Beef processor conditions improve

Beef Processor Trading Conditions Update

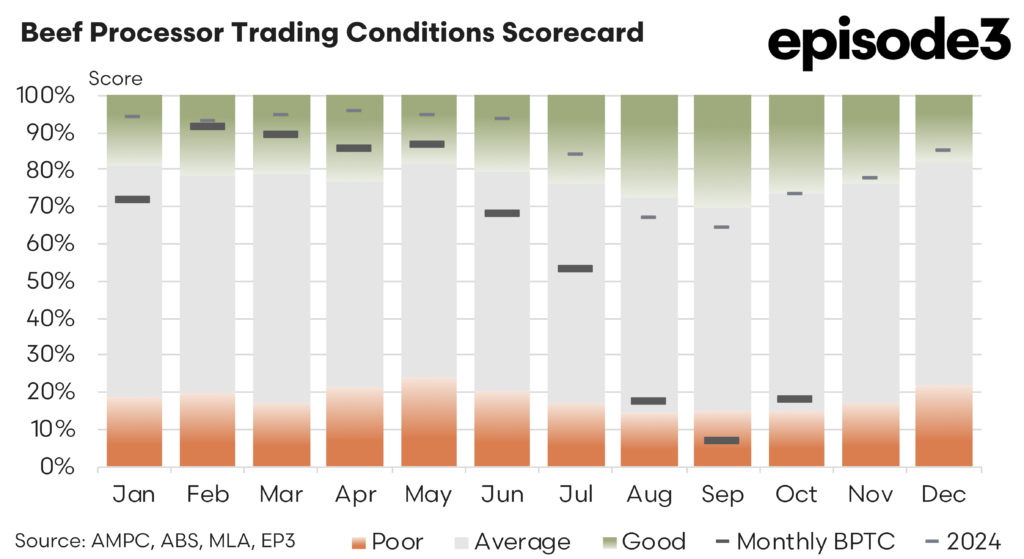

Beef processor trading conditions through September and October 2025 remained challenging, but the latest data confirms that the extreme margin pressure seen in late winter did not deepen further and that some stabilisation emerged as spring progressed.

While conditions are still well below the strong first half of the year, the broader picture for 2025 remains more balanced than recent monthly readings alone might suggest. With the annual average BPTC index sitting just under 60 percent for the year to October 2025, trading conditions have softened materially but have not collapsed outright, despite a brief dip to single digit levels in September.

September represented the low point for processor margins in 2025. Livestock procurement costs rose again across all major slaughter categories, with heavy steer and processor cow prices both lifting by 5 percent and young cattle prices increasing by 2.4 percent. These increases came on top of the sharp price escalation seen in August, further compressing margins at a time when export markets were offering little relief. While beef export values to the United States improved modestly and China recorded a solid lift, these gains were outweighed by a sharp decline in South Korean export values. Japan was flat over the month and, when aggregated, the top four export markets recorded a net decline. Domestic retail beef prices rose modestly, but the increase was insufficient to offset higher livestock costs. The result was a further deterioration in processor margins and a fall in the BPTC index to just 7 percent, marking the weakest monthly outcome of the year.

The September outcome highlighted the sensitivity of processor trading conditions to rapid movements in cattle prices when export demand is not strengthening in parallel. Throughput volumes remained broadly steady, meaning processors were forced to absorb higher input costs without the ability to recoup those increases through higher selling prices. This dynamic reinforced the imbalance that had already emerged in August, where strong restocker and feeder demand supported livestock prices while downstream markets remained cautious. The September reading effectively captured the cumulative impact of two consecutive months of rising cattle costs and sideways export pricing.

October brought some relief, although conditions remained constrained by historical standards. Livestock prices eased modestly across all major categories, with heavy steer, young cattle and processor cow prices all recording small declines. While the scale of the easing was limited, it represented an important shift after two months of sharp increases and reduced immediate procurement pressure for processors. Export markets also improved on balance. Strong gains in South Korea and China outweighed further weakness in Japan, lifting the combined value of exports across the top four destinations. Domestic retail beef prices rose again, improving domestic sales returns and providing additional support to margins.

These combined movements allowed processor trading conditions to stabilise modestly in October, with the BPTC index lifting to 18 percent. While still well below the levels seen earlier in the year and during 2024, the rebound suggests that the extreme margin compression experienced in September was not sustained. The October outcome reflects a more balanced interaction between input costs and selling prices, even if margins remain thin and vulnerable to further volatility.

The September and October results reinforce the highly cyclical nature of beef processing margins. The strong first half of 2025 was underpinned by relatively lower cattle prices and solid export performance, which pushed the BPTC index into consistently high territory. That period provided a buffer that has helped sustain the annual average for the year, even as conditions deteriorated sharply in late winter. The annual average BPTC of nearly 60 percent to October indicates that, despite recent pressure, 2025 has not been a poor year overall for processors when viewed in full context.

It is also important to note that current BPTC readings do not yet reflect updated co product and pharmaceutical values. These revenue streams, including hides, offals and tallow, can play a meaningful role in supporting processor profitability during periods of margin pressure. The most recent MLA co product data is not yet available, and future releases may result in revisions to recent BPTC scores. While any adjustment is unlikely to fully offset the impact of higher livestock prices, co product markets have historically provided partial cushioning during downturns and may influence the final assessment of trading conditions for late winter and early spring.

August and September serves as a reminder of how quickly margins can unwind when procurement costs rise sharply without corresponding gains in downstream markets. For now, the BPTC trajectory suggests that the worst of the pressure may have passed, but conditions remain fragile and well below the levels that characterised the first half of 2025.