China puts the squeeze on

The Snapshot

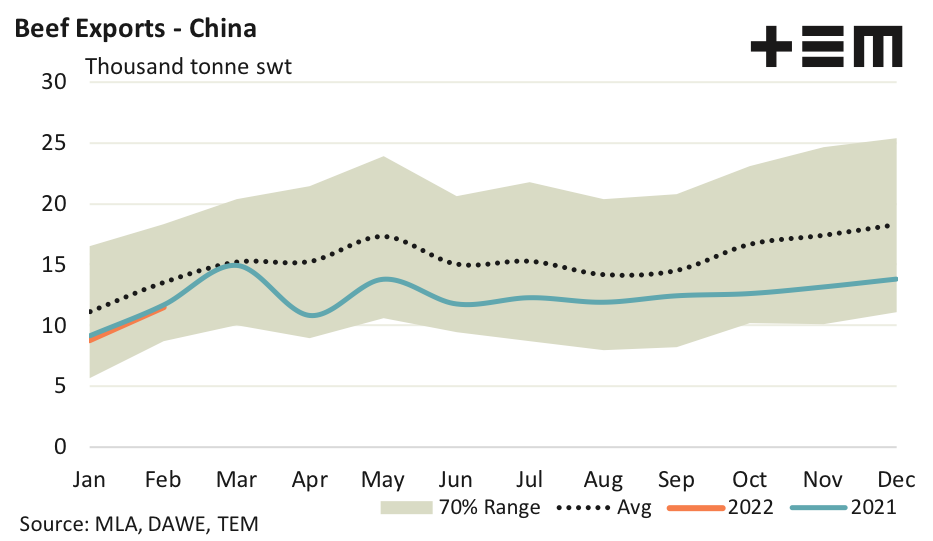

- There was 11,531 tonnes of Aussie beef exported to China over February, a 29% gain on the January volumes, to rest nearly 15% under the average trend for February.

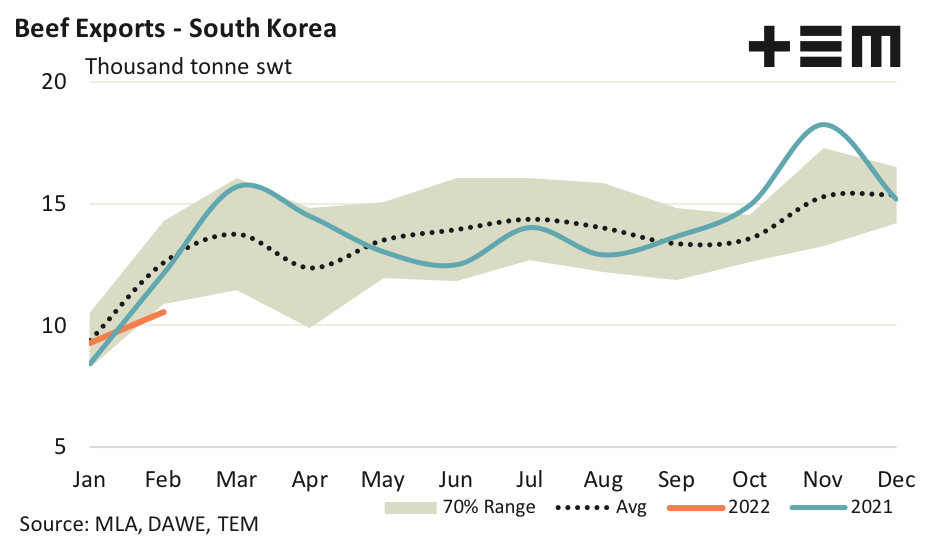

- South Korea managed just a 14% lift over February with current volumes sitting 17% below the average pattern for this month in the year.

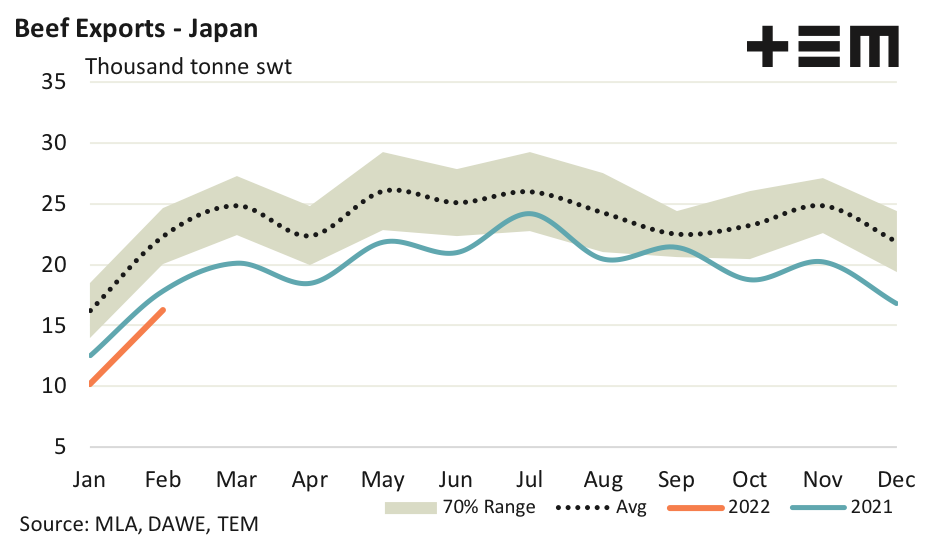

- Despite beef exports lifting by nearly 59% from January to February the monthly flows to Japan were unable to get back into the shaded “normal” range.

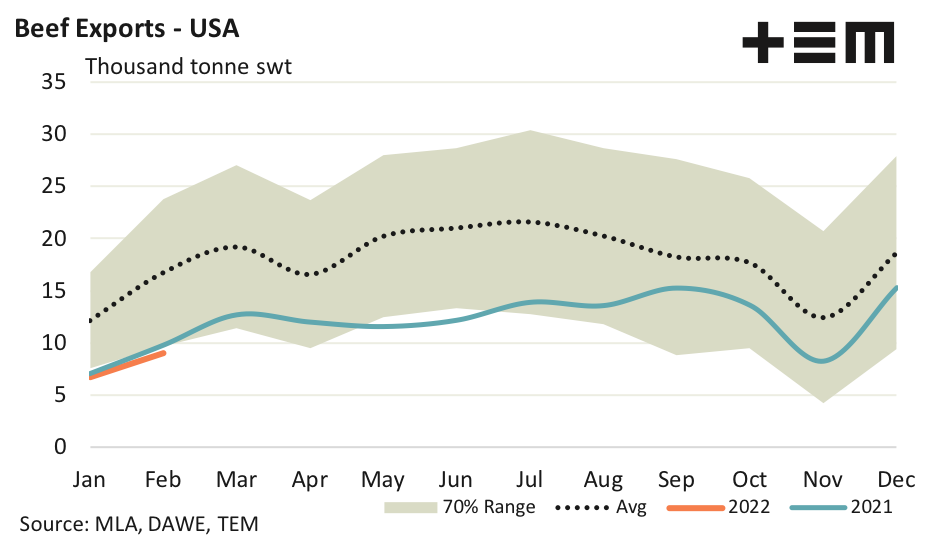

- There was just 9,025 tonnes of beef exports noted for February from Australia to the USA, which represents levels that are 46% below the five-year average for February.

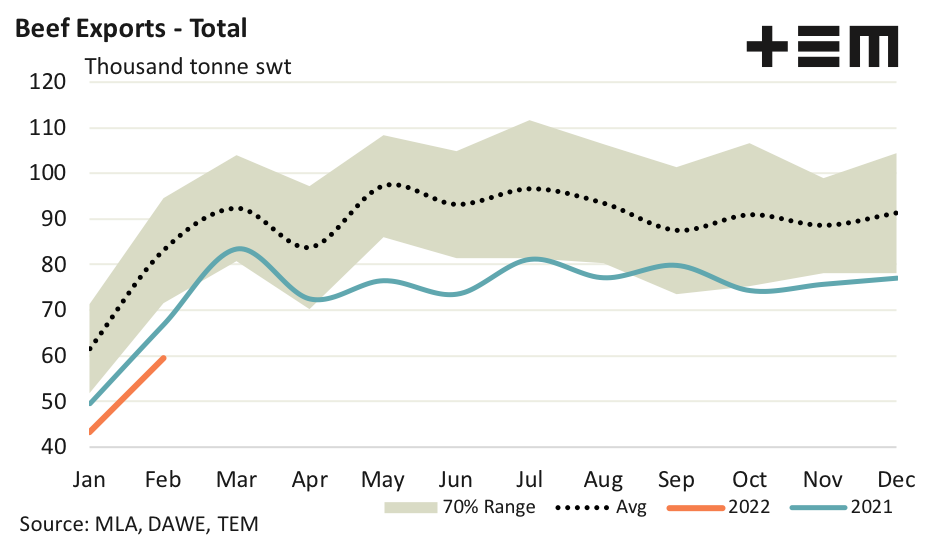

- Total beef exports were recorded at 59,513 tonnes swt for February 2022. Although this is a 37% gain on the January figure it still sits 28% under the seasonal average pattern

The Detail

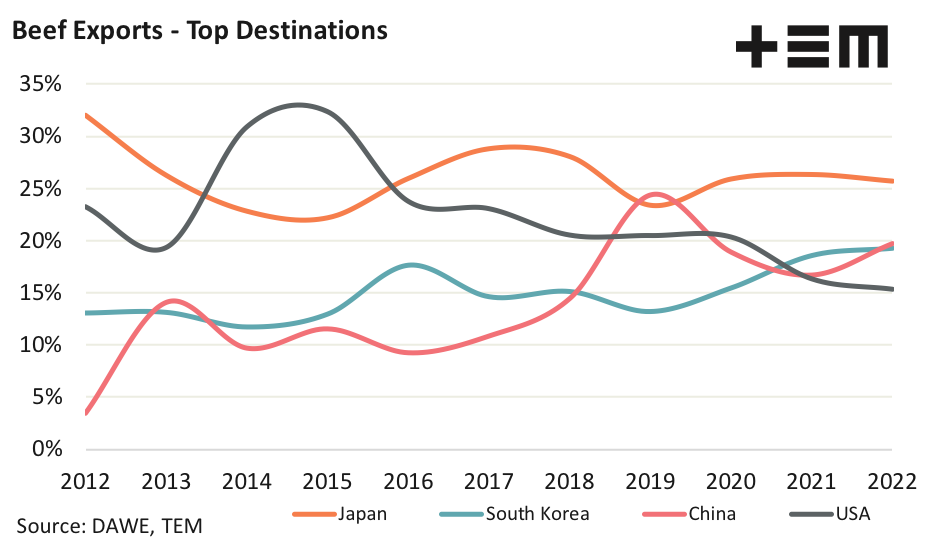

Beef export trade data for February 2022 shows that China has edged out South Korea to reclaim the second top destination for market share of Aussie beef exports for the current season. Japan is well clear in first place, holding 26.4% of the total beef export flows from Australia since the start of 2022. Meanwhile, China has edged out South Korea with a market share of 19.7% compared to 19.3 %. The USA are continuing to lag the gang of four with just 15.3% of the total trade volumes.

The monthly seasonal pattern for 2022 shows China is mirroring the export volumes shipped last year, almost perfectly. There was 11,531 tonnes of Aussie beef exported to China over February, a 29% gain on the January volumes, to rest nearly 15% under the average trend for February, according to the last five years of data. In comparison, South Korea managed just a 14% lift over February to register 10,564 tonnes of Aussie beef product shipped. South Korean demand is trekking along the lower boundary of the “normal” seasonal range with current volumes sitting 17% below the average pattern for this month in the year.

Japan’s performance so far in 2022 is weaker than the trend set in 2021. Since the start of the year average monthly beef export volumes from Australia are running 13% lower than over the same time in 2021 and 31% under the five-year pattern. Despite beef exports lifting by nearly 59% from January to February the monthly flows to Japan were unable to get back into the shaded “normal” range. At 16,232 tonnes, Aussie beef export flows to Japan have recorded their lowest February figure since 2002.

The USA continue to underperform with the 2022 trend replicating the lacklustre start seen to the season in 2021. There was 9,025 tonnes of beef exports noted for February from Australia to the USA which represents levels that are 46% below the five-year average for February.

Considering all of the top four trade destinations for Aussie beef are running below average in February it is unsurprising to note that total beef exports are stuck well below trend. Total exports were recorded at 59,513 tonnes swt for February 2022. Although this is a 37% gain on the January figure it still sits 28% under the seasonal average pattern that is set by the five-year average trend.