Beef export update January 2026

January 2026 - Beef export update

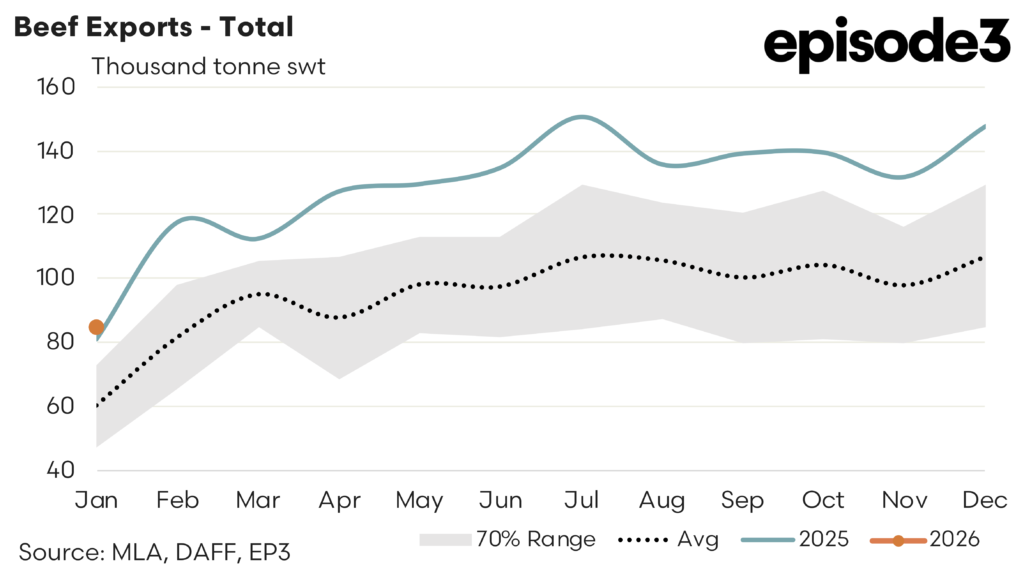

Australia’s beef export performance in January 2026 highlights a sector operating at historically elevated levels despite the normal seasonal reset that follows the December shipping surge.

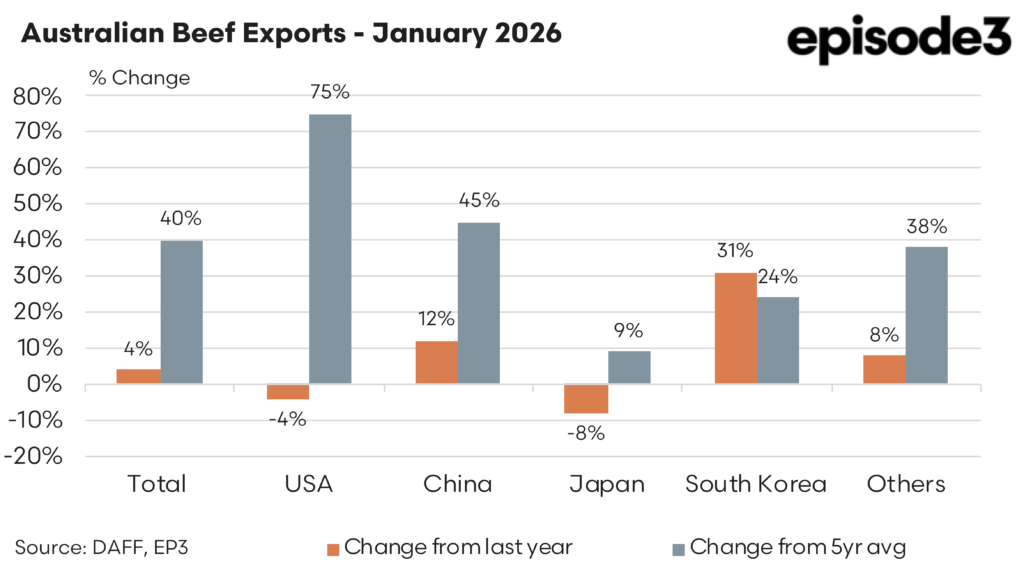

Total exports for the month reached 84,343 tonnes. While this represented a sharp 43 percent decline from December 2025, the broader context is critical. January volumes were still 4 percent higher than January last year and sat a striking 40 percent above the five year January average. This confirms that the post-Christmas slowdown was more a function of timing and logistics than any weakening in underlying demand, with export capacity continuing to run well above long term norms.

The United States remained Australia’s largest export destination in January, taking 23,747 tonnes of beef. Shipments to the US fell 42 percent from December and were 4 percent lower than January 2025, yet the longer term comparison tells a very different story. January volumes into the US were 75 percent above the five year average for the month, highlighting the scale of Australia’s role in supplying a market grappling with tight domestic cattle numbers. Even with some month to month volatility, the US market continues to absorb large volumes of Australian beef, reflecting a structural demand gap rather than a short lived trading opportunity.

China was the second largest destination in January, with exports totalling 16,636 tonnes. Volumes declined 44 percent from December, a pattern consistent with early year shipping resets and quota management behaviour. Compared with January last year, exports to China were 12 percent higher, and relative to the five year average they were 45 percent above normal levels. Anecdotal reports of Chinese importers keen to stockpile Aussie beef in cold store to get ahead of the safe-guard tariff, set to be imposed around May 2026 once the 205,000 tonne quota is breached, appears to be clearly demonstrated in the strong demand from China at the start of the season.

Japan received 14,563 tonnes of Australian beef in January, placing it third among export destinations. Shipments were down 36 percent from December and 8 percent lower than January 2025. However, exports to Japan were still 9 percent above the five year January average, suggesting a market characterised more by stability than rapid growth. Japan continues to provide a dependable base load for Australian beef exports, with volumes holding above historical norms despite softer year on year comparisons.

South Korea stood out as a relative bright spot in the January data, with exports reaching 13,100 tonnes. While volumes fell 38 percent from December, shipments were 31 percent higher than a year earlier and 24 percent above the five year average. This strong annual growth reflects favourable market conditions early in the year, including tariff related dynamics and competitive positioning against key competitors, like the USA. Korea’s performance underscores its importance as a destination capable of delivering meaningful growth within Australia’s diversified export portfolio.

Exports to all other destinations combined came in at 16,296 tonnes. Volumes to these markets eased 50 percent from December, yet were 8 percent higher than January last year and 38 percent above the five year average. This highlights the depth of demand across a wide range of secondary markets, which continue to underpin overall export resilience.

January 2026 confirms that Australia’s beef export sector remains in a high volume phase. Despite the sharp month to month correction from December, shipments across all major destinations were well above historical benchmarks, reinforcing the view that global demand for Australian beef remains robust and structurally supportive.