Beef export update November 2025

November 2025 - Beef export update

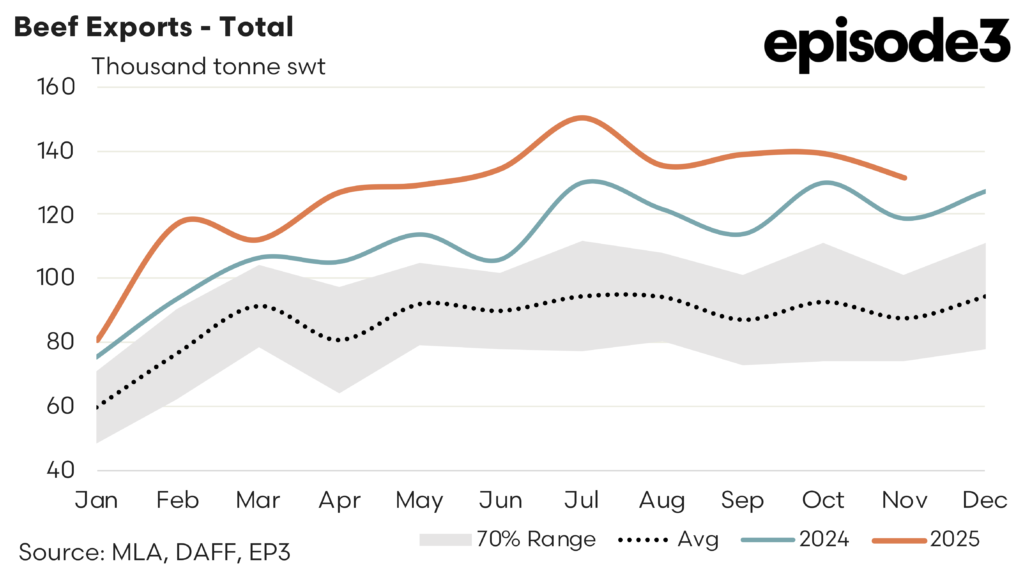

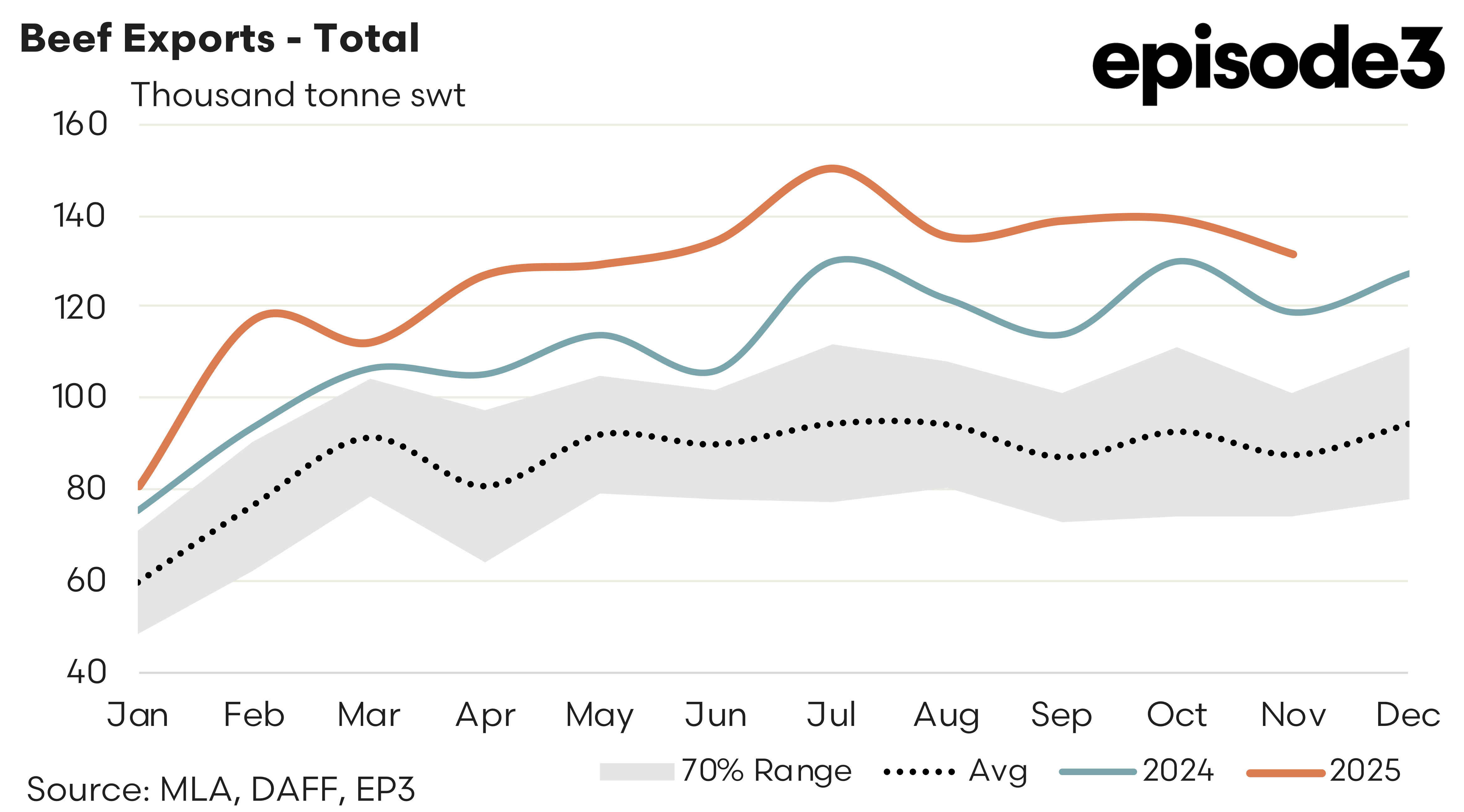

Australian beef exports softened in November, although the broader picture remains one of exceptional strength across all major markets. Total beef exports for the month reached 131,705 tonnes, a decline of 5 percent on October, yet still sitting approximately 50 percent above the five year average for November. This continues the run of elevated export volumes seen throughout 2025 and reflects a global demand environment that remains broadly supportive despite some expected seasonal recalibration.

Across all major destinations the key theme is consistency at high levels. November’s total export decline may initially appear to signal softening, yet the broader context makes clear that Australian beef remains in a period of very strong global demand. Each of the major markets continues to operate well above its five year November average, demonstrating that the elevated volume seen through 2025 is not an isolated surge but a sustained shift in global reliance on Australian supply.

A summary of the top trade locations, in order of top market share for 2025, is as follows:

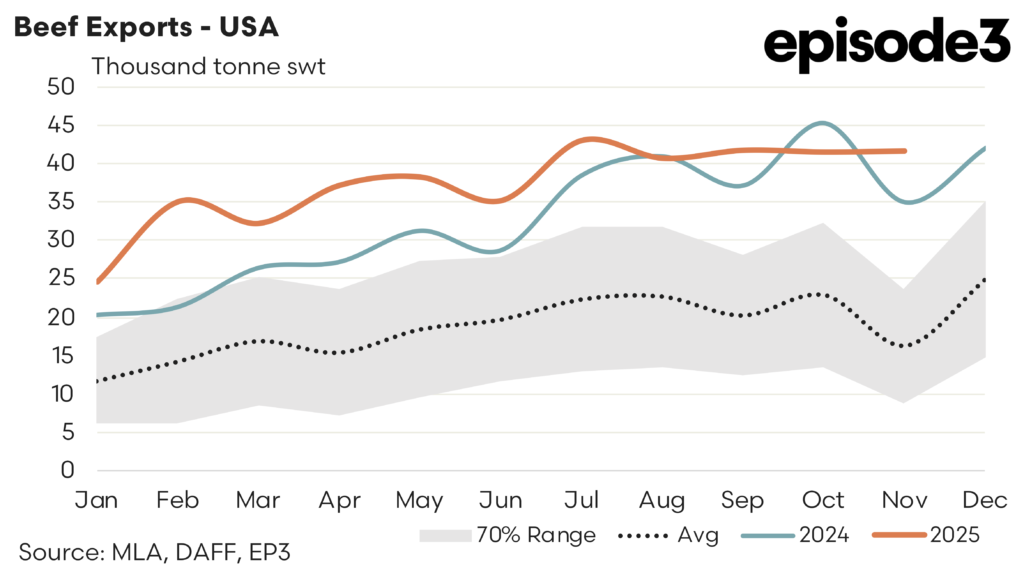

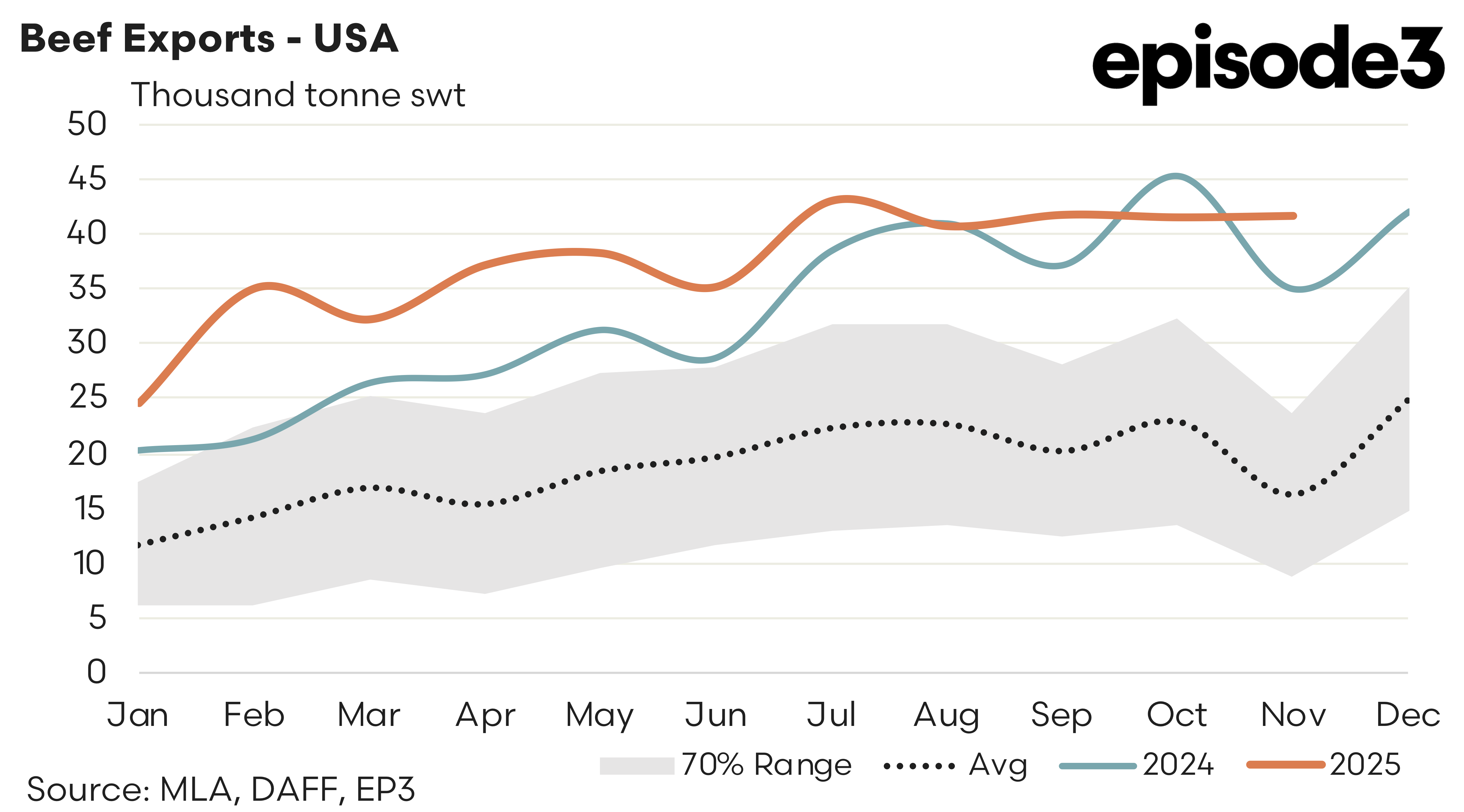

USA – Exports to the United States were effectively unchanged over the month at 41,676 tonnes. November often brings a modest easing in flows as the annual quota is normally close to exhausted by this point in the season, but this year has bucked that typical pattern. As of 1 December Australia still had around 1 percent of its US beef quota remaining. Shipments made in December will roll into the following year’s quota, so the industry is now set for a record year of beef exports to the United States for 2025. Because the usual November decline did not occur, current United States export flows sit at an extraordinary 155 percent above the five year trend for November, highlighting just how strong American demand has been relative to historic patterns.

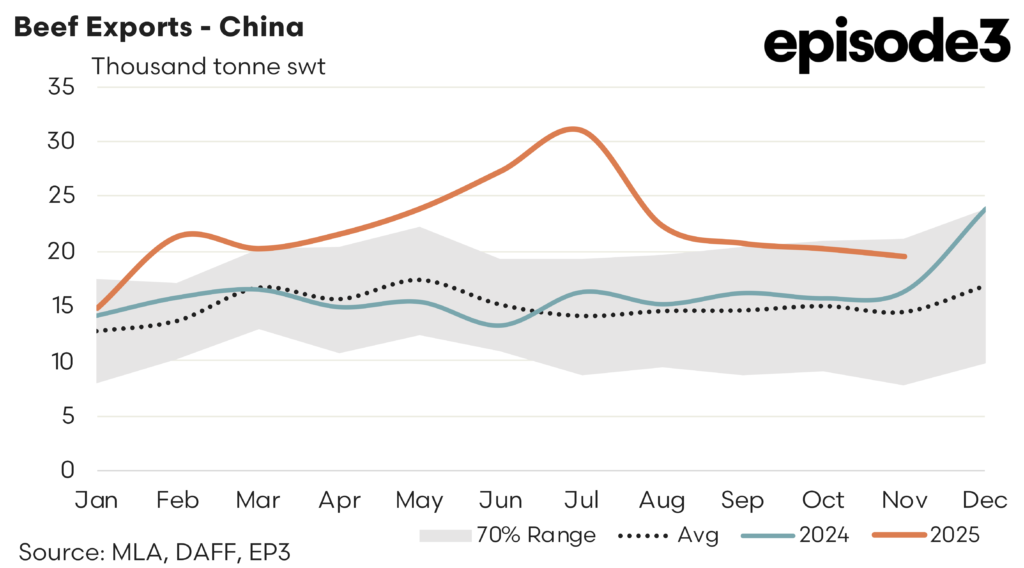

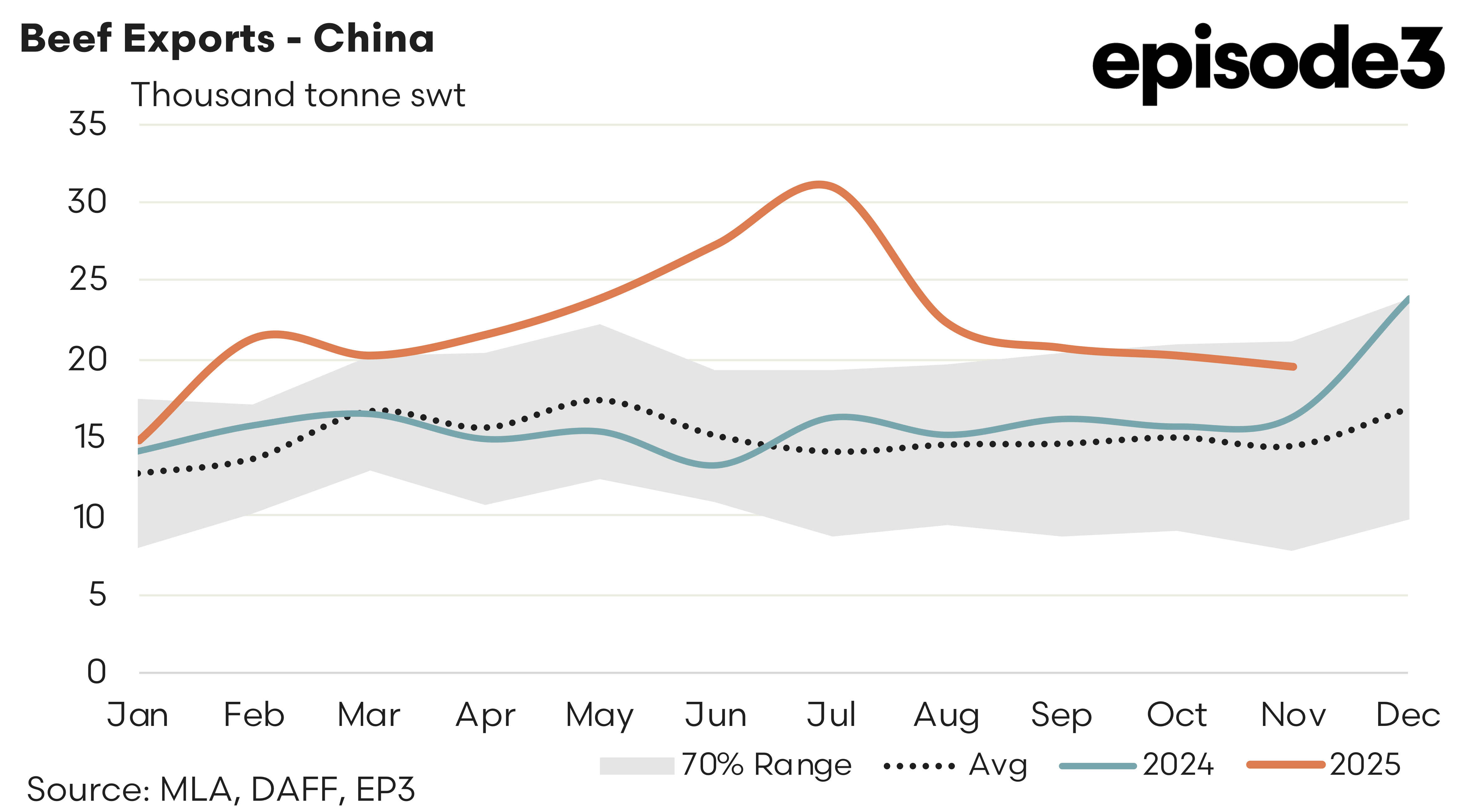

China – China recorded a slight softening in November, easing by 3 percent to 19,554 tonnes. While the month on month movement was small, volumes remain firmly elevated when compared to the longer term benchmark. Current exports to China are approximately 35 percent above the five year average for November. This suggests that Chinese importers are continuing to draw on Australian product at a level well above seasonal norms, even if monthly fluctuations show some gentle tapering.

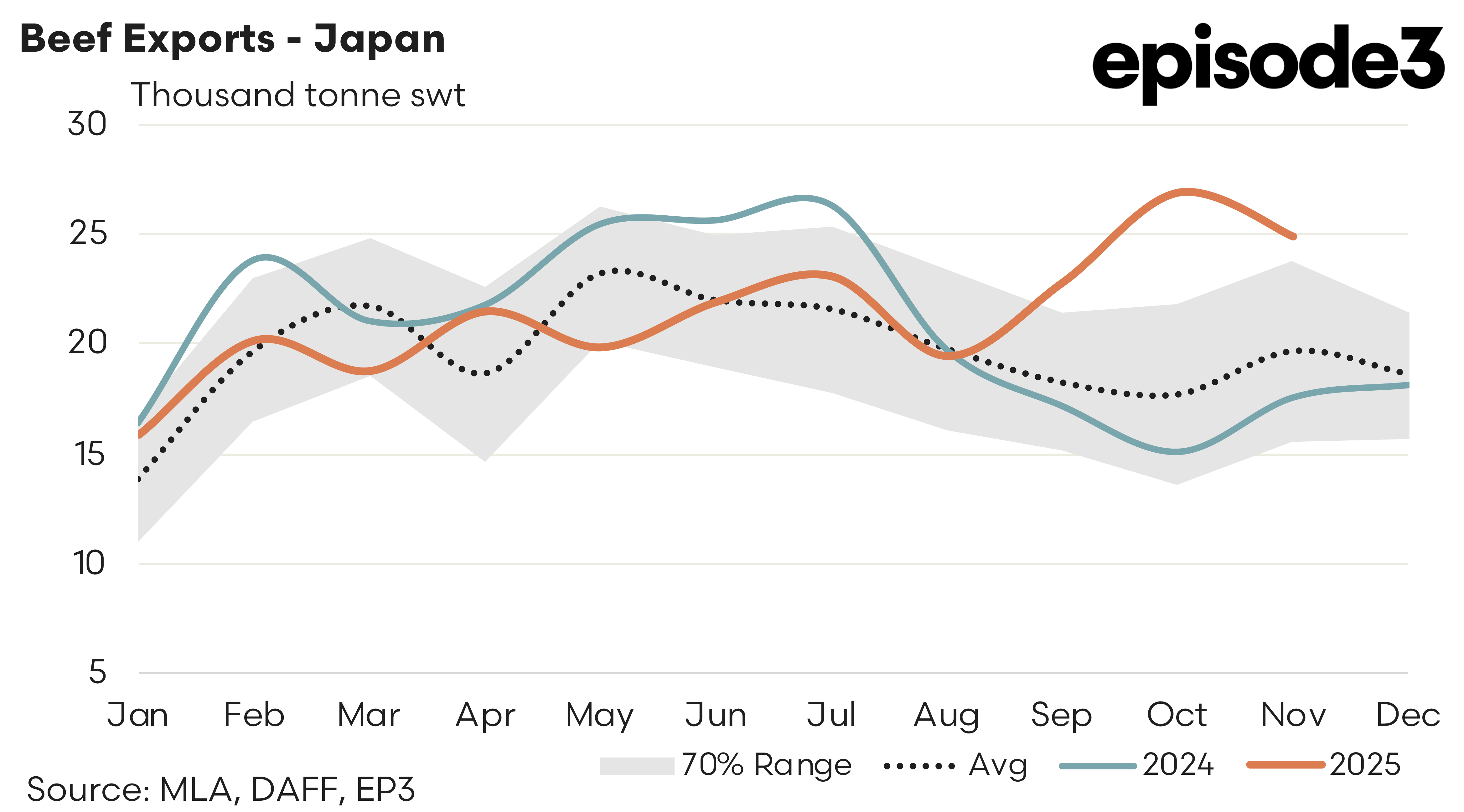

Japan – Japan also eased through November, with volumes stepping back by around 7 percent to 19,660 tonnes. Despite that correction, demand from Japan remains notably strong. At present, shipments into the Japanese market sit roughly 27 percent above the five year average for November. This indicates that the underlying appetite for Australian beef remains robust and that the recent easing is more a reflection of normal monthly movement than any meaningful structural change in purchasing behaviour.

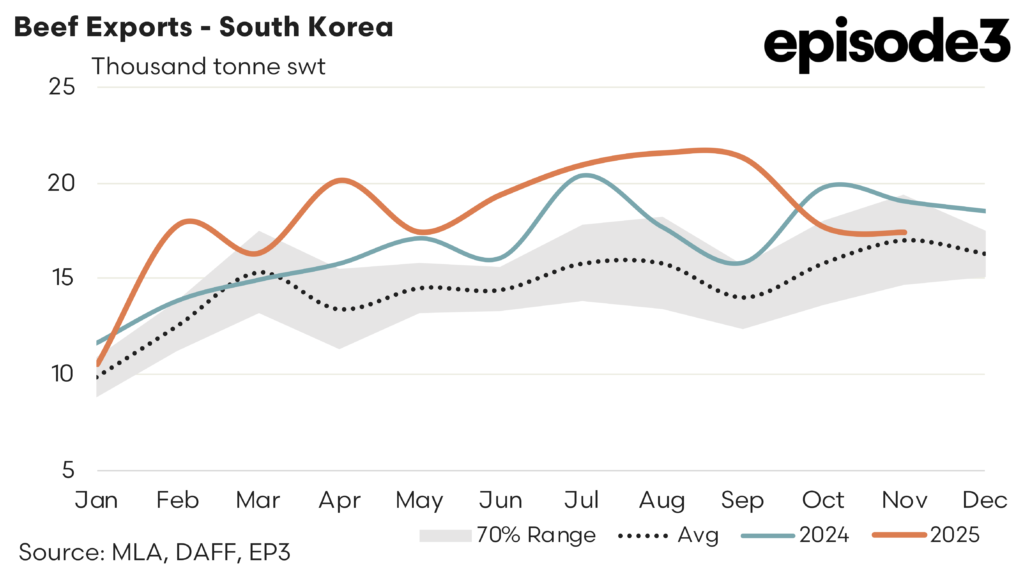

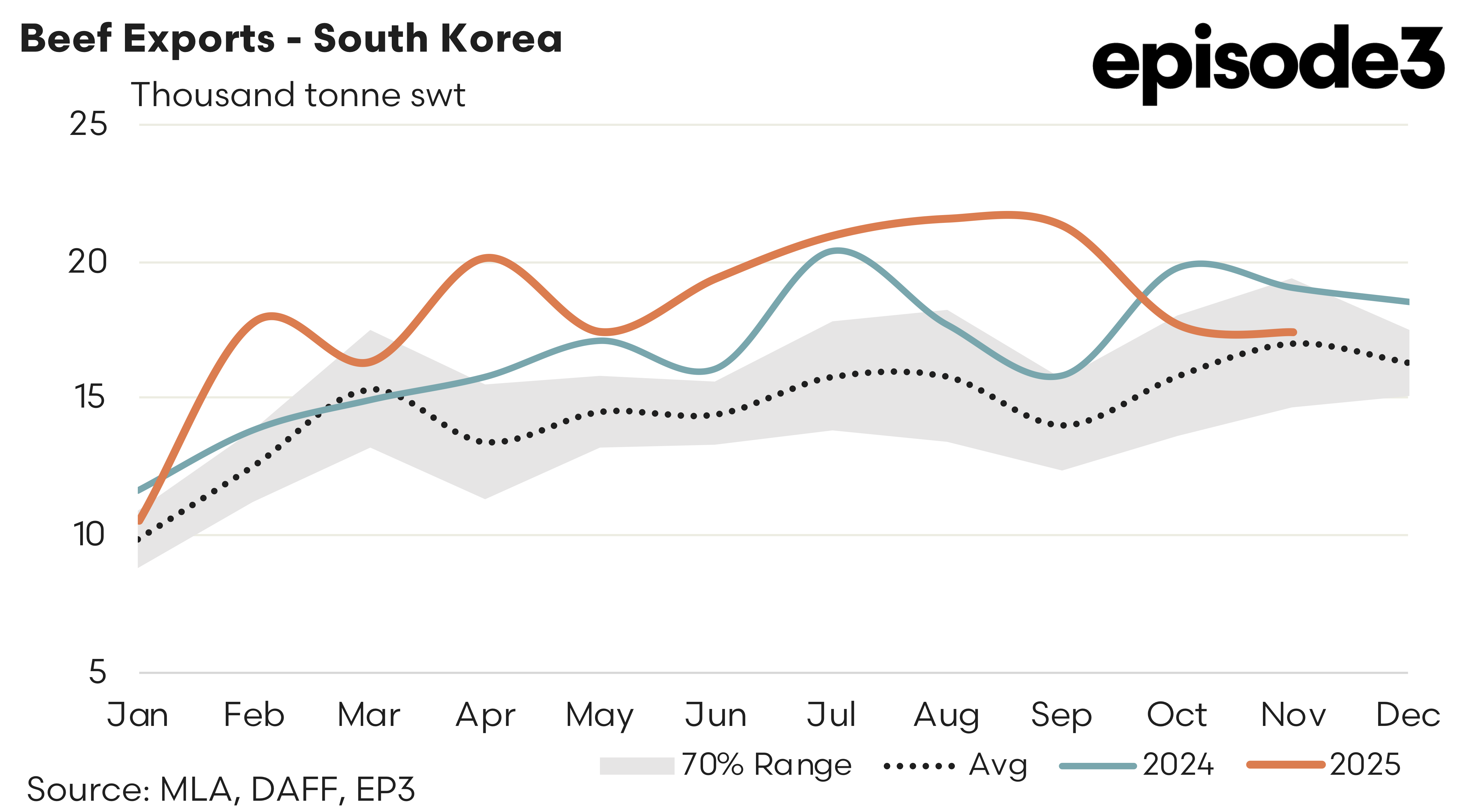

South Korea – South Korea recorded a comparatively mild adjustment, with exports dipping by 2 percent to 17,399 tonnes. This effectively keeps Korean demand aligned with seasonal expectations. Current flows are sitting about 2 percent above the five year average for this time of year, which illustrates a market that is steady rather than volatile. South Korea continues to reflect its long-standing position as a consistent and reliable buyer of Australian beef, even as other regions experience larger swings month to month.

The United States stands out as the dominant story of the month. The combination of strong US buyer activity and the unusual circumstance of quota space still being available in early December has propelled export flows to levels rarely seen. The momentum heading into the end of the calendar year is strong and sets the stage for a remarkable final export tally once the full year is closed. Meanwhile China, Japan and South Korea have all eased slightly but remain firmly in supportive territory relative to historical norms.