Grinding higher

The Snapshot

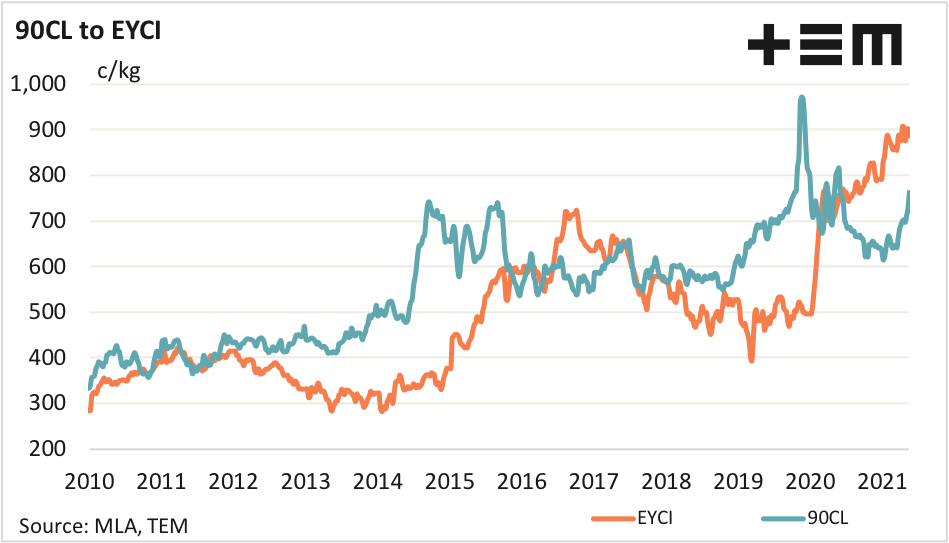

- The 90CL weekly indicator rallied nearly 5% to bring it to the highest point since June 2020 at 763c/kg.

- The discount percentage spread between the 90CL and EYCI narrowed from 20% to 14%.

- Currently, the annual average spread of the 90CL to EYCI sits at a discount of 23.4%, which is consistent with levels that would be expected given Australia’s low forecast beef cattle slaughter volumes.

- An ongoing tight slaughter environment suggests that the discount spread of the 90CL to the EYCI is likely to persist into 2022 with an average annual spread discount nearer to 14% likely.

The Detail

Argentina only has an import quota of 20,000 tonnes of beef to the USA and are relatively small players into the import space there. However, the surprise announcement that they would be suspending beef exports fired up imported beef prices in the USA as a surge in demand for US beef from Chinese buyers and a scramble from local meat buyers to secure stock provided additional price support.

US meat industry analysts, Steiner Consulting, reported a huge surge in weekly beef exports from the US to China from 1,000 MT to 9,000 MT to the week ending May 13. During the entire 2020 season weekly flows of beef from the US to China ranged between zero to 4,000 MT, so the lift towards 9,000 MT is significant.

The result of the pick up in demand, both internationally and domestically in the US, saw the 90CL beef export price indicator rally nearly 5% to bring it to the highest point since June 2020 at 763c/kg and closing some of the discount that had opened up between the 90CL and the Eastern Young Cattle Indicator (EYCI) during the 2021 season.

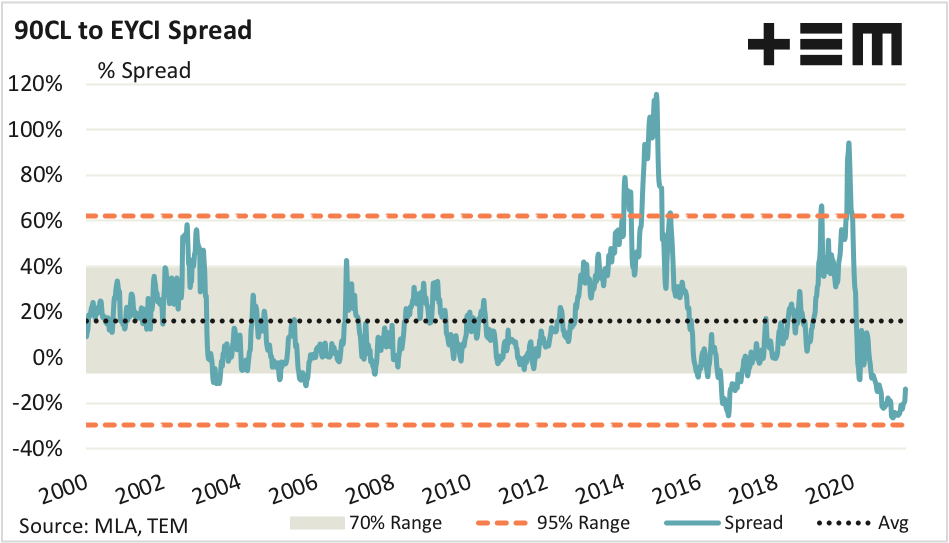

The discount percentage spread between the 90CL and EYCI narrowed from 20% to 14% over the week as the strong lift in the 90CL was only matched by a sideways drift in the EYCI. Historically the 90CL to EYCI spread has a long term average premium spread of 16%, and spends 70% of the time fluctuating between a discount of 7% to a premium of 40%. Movement of the spread beyond a discount of 30% and above a premium spread of 60% would be considered extreme.

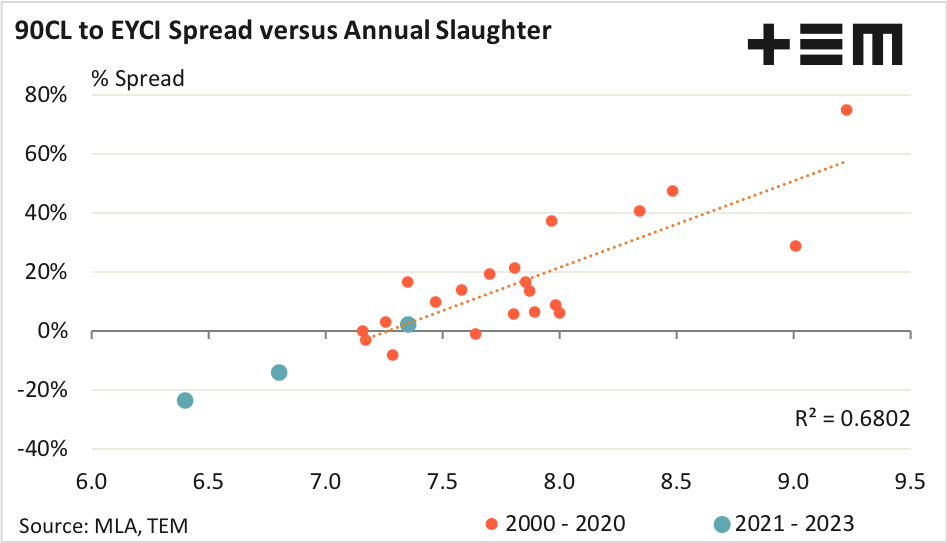

Analysis of the historic annual average spread between the 90CL and the EYCI compared to the annual cattle slaughter volume demonstrates that slaughter can be a good predictor of spread behaviour. During periods of high annual slaughter (above 9 million head per annum) can see the 90CL run at premium spread levels beyond the 60% premium spread boundary. Similarly, very low annual slaughter volumes can push the spread to relatively wide discounts.

Meat and Livestock Australia (MLA) revised their annual slaughter forecast for the Australian beef industry from 6.9 million head to 6.4 million head for the current season in their recent release of the April beef industry projections. Assuming that the 2021 slaughter figure comes in at 6.4 million head the correlation pattern suggests an annual average 90CL to EYCI spread discount of 25.7% is anticipated for the year. Currently, the annual average spread of the 90CL to EYCI sits at a discount of 23.4%.

MLA are expecting annual slaughter for 2022 to come in at 6.8 million head. This tight slaughter environment suggests that the discount spread of the 90CL to the EYCI is likely to persist into 2022 with an average annual spread discount nearer to 14% likely, based on the historic relationship between the two data sets.