Feedlot update

September 2025 cattle on feed update

Australia’s feedlot sector continued to expand in structural terms through Q3 2025, but operating conditions eased from the extreme tightness seen in the June quarter.

Built feedlot capacity lifted another 3% over the quarter to a new record of 1.75 million head, reinforcing the longer-term shift toward a larger, more permanent grainfed footprint. However, the number of cattle on feed declined 4% from the June record to 1.52 million head, pushing national utilisation back to 87% after peaking at 93% in Q2.

The pullback in cattle on feed did not reflect weaker demand. Instead, it coincided with a sharp lift in turnoff, with grainfed marketings rising to a record 962,000 head in the September quarter, up 8% on the previous quarter. This reflects a deliberate clearing of cattle rather than a contraction in the system, as feedlots balanced higher feeder prices, improved slaughter pull and space constraints following the June peak.

Queensland remained the clear centre of gravity for the sector. Capacity expanded again to a new record just under one million head, while cattle on feed eased only marginally to 885,000 head. Utilisation slipped to 91%, still historically high, while turnoff surged to a new quarterly record of 565,000 head. New South Wales recorded the largest proportional lift in capacity, rising 7% over the quarter to 527,000 head. Cattle on feed were broadly steady at 468,000 head, with utilisation easing to 89% as additional pen space came online.

Western Australia showed the strongest seasonal swing. Turnoff lifted to its highest level since 2020, while cattle on feed fell sharply to 45,000 head and utilisation dropped to 50%. South Australia and Victoria both recorded declines in cattle on feed and lower utilisation rates, falling to the mid-70% range, consistent with seasonal conditions and feeder availability.

On the demand side, grainfed beef production remained a key driver of export performance. Grainfed exports rose 7% over the quarter to a new record of just over 121,000 tonnes, with solid gains across North Asian markets and China. This export pull underpinned strong slaughter demand despite softer feedlot occupancy at quarter-end.

Cost signals were mixed. Feeder cattle prices rose sharply through the quarter, with feeder steers up 18% and feeder heifers up 21%, materially lifting entry costs for lot feeders. Grain prices eased modestly, with wheat down around 4%, offering limited relief on ration costs. The net effect was a shift in feedlot behaviour toward higher throughput and disciplined placements rather than further expansion in cattle on feed.

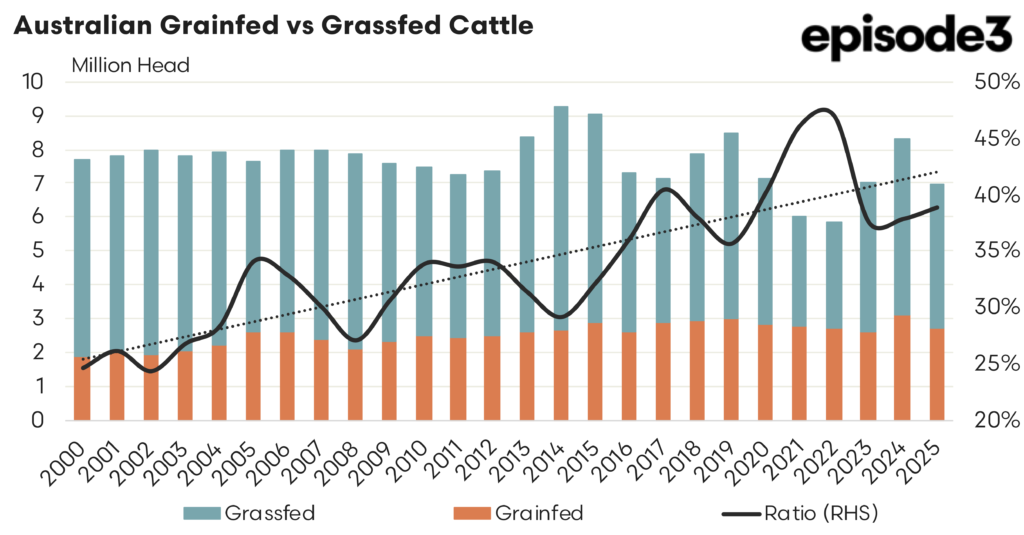

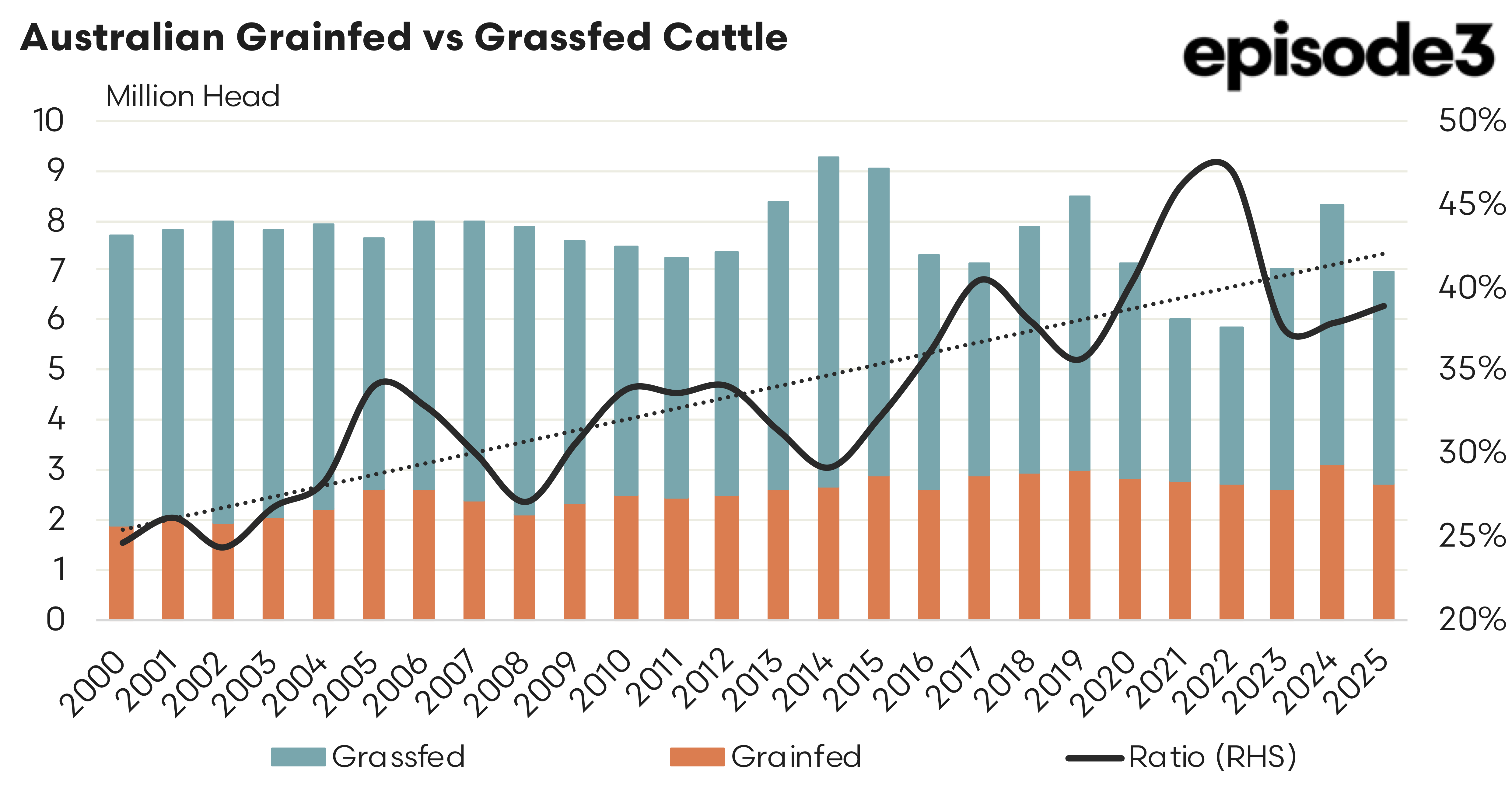

The long-term chart shown above highlights the structural shift in Australia’s beef production system toward grainfed supply, even though grassfed cattle continue to dominate overall slaughter volumes. From the early 2000s, Australia’s beef production system began a clear structural shift toward greater reliance on grainfed cattle, driven by expanding feedlot capacity, export market requirements and periodic supply shocks. In 2000, grainfed slaughter rose sharply to 1.9 million head, accounting for almost 25% of total slaughter, up from low-teens shares through the 1990s. Through the first half of the 2000s, the grainfed share continued to lift, moving into a consistent 30–35% range as annual grainfed throughput exceeded 2.5 million head and grassfed slaughter fell below 5.5 million head.

This trend intensified during the mid-2010s and accelerated again through the 2018–22 drought and herd liquidation phase. By 2017, grainfed cattle accounted for more than 40% of national slaughter, and the ratio peaked at around 47% in 2021–22 as grassfed slaughter collapsed to just over 3.1 million head while grainfed volumes held near 2.75 million head. Although grassfed slaughter has partially recovered since then, the system has not reverted to pre-drought norms.

In 2025, grainfed slaughter is estimated at 2.72 million head from total slaughter of just under 7.0 million head, equating to a grainfed share of 38.9% and grassfed slaughter of 4.27 million head. Average cattle on feed reached a new high of more than 1.53 million head, but increased long-fed programs in the system (long-fed Angus and Wagyu) means average days on feed has risen to around 154 days, well above early-2000s levels of 120 days. The data show that since 2000, grainfed production has evolved from a cyclical buffer into a permanent and central pillar of Australia’s beef supply chain, with the grainfed–grassfed split now structurally closer to 40:60 than the 25:75 balance that prevailed at the start of the century.