A critical time

Market Morsel

It’s a very difficult time for WA sheep producers, low prices for livestock, high feed costs, dry conditions and a live export sector about to head into the annual northern hemisphere summer moratorium. The frustration has boiled over on social media in recent weeks, and rightly so given the dire circumstances of many WA producers. Even the team at Episode 3 wasn’t immune to some stinging criticism that we weren’t doing enough to assist.

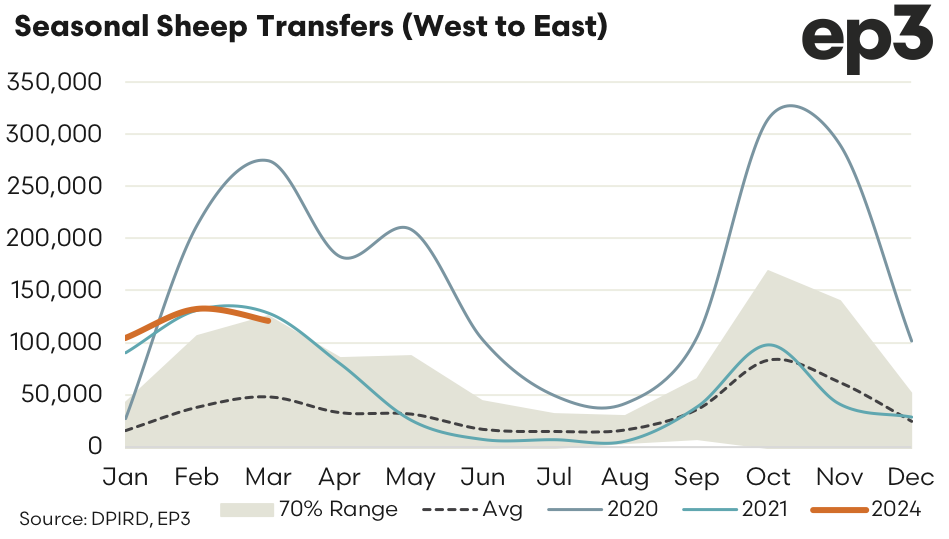

While we have taken complaints directed to us on board, we had already planned to take a look at sheep turnoff options into the eastern markets for WA farmers, before the online battering, as the new transport data for Q1 2024 was just released from DPIRD. Analysis of the seasonal transport flows for sheep and lamb from WA to the eastern states shows that 2024 is shaping up very similarly to 2021.

Compared to the ten-year average monthly volumes for Q1 2024 are running 250% higher, in average volumes per month since the start of the season. This equates to about 120,000 sheep and lamb being sent to the east each month since the start of 2024 versus the 35,000 or so head that would be expected to be sent each month, based on the average volumes seen transported over the last decade for the first quarter of the year.

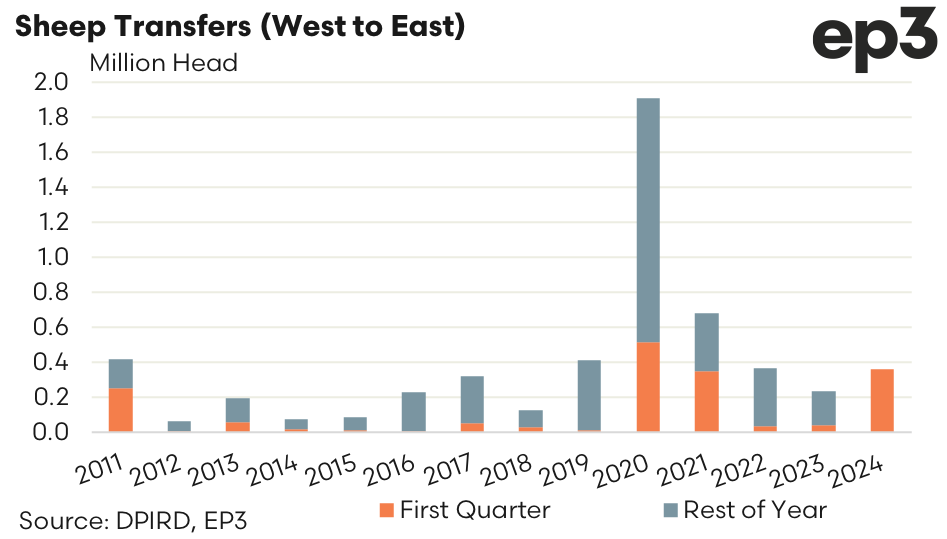

In total, 357,602 head of sheep & lamb have been sent from west to east so far in 2024, which is the second highest Q1 flows on record behind the 2020 season. In Q1 2020 we saw 513,844 sheep & lambs shipped west to east and for the whole of 2020 the total flow west to east reached 1,909,047 head.

The strong volumes seen shipped west to east so far in 2024 rival the 2021 flows. In Q1 2021 transports of sheep to the east was 349,122 head so the current years flows are sitting 2.4% higher.

Big volumes like what are being sent west to east this year are only really viable when the price discount between the west and east are wide enough to cover freight costs, so these volumes highlight very clearly the strain the WA sheep producer is facing presently. The looming concern is that the live export avenue for turnoff will soon be closed off until mid-September.

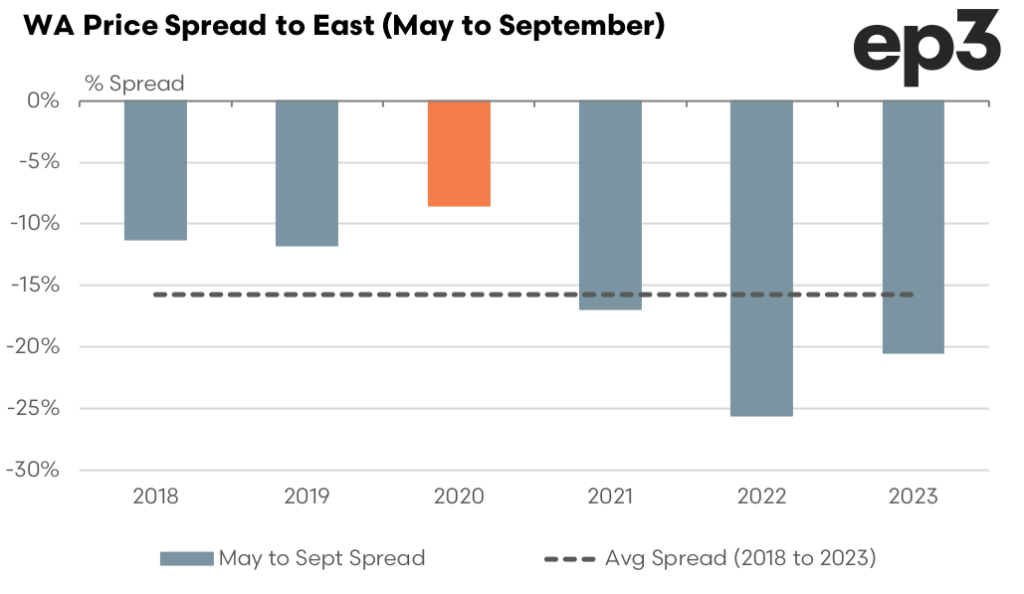

Analysis of the spread between the western and eastern pricing has shown that since the moratorium began in 2018 the discount spread has deteriorated during the May to September period every year despite 2020. Earlier analysis we provided (free of charge) on Episode 3 on spreads between WA and the east highlighted that the long term average discount between WA Trade Lamb and the Eastern States Trade Lamb sits at a 7% discount. During May to September in 2020 the discount widened to just 9%. In 2020 it seems that the very strong demand for WA sheep and lamb in the east helped keen the discount spread at fairly normal levels.

However, in other years when the live export sector was not available as an outlet for WA farmers to turnoff due to the moratorium period, and the demand from the east wasn’t so strong, the discount widened significantly between western and eastern prices. As we have outlined many times on Episode 3 articles (and whenever we have the chance to speak about this issue in the media or at agricultural conferences we are invited to present at) if we are planning to exit the live sheep trade we need to ensure that there are several viable options for WA sheep producers to access all year round.

For example, the air freight avenue to send “bag lamb” carcass to the MENA region via passenger flights is a part of the solution to offer alternative market destinations to WA farmers, particularly if live sheep is to be phased out. We need to be doing all we can to rebuild relationships into the MENA region and develop pathways for increased access for boxed sheep meat. The government decision to limit access for Qatari airlines did not help our chances at all. Airfreight volumes to MENA for Australian sheep meat remains below pre-Covid levels. We should be encouraging this airfreight option for turnoff to assist WA growers, particularly for the “bag lamb” market.

Similarly, meat processors, particularly in WA, need to be well supported to step into fill the gap that will be left, otherwise WA producers will bear the brunt if there is a backlog of sheep and lamb to process.