Meet me in the middle of the meat

The Snapshot

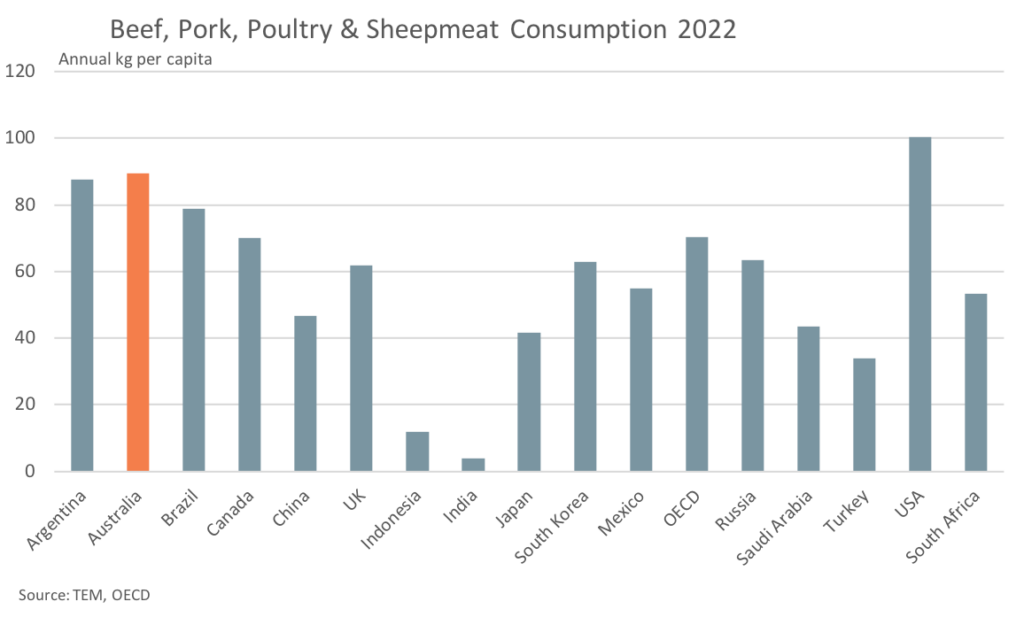

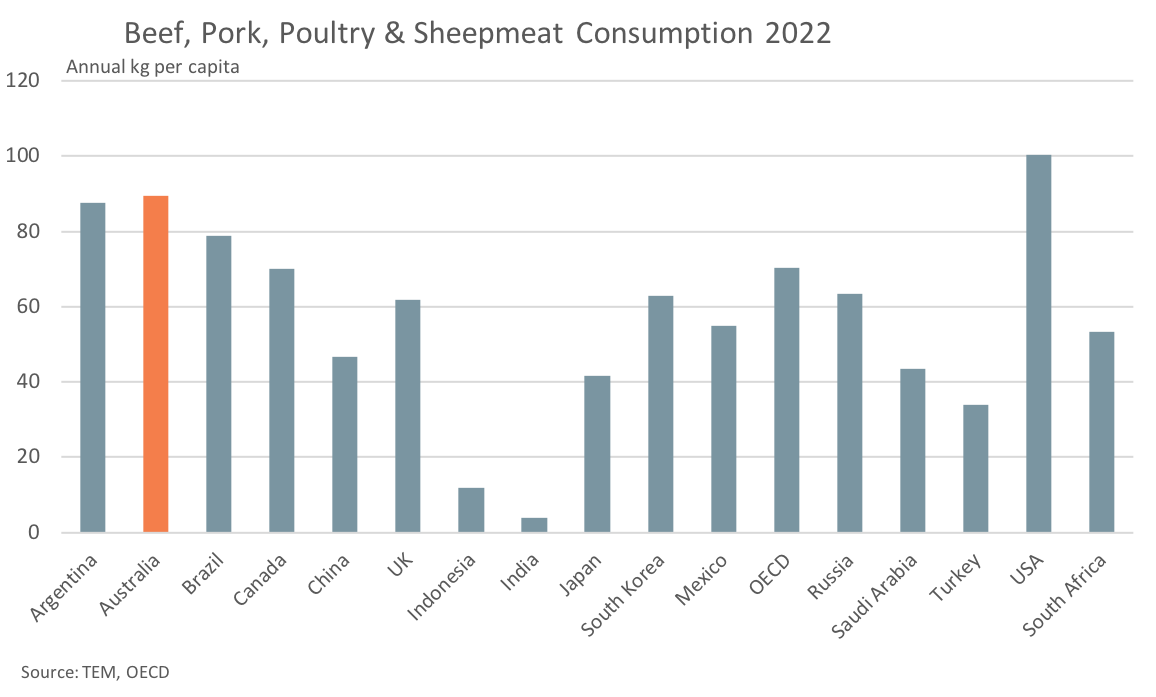

- In terms of total consumption in 2022 the USA lead the pack at 100.5 kg per person per annum.

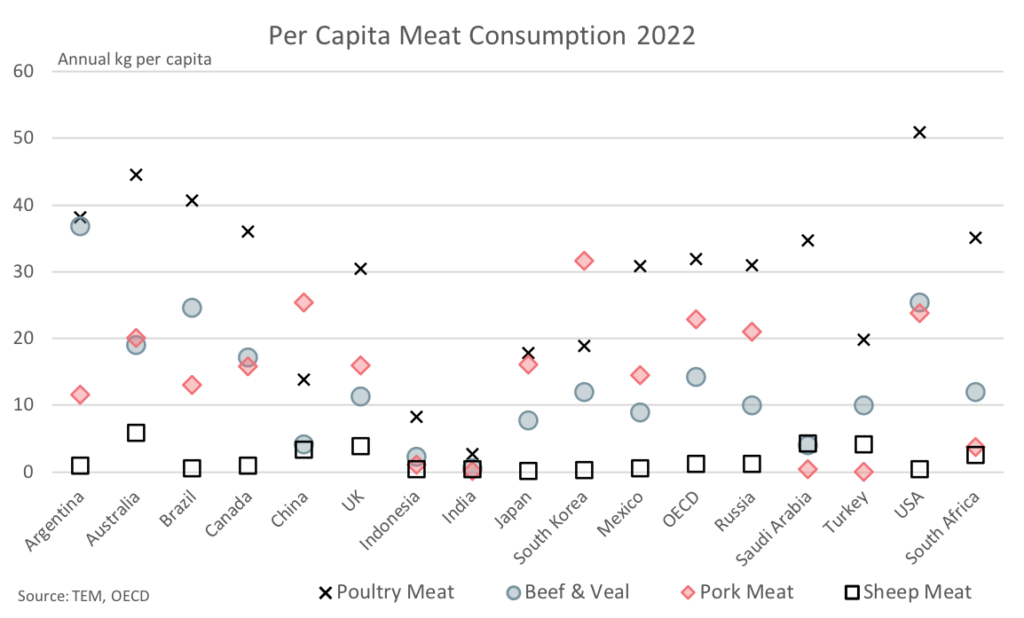

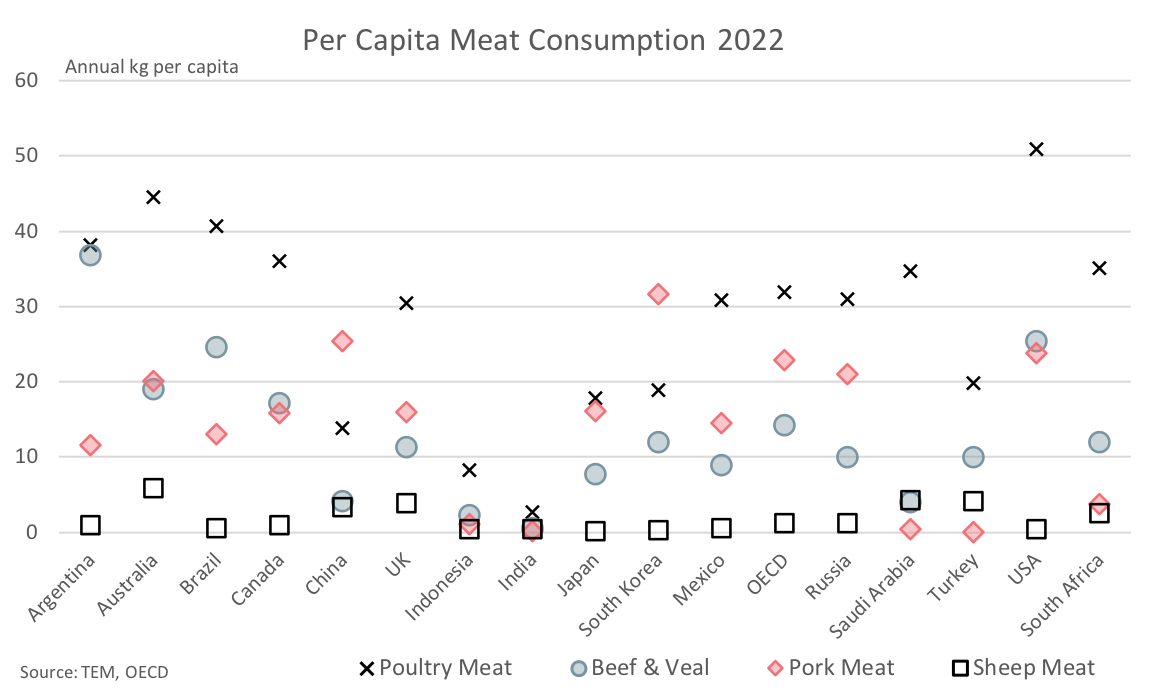

- In most countries, irrespective of overall meat consumption levels poultry meat is the clear favourite, although South Korea and China are the exception with pork dominating.

- India and Indonesia have forecast growth in meat consumption to 2029 of 13.3% and 11.2%, respectively.

The Detail

The Organisation for Economic Co-Operation & Development (OECD) publish meat consumption levels and forecasts to 2029, on an annual kg per capita basis, across a range of meat types. The EP3 team along with our good mate, Dr Elizabeth Jackson from Curtin University in WA, thought it was a good idea to take a look at some of the numbers.

In terms of total consumption in 2022, across beef & veal, pork, poultry and sheep meat, the USA lead the pack at 100.5 kg per person per annum. Australia and Argentina aren’t far behind though at 89.5 kg and 87.6 kg per person per year, respectively. Meanwhile, at the other end of the scale is India on 3.8 kg/per capita per year and Indonesia on 11.9 kg.

A breakdown of meat by type highlights some interesting trends. In most countries, irrespective of overall meat consumption levels poultry meat is the clear favourite. South Korea and China are the exception with pork dominating consumer choice here. In 2022 South Korean pork consumption is forecast at 31.7 kg per person per year while Chinese pork demand sits at 25.4 kg. In Australia annual pork and beef consumption are neck and neck at around 20kg/per person.

Sheep meat is the clear laggard in the meat types with many nations still relatively unfamiliar with the product, such as Japan and the USA. However, this provides much opportunity for growth. In the last two years Australian lamb export volumes to the USA have been trending well above average (as reported in early August) so the longer term fundamentals for the sheep meat sector and export opportunities for the Aussie sheep meat producer are pretty robust.

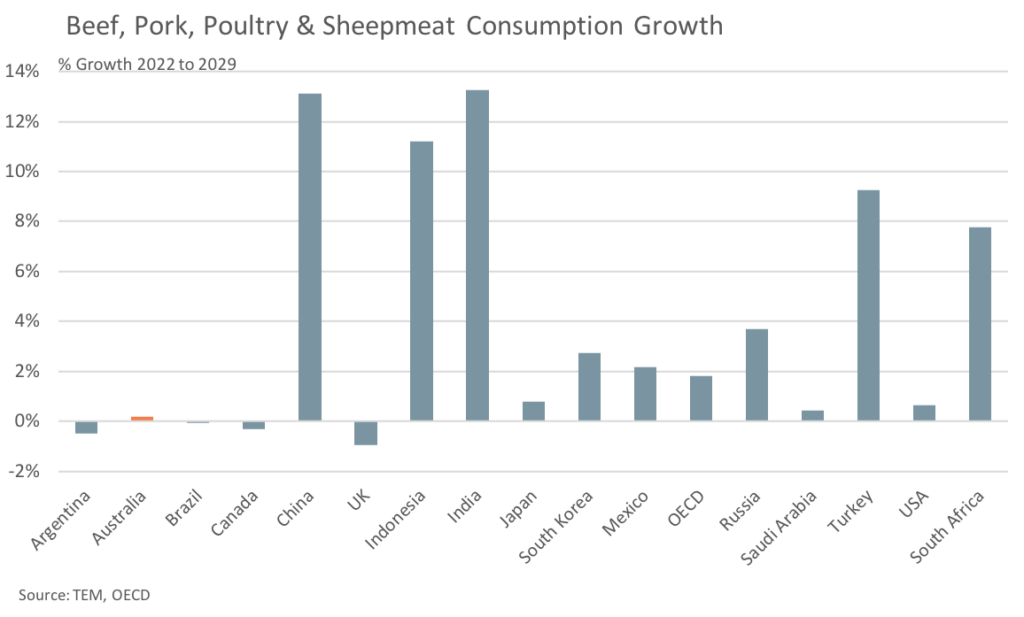

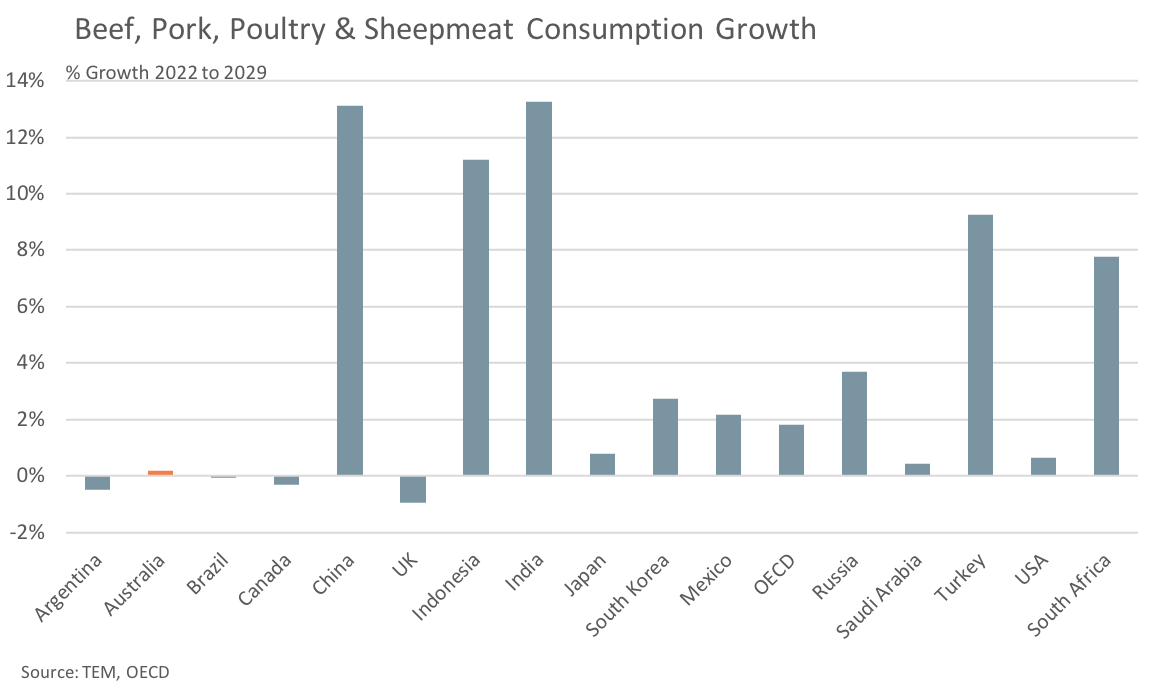

Speaking of growth opportunities, we have taken a look at the projected increase to total meat consumption (across beef & veal, pork, poultry and sheep meat) for the OECD countries listed. While many developed economies are showing signs of marginal growth or slight declines there are some good growth opportunities with some of Australia’s key trading partners.

India and Indonesia, whom Australia has recently signed a free trade agreements with, have forecast growth in meat consumption of 13.3% and 11.2%, respectively. Meanwhile, China (who continue to be a key trade partner to Australia despite diplomatic tensions and trade disputes) have forecast meat consumption growth levels of 13.1%.