Goat exports not GOAT

The Snapshot

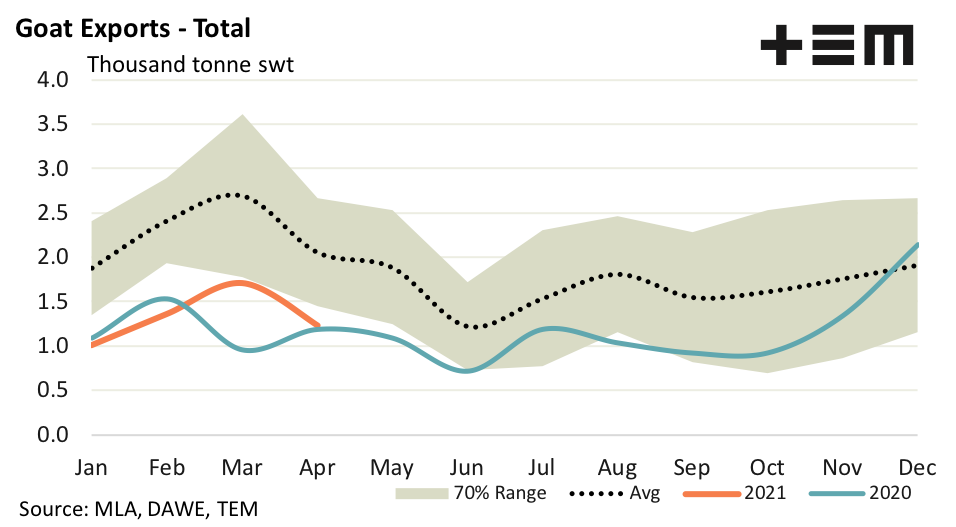

- Total Australian goat export volumes eased 28% during April to see 1,234 tonnes swt consigned for the month.

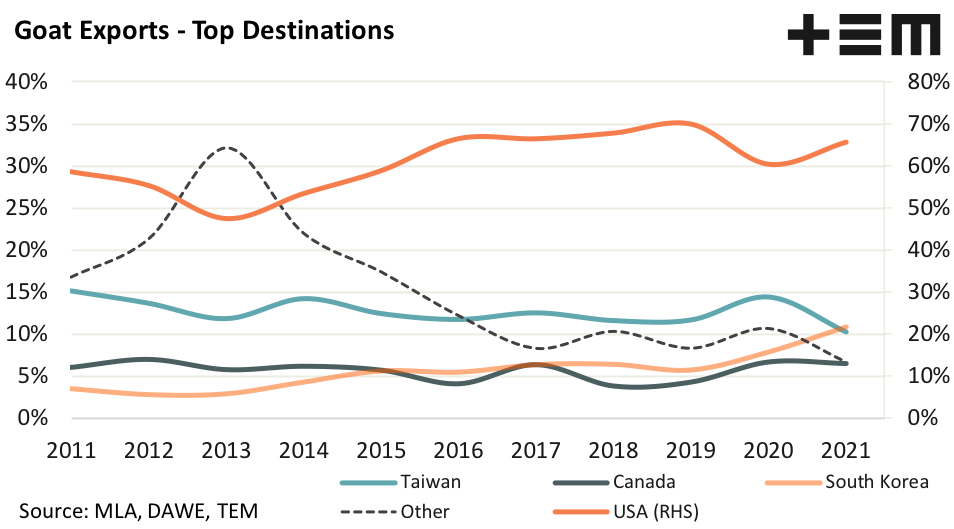

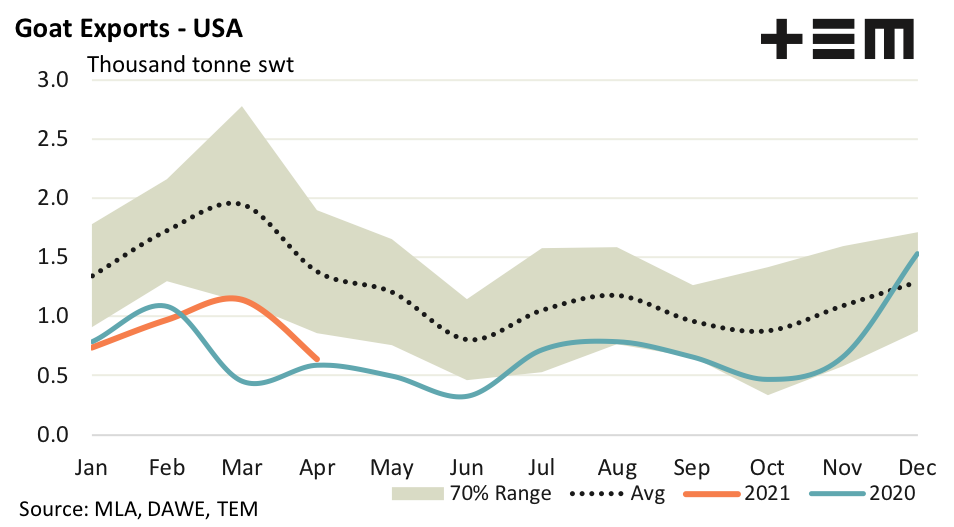

- Historically, the USA take most of Australia’s goat meat exports, usually capturing annual market share between 60-70%. During April 2021 the flow of Australian goat meat exports to the USA declined by 44% to record 642 tonnes shipped.

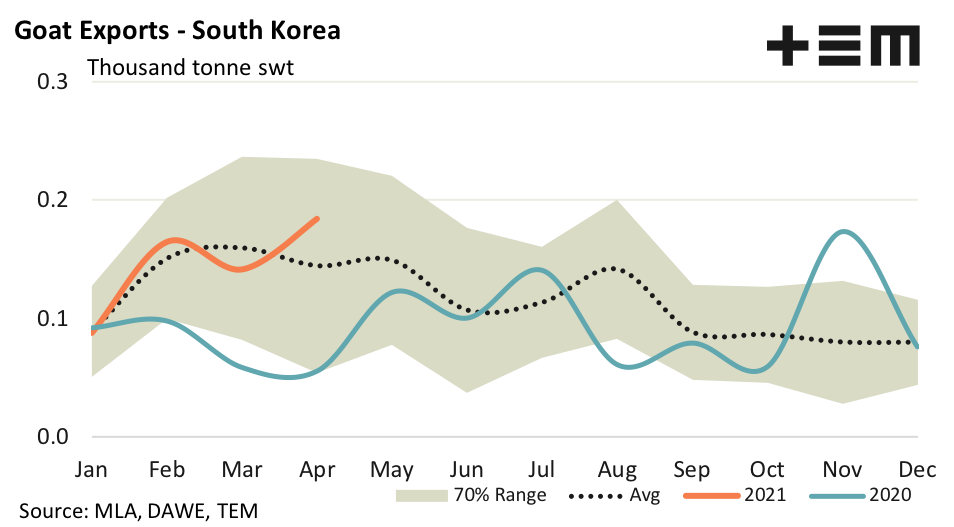

- April 2021 saw the highest monthly flow of Aussie goat meat to South Korea since April of 2018 and represents levels that are 28% above the five-year average for April.

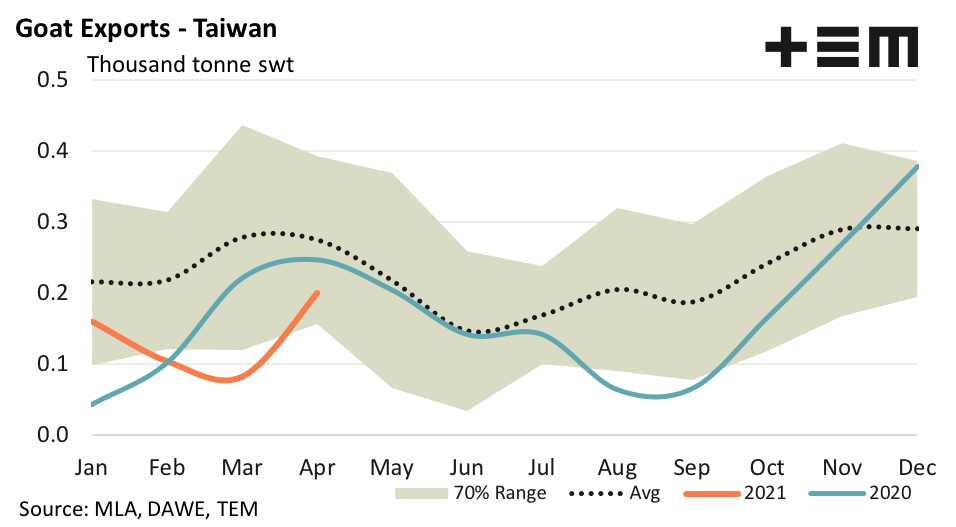

- Despite a 147% lift in goat meat flows to Taiwan from March to April, volumes remain 27% below the average trend.

The Detail

Australian goat meat export volumes are not the greatest of all time (GOAT) and, while there are signs of life in some of the top four trade destinations, the slow start to the season for the USA (which is the big player in the industry) has kept total export flows subdued.

Goat export volumes eased 28% during April to see 1,234 tonnes swt consigned for the month. Australian goat export volumes since the start of 2021 are running 41% under the five-year average trend and has remained outside the lower end of the normal seasonal range (as identified by the grey shaded 70% area) for all of 2021.

Historically, the USA take most of Australia’s goat meat exports, usually capturing annual market share between 60-70%. This season the American proportion sits at 66%, compared to 11% for South Korea, in second place, and 10% for Taiwan, coming a close third.

During April 2021 the flow of Australian goat meat exports to the USA declined by 44% to record 642 tonnes shipped. This represents export flows that are 53% lower than what could be expected for April, based on the five-year average pattern.

The sluggish start to the season in goat meat demand in the USA is mirroring the drop seen in Aussie beef exports to date, with goat and beef export volumes so far this season sitting about 45% under the normal volumes that could be expected, based on the five-year average trend.

In contrast, South Korean demand for Aussie goat meat has been on an upward trend during 2021, pushing out Taiwan from the second highest market share destination for Australian goat exports this year. April 2021 saw goat export volumes to South Korea lift by 30% over the month to reach 185 tonnes swt.

This is the highest monthly flow of Aussie goat meat to South Korea since April of 2018 and represents levels that are 28% above the five-year average for April.

Taiwan also saw a lift in flows during April, after a dip below the normal seasonal range was recorded for March. There was 200 tonnes swt of Aussie goat meat consigned to Taiwan during April, a 147% recovery from the low set in March and it places current flow of goat meat 27% under the five-year seasonal average pattern for April.

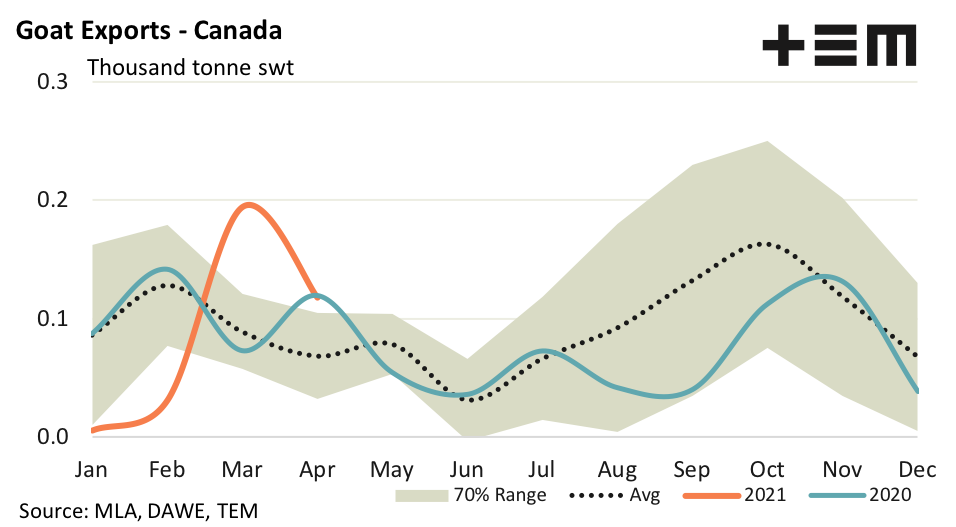

Canada sits in fourth spot, as a top destination for Australian goat exports. During 2021 Canada accounts for just under 7% of goat exports from Australia. During April volumes eased by 40%, but this was coming off an uncharacteristically high volume set in March.

April registered 117 tonnes of Australian goat exports to Canada and despite the reduction in month to month volumes has managed to match levels set during April 2020, which is representative of flows that are 72% above the five-year average for April.

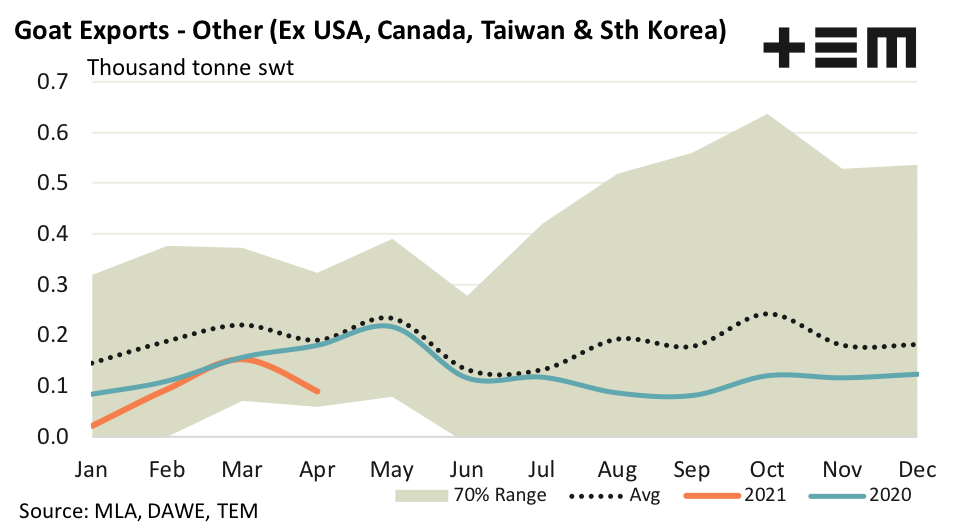

The combined flow of Australian goat exports to “other countries” (those destinations outside of the top four of the USA, South Korea, Taiwan and Canada) declined by 41% during April to register 90 tonnes swt exported.Flows to “other countries” during April are sitting 53% under the five-year average pattern.