I spy with my little eye, something beginning with S

Sheep

As we turn our attention to the 2021 season the EP3 team have come up with a few items to keep a watch on for those interested in sheep and lamb markets.

The global downturn due to Covid-19 put a dampener on lamb prices during 2020. However, a resurgence in growth in 2021 should see export demand for sheep meat recover, particularly in the Middle East.

With limited competitors in the sheep meat export space expect to see strength return to the Eastern States Trade Lamb Indicator (ESTLI) in 2021 as economic growth levels within key trade partner’s economies improve, so long as there are no hiccups along the way.

There will be ESTLI forecasts published by EP3 early in the new year, but as the season progresses keep an eye on the following three areas:

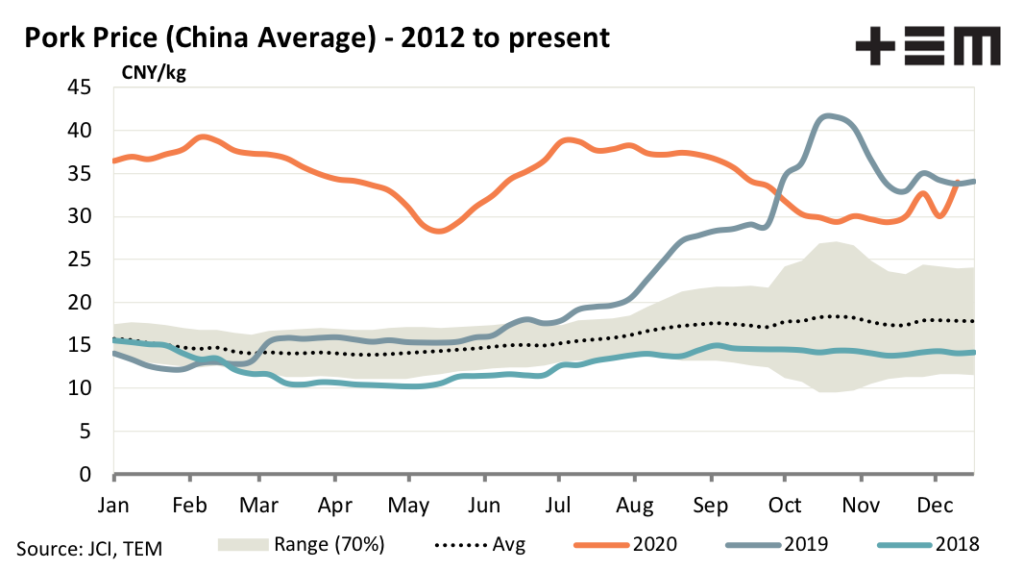

1 – China pig prices and meat import volumes

Speculation that the Chinese pig herd and pork production is back near pre- African Swine Fever levels is questionable. Rather than relying on the official word from the Chinese authorities keep a close watch on the pork price in China and the level of Chinese meat import flows.

While prices remain elevated and meat imports (of all types and from various source countries) remains high this suggests that the pork production deficit in China remains.

During 2020 Chinese demand for Australian sheep meat remained strong. Despite some recent suggestions that China may be targeting Aussie sheep meat in an escalation of trade tensions there has been little evidence of this occurring. Given the reliance the global sheep meat export sector has on Australian sheep meat (circa 40% of global sheep meat demand is satisfied by Australia) there is limited scope for China to shun the Aussie supply, particularly while their pork meat production gap remains.

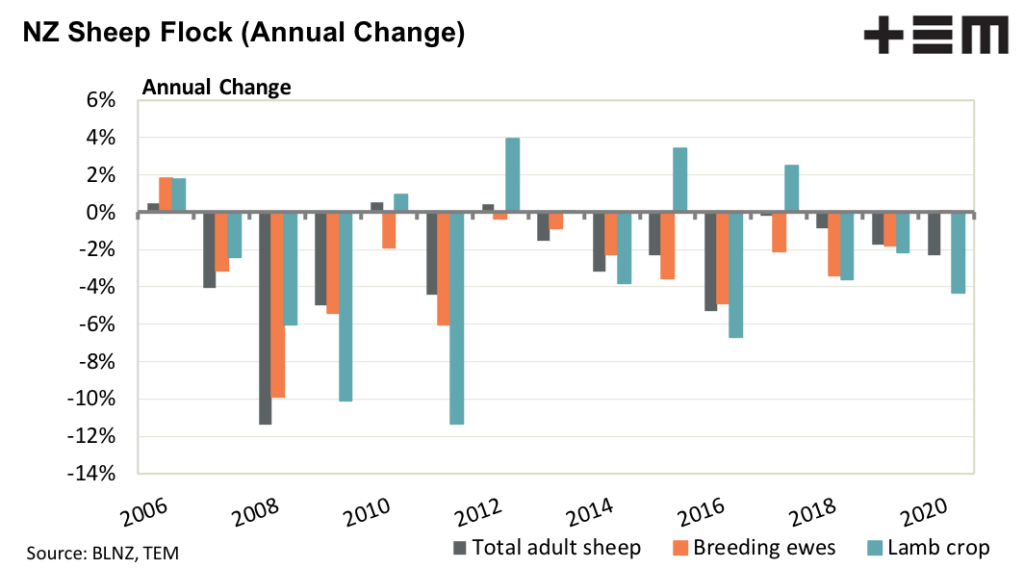

2 – NZ sheep flock

The sheep flock in NZ has been in steady decline for more than three decades with sixteen of the last eighteen seasons posting an annual decline in the number of breeding ewes.

The forecast from Beef & Lamb New Zealand for the 2020/21 season shows the first increase in breeding ewe numbers since 2006. The NZ breeding ewe flock is anticipated to grow 0.1% from 16.85 million head to 16.86 million head. Despite the increase to breeding ewe numbers the NZ lamb crop is expected to reduce by 4.3% from 22.3 million head in 2020 to 22.3 million head in 2021.

New Zealand is Australia’s only real export competitor in the sheep meat export space and while they continue to see a decline in sheep numbers, lamb crop, sheep meat production and export volumes they provide an opportunity for Australian producers and Aussie sheep meat exports to increase market share.

3 – Ongoing Covid-19 complications

Sheep meat export demand is susceptible to decreased economic growth levels, so the pace of the global recovery is key to supporting lamb/sheep prices into 2021.

The outbreak of a more contagious variant COVID-19 in the UK has forced parts of the country back into a strict lockdown, despite the rolling out of a vaccination program. While the UK aren’t a huge proportion of Australia’s sheep meat export program the prospect of a new variant wave of Covid-19 spreading around the globe in 2021 could delay the economic recovery in many regions that are key sheep meat trade partners.

Additionally, there is a risk of a US lockdown phase early in the new year after the Biden administration takes over. During the first US lockdown phase in 2019 Australian sheep meat export volumes suffered a few months of reduced flows, particularly impacting domestic prices paid for heavy lambs. Remember around 60% of Australian sheep meat exports to the USA go to the food service sector and 60% of these flows end up in the fine-dining restaurants (which will likely be the first food sector participants to be locked down and last to re-open).