What’s happening in fertilizer markets?

The Snapshot

- Natural gas prices have fallen in recent months.

- As the main input in urea production, gas prices have led to urea falls.

- Whilst the urea pricing in Australia is not advertised we are hearing of offers in the range of the high A$600s to low A$700s

- This is good timing ahead of seeding.

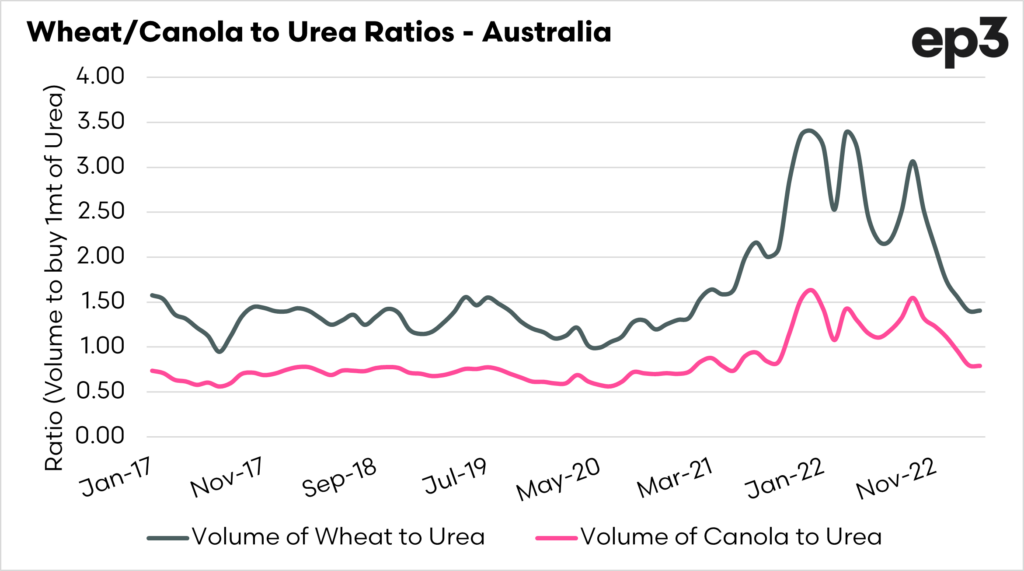

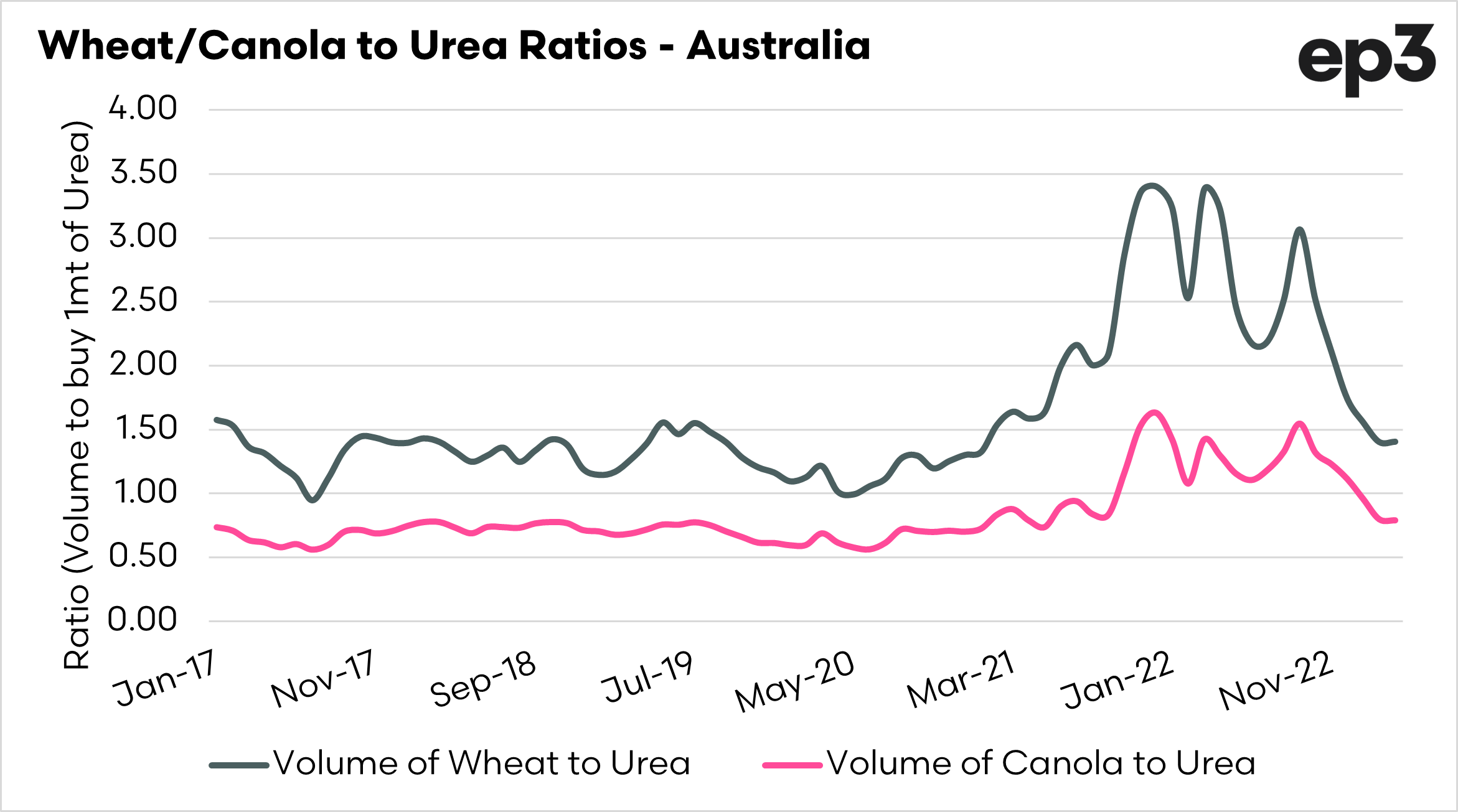

- A cost price squeeze occurred in recent years, but the ratio of wheat/canola to urea has come back to more normal levels.

The Detail

Good news for Australian farmers. The fertiliser market has started coming off, with prices falling over the past month.

As all our readers will know, we have been closely monitoring fertiliser markets for a long time. Fertiliser is one of the highest costs on farm, and knowing what happens with this market is important. We analyse the market with independent eyes – we aren’t here to sell you fertiliser.

So what’s been happening?

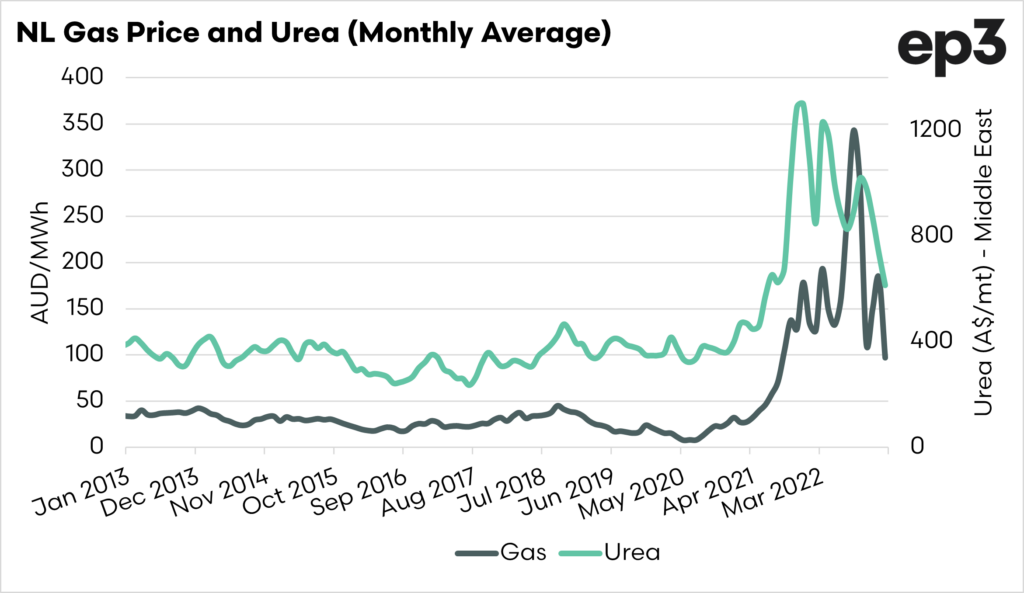

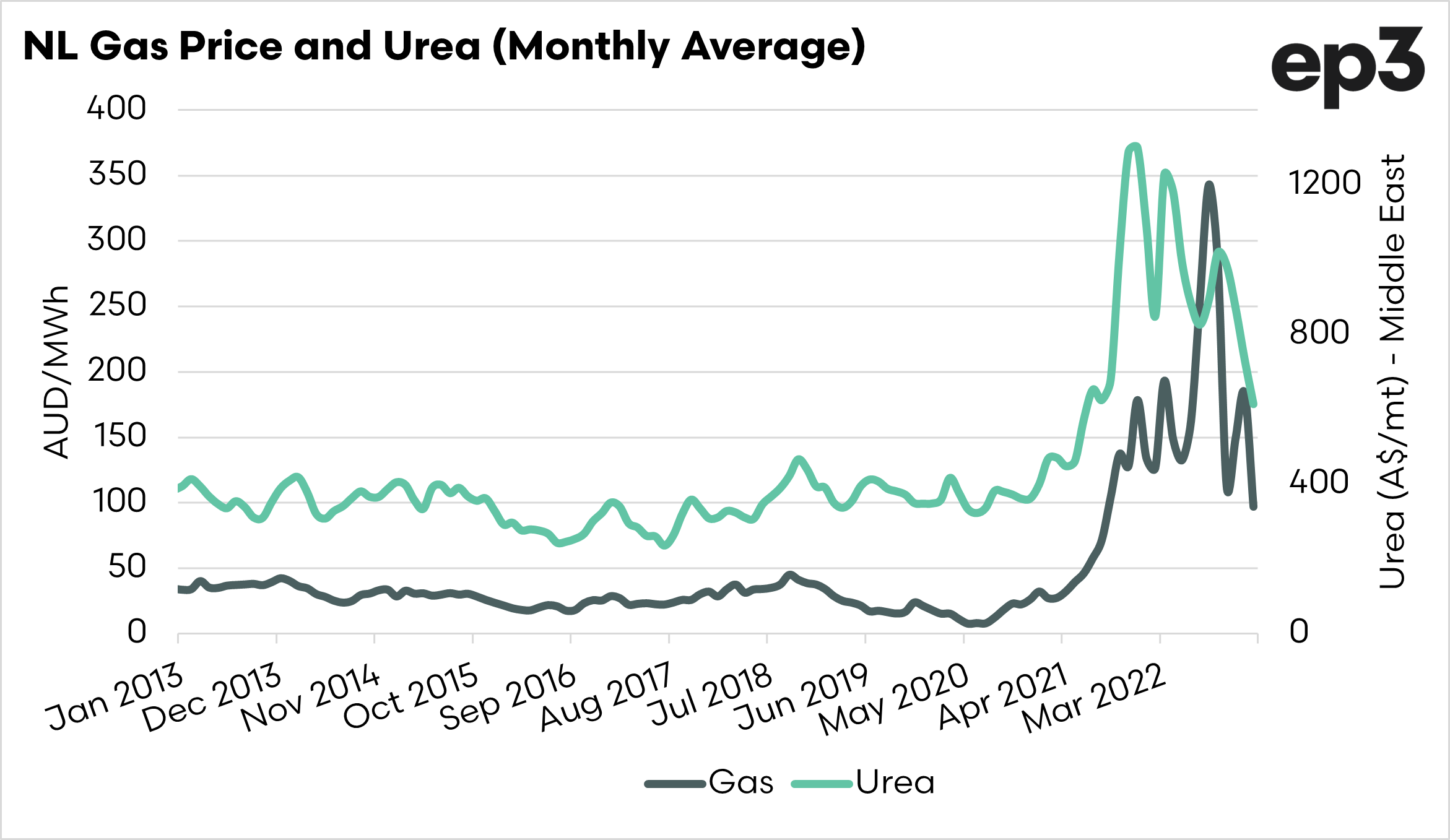

If you have read our previous articles over the years. In that case, you will understand that the primary input into urea is natural gas (or coal in some nations). The gas prices rose dramatically last year, in large part due to the invasion of Ukraine.

The chart below shows the monthly price of natural gas and urea. We can see that they follow a similar trajectory, and with the fall in the price of gas, we have seen a fall in the price of urea.

At the same time we have also seen fertiliser demand globally dropping. There was a tender by India for 1.1mmt, however, this wasn’t enough to quell the huge oversupply on the market at present. Buyers are starting to purchase hand to mouth and ride the wave down.

What about Australia?

Anecdotally, we hear of urea prices dipping to the high A600s / low A$700s. A far cry from the prices experienced by farmers last year.

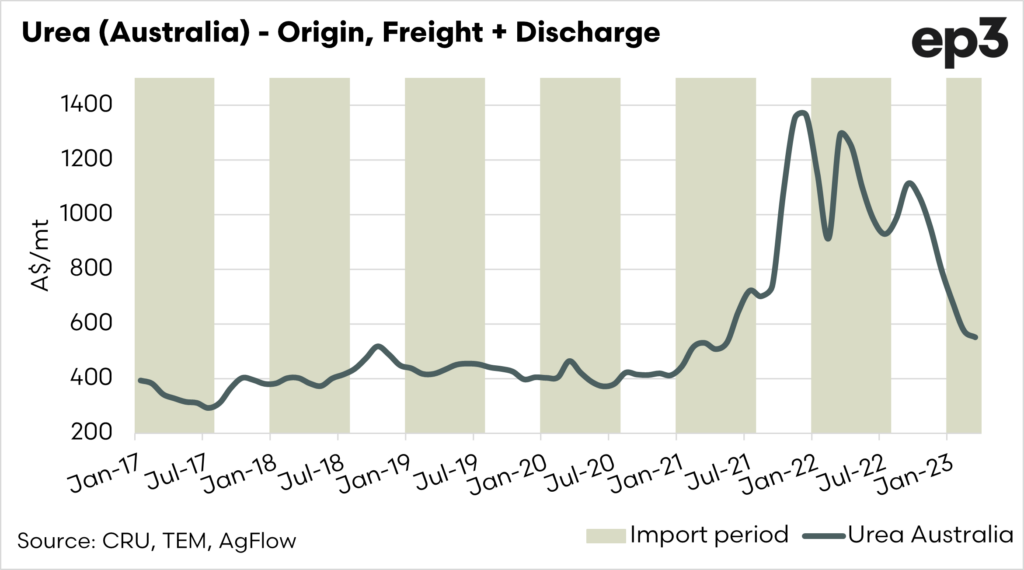

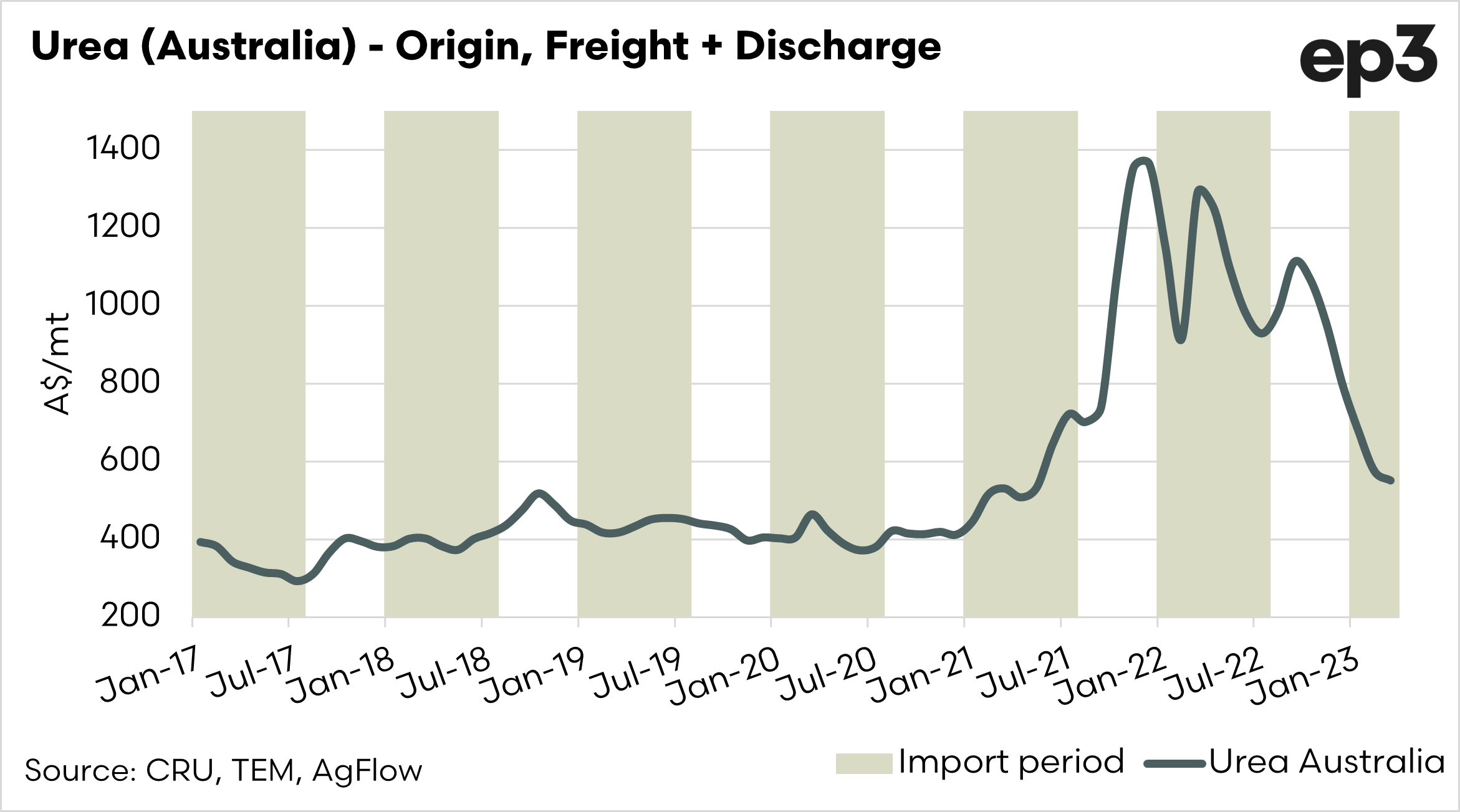

We were the first independent analysts to produce a ‘landed Australia’ urea price. This modelling is the price of wholesale purchase of urea in the middle east with freight and unloading in Australia.

Whilst this to the chagrin of some ‘players’ in the fertiliser space, it provides an idea of the trend of the replacement value of fertiliser in Australia.

The current replacement value of urea in Australia is in the mid-A$ 500s, although it is important to include that this does not include finance costs, margins etc.

The good news is that the price is starting to fall in line with overseas values.

In theory the price of fertiliser doesn’t really matter if grain prices are high. We track the landed model against the sales price of grain. The chart below this shows that relationship between grain price and urea as a ratio.

I.e how many tonnes of grain required to purchase a tonne of fertiliser. After a period of huge blow outs and cost price squeezes, we are seeing fertiliser come back into a more normal realm.