Green shoots for Wagyu premiums

Market Morsel

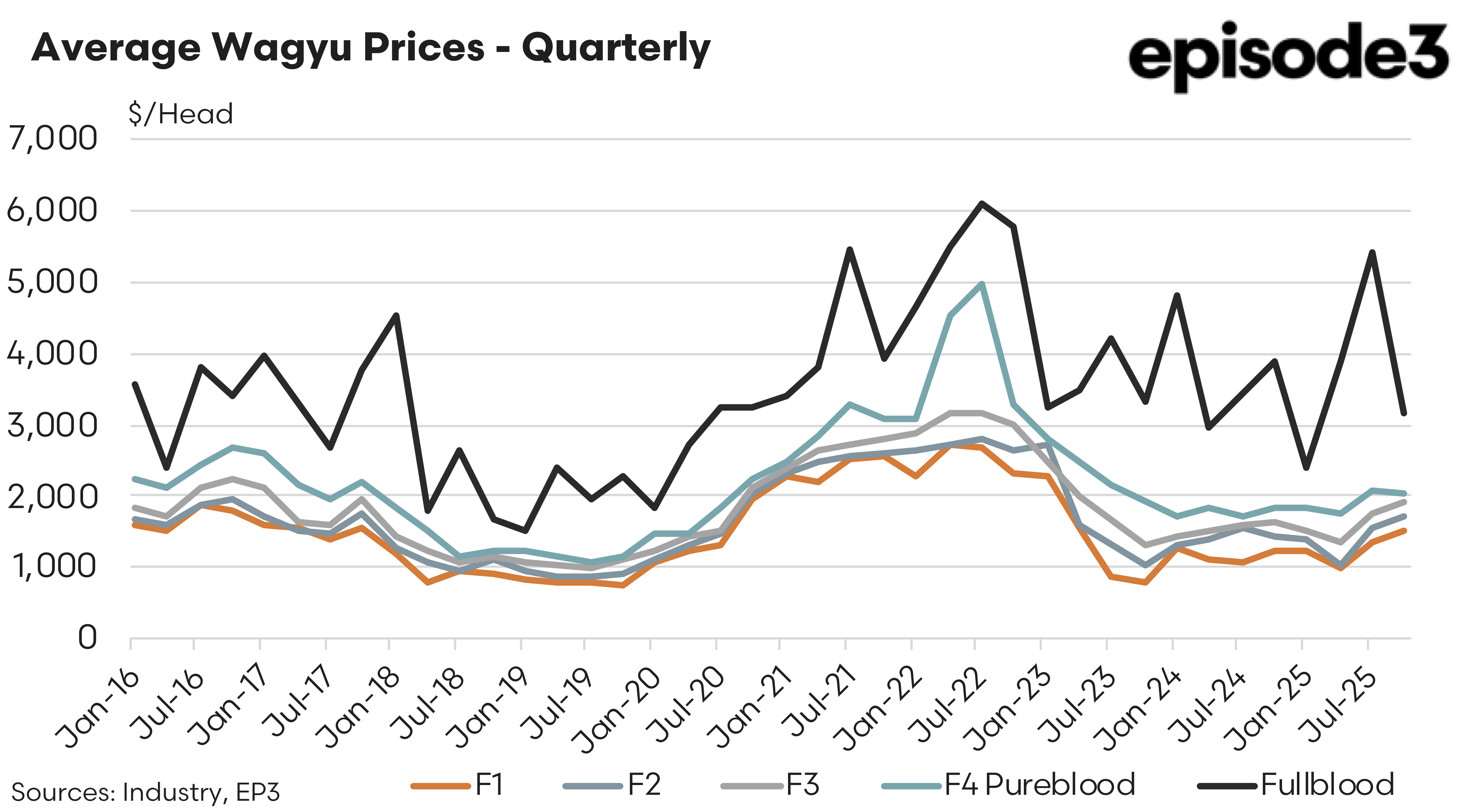

Australian Wagyu prices continued their long running adjustment through the third quarter of 2025, reflecting a market that is still working through the legacy of extraordinary highs reached earlier in the decade. While some improvement was evident compared with the June quarter, values across most Wagyu categories remain well below the peaks of 2021 and 2022, and premiums over the broader cattle market have narrowed substantially.

The Wagyu sector has experienced a pronounced cycle over the past five years. Rapid expansion, strong export demand and elevated feeder cattle prices combined to push Wagyu values to unprecedented levels during the pandemic period. Since mid 2022, however, the market has been correcting, with prices retreating as supply expanded and demand normalised. The third quarter of 2025 confirms that this correction is ongoing, although signs of stabilisation are beginning to emerge.

Quarterly pricing data shows modest improvement for most Wagyu categories compared with the previous quarter. F1, F2, F3 and Pureblood cattle all recorded small quarter on quarter increases, suggesting the sharp declines seen through 2023 have eased. Fullblood Wagyu, by contrast, softened slightly from the June quarter, although this category continues to outperform all others by a significant margin.

Average weighted prices for the September quarter were $1,499 per head for F1 Wagyu, $1,715 for F2, $1,908 for F3, $2,047 for F4 Pureblood and $3,169 for Fullblood cattle. These figures represent a recovery from the low point reached in 2023, but they remain well below long term averages and far short of the record highs recorded during the peak of the market cycle.

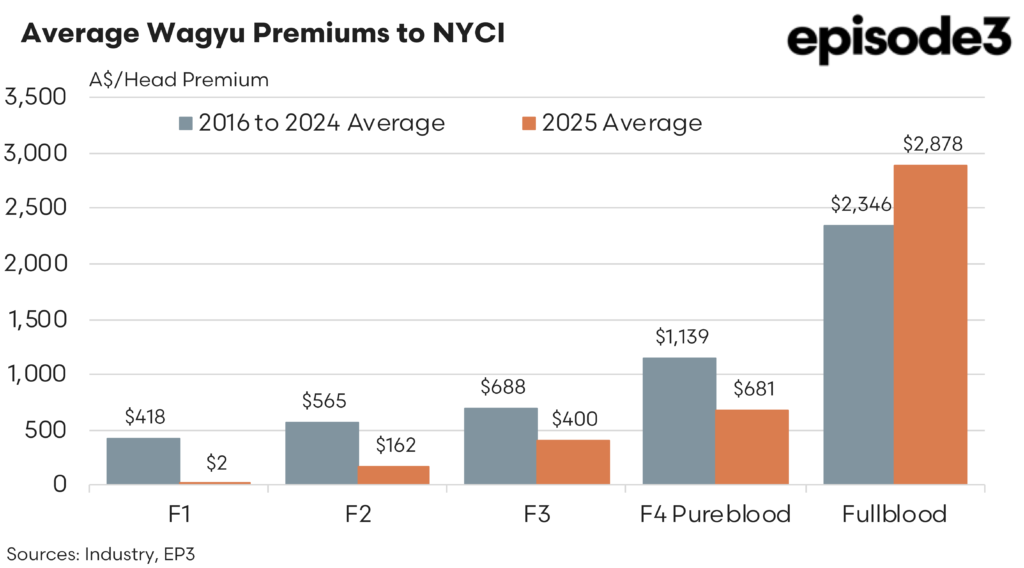

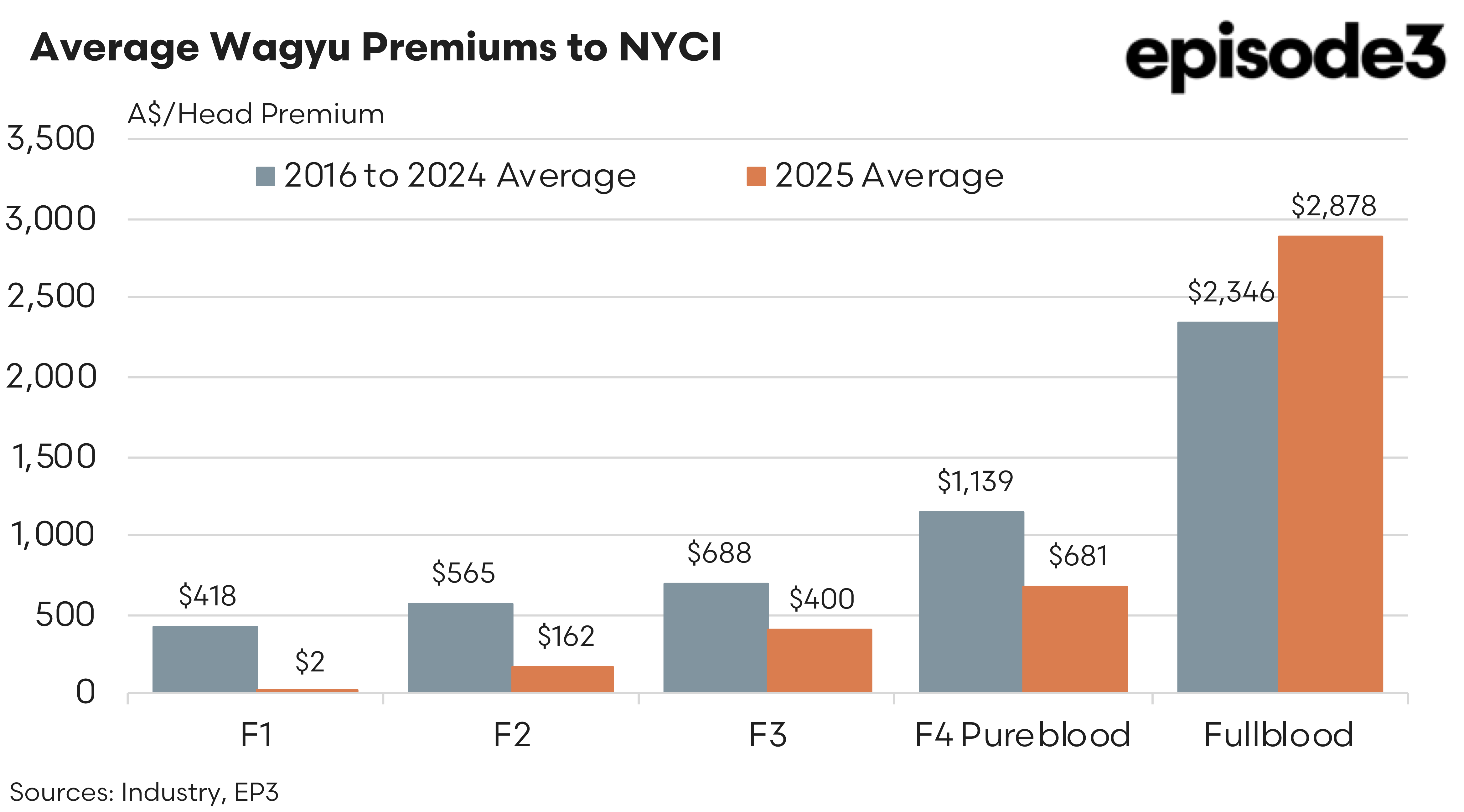

One of the most striking developments has been the contraction in Wagyu premiums relative to the National Young Cattle Indicator. Historically, F1 Wagyu cattle attracted a substantial premium over the broader young cattle market, averaging around $418 per head or roughly 35 percent above the benchmark. In the third quarter of 2025, that premium narrowed to just $122 per head, with F1 Wagyu trading at an average of $1,499 per head compared with an NYCI benchmark of $1,377.

This compression in premiums highlights the changing economics of the Wagyu sector. For many producers, particularly those operating at the F1 and F2 level, the traditional margin uplift associated with Wagyu genetics has diminished. While F2 and F3 cattle continue to trade above the broader market, their premiums are also well below historical norms, reducing the buffer that once helped offset higher production costs and longer feeding programs.

Fullblood Wagyu remains the clear exception. Despite easing from exceptionally high levels earlier in the year, Fullblood prices continue to attract substantial premiums over the NYCI. This resilience reflects the genetic value of Fullblood cattle, specialist demand from supply chains and the inherently limited supply of these animals. While Fullblood values in the September quarter were lower than long term benchmarks, they remain the strongest performing segment of the Wagyu market and the only category to consistently exceed historical premium expectations during 2025.

Taken as a whole, the third quarter results reinforce the view that the Wagyu sector is undergoing a structural correction rather than a short term dip. Prices across most categories have reset to more sustainable levels, and while the extreme volatility of recent years appears to be easing, the market environment remains softer than many producers have been accustomed to over the past decade.

Encouragingly, the modest lift in prices across several categories suggests the market may be beginning to find a base. Improved seasonal conditions, greater certainty around supply and more disciplined production decisions are all contributing to a more stable outlook. However, the path to a full recovery is likely to be gradual, particularly for lower generation Wagyu cattle where premiums have been most heavily eroded.

To provide continued insights into how the Wagyu market is evolving, the Episode 3/ Australian Regional Insights Q4 2025 Wagyu price trend survey is now open for producer and feedlot submissions. The survey is designed to capture on ground pricing, sentiment and market dynamics across all Wagyu categories, providing valuable insight into how Wagyu cattle performed into as at the end of 2025. A link to participate in the survey can be found below , and all participants will receive a free summary report of the results via email once the survey is complete.

Survey Link

To provide continued insights into how the Wagyu market is evolving, the Episode 3: Australian Regional Insights Q4 2025 Wagyu price trend survey is now open for producer and feedlot submissions.

The chart of annual average dollar per head premiums for 2025 thus far, shows a clear compression in Wagyu premiums relative to the NYCI in 2025 compared with the long-run average, particularly across the lower crossbred categories. F1 premiums have effectively collapsed to near zero, while F2 and F3 premiums are materially below their 2016–2024 averages, indicating weaker demand or oversupply in these segments. Even F4 Pureblood premiums have declined sharply year on year, though they remain meaningfully positive. In contrast, Fullblood Wagyu stands out as the exception, with 2025 premiums exceeding the historical average, reinforcing the ongoing market bifurcation where top-end genetics continue to attract strong price support while mid-tier Wagyu categories face margin pressure.

As the Wagyu sector continues to adjust, transparent data and producer input will be critical in understanding where prices are heading next. While the era of extraordinary highs may be behind us, the foundations of the Wagyu market remain intact, with genetics, quality and supply discipline continuing to underpin long term value for the industry.