Market Morsel: Chinese imports Part 2 – Livestock & Meat

Market Morsel

On a monthly basis, the Chinese government release statistics on the volume (& value) of major commodities imported into the nation. Chinese import volumes are important at the best of times; however, in recent times with the hoovering up of agricultural commodities, it becomes increasingly important to keep an eagle eye on them.

We will regularly cover the import volumes with a concise summary of the main points. In today’s update we will look at livestock and meat.

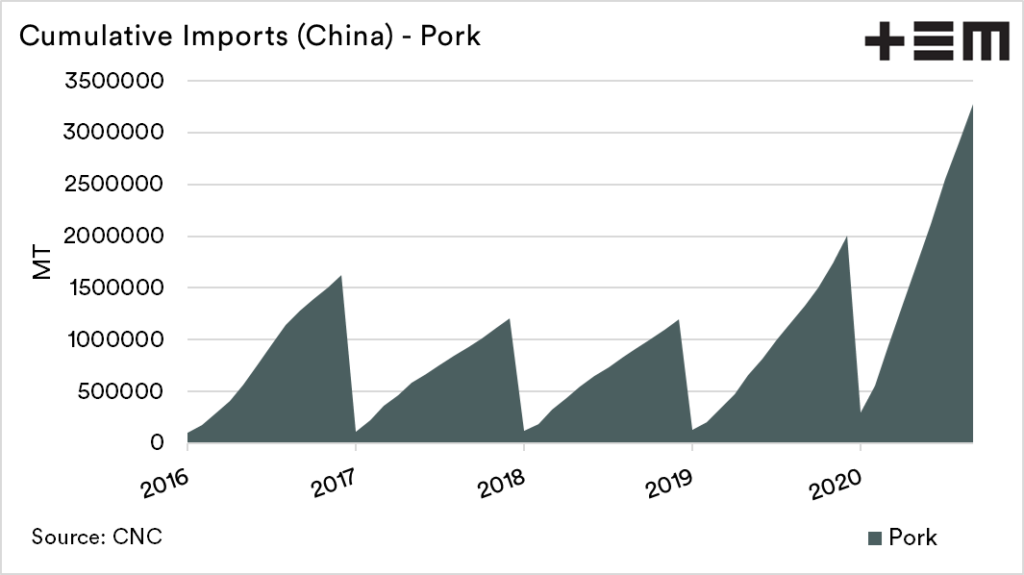

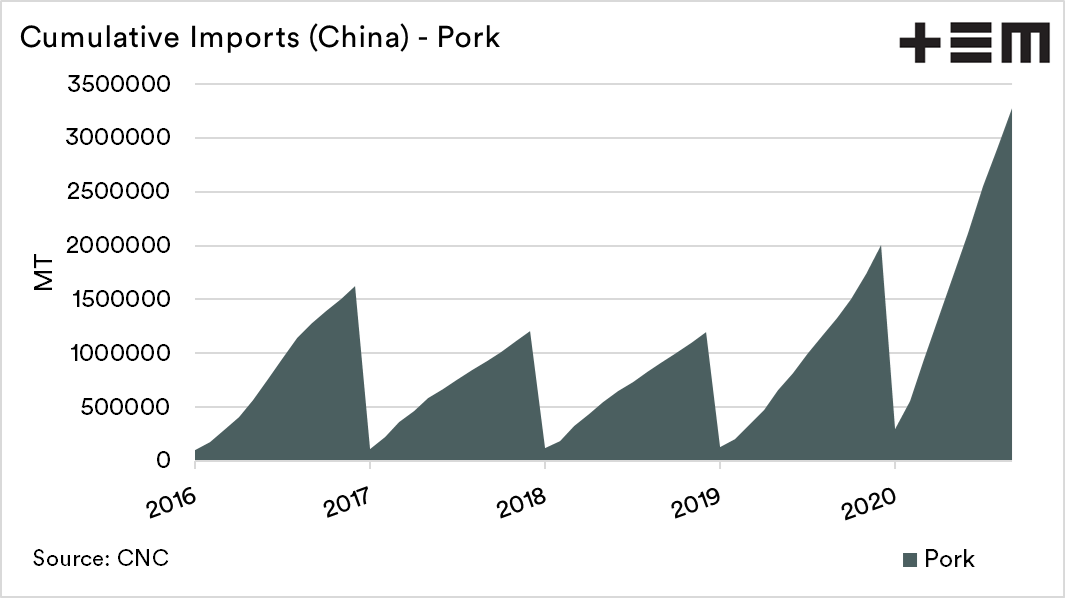

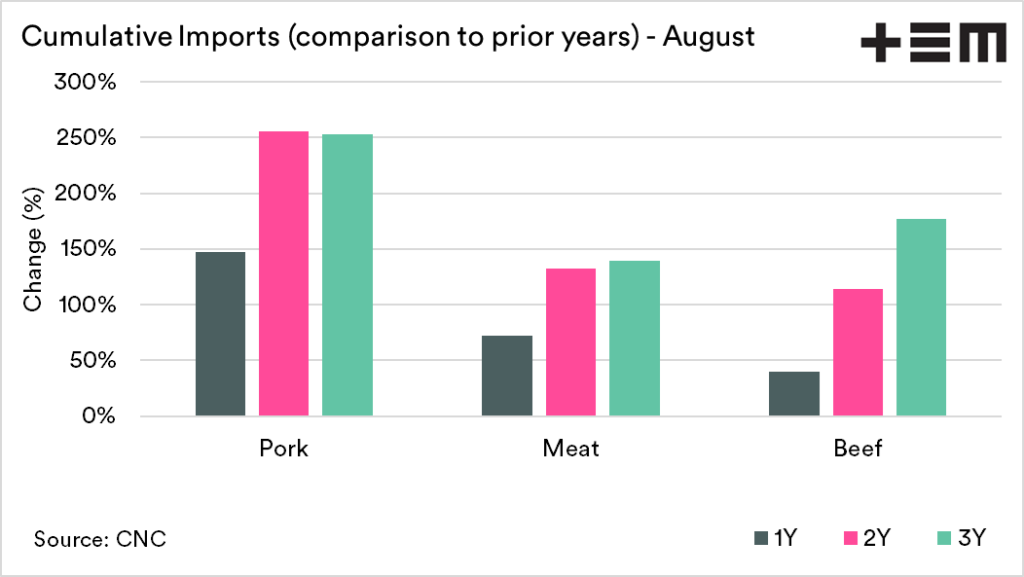

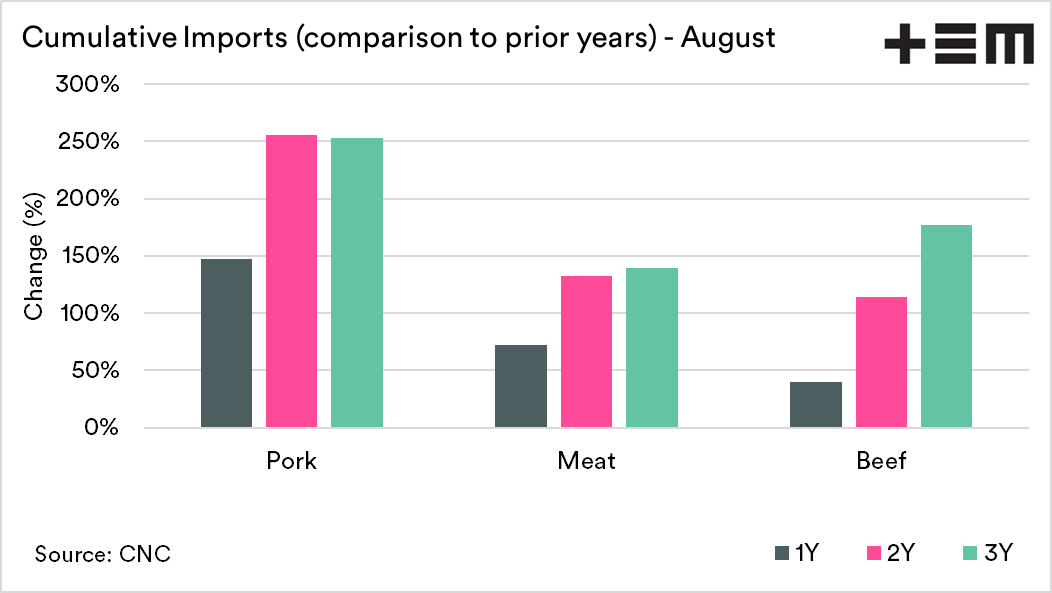

Pork: In an article during October we questioned whether the pork herd rebuild was as effective as lead to believe (see here). At present pork imports have reached 3.28mmt for the year, up 147% versus this time last year. The total imports for the month of September were up to 380kmt, versus 350kmt during August.

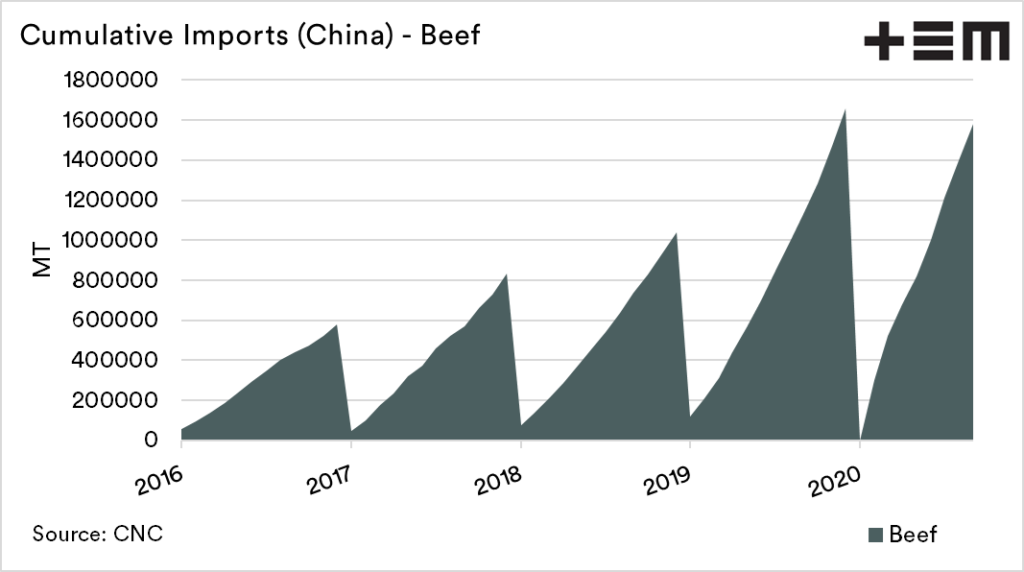

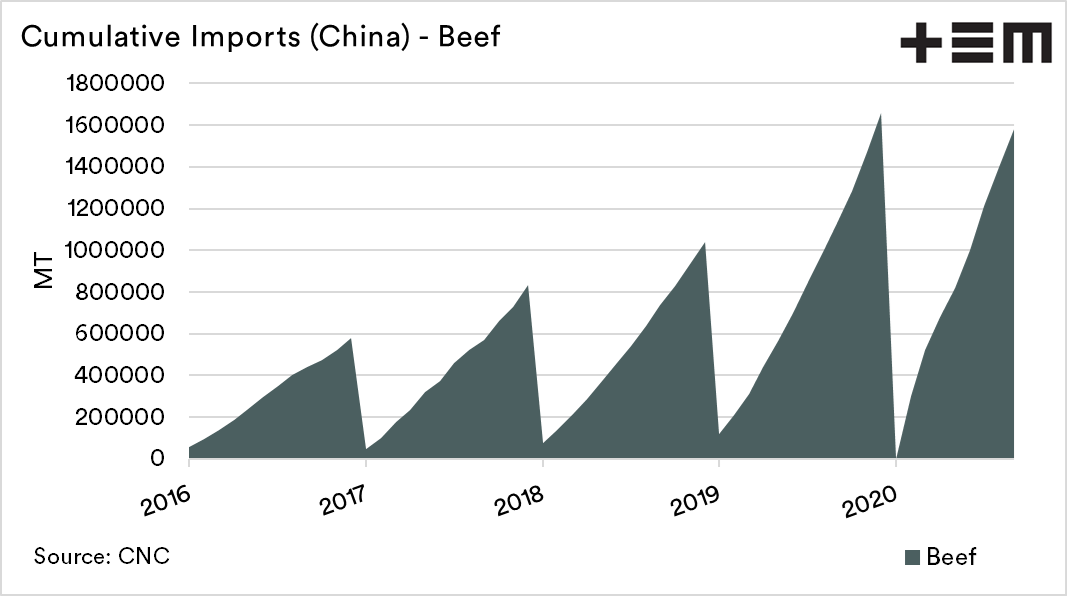

Beef: As African Swine Fever drove demand in China for Alternative proteins higher, cattle was one of the commodities to benefit. At present Australian beef is the most expensive in the world, which has lead to reduced exports from Australia (see here).

The overall import of beef into China has remained strong. It is likely that during October the full year (2019) imports will be exceeded with two months remaining.

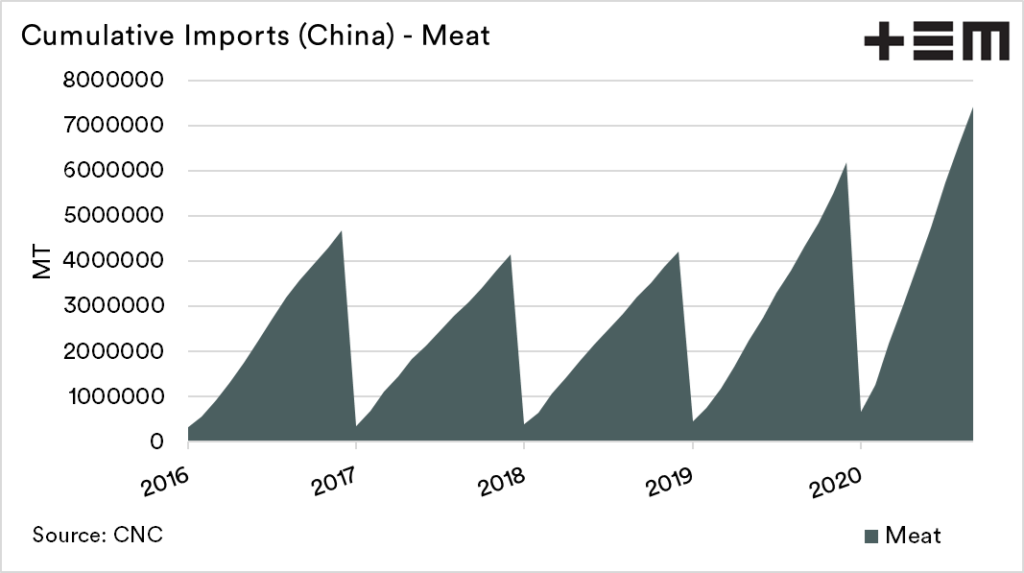

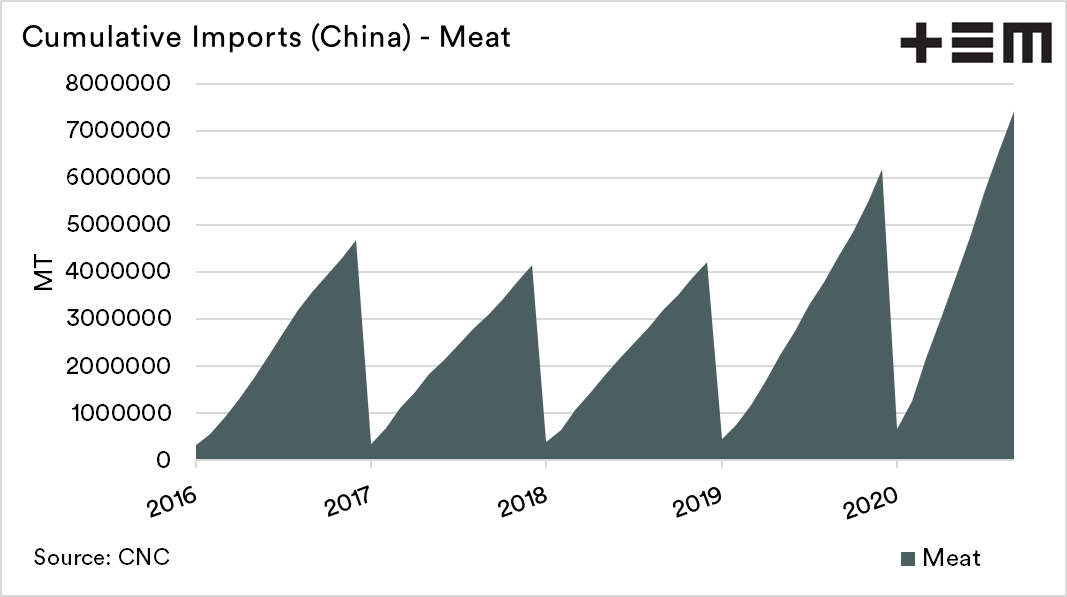

All meat (incl offal): During July meat imports into China reached their zenith, at 1mmt for the month. Subsequently during August volumes dropped to 830kmt. At this point many analysts pointed towards reducing demand, however at 830kmt this was still an extremely high level. During September import volume was the same as August at 830kmt.

The import of meat into China during 2020 has been stratospheric, and shows little signs of reducing to pre-ASF levels. Once we see recurring months of reduced imports of meat products, then this will give a better indication of a true and effective swine herd rebuild.