Market Morsel: Fertilizer Price Shock.

Market Morsel

Since October, we haven’t published the cost and freight model for fertilizer into Australia on the EP3 website (see here). Although we did publish some updated charts on our social media, so if you’re not following us on twitter or linkedin – get on it.

So let’s jump in on it and get it over with – although you might want to take a seat.

What is the cost and freight model (CFR+), and why are we doing it? In Australia, it is hard to get a handle on fertilizer pricing data, so we decided to do the next best thing, a model to work out what roughly fertilizer pricing should be in Australia. As far as we are aware, EP3 were the first to publish publicly the CFR+ model, and over time we hope it helps farmers and the broader industry get better insights into pricing levels for one of their most important inputs.

The CFR+ model sounds more complex than it is. It is basically a simple addition of factors* that drive the price:

- The cost of purchase at origin – loaded onto the boat.

- The freight cost to destination (Australia).

- The cost of discharging

Fertilizer prices have increased dramatically in recent months and continue to be hampered by high energy prices and the subsequent political moves (quotas/bans)

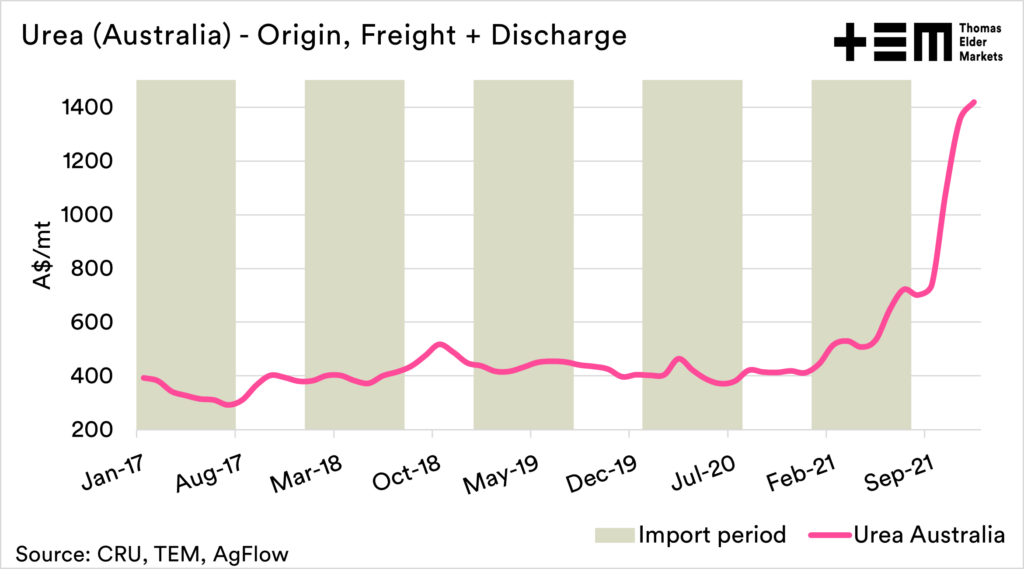

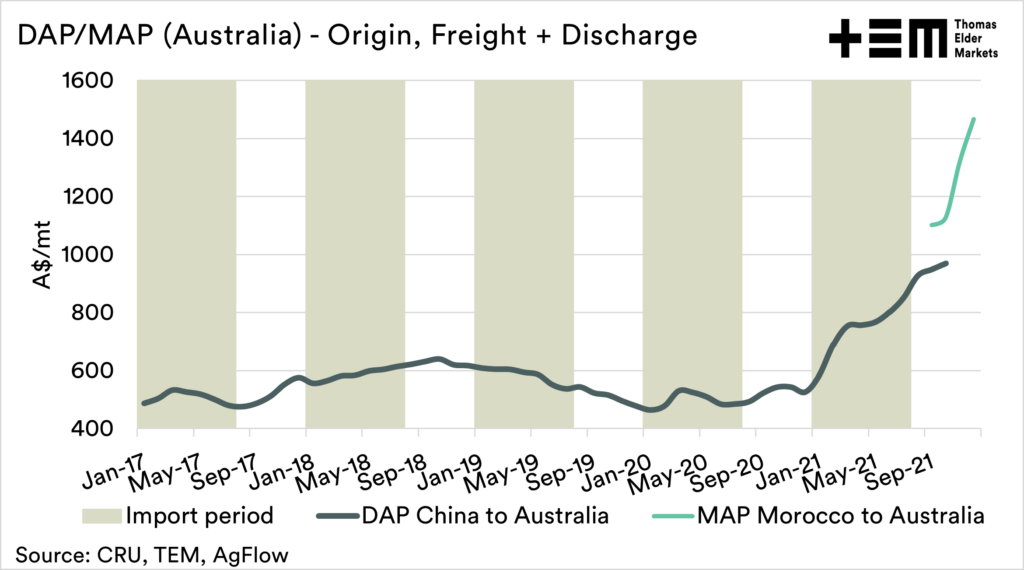

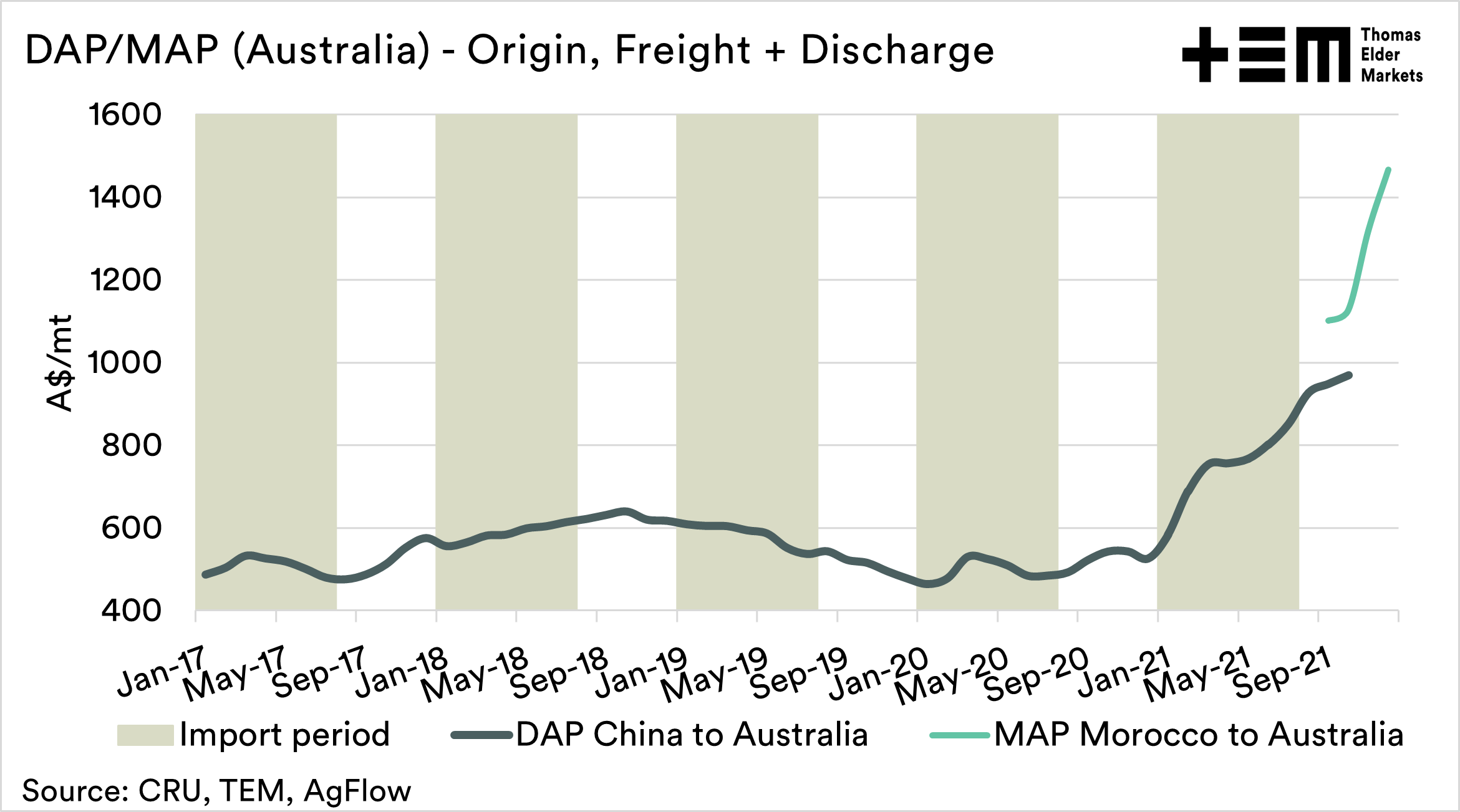

The charts below show the CFR+ model for Urea and DAP/MAP into Australia.

The Urea price has increased by 92% since September when the fertilizer market started coming under real strain, although most worrying is that the price is up >230% since last November. The modelled price for December is currently in the range of A$1400-1430.

As we all know, China has banned exports of fertilizer, which has a massive impact on our DAP/MAP imports (see here). Typically we would use China as an import origin. As Chinese exports are unavailable, we have switched to Morrocco, although there are rumours of Mexican cargoes loading in December.

Since September, DAP/MAP is up 55% and 170% since last November. The current modelled value is currently in a range of A$1450-1475.

It was a surprise to me to see the values of the CFR+ model, as I was hoping for a bit of stability. As farmers, we are going to have to ensure that we do some good calculations over the coming months.

If you want to be kept abreast of what is happening in the agriculture markets, make sure to sign up for the free EP3 email update here.

You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.

*It is important to note that this price does not include margins, administration or internal Australian logistics costs. It does provide a good overview of the trend, and roughly where the price should sit before these additional costs are added.