China rebuilds pig herd, sow what?

The Snapshot

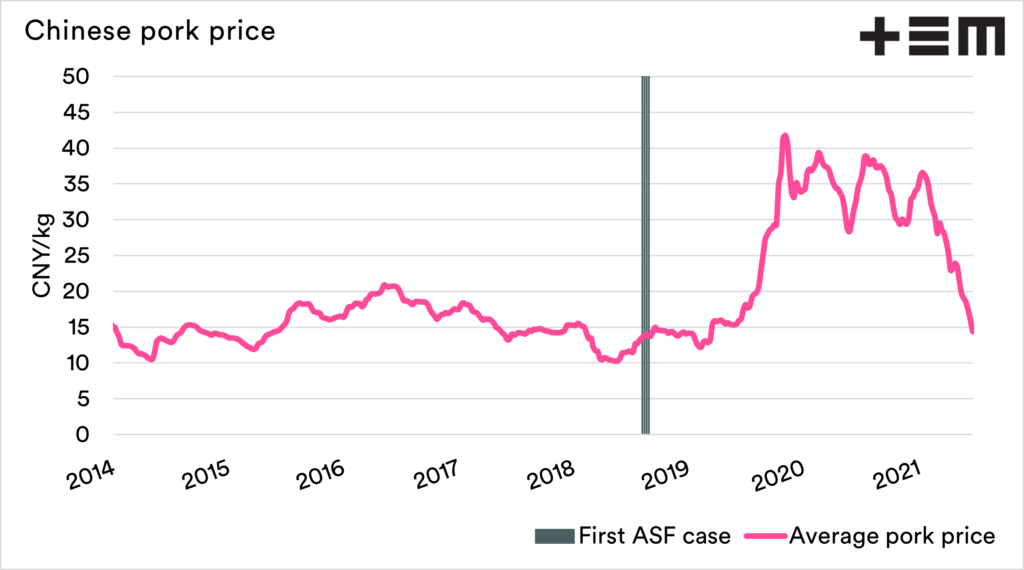

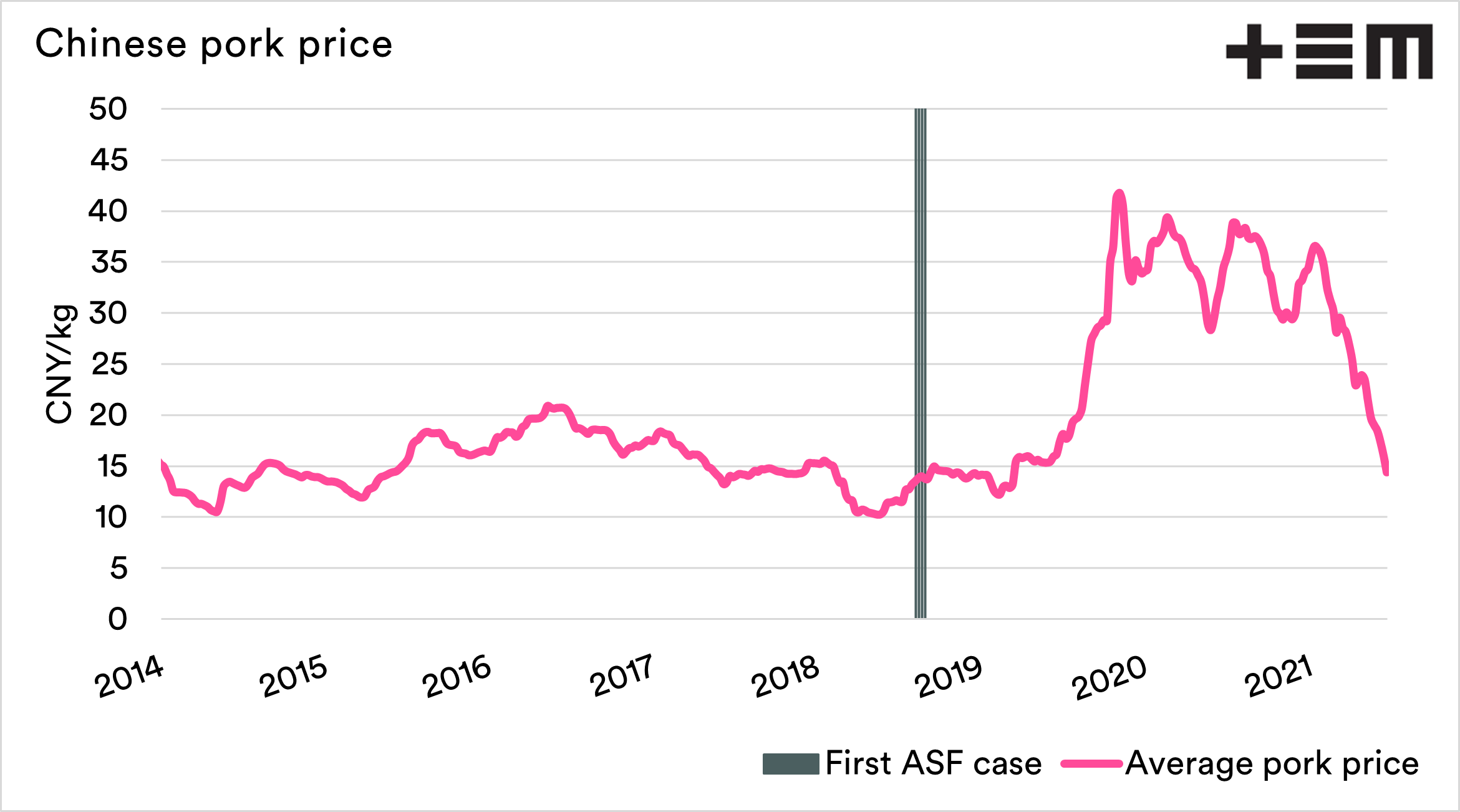

- African Swine Fever in China has helped keep protein prices strong around the world.

- The Chinese government have announced that the sow herd is back to 98.4% of 2017 levels.

- Imports of pork and beef remained strong into China during May.

- The price of pork within China has crashed in recent months.

- The efficacy of the rebuild is likely not great, as sows as kept, which shouldn’t have been.

- The herd is likely not as productive as pre-ASF levels.

- Imports of protein may be still be required for a while.

The Detail

At EP3, we have had our reservations about the rebuild of the Chinese pig herd. We wrote about this numerous times over the past year (see here & here).

The Chinese government have announced that the sow herd is back to 98.4% compared to 2017 levels. We had concerns in the past year of the Chinese rebuild being close. There were secondary indicators that seemed at odds with the rebuild figure.

These figures were pork imports and local pork pricing. If the rebuild was close to complete, pork prices and imports should fall due to the regained supply.

We will trust a pig herd rebuild when we see reduced imports and lower pricing points. Let’s look at both now.

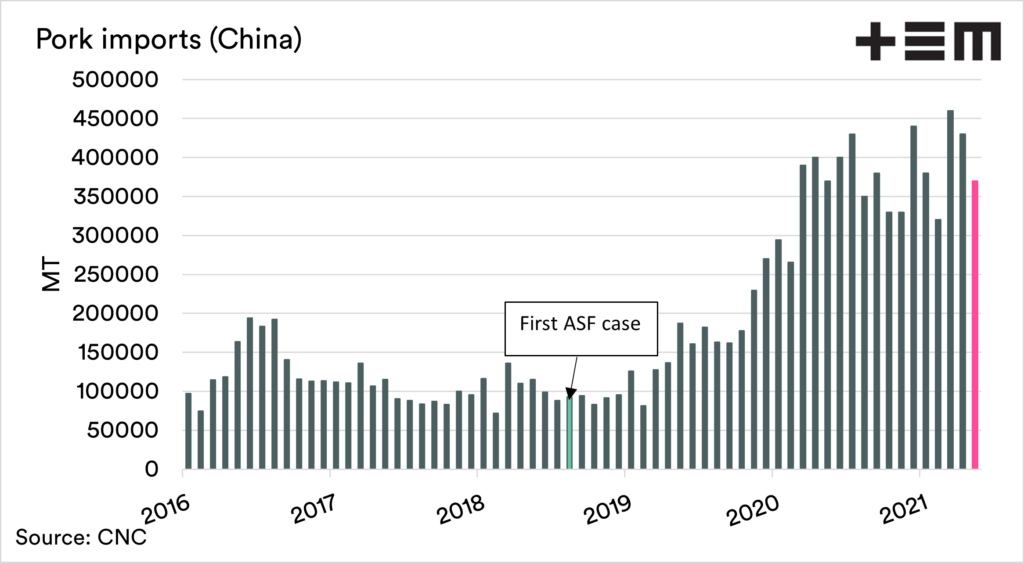

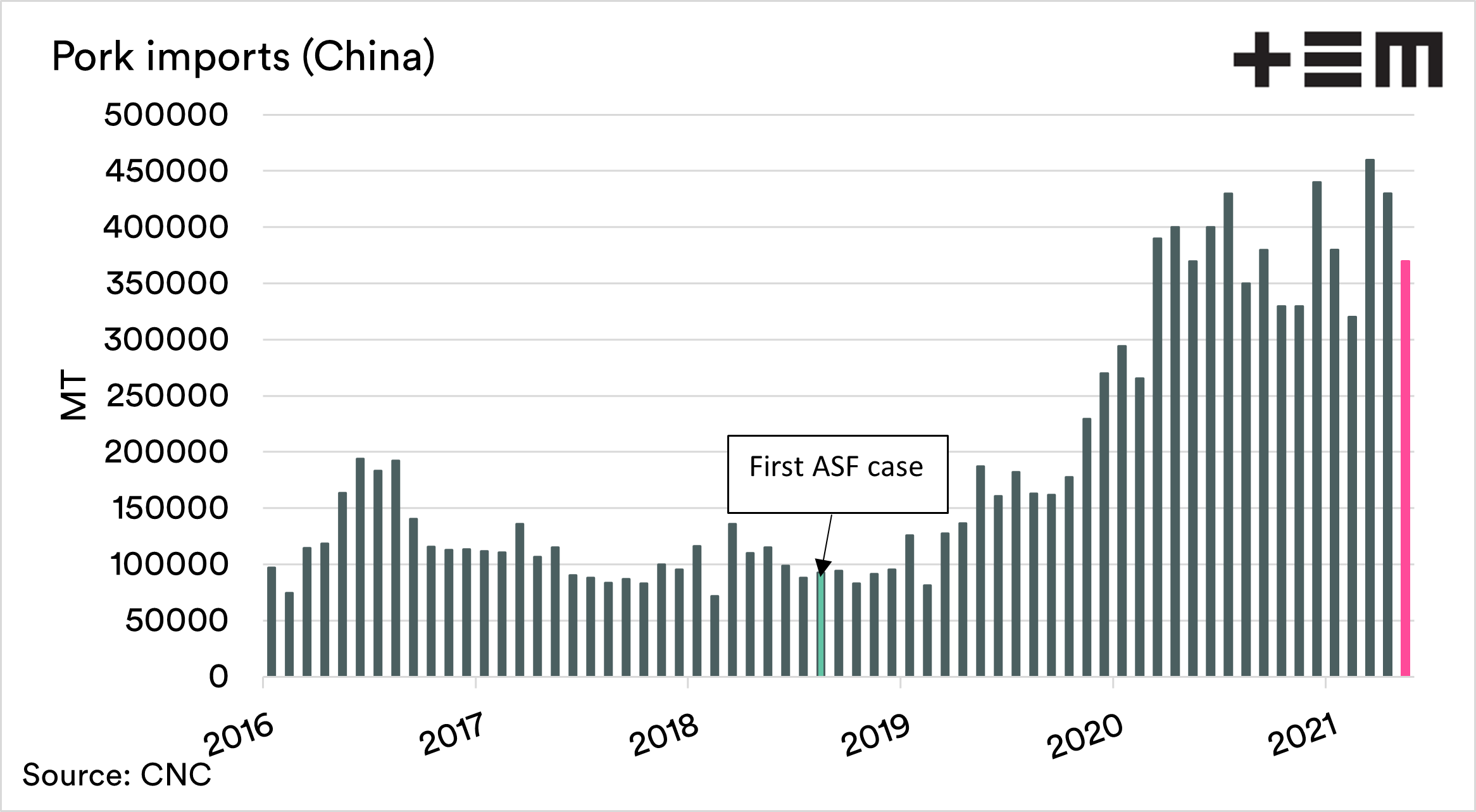

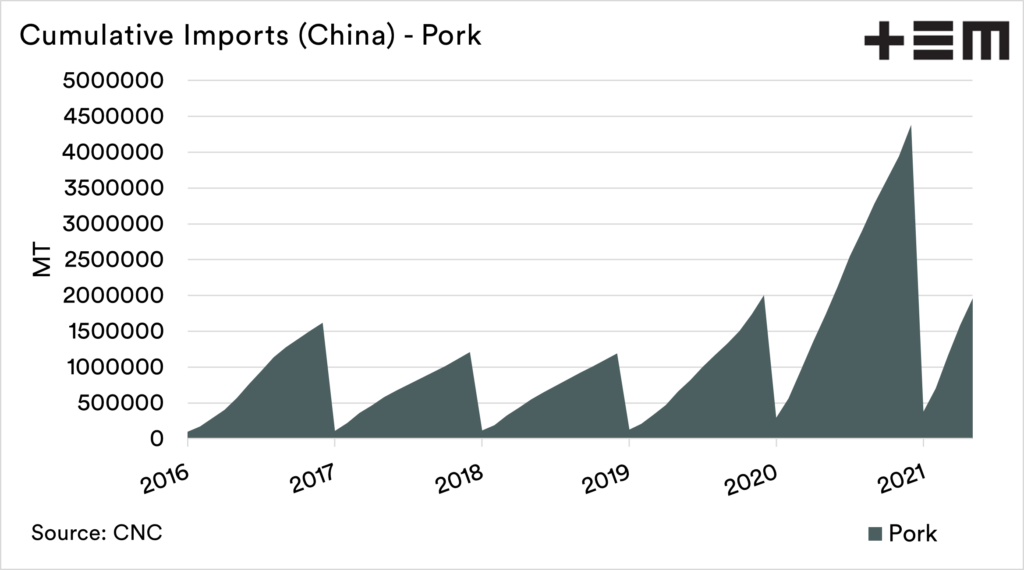

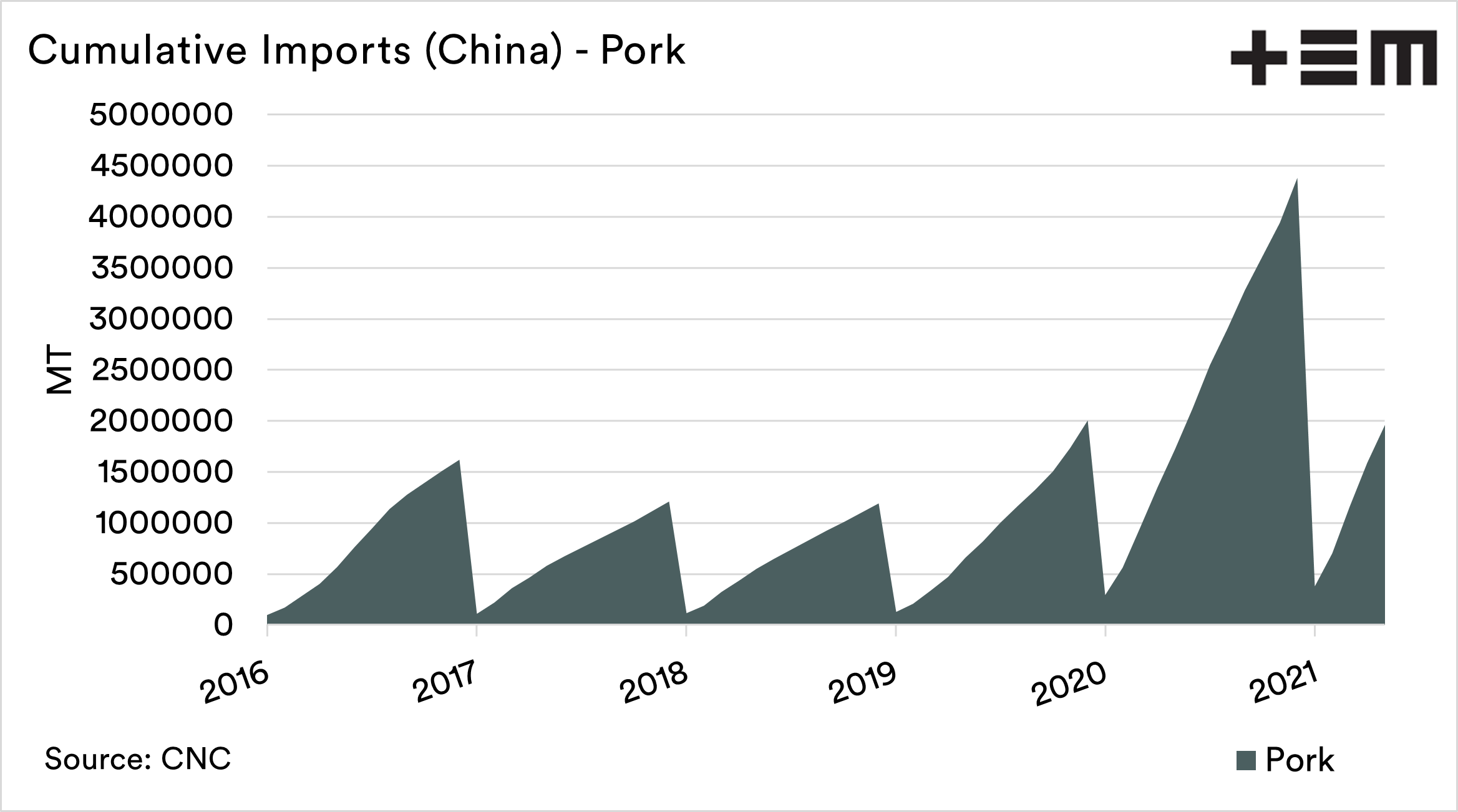

Imports

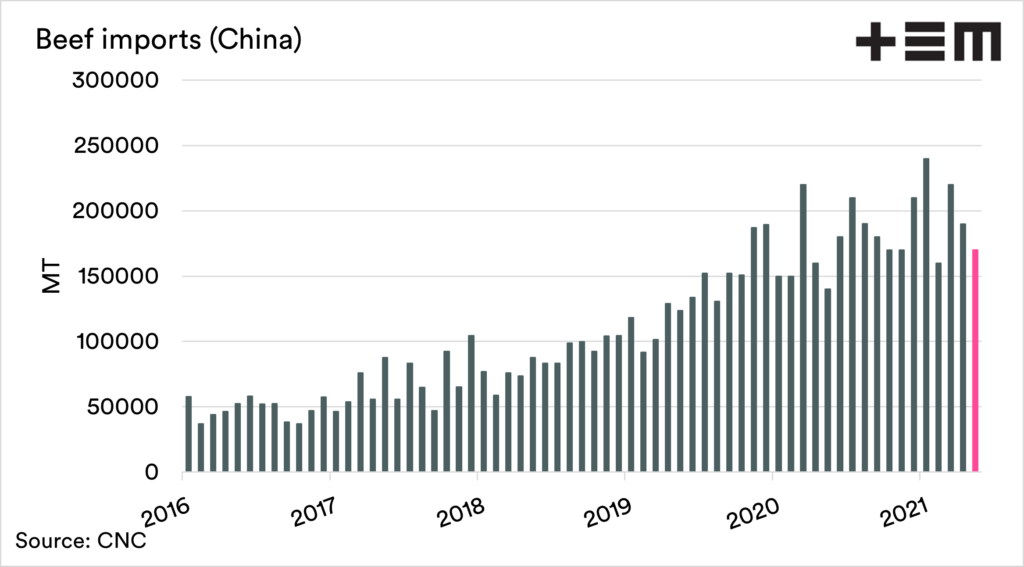

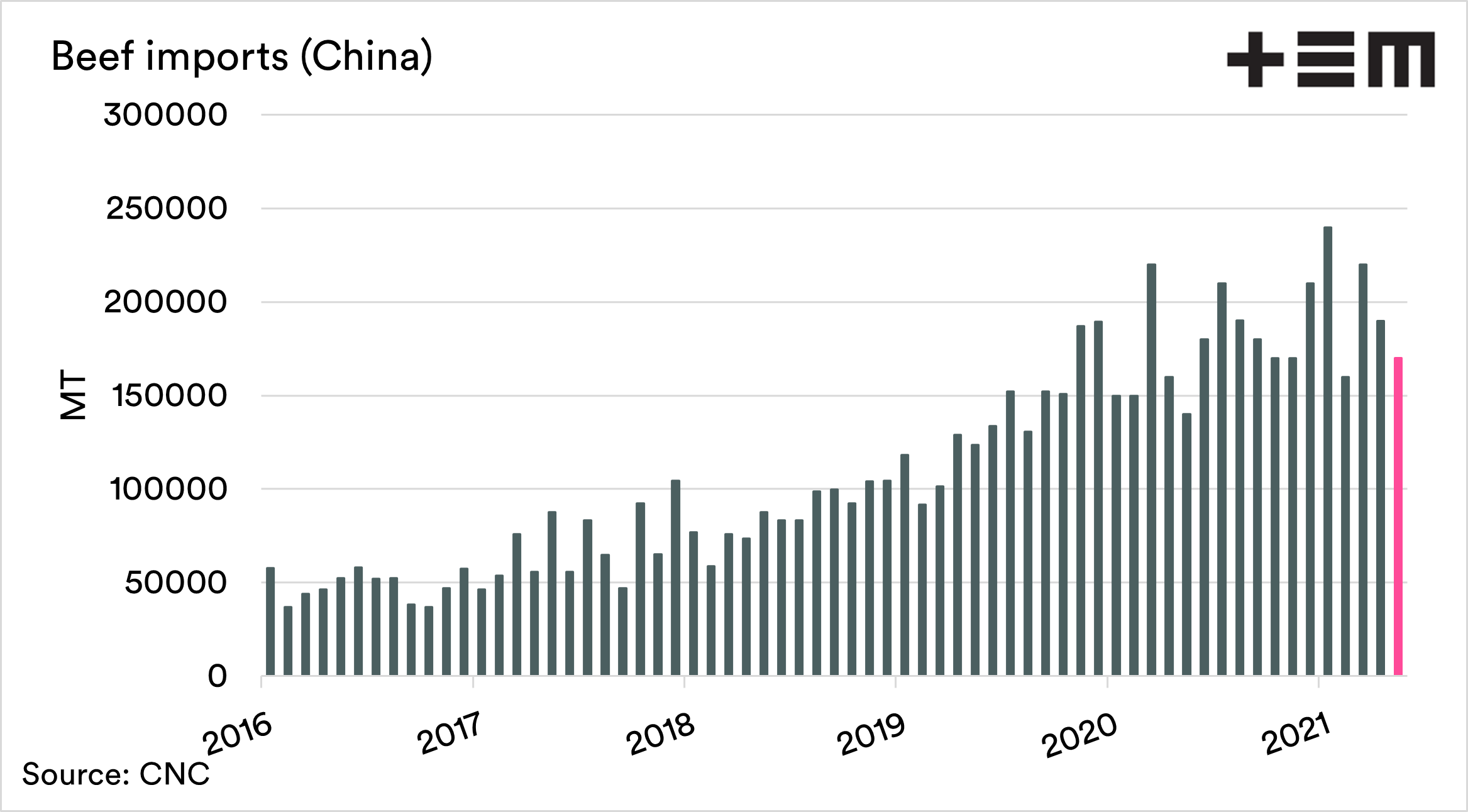

The import data for China came out this morning, and it has dropped month on month. Imports for May were at the same level as May 2020 (370kmt). On the whole, however, China has imported 240kmt more pork for the first five months of the year than it did in 2020.

A large chunk of this rise can is attributed to damaged logistics chains during the early part of the COVID pandemic.

Pork Pricing

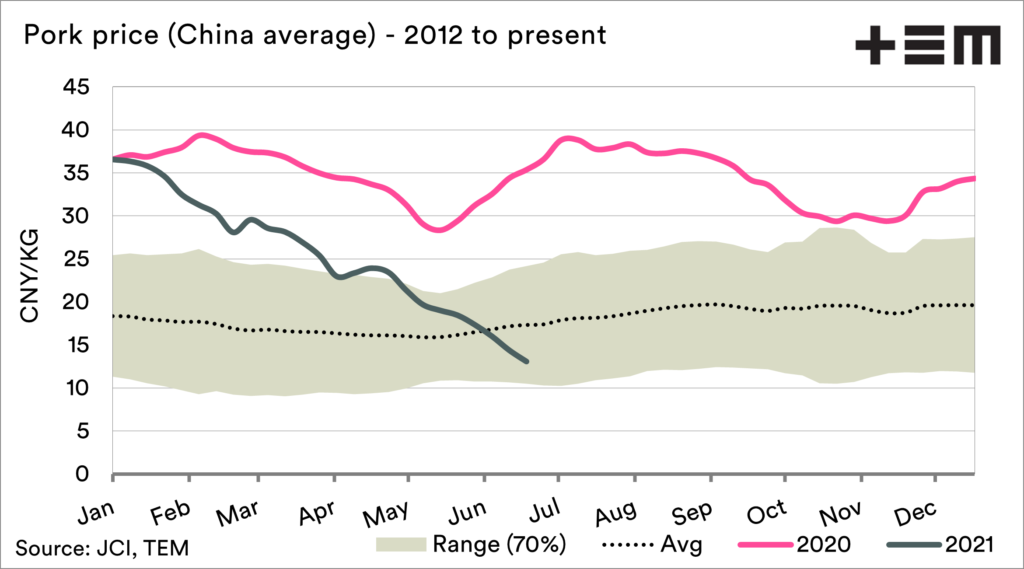

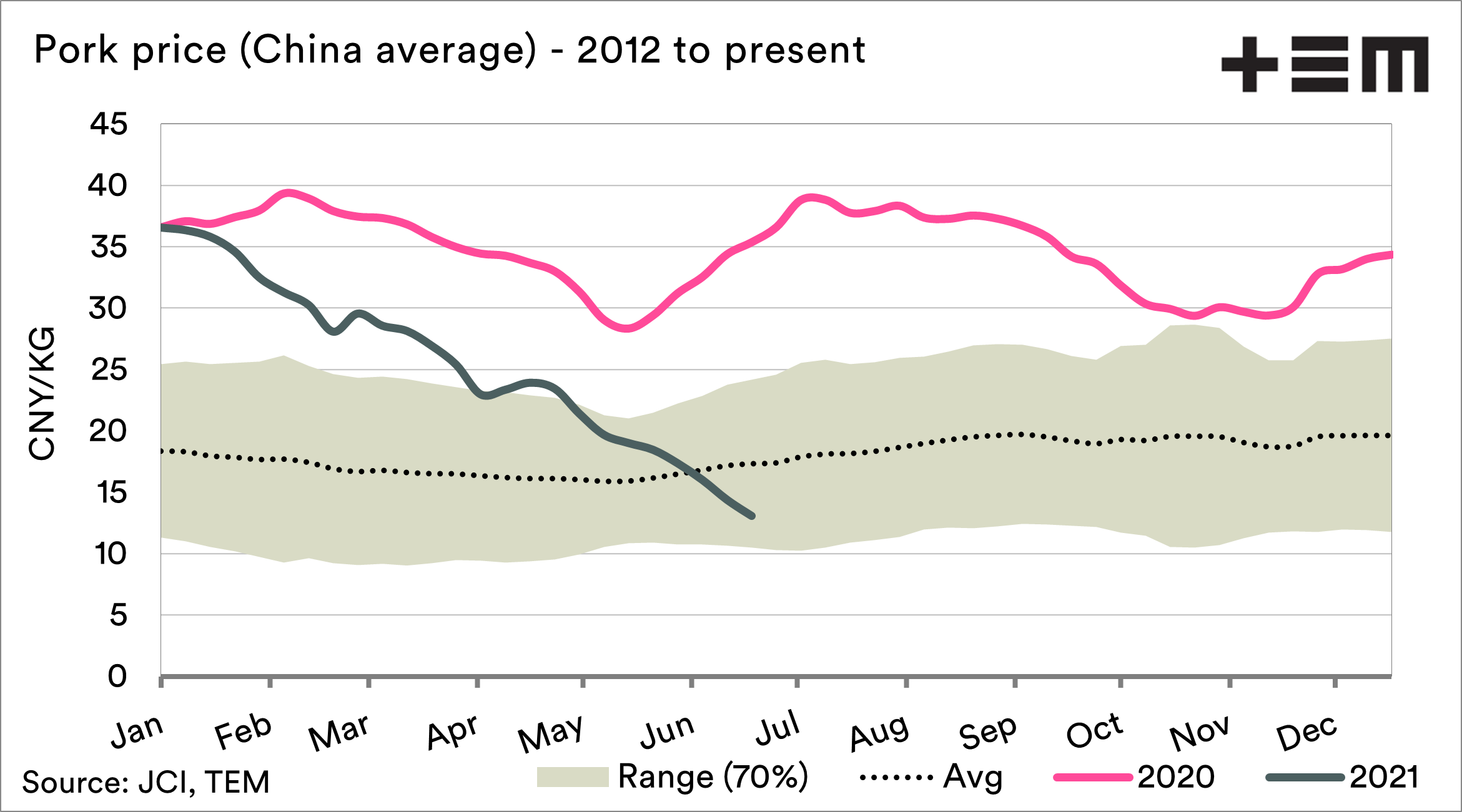

Local pork pricing in China went ballistic as a result of ASF. Pork is the most popular meat, and with supply destruction, the price went higher. The price has been extremely elevated right through the period from mid-2019 to the early part of 2021.

In recent months, the price has been dropping substantially. At this point, the pricing level is below the long term average.

This points to increased supply being available to the market. There are concerns that this extra supply comes from farmers selling earlier, as they fear that prices will fall.

This becomes a self-fulfilling prophecy, as sell to participate before a fall causes the fall.

Efficacy of rebuild.

The pig herd is rebuilding; there was never any question of that. It is the extent and efficacy of the rebuild that is important.

There are reports from contacts that the efficacy of the pig herd rebuild is not great. There are concerns that some of the sows being retained would not typically be kept. The productivity of these sows is lower, resulting in reduced litters.

The sow herd might be back to pre-ASF numbers. If reproductive capacity remains constrained then pork available for sale will be reduced. This explains the high imports despite high sow numbers.

What does it all mean?

ASF has been a huge support for global meat pricing in recent years as China fills the protein gap (see here). An effective rebuild of the Chinese pig herd is a great concern for meat producers.

The data does point to an improving situation in China, the reality is that their local production is likely to be reduced due to the quality of the sow herd. This will necessitate strong protein imports.

There are also concerns of further ASF resurgences, which will be a continued issue in China for some time. The longer that their herd is depleted productivity-wise, the better for our sheep and beef producers.

Conflict Register: Please note Andrew Whitelaw and Matt Dalgleish operate a commercial piggery in Victoria, Australia