Beef export update December 2025

December 2025 - Beef export update

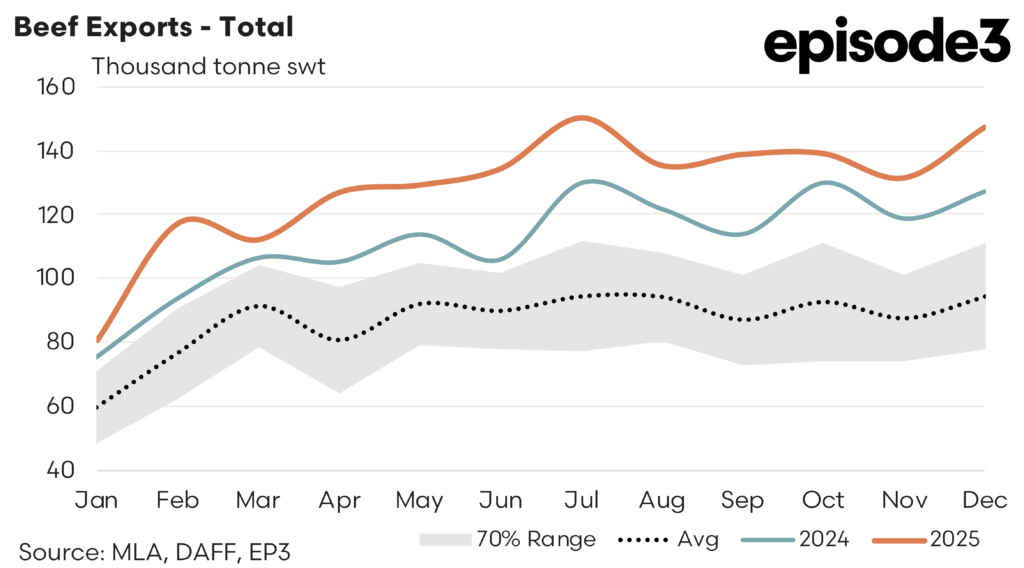

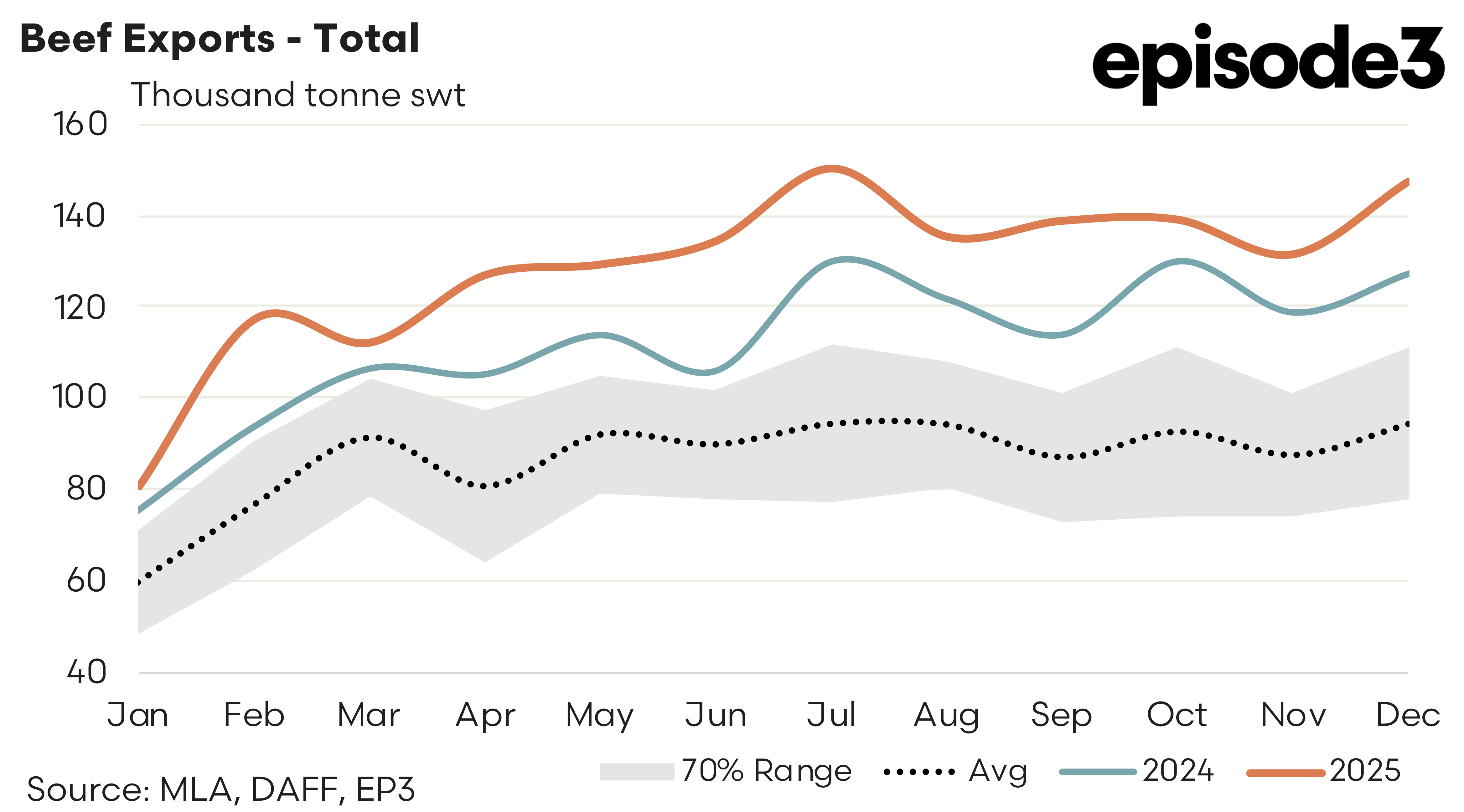

The 2025 Australian beef export season finished at a record scale, but the December data also reveal important shifts in momentum between the September and December quarters and relative to both last year and longer-term norms. Total annual beef exports reached 1,545,759 tonnes swt for the year, 15 percent higher than 2024 and 48 percent above the five-year average, with the final quarter playing a critical role in locking in that outcome.

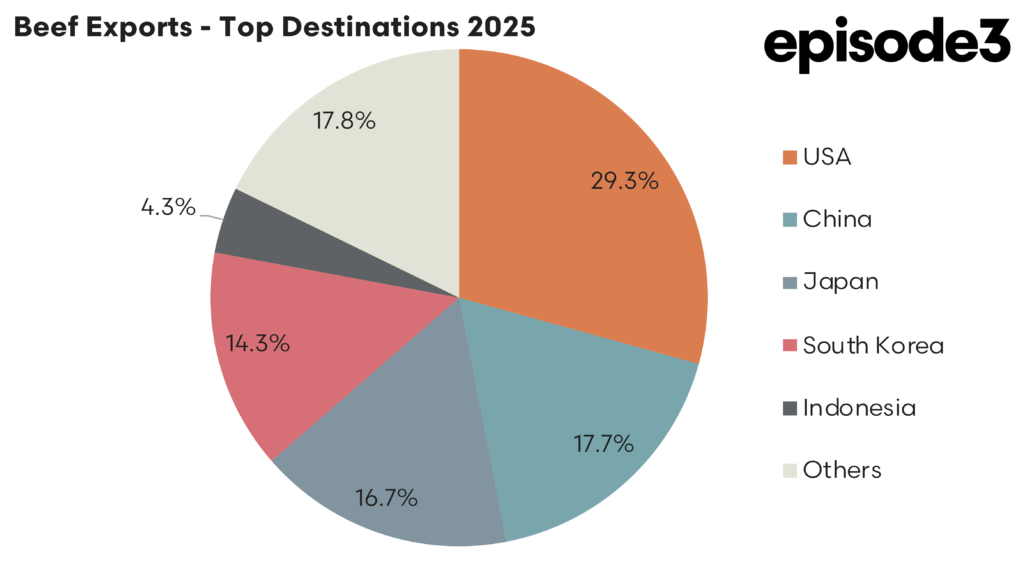

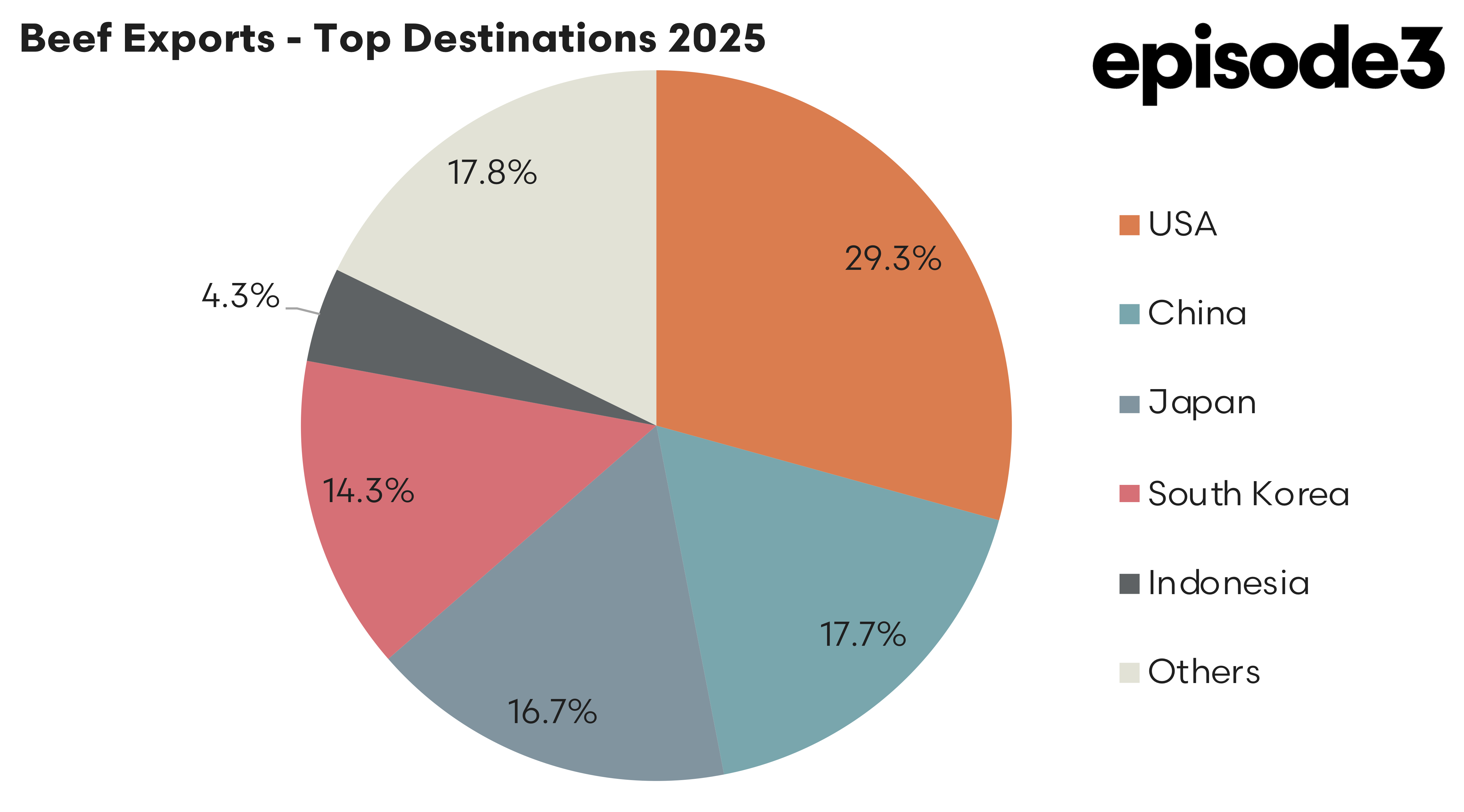

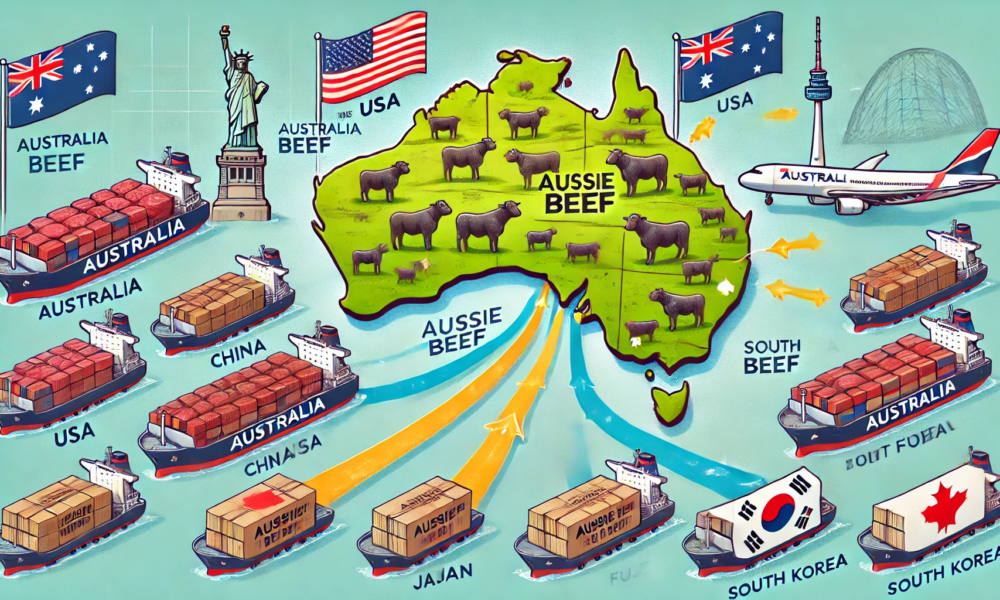

A summary of the top trade locations, in order of top market share for 2025, is as follows:

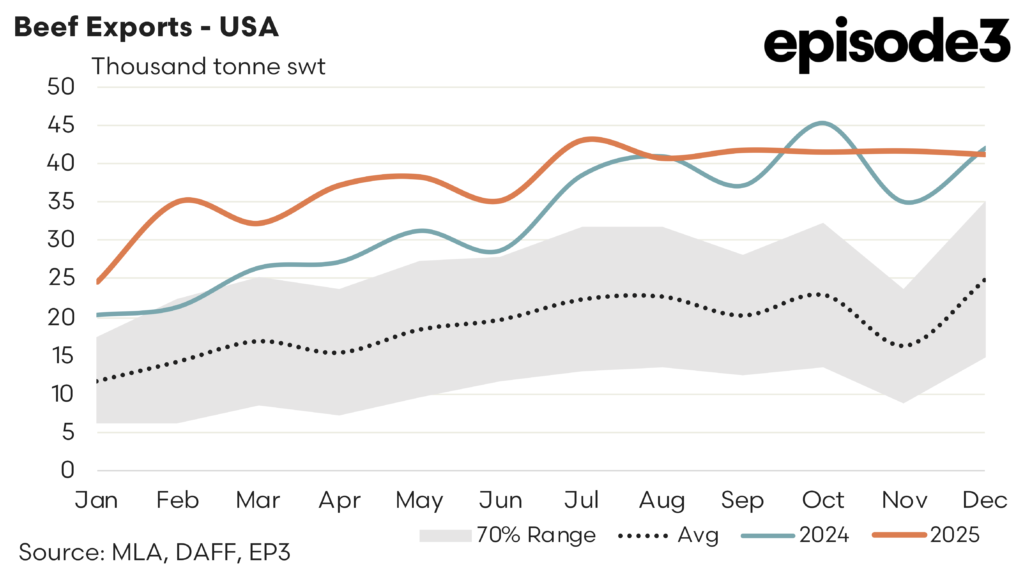

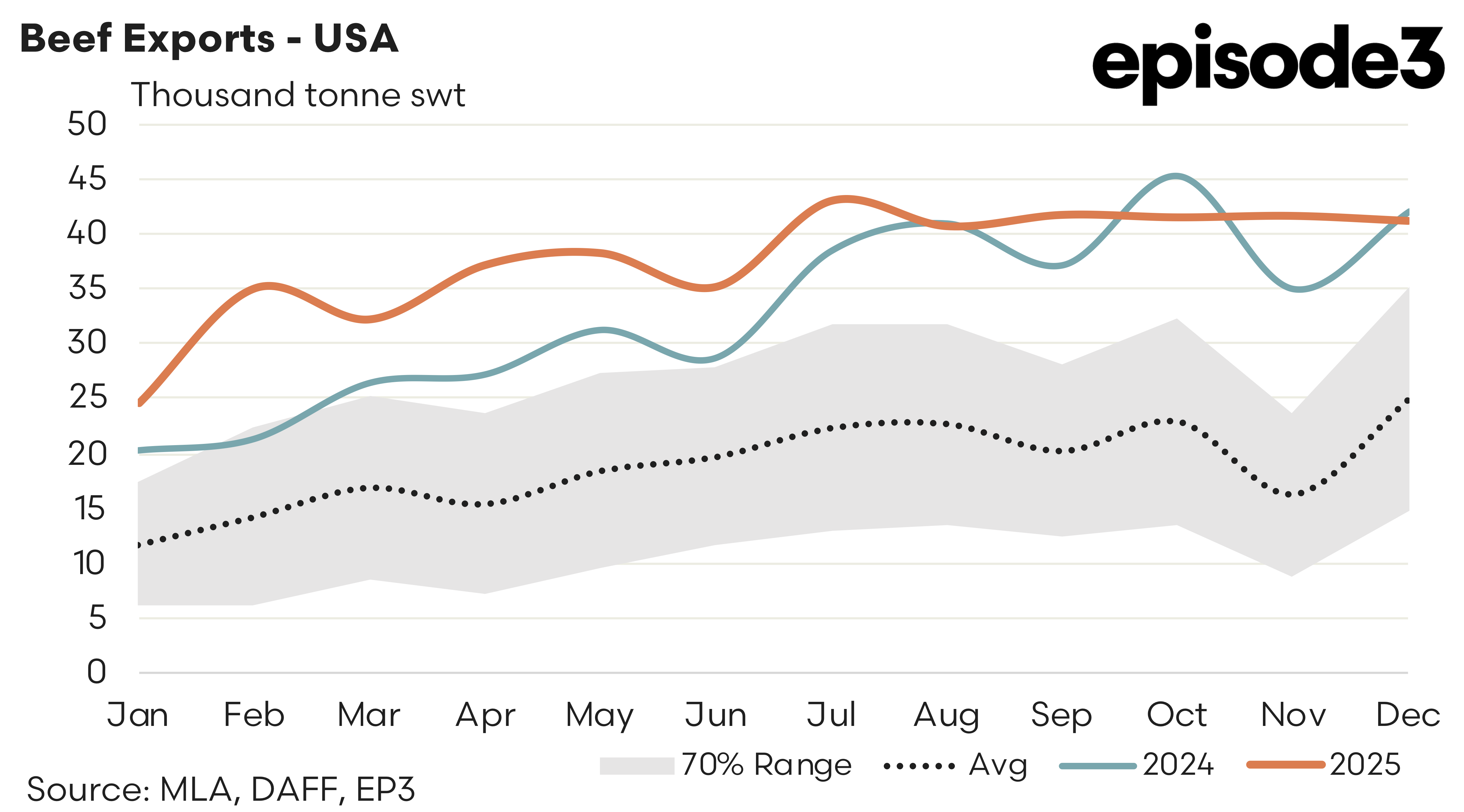

The United States consolidated its position as the dominant destination, accounting for 29.3 percent of total exports in 2025. Volumes eased marginally between Q3 and Q4 2025, slipping by around 1 percent to 124,446 tonnes for the final quarter of 2025, but this followed an exceptionally strong September quarter and did little to alter the broader picture. Compared with Q4 2024, exports to the United States were 2 percent higher, while relative to the five-year average, Q4 shipments were 94 percent higher. This confirms that even with some late-year stabilisation, US demand in 2025 operated at levels far above historical norms and remained the single most important contributor to the record annual result.

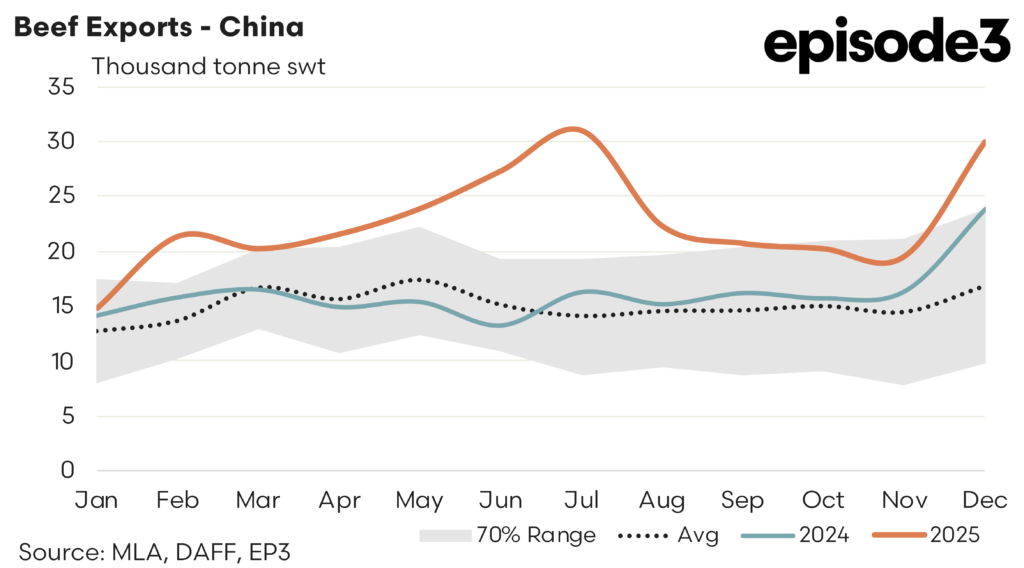

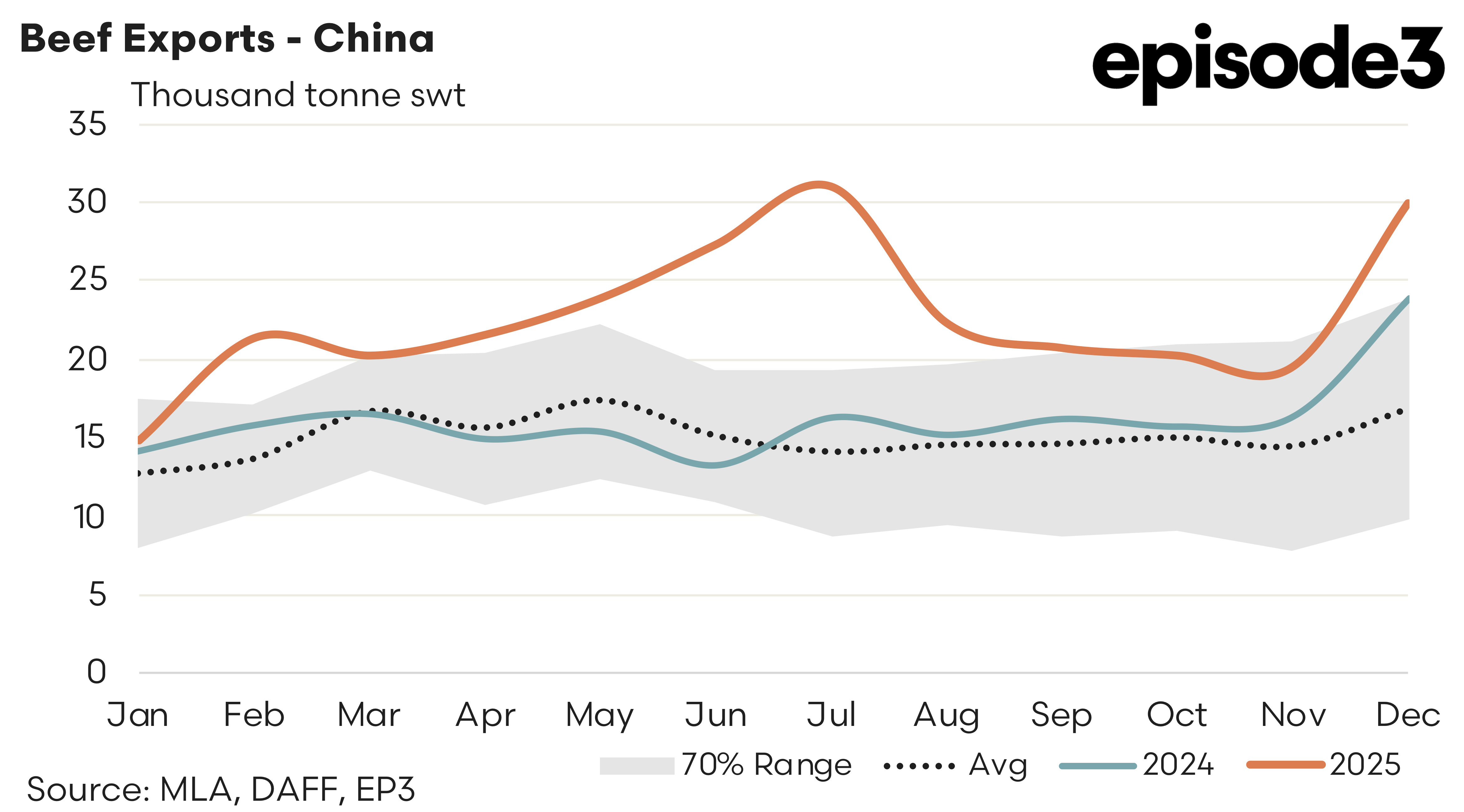

China finished the year as the second largest destination with a 17.7 percent share of exports. Quarterly flows softened into year end, with Q4 2025 volumes around 6 percent lower than Q3 at 69,691 tonnes. Despite that easing, the year-on-year comparison remains striking. Q4 exports to China were 25 percent higher than Q4 2024 and 51 percent above the five-year average. This highlights how elevated Chinese demand has become over the past two years, even allowing for seasonal moderation in the final quarter of the year. Looking ahead, the newly announced tariff framework for 2026 introduces a potential constraint, although the safeguard mechanism means it will not take effect until the trigger volume is reached, likely around the middle of the year, limiting any immediate impact on early-season trade.

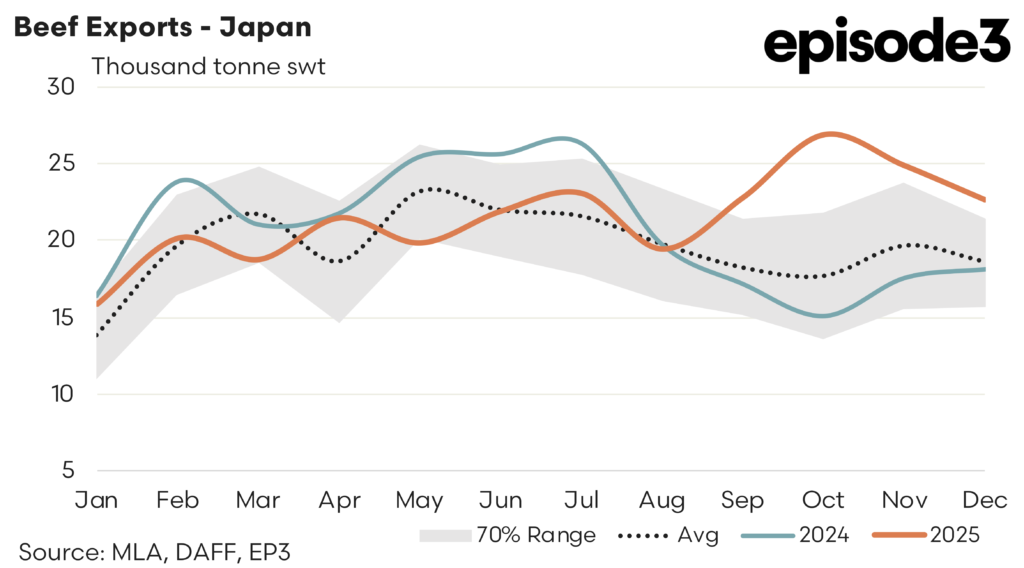

Japan accounted for 16.7 percent of total exports and stood out for its strong finish to the year. Volumes into Japan lifted sharply from Q3 to Q4 2025, rising by around 14 percent to 74,392 tonnes, reflecting a seasonal strengthening in demand. Compared with Q4 2024, exports were 47 percent higher, and relative to the five-year average, Q4 volumes were 33 percent higher. This represents a clear re-acceleration in Japanese buying through the final quarter and reinforces Japan’s role as a stable but increasingly supportive market in the current tighter global beef supply environment.

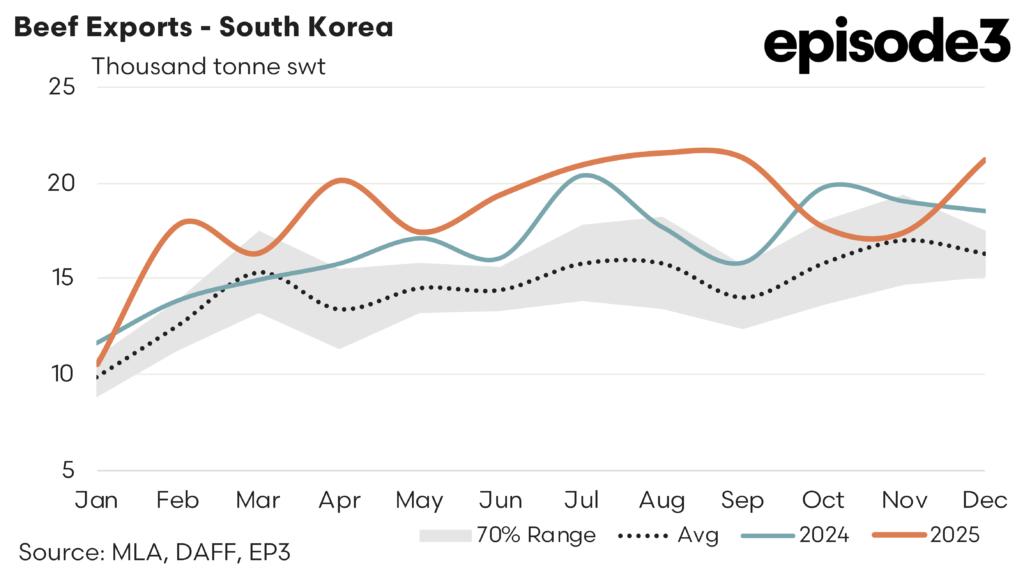

South Korea rounded out the top four destinations with a 14.3 percent share of exports. Unlike Japan, South Korea saw a pullback in the last quarter of the year, with Q4 volumes around 12 percent lower than Q3 2025 to see 56,212 tonnes shipped during Q4 2025. On a year-on-year basis, Q4 exports this year were 2 percent lower than Q4 2024, suggesting some mild softening in late-year demand. Even so, Q4 volumes remained 14 percent above the five-year average, indicating that underlying import requirements in 2025 were still stronger than historical norms despite short-term volatility.

The quarterly comparisons show a market that remained exceptionally strong in aggregate but increasingly differentiated by destination as the year progressed. The United States continued to dominate in both volume and market share terms, China maintained structurally higher demand despite a softer December quarter, Japan surged into year end, and South Korea eased back while still outperforming long-term averages. The market share split, led by the United States at just under 30 percent and followed by China, Japan and South Korea in a relatively tight cluster, underscores how diversified Australia’s beef export growth has become, even as total volumes push well beyond historical benchmarks.