Producer share update – September 2025

Producer Share September 2025 Quarterly Update

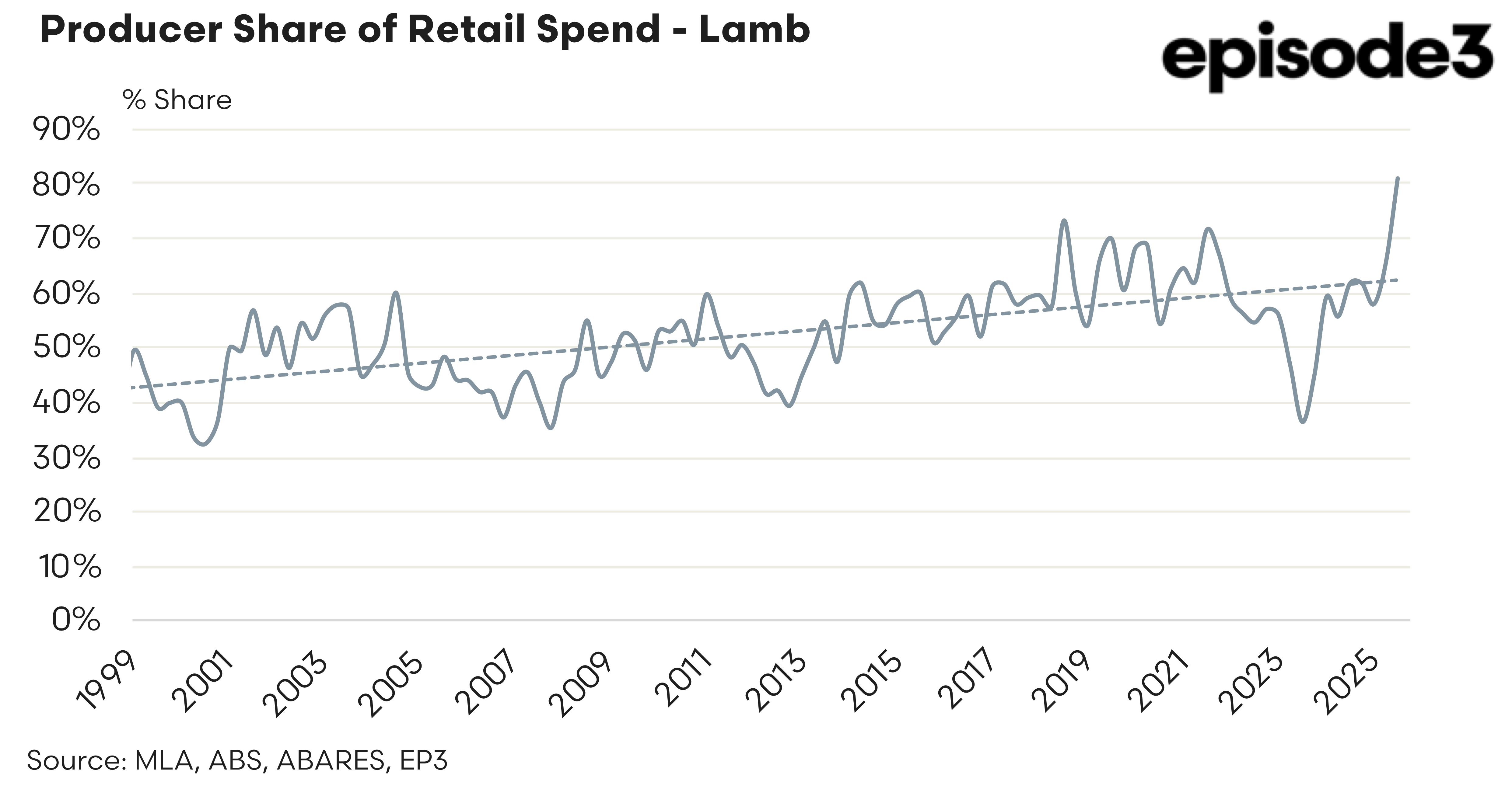

The latest producer share update for the September quarter of 2025 highlights a further strengthening in the position of livestock producers within the Australian red meat supply chain. Both cattle and lamb producers saw an improvement in their share of retail spending during the quarter, although the magnitude and drivers of these gains differed markedly between the two sectors. Most notably, lamb producer share reached a record level, exceeding 80 percent, an outcome that reflects a sharp lift in saleyard values relative to more gradual movements in retail pricing.

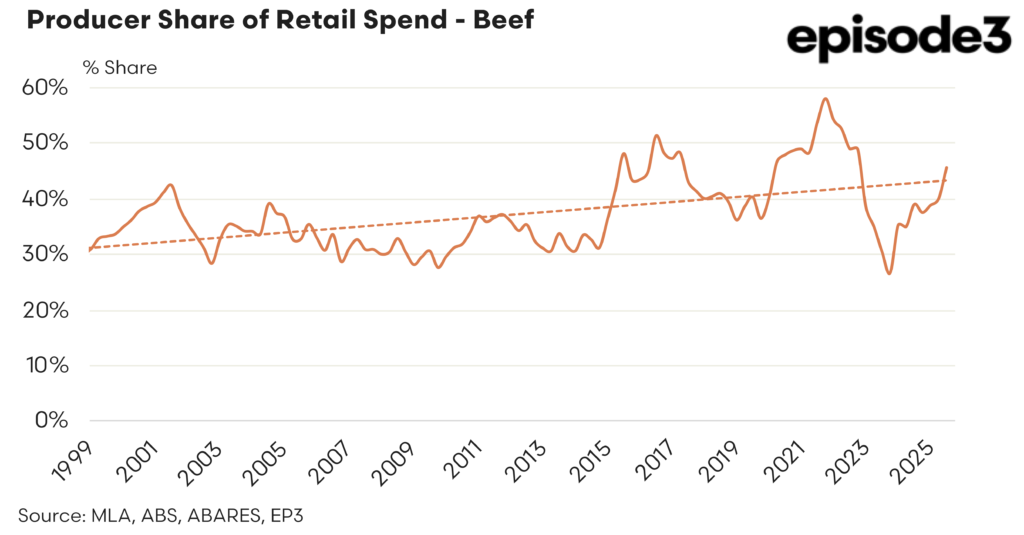

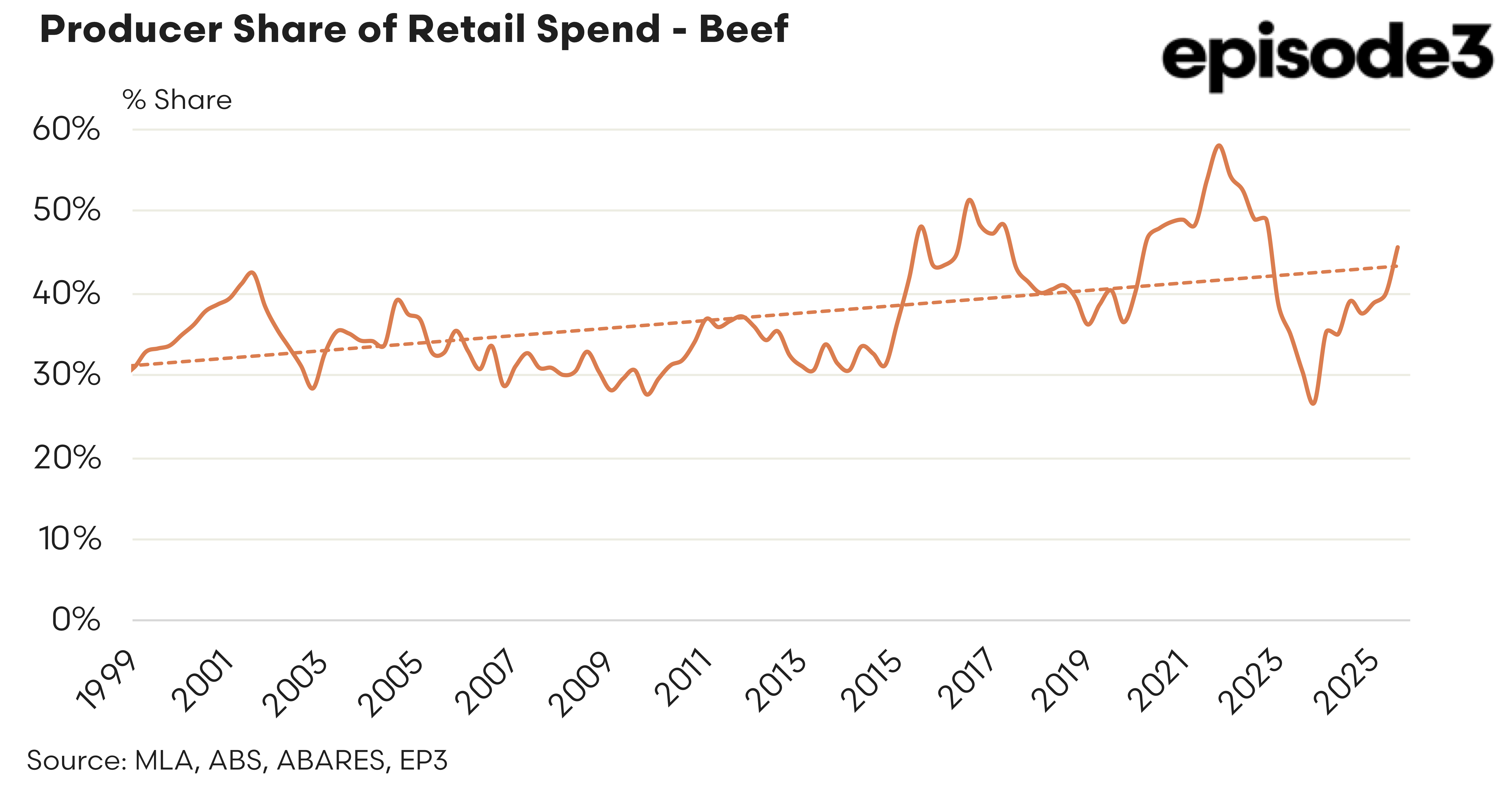

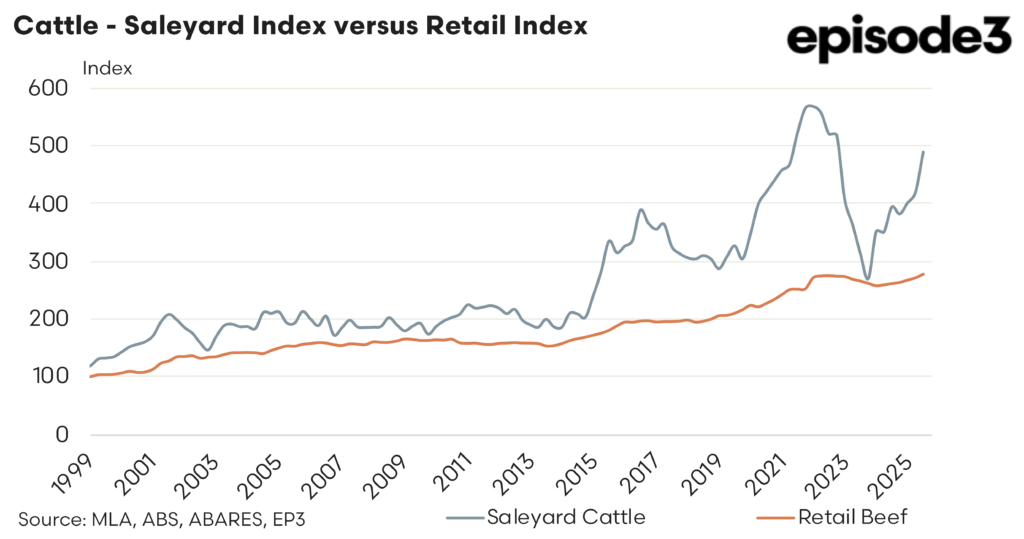

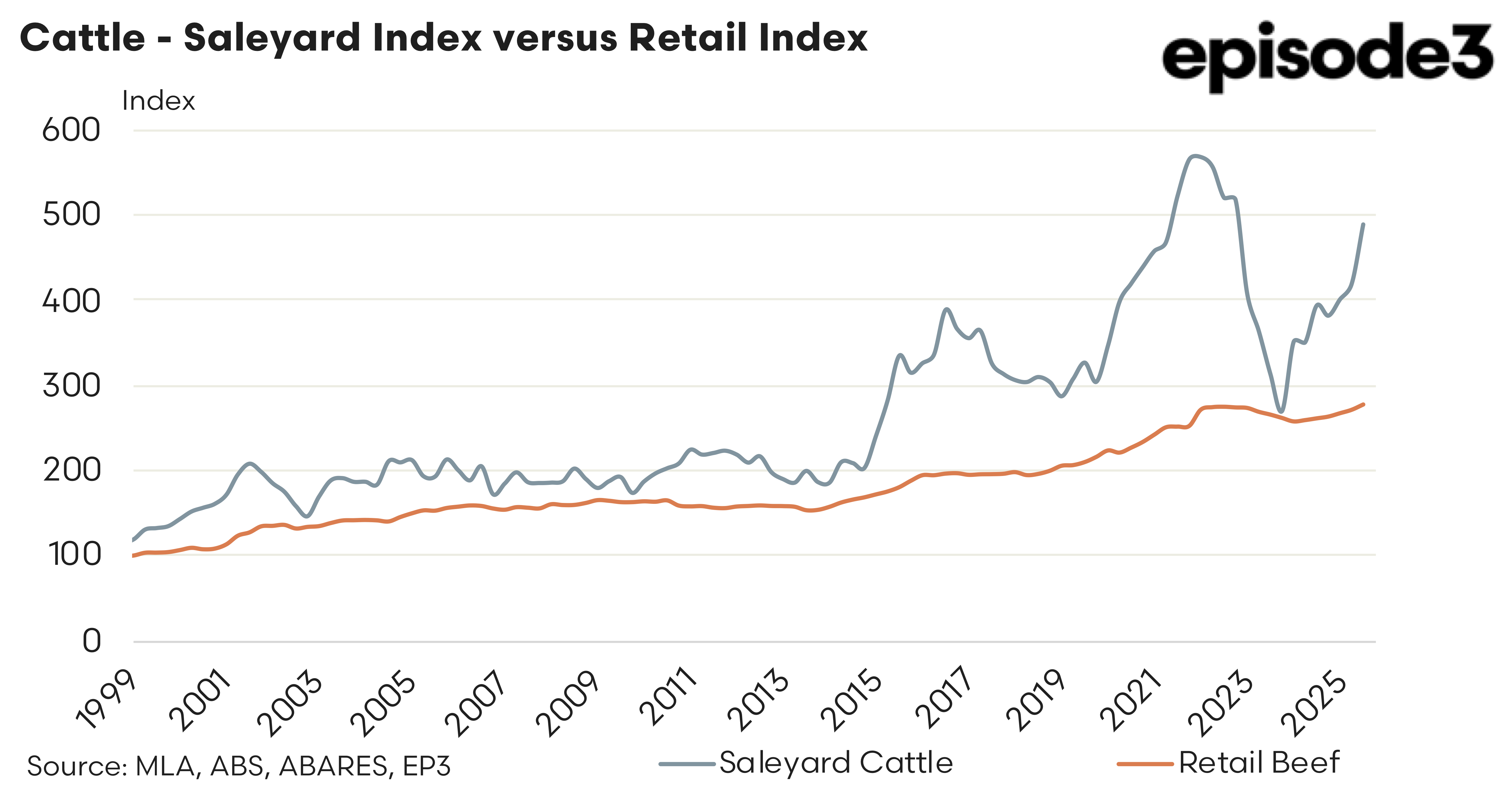

In the cattle market, producer share continued to recover through the September quarter, supported by a substantial lift in saleyard prices. Average cattle prices rose to 857 cents per kilogram carcase weight, up from 734 cents in the June quarter and 703 cents in the March quarter. On a retail equivalent basis, cattle values increased to an estimated 1247 cents per kilogram retail weight. Retail beef prices, however, moved only marginally higher over the same period, lifting to 2737 cents per kilogram. This divergence resulted in cattle producer share rising to 45.6 percent in the September quarter, up from 39.9 percent in June and 38.8 percent in March.

The index series reinforces this trend. The cattle saleyard index rose sharply to 490 in the September quarter, compared with 420 in June and 402 in March. In contrast, the retail beef index increased only modestly to 278, up from 272 in the previous quarter. While producer share remains below the peaks observed during previous cattle cycles, the latest data confirms a clear improvement from the lows recorded in 2024 and points to a more favourable pricing environment for producers as supply tightens and restocker demand strengthens.

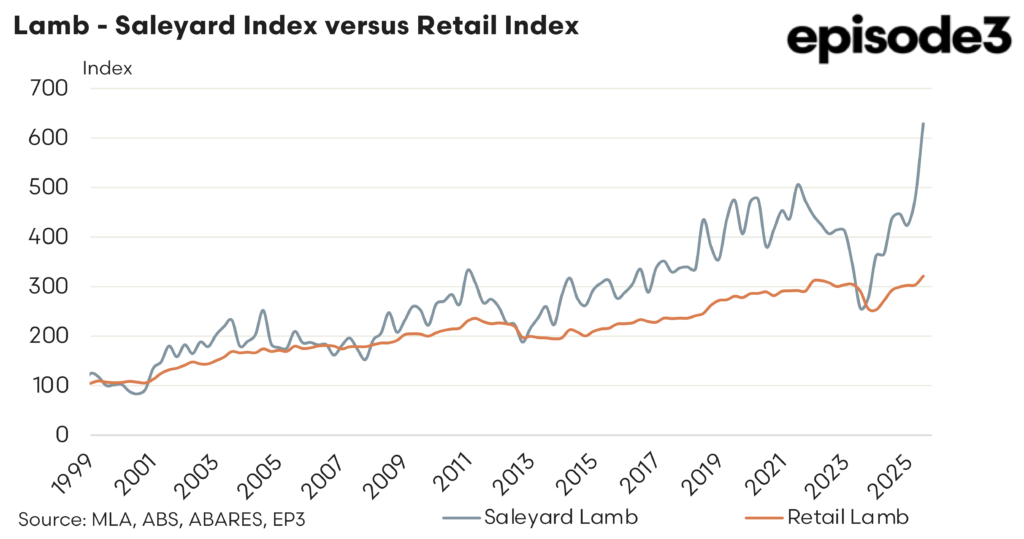

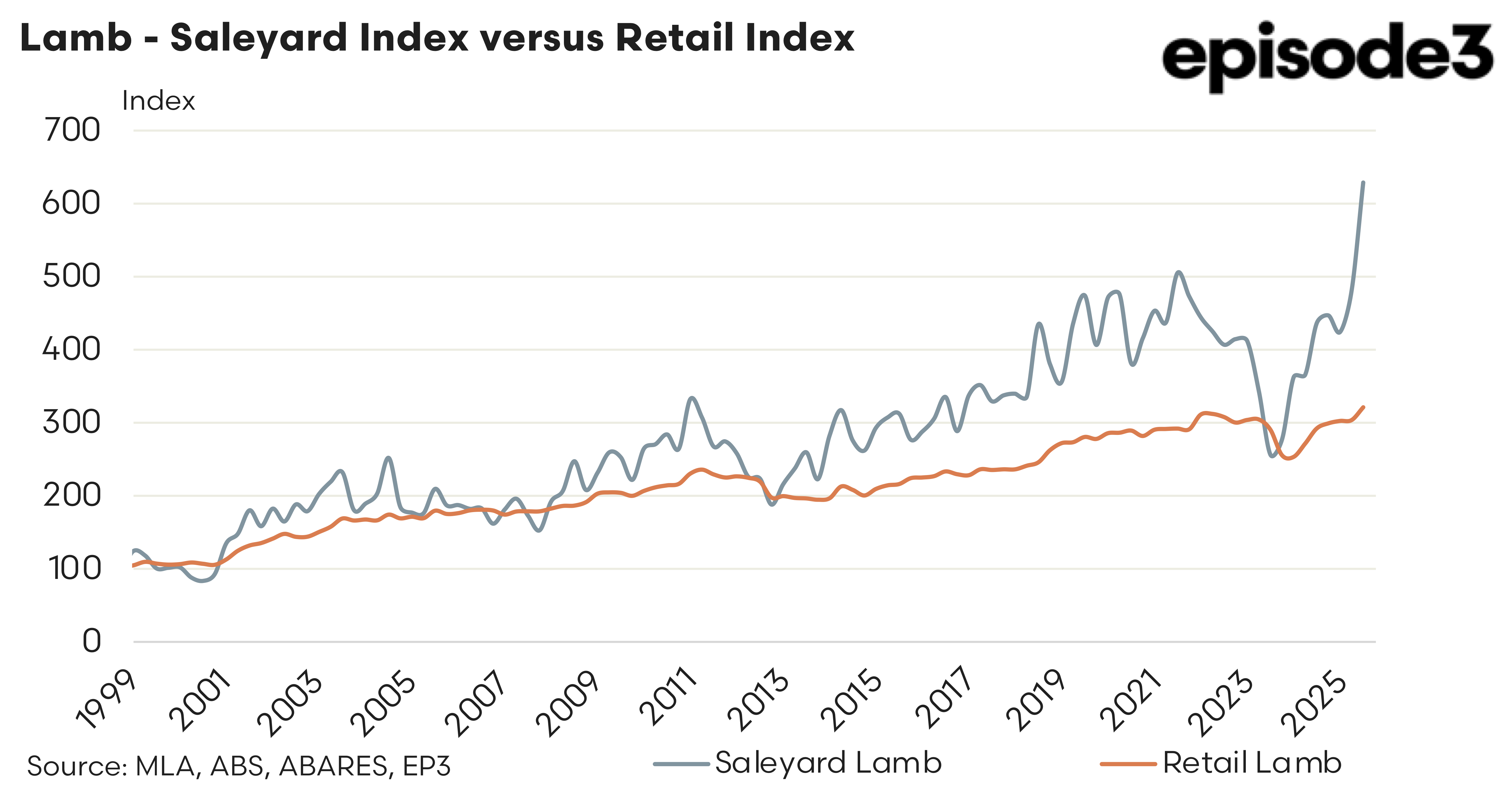

The lamb market tells a more pronounced story. Lamb saleyard prices surged during the September quarter, with average values lifting to 1163 cents per kilogram carcase weight, compared with 889 cents in June and 784 cents in March. On a retail equivalent basis, lamb prices rose to an estimated 1662 cents per kilogram. Retail lamb prices increased more gradually, reaching 2047 cents per kilogram in the September quarter, up from 1935 cents in June and 1927 cents in March. As a result, lamb producer share climbed sharply to 81.2 percent in the September quarter, up from 65.7 percent in June and 58.1 percent in March. This represents the highest producer share recorded in the available data series and marks a new record for the lamb sector.

The lamb saleyard index surged to 628 in the September quarter, compared with 480 in June, while the retail lamb index increased to just 320 from 302. The scale of the divergence between saleyard and retail indices is unusually large and underpins the record producer share outcome.

Over the longer term, the lamb producer share series shows a gradual upward trend punctuated by periods of volatility driven by seasonal conditions, flock cycles and shifts in domestic and export demand. The September quarter outcome stands out not only for its level but also for the speed at which it was achieved. It reflects a market environment characterised by constrained supply, strong competition for available lambs and a lag in retail price transmission. While such elevated producer shares are unlikely to persist indefinitely, the current data clearly demonstrates that producers are capturing an unusually large proportion of the retail dollar.

The September quarter results confirm a further rebalancing of value back towards producers across both cattle and lamb markets. For cattle, the recovery in producer share appears more measured and consistent with tightening supply and improving demand conditions. For lamb, the outcome is exceptional, with producer share reaching a record level above 80 percent. The durability of these gains will depend on how retail prices respond over coming quarters, as well as broader factors such as consumer demand, export market conditions and seasonal supply dynamics. For now, the data underscores a period of markedly improved pricing power for Australian livestock producers, particularly in the lamb sector.