The boy who cried urea.

The Snapshot

- Fertilizer prices have moved back to levels not seen since early 2021.

- The fertilizer market is driven by natural gas, and prices are moving downward as we approach summer in Europe.

- There are rumours that Australia will run out of urea soon.

- There have been rumours of supply shortages every year since 2016, which have generally not occurred.

- There may be a shortage of urea, but the ‘boy who cried wolf’ story springs to mind. If you make this claim too many times, people will stop believing.

- Farmers need to ensure that they are not gambling on their production, but more transparent information on the fertilizer industry would assist in reducing risk, potentially for buyer and seller.

The Detail

We have been getting many questions lately about fertilizer availability. There are concerns that there will not be enough urea around to meet demand “Get in quick, before we run out!!”. We’ll get into that later in the article, but let’s look at what is happening in the market.

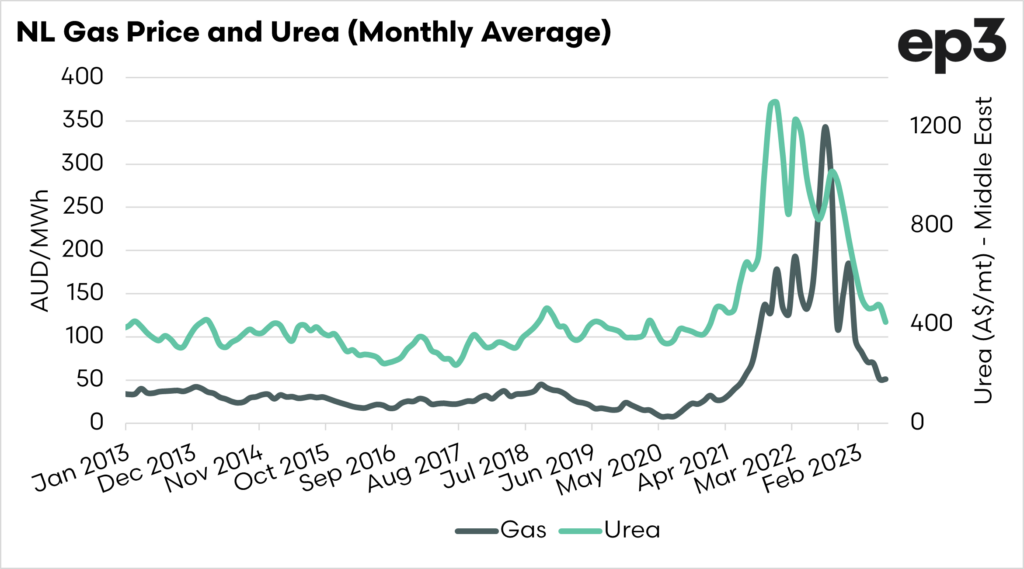

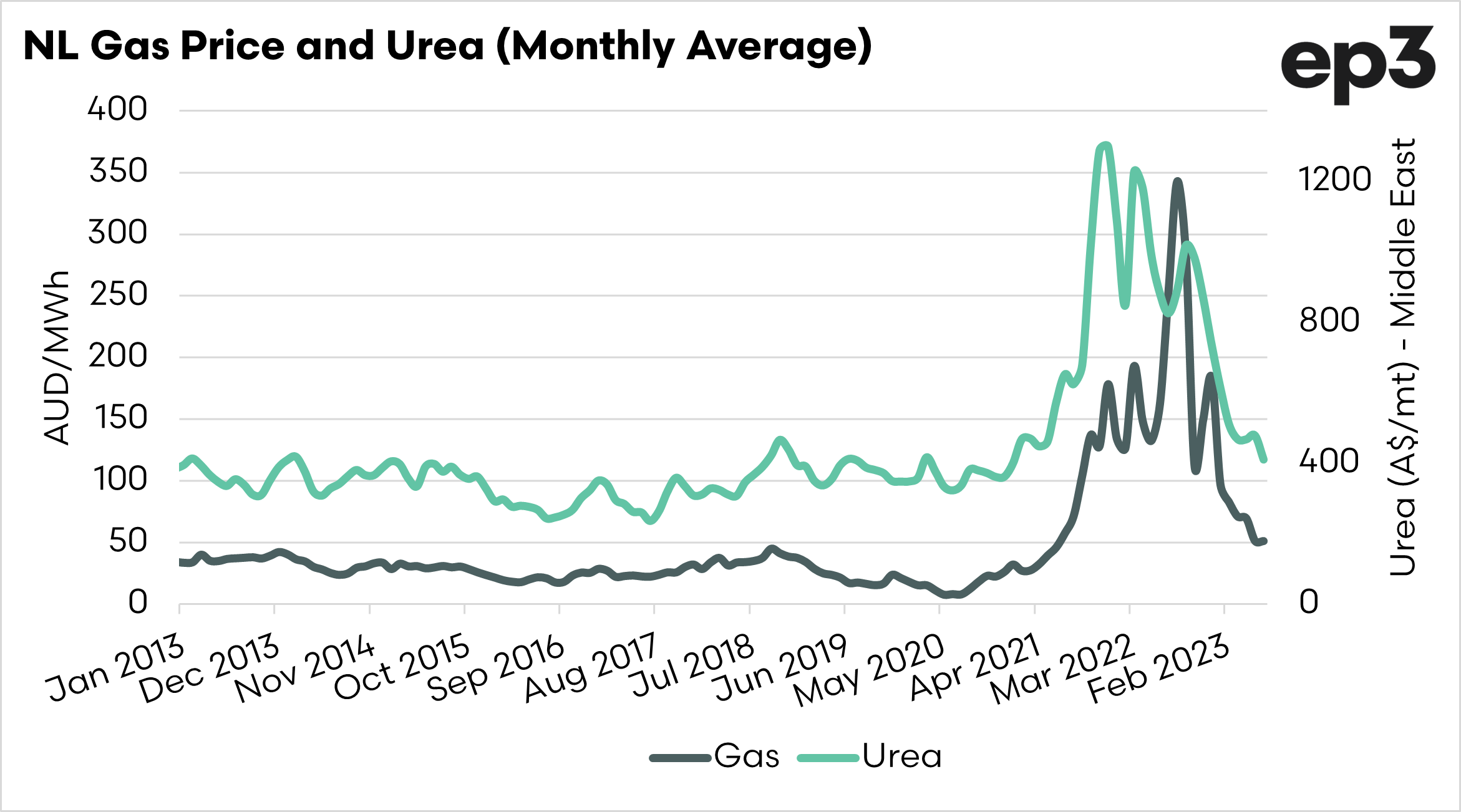

As anyone who reads our articles will know, a lot of agricultural markets have a very close linkage with energy markets. This is especially true when it comes to urea. Natural gas is the main feedstock for the production of urea.

It, therefore, makes sense that the price of urea tends to follow that of natural gas. We can see that in the chart below.

The gas price last year was abnormally high due to the war in Ukraine. The bulk of European natural gas used to come through pipelines from Russia. This caused a huge increase in gas prices as there was a huge degree of uncertainty.

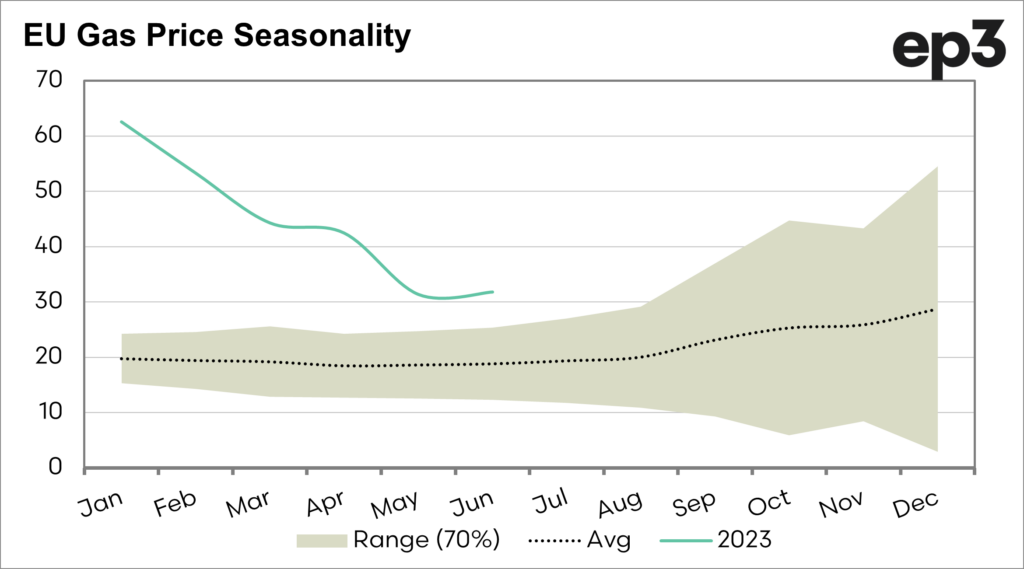

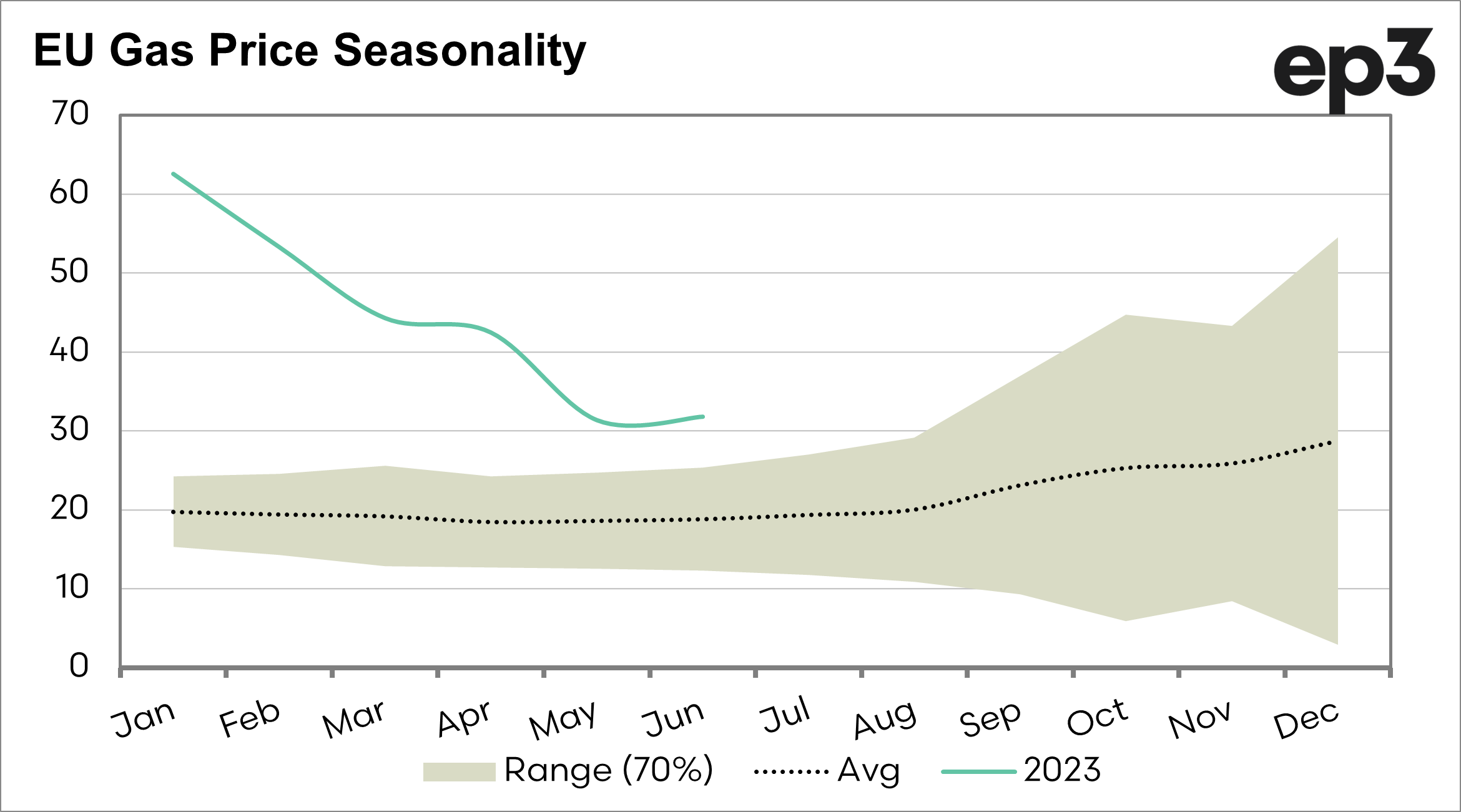

Natural gas follows a seasonal pattern. The chart below shows the seasonality of natural gas prices. The natural gas price tends to have a strong seasonal pattern. In this chart, I removed last year because the enormity of the movement in price changes the seasonal pattern, and this movement could be considered a black swan event.

It is the weather that typically drives natural gas prices. As Europe moves into winter, the demand rises for gas for heating. As we move into European summer, this demand drops.

Gas prices remain elevated but are moving back to more normal levels.

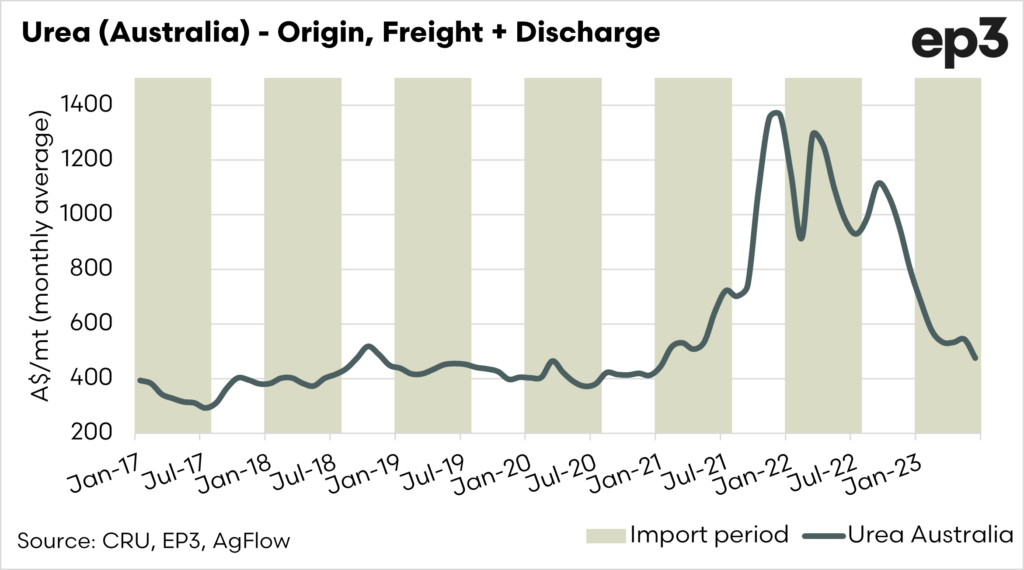

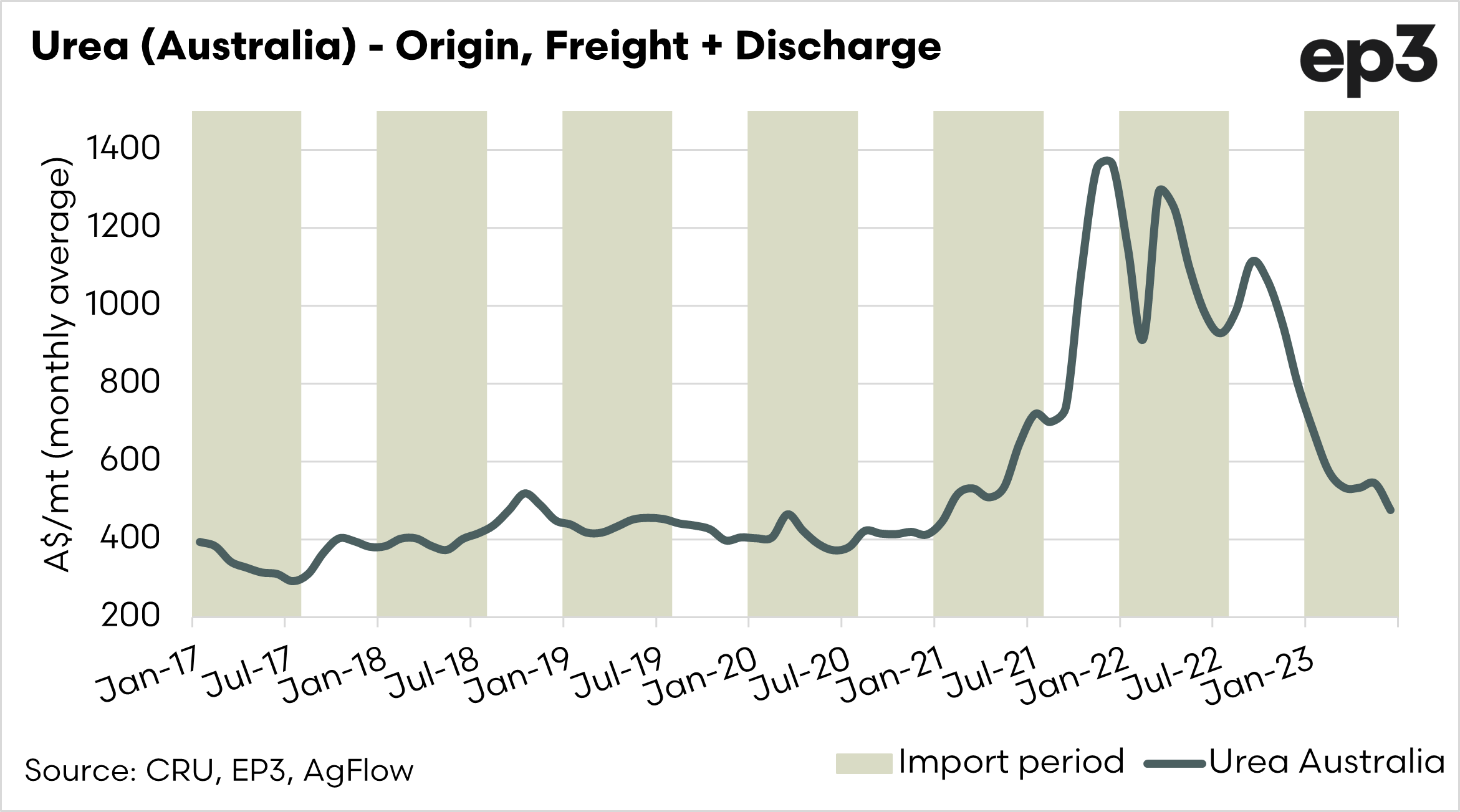

At EP3, we were the first to provide a cost and freight+ model for urea into Australia. We decided to produce this in order to give an insight into the trends of urea pricing at a basic Australian spot price.

This was in place of any transparent pricing available to the marketplace. We can see now that fertilizer prices landed in Australia have fallen to their lowest levels since January 2021. At these levels, we don’t foresee significant further falls.

It is important to note that these prices are the average costs for a month for replacing urea. It is the cost of the purchase in the middle east, plus freight and discharge. There are other costs that this does not take into account and is solely there as a guide for the pricing trend.

To further improve fertilizer transparency, complete this survey

So prices are declining globally, and we are seeing that flow through to the prices that farmers are quoted.

We are hearing that farmers are being told to “buy it now before it’s gone”.

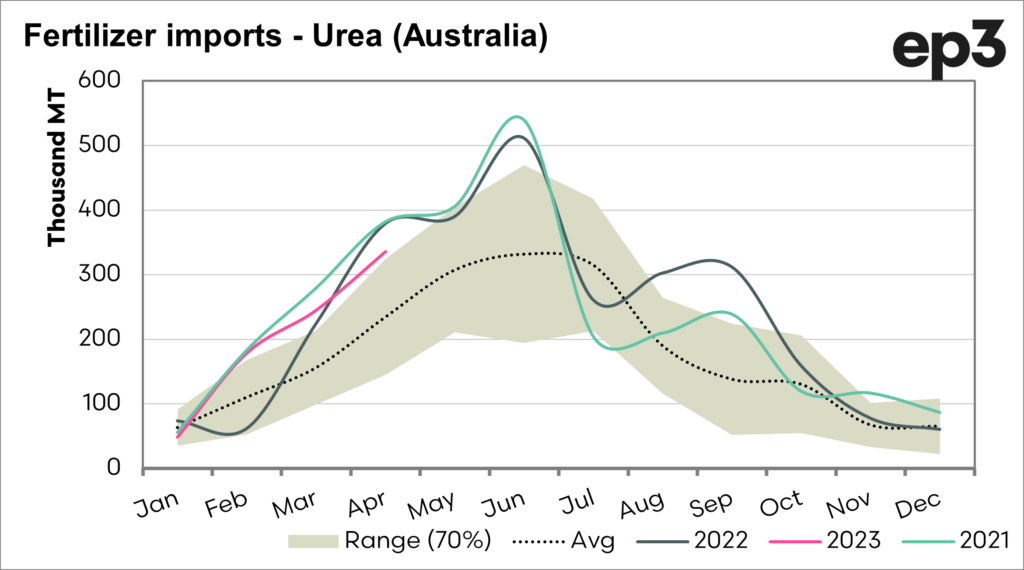

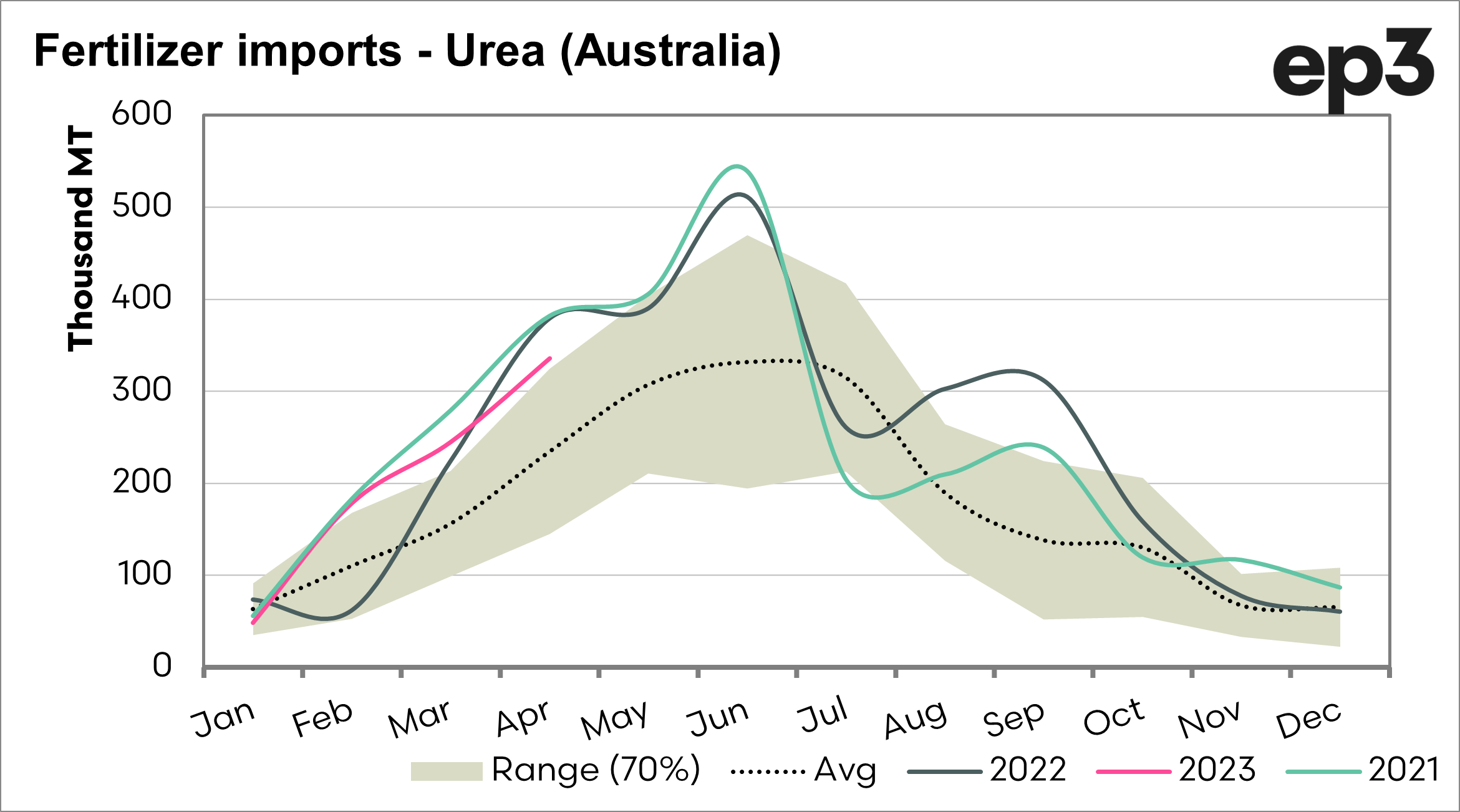

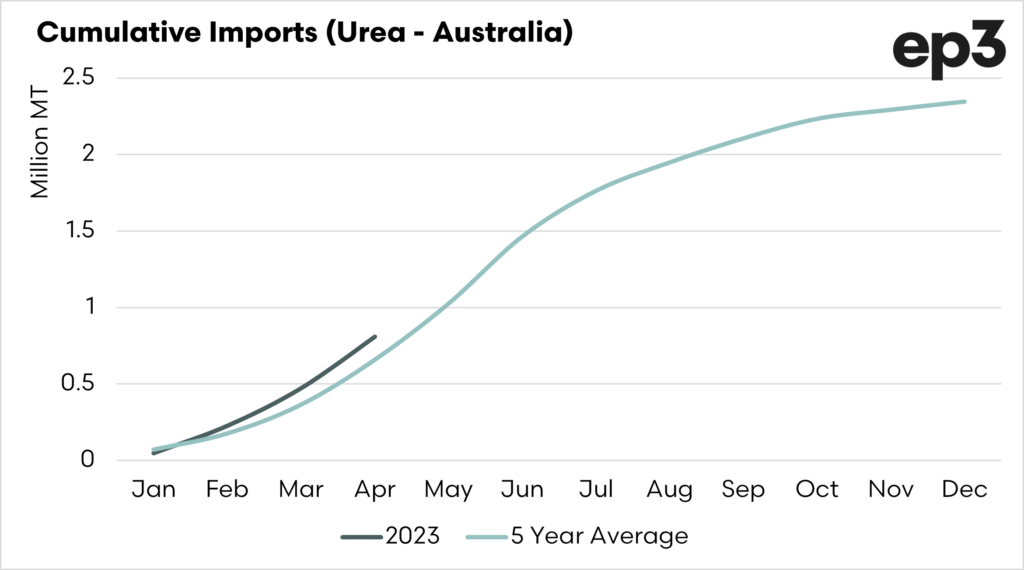

The chart below shows the seasonality of our urea imports into Australia. It makes sense, but the bulk of imports occur during the middle of the year, mostly in May-July. This is around the period of peak demand.

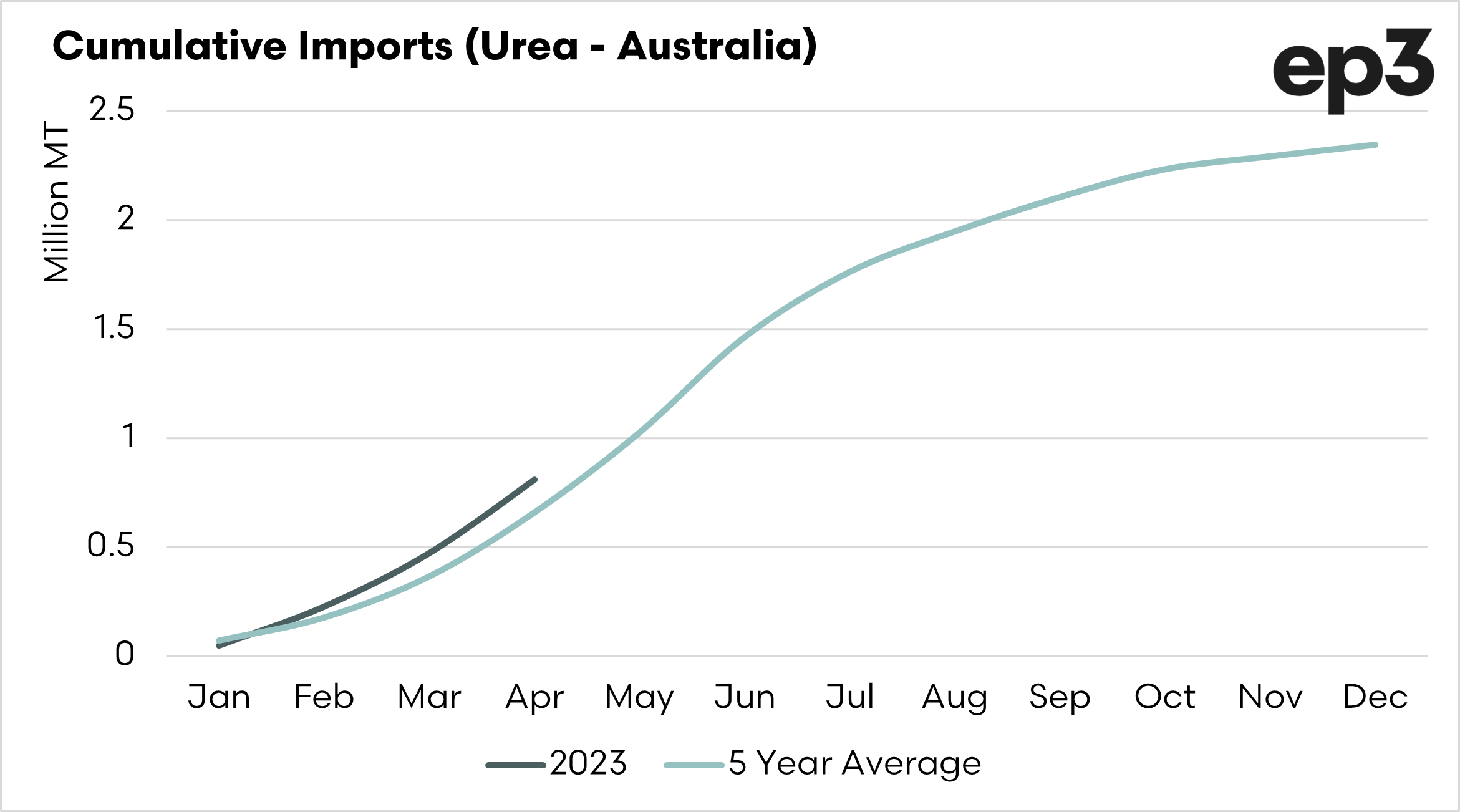

The import data is delayed, but until the end of April, fertilizer imports had been strong and ahead of the average for the longer term.

This can be seen below in the chart, which shows the cumulative urea imports for this year versus the five-year average. So up until April, we were ahead of the curve on imports. Does this mean we will run out of urea?

The demand for urea this year was looking to be constrained in Australia as dry conditions were expected to prevail. In many parts, there has been an uptick in demand due to better-than-expected moisture.

I have been covering fertilizer markets in Australia since 2016. In each year, I have received calls from those within the fertilizer trade. In each of these years, I have been told that fertilizer will be short and that farmers need to buy regardless of price.

In each of those years, I don’t recall much if any, shortage occurring (but I’m open to being corrected).

I told a supplier last year you have to be careful about making these comments because you make them every year. One year, the market will actually be short, and no one will believe you, “Yeah yeah, we’ve all heard this story before”. We need to all remember the boy who cried wolf story.

Will urea run short in the coming months? Who knows? You’ll just have to make your own decision.

None of the fertilizer companies want to be holding expensive stock when new cargoes come in. We’ll see in a couple of months whether the shortage transpires or not.