Ewe turn

Market Morsel

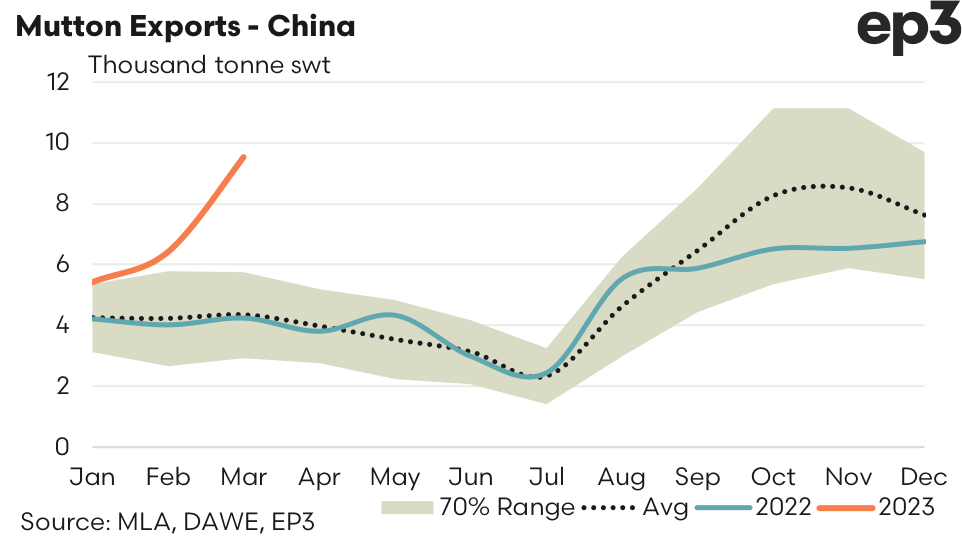

Last week we reported on the very strong export demand seen for Australian mutton since the start of 2023, particularly out of China. We had some subscriber queries on why this additional demand hasn’t shown up in price support for mutton at the saleyards, but it has.

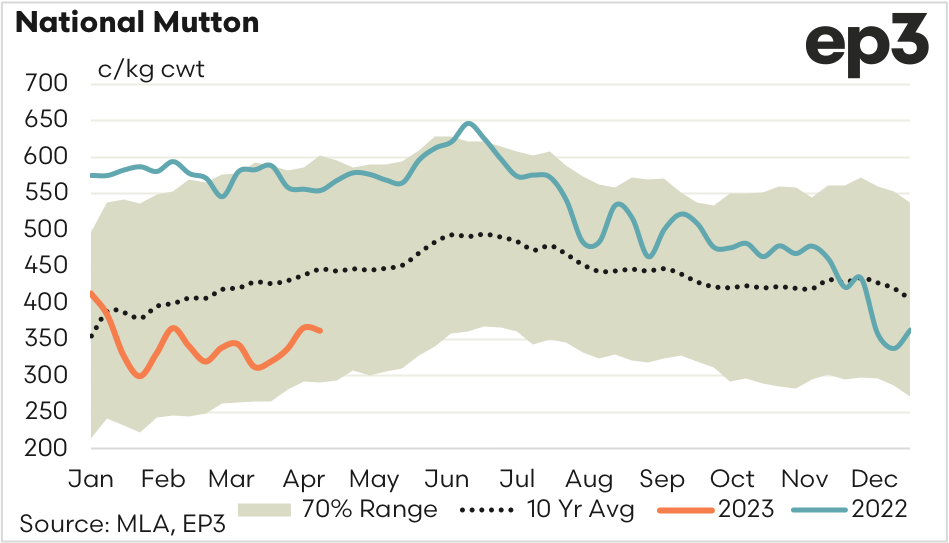

The National Mutton Indicator has probed the 300c/kg cwt level several times this season and found good price support here. Indeed, mid-March saw the indicator slip toward 312 cents but recovered back above 365 cents by the start of April, a price gain of nearly 20% in a fortnight.

The impact of Chinese mutton export demand on price can be seen during the final quarter of 2022, when below average demand saw domestic mutton price ease by nearly 30% from around 480 c/kg cwt in October 2022 toward 340c/kg in mid-December. Given that China accounts for 40% of Australian mutton export flows each year and more than 95% of our mutton production in exported it is no surprise that Chinese demand, or lack of it, can have such a strong impact upon local pricing.

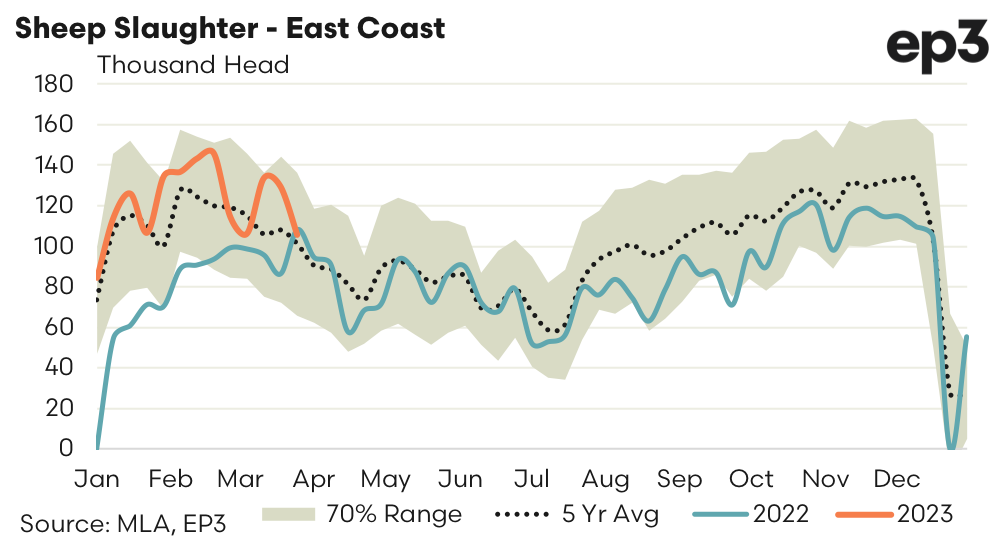

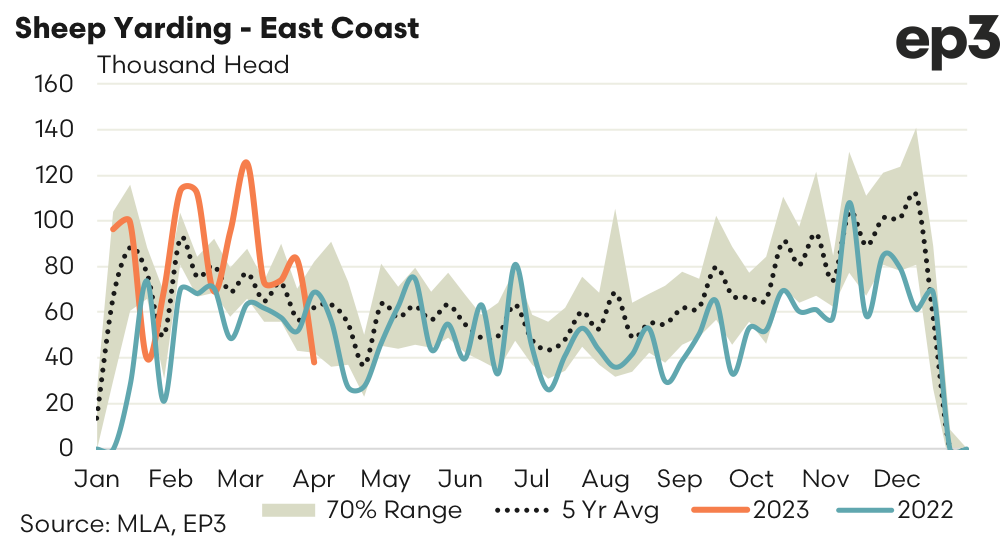

But demand is only one side of the price story. Supply, in the form of sheep slaughter volumes and sheep saleyard throughput levels, also plays a part. Compared to 2022 the current season has seen much stronger sheep supply and this has offset some of the strong export demand seen since the start of 2023.

In terms of sheep slaughter, weekly east coast processing volumes over the first quarter of 2023 have averaged around 122,000 head, which is nearly 44% higher than the 85,000 head per week (on average) seen over the same time period in 2022. East coast sheep throughput paints a similar picture of strong supply with average weekly volumes during quarter one of 2023 running at around 84,000 head compared to the 57,000 head seen during the first quarter of 2022. This represents 47% more sheep seen at the saleyard so far this season than what were offered during the same period in 2022.

So, yes demand for Australian mutton is booming. But supply is also stronger. The net result of these competing economic forces is that the National Mutton Indicator has found some support ahead of the 300 c/kg level, but is facing a few supply headwinds as it tries to get back above 400 cents.

One seasonal factor that may provide some price hope for sheep producers is the lower supply (slaughter and yarding) often seen into quarter two. Usually export demand also trends lower into the middle of the year, but given the very strong start to 2023 this may not be the case. If export volumes can stay robust has we head toward the middle of the year and supply dips we could see mutton prices climb back above 400c/kg cwt in the coming months.