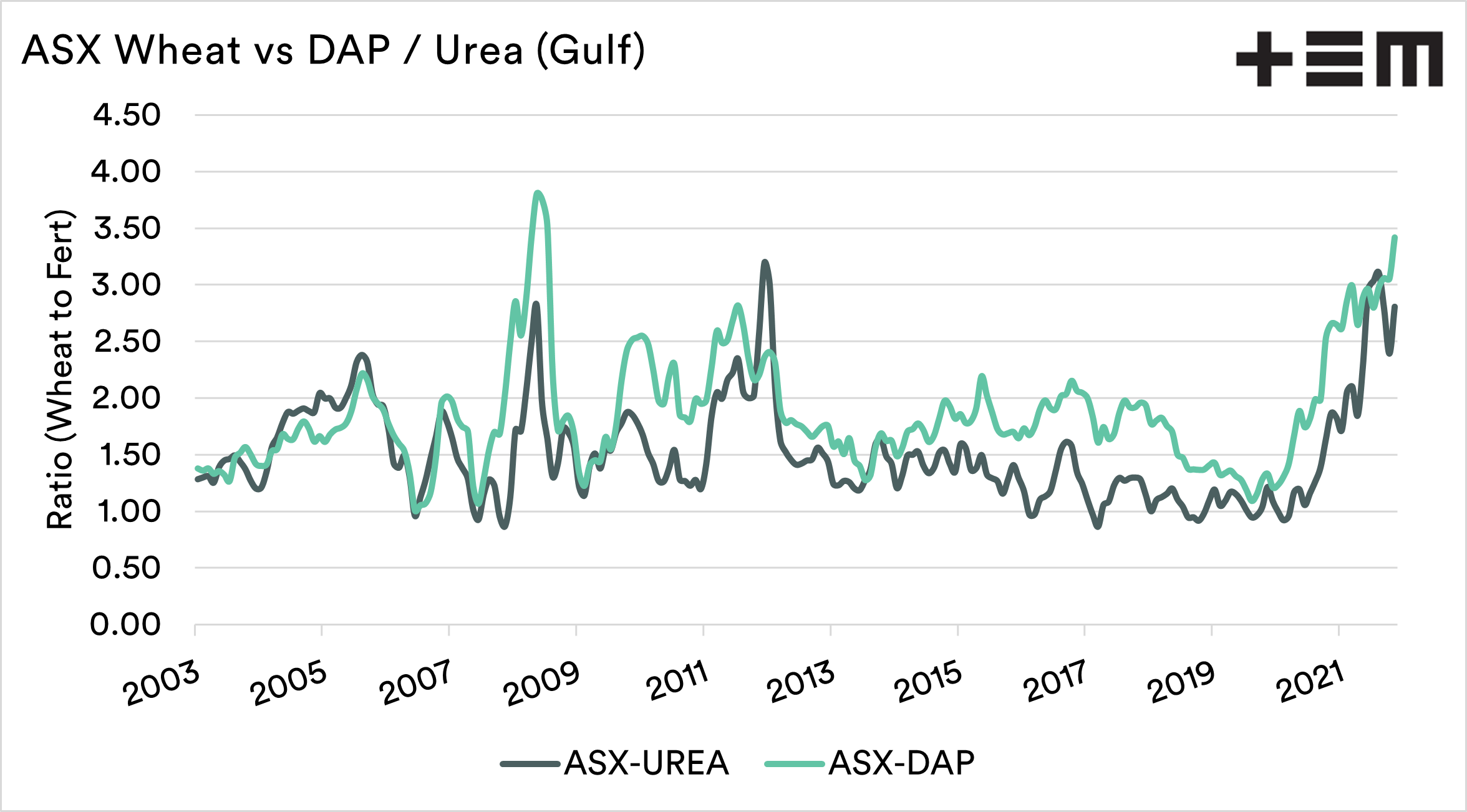

The result is that the ratio of wheat to fertilizer has risen to extreme levels. This points towards a risk of a cost-price squeeze; this is especially the case if grain prices collapse. Whilst grain prices are supported, this should be less of an issue.

Fertilizer prices in Australia are largely divergent from overseas values, and there is a long lag time before any downward trend is passed on. At the moment, fertilizer prices are unlikely to come under much pressure. If global markets fall, there is not likely to be much softening in Australia in time for farmers to benefit.