Market Morsel: Aussie sheep versus the world.

Matthew is in the big smoke with clients for a few days, so I thought I would branch out and move into lamb.

I think it is always important to examine our relative value for commodities. What we produce in Australia is largely interchangeable with other producers around the world. We do this all the time with grains, because it gives us a basis level to work with in comparison to wheat futures, but what about sheep?

I grabbed some data and selected some countries which I thought would be interesting, and that had reliable data.

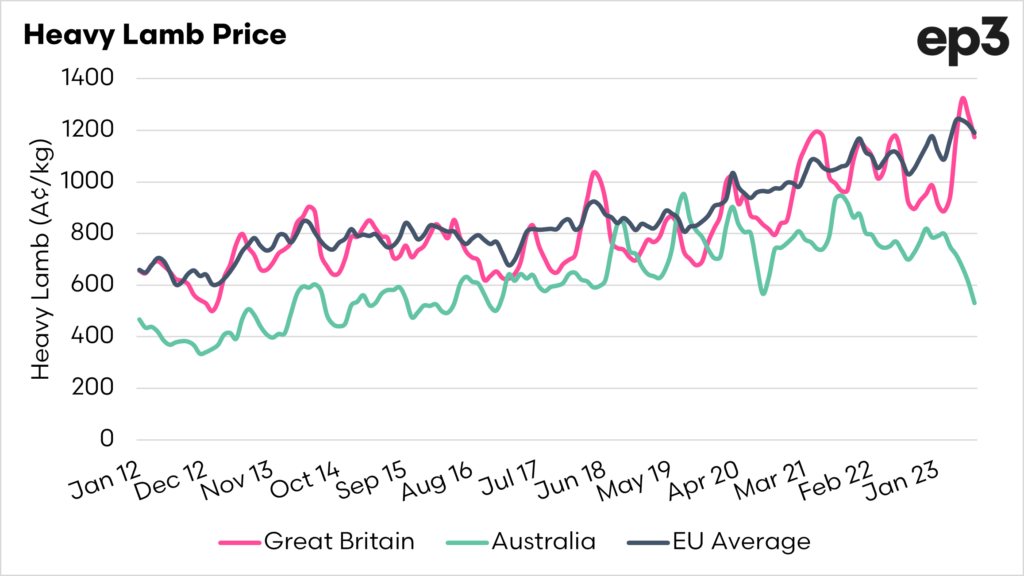

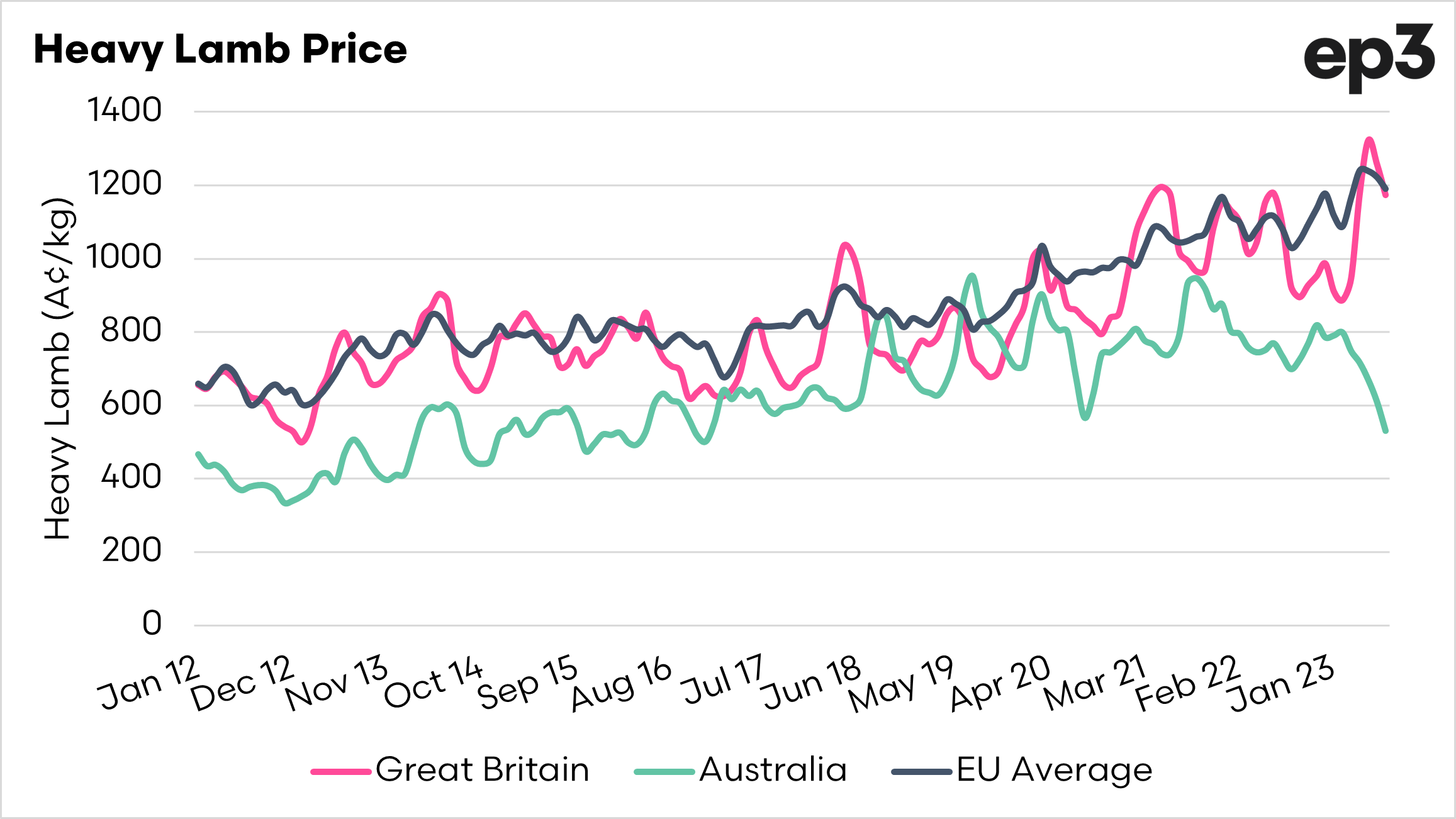

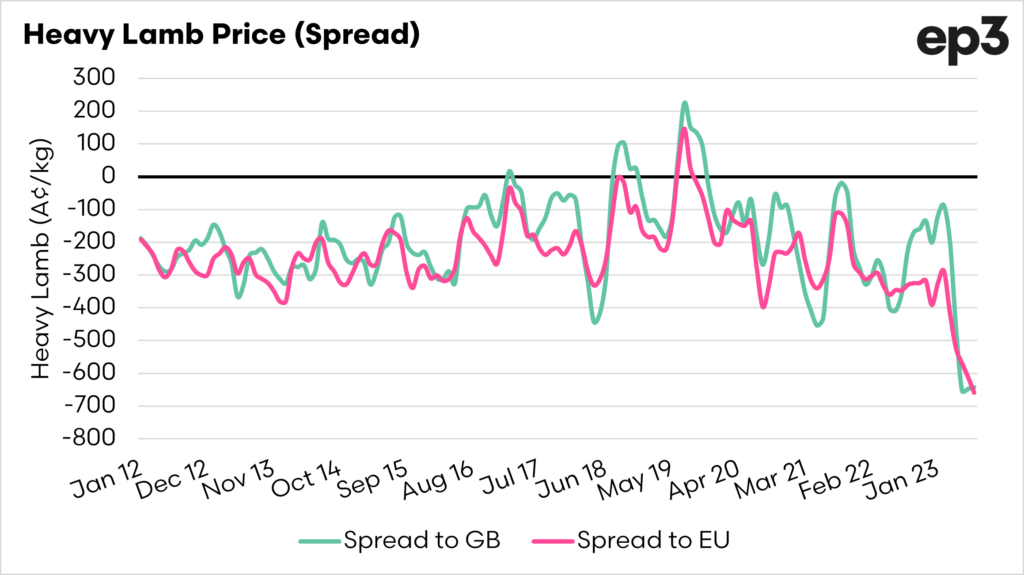

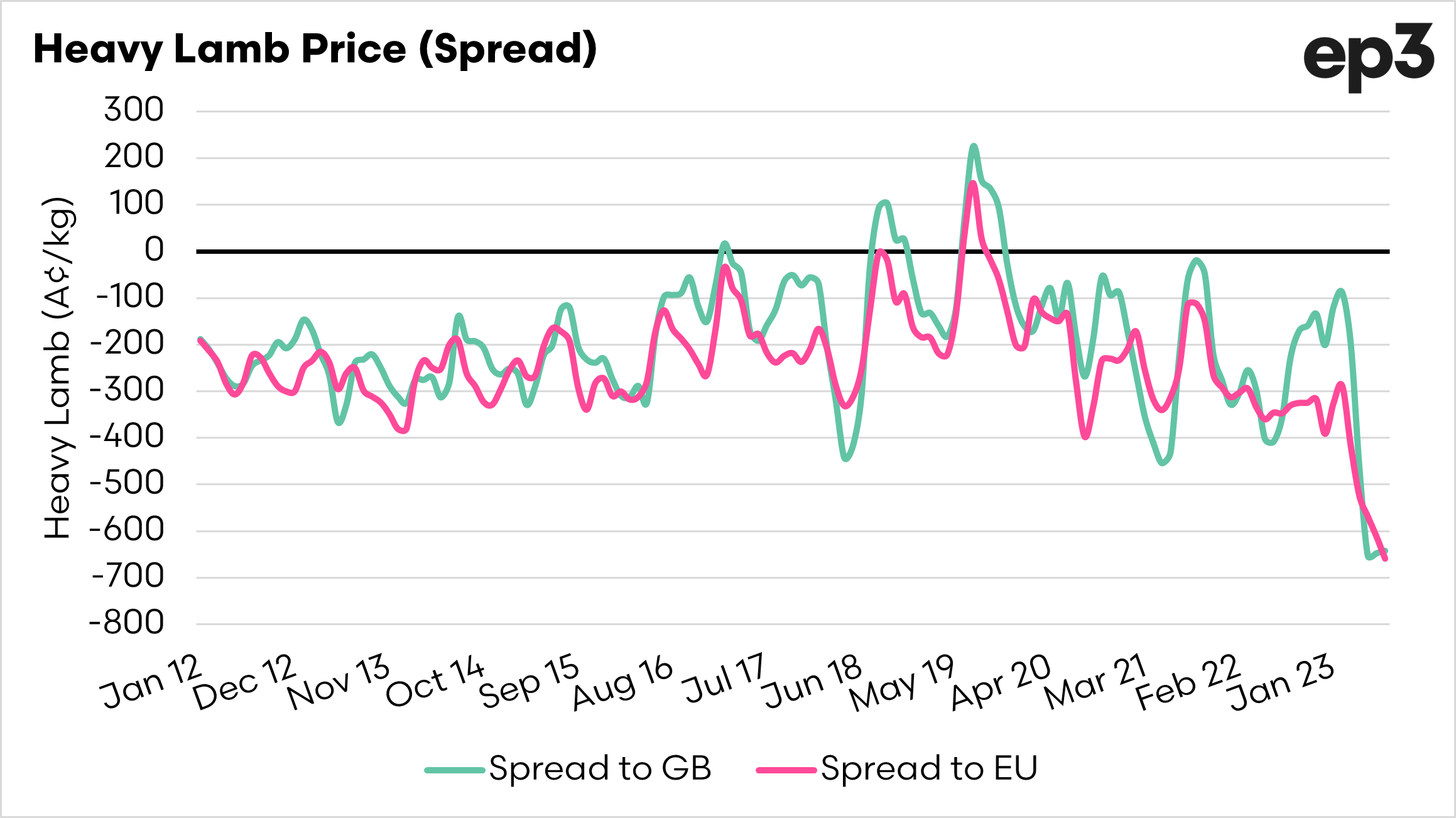

The first chart below shows the heavy lamb price for the UK, Australia and France. The second chart shows the spread between these markets and Australia, to highlight the scale of the discount.

The discount for Australian lamb is at the highest level since at least 2012, which is frustrating after having made such good progress on pricing in recent years.

Why is this discount occuring? I’ll probably leave this for Matthew to answer in more detail when he is back from his junket, but could it be related to the following:

- Cold storages are reported to be full.

- Lamb is an expensive, almost niche product. Is the cost of living crisis forcing a change of demand, this is something I have speculated as a risk to lamb (and wool) for the past two years.

- Are there too many lambs on the market. MLA expects a record year of lamb production. I wrote today about basis in wheat (see here), is a similar effect as the last two years for wheat being experienced in sheep?

It could likely be a combination of all these factors conspiring at the same time, the ‘perfect storm’. I am sure Matthew might be able to spread more light on this.

As it looks, the UK might be getting some bargain lamb.