A very small win for sheep meat processors

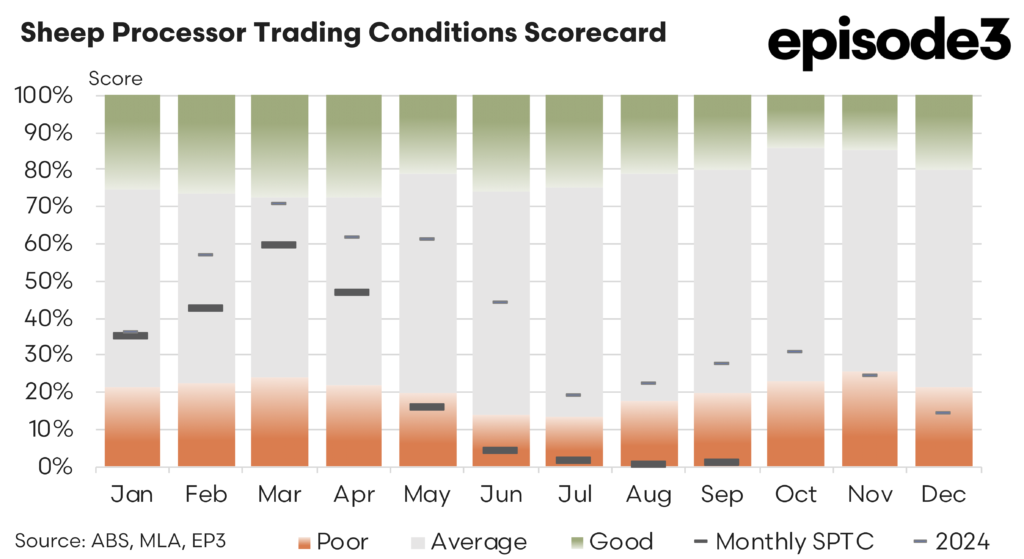

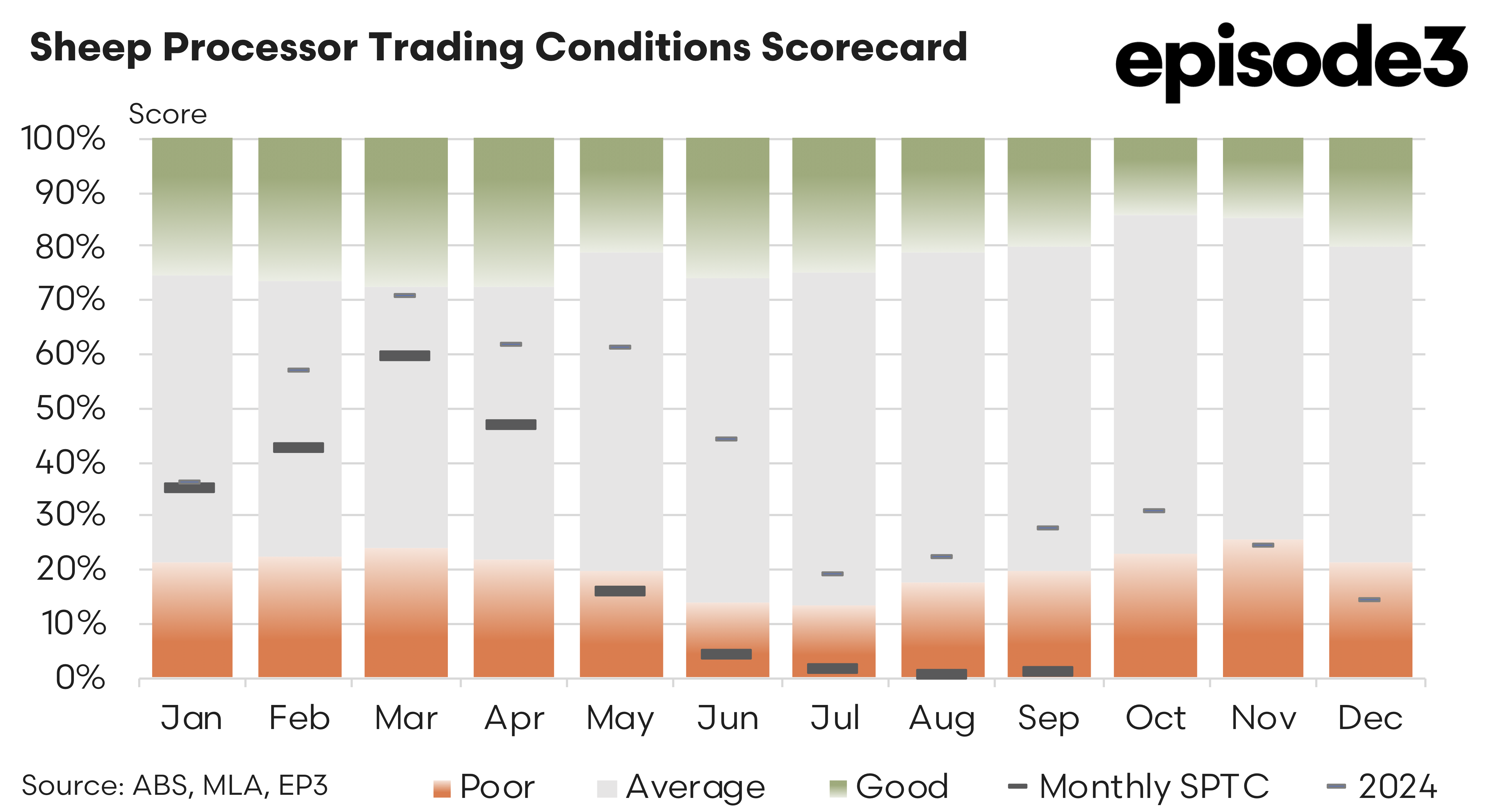

Sheep Processor Trading Conditions Model

The latest update to the Sheep Processor Trading Conditions index for September offers a marginal improvement in what has been a difficult year for processing margins, but the overall picture remains one of persistent pressure. The move in the SPTC index from 0.4 percent in August to 0.9 percent in September represents a slight easing in cost imbalances, yet the gain is fragile and heavily dependent on co product strength rather than any meaningful shift in the relationship between farm gate prices and export returns.

The improvement brings the 2025 annual average SPTC to 23 percent, but the lift should be interpreted as stabilisation rather than recovery. Processors continue to operate in an environment where incremental shifts in either livestock costs or export values can erode already thin operating margins.

September’s results reflect a combination of mixed export performance across key markets, further increases in livestock procurement costs, and another month of improving co product values that has provided some relief. Export prices showed a mild improvement overall, rising by 3.4 percent from August to September. However this headline masks significant variation between individual destinations. Shipments to China declined in value by 4.2 percent falling from an average of six dollars and three cents per kilogram in August to five dollars and seventy seven cents in September. This movement highlights the volatility still present in one of Australia’s largest sheep meat markets and underscores the price sensitivity of Chinese buyers who remain cautious in the face of economic headwinds.

Malaysia recorded a small improvement in returns with average export values rising from eight dollars and seventy nine cents to nine dollars and eleven cents per kilogram. The United Arab Emirates delivered a much stronger lift with average returns increasing by 12.8 percent to thirteen dollars and twenty five cents per kilogram. By contrast the United States market weakened again slipping by one percent to fourteen dollars and eighty nine cents per kilogram. The continued softening in the US is notable because of its importance as a high value chilled lamb destination. With American consumer sentiment weighed down by inflationary pressure and reduced discretionary spending, Australian exporters have faced ongoing difficulty in maintaining the premiums traditionally available in that market. The combined effect of these varied movements is a modest uptick in the overall export average but not enough to decisively shift processor profitability.

On the domestic cost side processors faced another lift in livestock procurement expenses. Mutton values increased by 2.5 percent from August to September and lamb prices rose by 1.1 percent. While these rises are not as sharp as some earlier winter movements they are still enough to constrain margins when export returns are rising only marginally. Restocker confidence and widespread interest in flock rebuilding have tightened supply at saleyards and ensured processors remain in a competitive buying environment. The increasing diversion of lighter lambs toward restocking programs has contributed to stronger pricing at the farmgate which has flowed directly into processing cost structures.

Co product values have again provided crucial support. During the month co product prices rose by a further 7 percent helping to counterbalance the rising cost of raw livestock. Offal demand from Southeast Asia and the MENA region has remained firm and tallow prices continue to benefit from sustained interest from renewable fuel manufacturers. These ancillary revenue streams have become increasingly important over the past year.

Retail lamb prices have also edged higher with values increasing by 5.8 percent from the second quarter to the third quarter. However this movement offers limited direct benefit to processors because supermarket and butcher margins are already constrained by the sensitivity of domestic consumers to food price inflation. The domestic market remains an important anchor for volumes but not a major source of margin expansion.

Taken together the September results show a sector managing to find small points of stability despite broader pressures. Export returns have improved enough to prevent further deterioration in margins yet not sufficiently to deliver a meaningful turnaround. Livestock costs continue to trend higher and remain the single largest constraint on profitability. Co product markets are doing much of the heavy lifting in supporting the trading environment and their strength is the primary factor behind the slight rise in the SPTC index. The outlook remains one in which further improvements will depend on either softening livestock prices as supply normalises or stronger and more uniform export demand across high value markets. Until one of those shifts materialises processors will continue to operate in a tight and delicately balanced margin environment.