Go east, life is sheepful there

The Snapshot

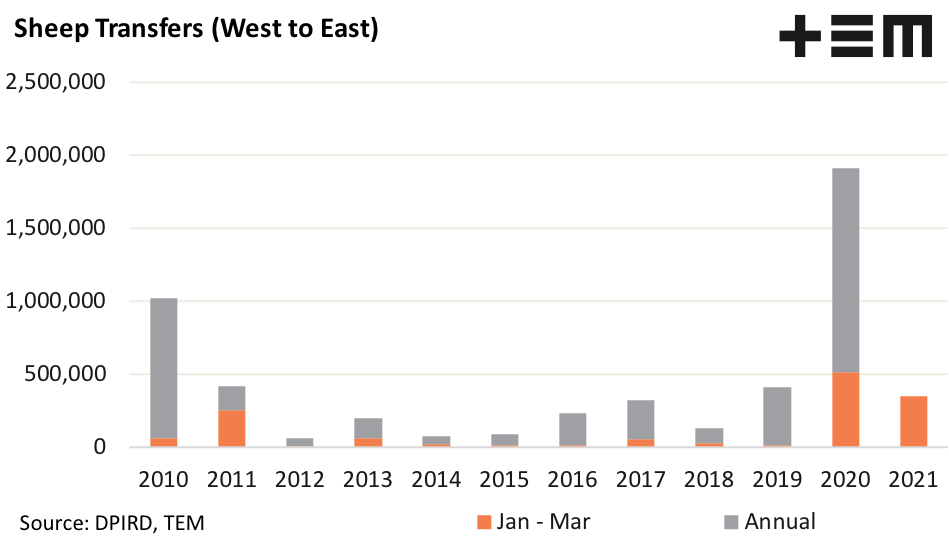

- The 2020 season saw a record number of sheep and lamb transported from the west with a record 1.9 million head.

- January to March 2021 WA transport volumes show nearly 350,000 head sent east this year compared to just over 500,000 for the same time frame in 2020.

- During 2020 volumes ran at 159,000 head per month on average, which is 333% higher than the seasonal trend seen over the last decade.

- The 2021 average monthly volumes (Jan to Mar) are trekking 278% higher than the average pattern for this time in the year.

The Detail

During the 2020 season a record number of sheep and lambs were transported from Western Australia to the eastern states, particularly to New South Wales, as producers took advantage of lower west coast prices to restock.

The flow of stock from west to east helped underpin sheep and lamb prices in WA as dry seasonal conditions and reduced live export flows had been acting as a solid headwind. The 2020 season saw a record number of sheep and lamb transported from the west with a record 1.9 million head going to the eastern seaboard during the year.

The last time transportation numbers were anything like this was during the 2010/11 La Nina event when the combined total for 2010 and 2011 reached 1.4 million head. The January to March transport volumes show that so far during 2021 numbers of sheep and lamb moving from west to east remain strong with nearly 350,000 head sent across the Nullarbor this year compared to just over 500,000 for the same time frame in 2020.

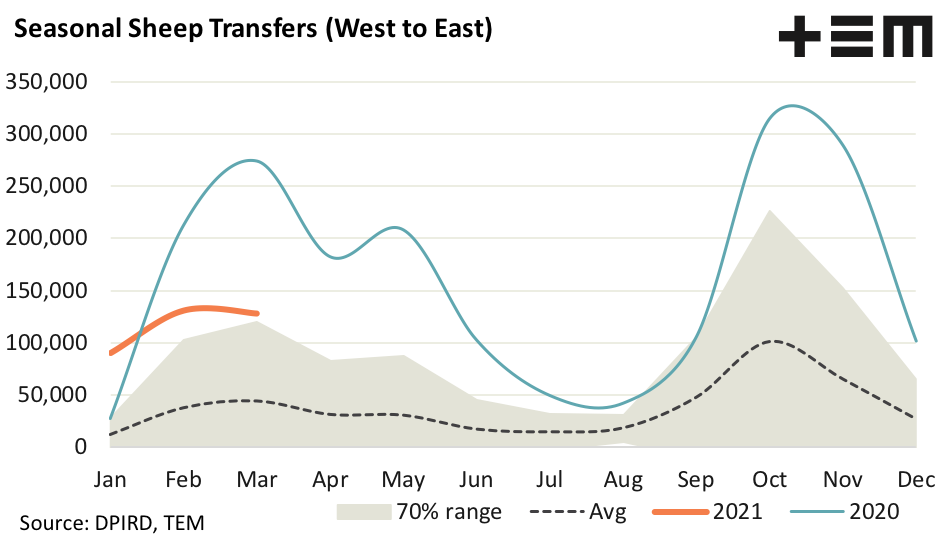

The seasonal picture for sheep and lamb flows from west to east highlights just how strong the draw has been for WA producers to take advantage of the scramble for stock seen in the east. Indeed, for all of 2020 the monthly seasonal pattern of stock transport volumes remained above the upper end of the normal range, as highlighted by the 70% range.

During 2020 average monthly volumes ran at 159,000 head, which is 333% higher than the average trend seen over the last decade. This season average monthly volumes are still running outside the upper 70% range boundary and have been trekking 278% higher than the average pattern for this time in the year.

Given the incredibly low volumes of live export sheep leaving WA, particularly during February, the strong demand for WA sheep and lamb in the east has been a comfort for WA sheep producers and has continued to provide support prices in the west when live export buyers have been absent.

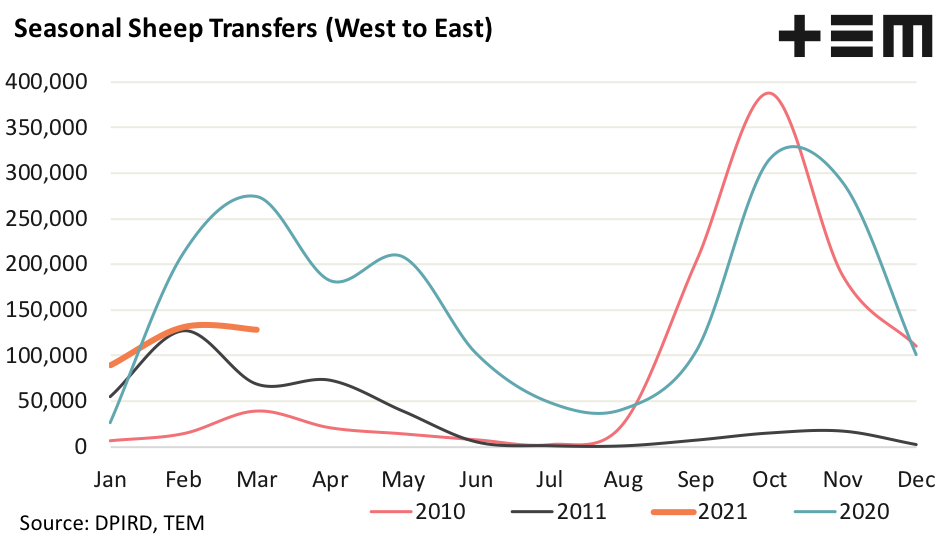

A comparison of the seasonal pattern of sheep and lamb flows from the 2010/2011 period to the current season shows a remarkably similar trend, particularly during the second half of 2010/2020 and the first half of 2011/2021, both in terms of directional trend and volume levels.

Interestingly, the 2011 pattern shows that by the middle of the year the exodus of sheep and lamb from west to east had reverted to relatively normal flows. This highlights the fact that the eastern markets are only an occasional avenue for stock turn off for WA producers and cannot be relied on in every season to provide price support.

Historically the live export sector provided up to 30% of the turn off options to WA sheep producers. However in recent years the decline in live export flows has seen this fall to sub 20% of annual turn off. The option to send sheep and lambs from west to east provided some welcome additional avenues to WA producers during 2020/2021, but the sector really needs a viable and active live sheep export participant to ensure there is buyer competition in the west for every season.