Red Meat 2025 – Round 2

Round 2 - Red Meat Export Potential

This is the second instalment in a series of three focusing on interesting development seen in the red meat sector currently and into 2025. In the first instalment we looked at the tightening of global beef supply and what it could mean for the Australian red meat sector next year. In this piece we look at the growth in Australian red meat exports to a selection of countries that we have negotiated free trade agreements (FTA) with since 2020 and the prospects for further growth in demand into 2025 as more FTAs come into force.

As global beef supplies tighten in 2025, driven by herd reductions in key producing nations such as the USA, Australia is uniquely positioned to capitalise as their primary competitor into key beef export markets like Japan and South Korea. Coupled with New Zealand’s waning competitiveness in sheepmeat exports due to a declining flock and falling export volumes, Australia’s position as the leading global supplier of sheepmeat is advantageous.

Free Trade Agreements (FTAs) signed since 2020 have unlocked greater access to developing markets and Australia has already begun to see significant growth in red meat exports to nations like Indonesia, PNG, India, and the UK, with further opportunities emerging in the UAE and ongoing negotiations with the EU.

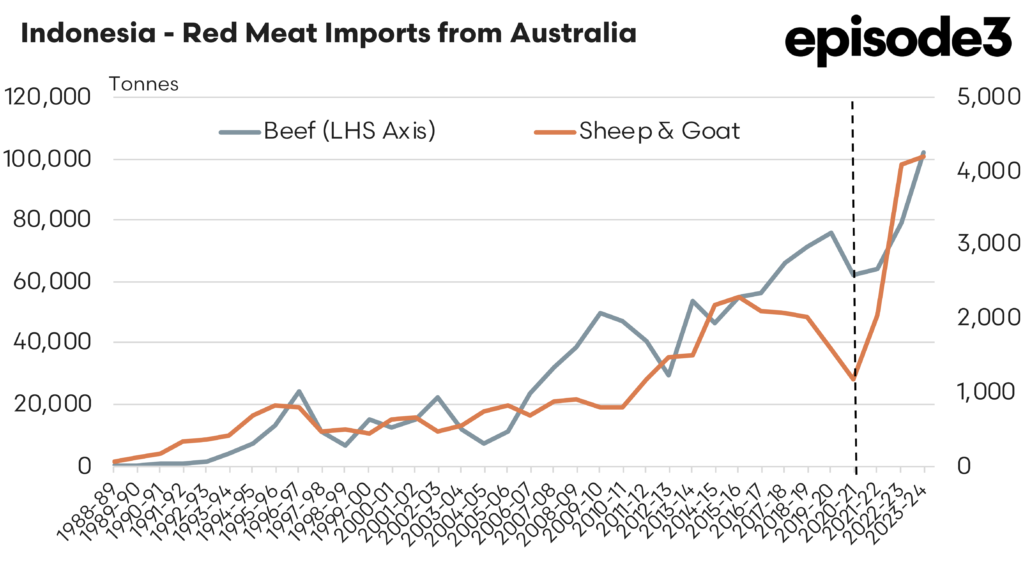

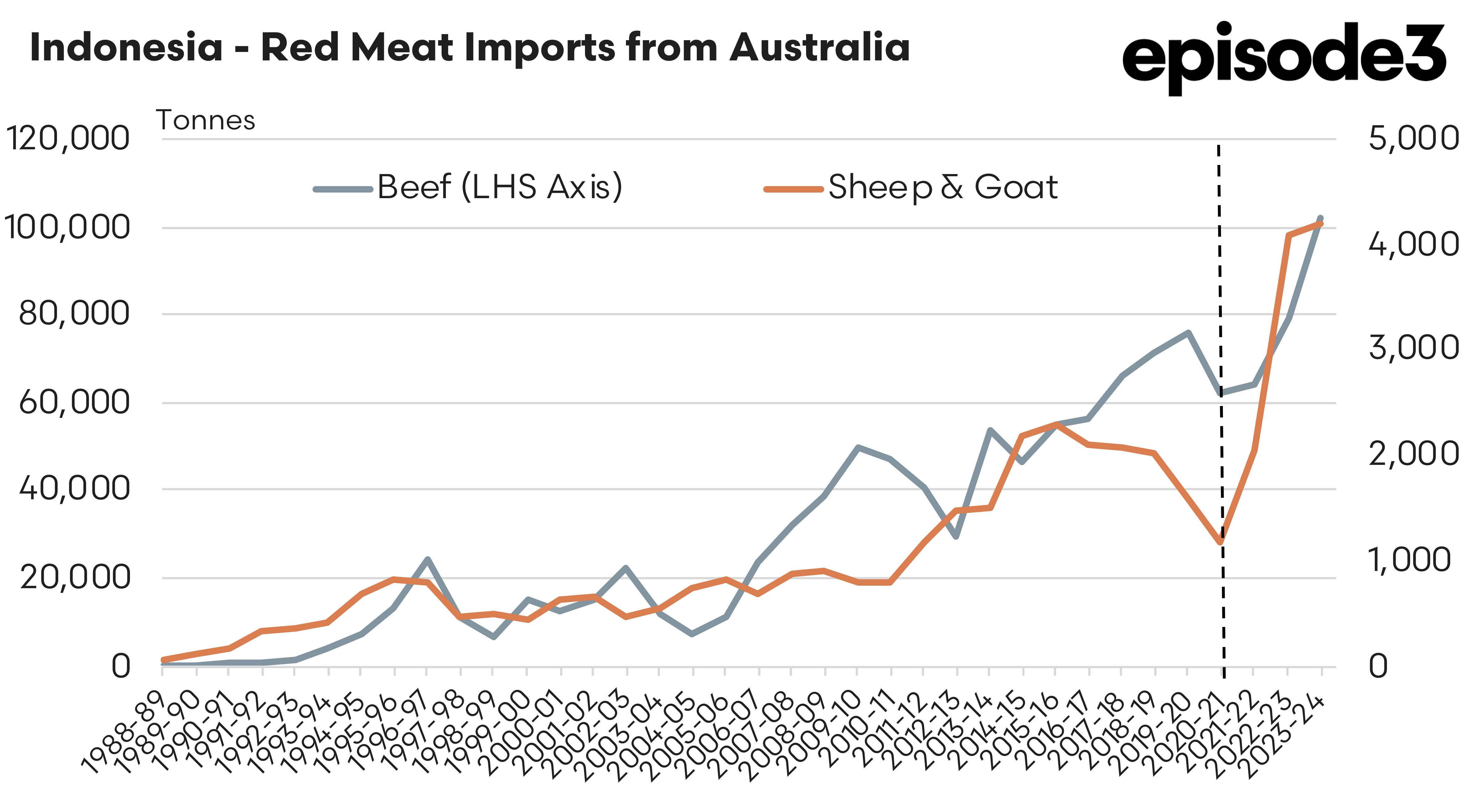

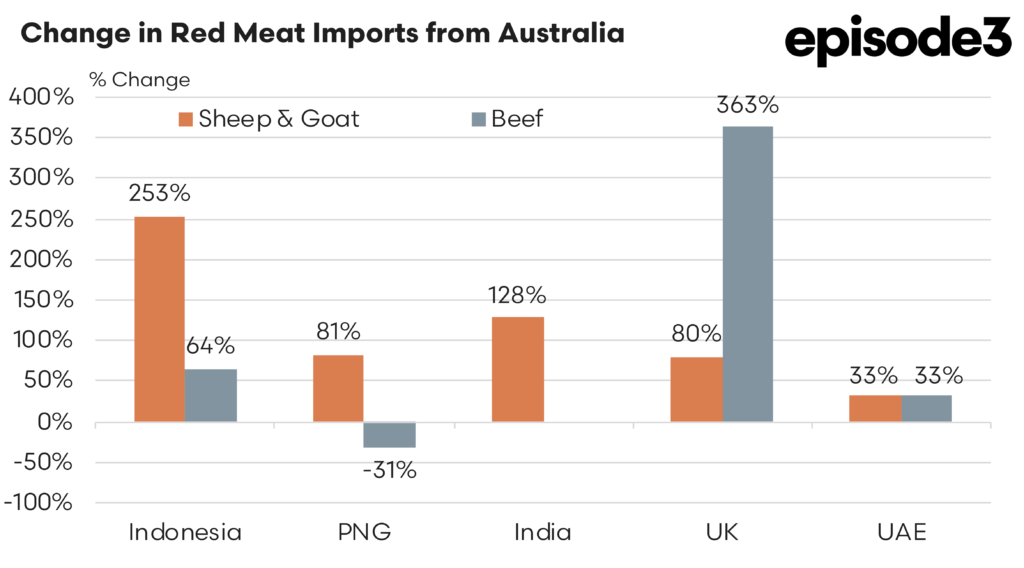

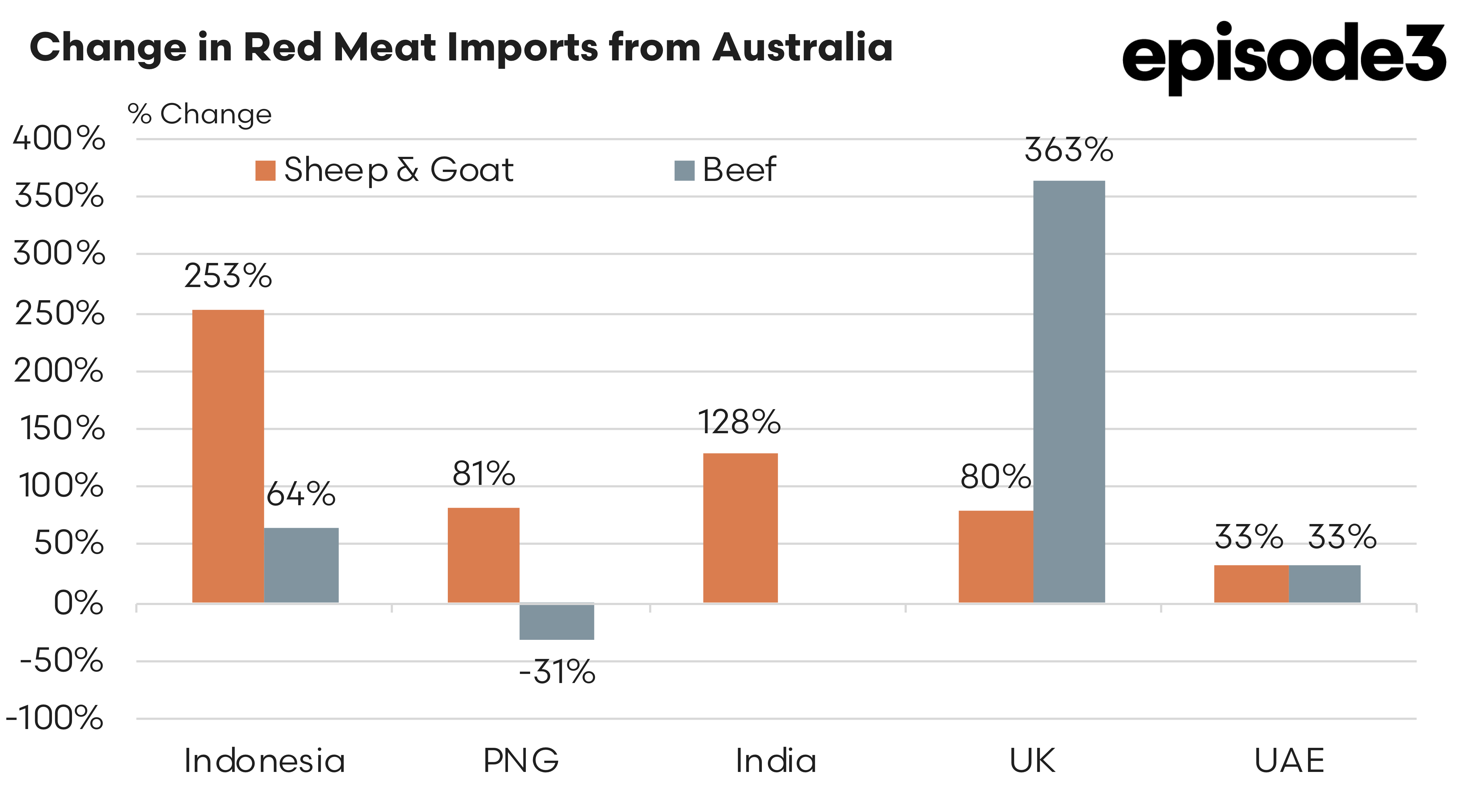

The Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA), formalised in July 2020, has been a standout trade development for Australian red meat exports. Since its inception, Australia’s beef exports to Indonesia have grown significantly, rising by 64% from 62,000 tonnes to 102,000 tonnes. This growth has been underpinned by Indonesia’s increasing demand for quality protein as its population grows and consumer incomes rise. The chart below shows a dotted line where the FTA came into force and the growth in Australian red meat exports to Indonesia since then.

While the beef trade has driven much of this success, Australia’s sheep/goat meat exports to Indonesia have also surged dramatically, albeit off a smaller base. From just 1,200 tonnes in FY2020/21, exports have risen by 253% to reach 4,200 tonnes by FY2023/24. This growth highlights the potential for further expansion, particularly as Australia’s red meat pricing remains competitive, and Indonesia continues to build its food security framework to meet growing demand.

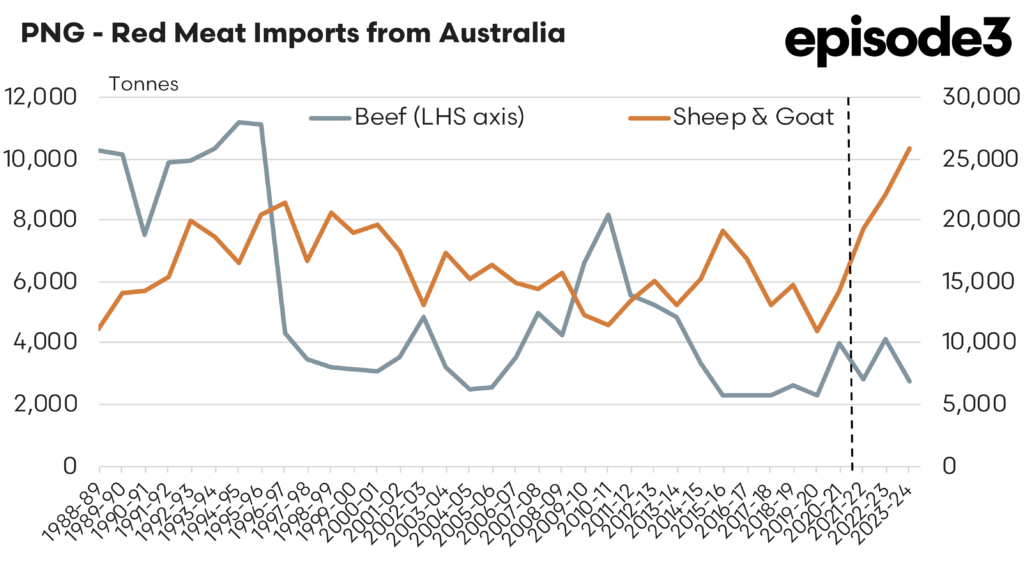

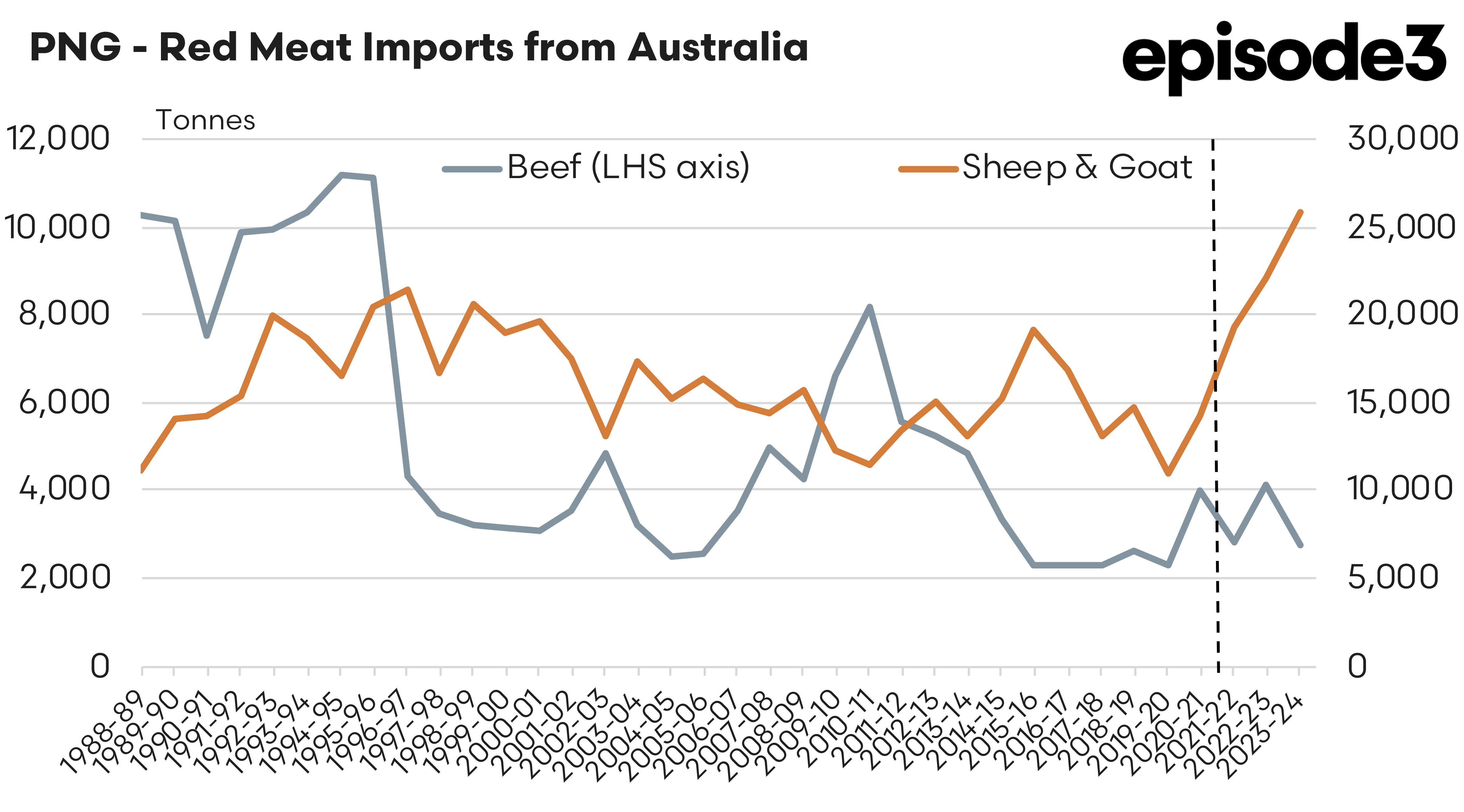

Australia’s FTA with Papua New Guinea, which came into force in December 2020, has delivered similarly strong results in the sheep/goat meat sector. Exports to PNG have climbed by 81%, growing from 14,000 tonnes in FY2020/21 to 26,000 tonnes by FY2023/24.

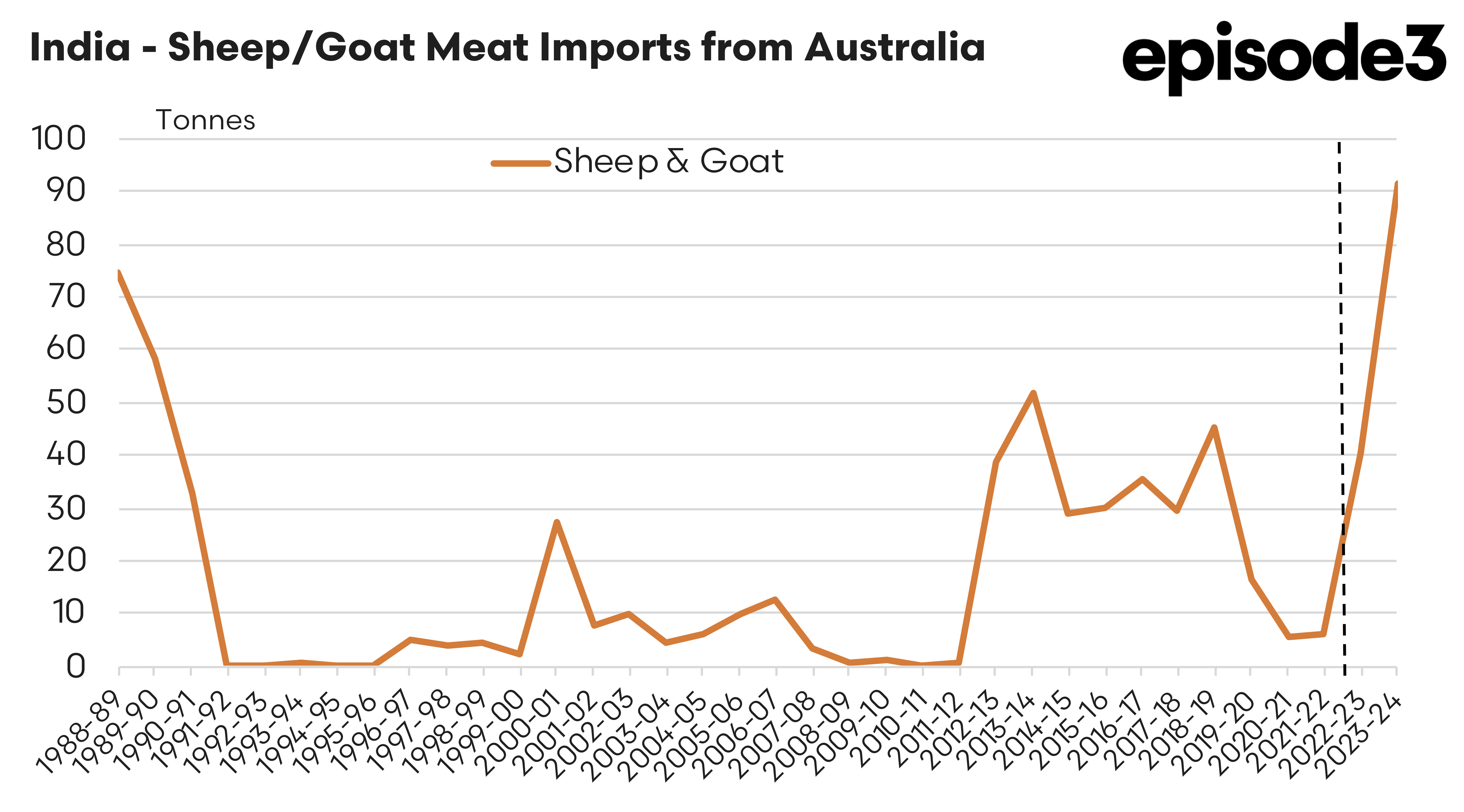

India has emerged as another promising market following the implementation of the Australia-India Economic Cooperation and Trade Agreement (ECTA) in December 2022. Although India’s volumes remain small relative to other markets, the growth trajectory for sheep/goat meat exports has been striking. Since the FTA came into effect, exports have increased by 128%, rising from just 40 tonnes to 91 tonnes. India’s massive population and rising per capita wealth suggest immense long-term potential for further trade. If carefully developed, India could become a market of similar importance to China, especially as consumer preferences shift and demand for quality red meat grows alongside rising incomes.

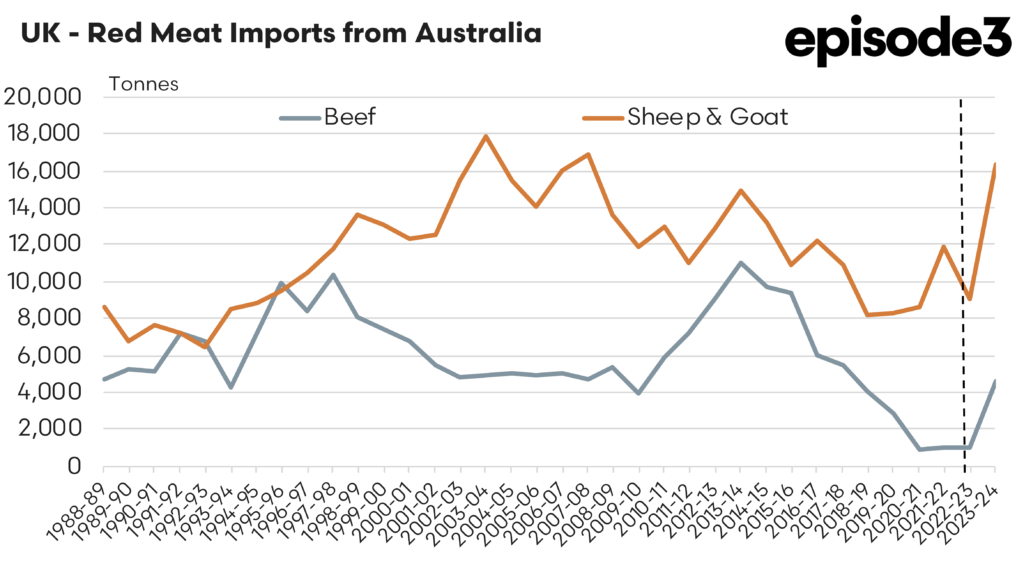

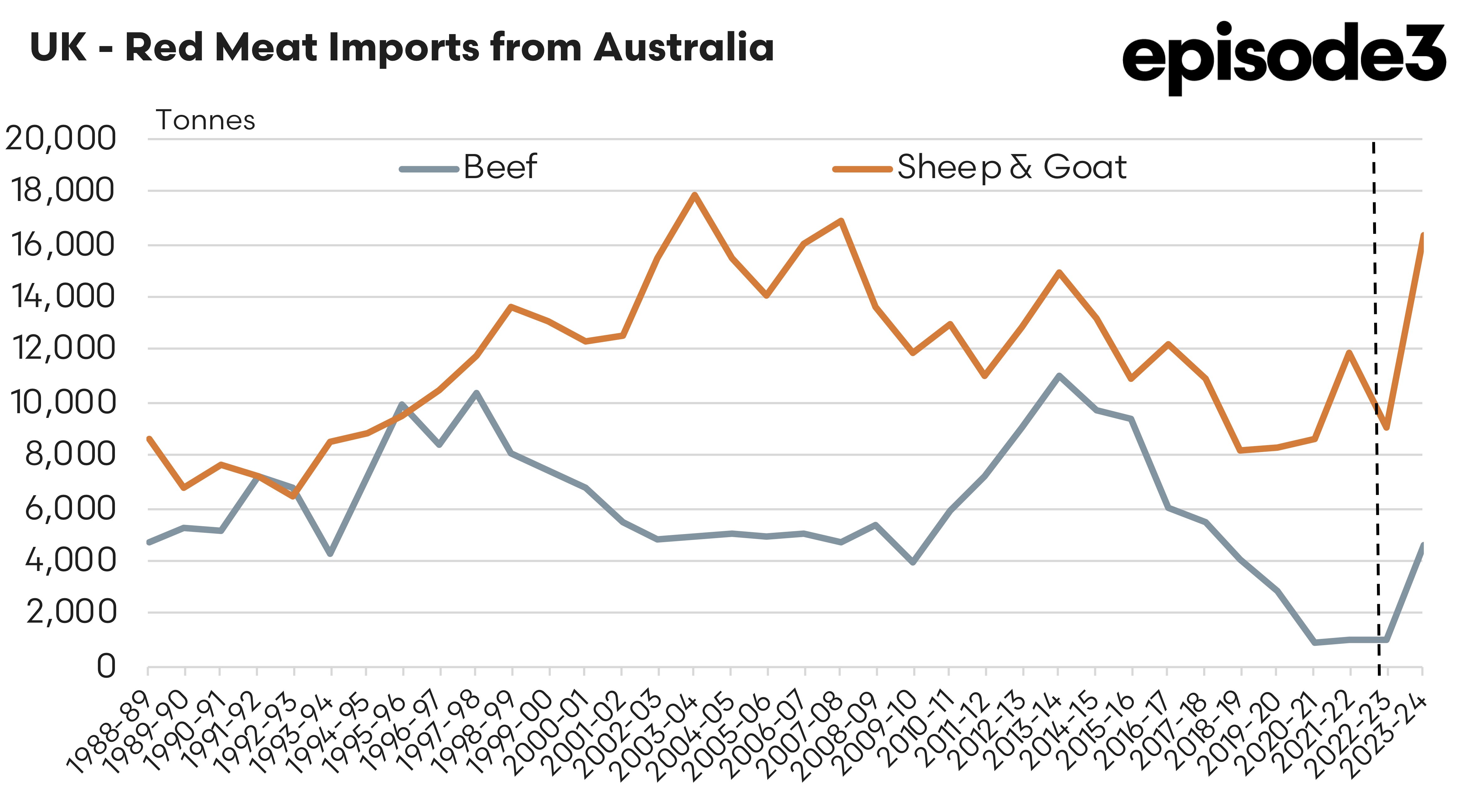

The UK-Australia Free Trade Agreement, which came into effect in May 2023, has already begun to deliver promising results, particularly for Australian beef and sheep meat exporters. Sheep meat exports have grown by 80%, increasing from 9,000 tonnes to nearly 16,500 tonnes, while beef exports have surged by an extraordinary 363%. Although the increase in beef trade comes off a low base, rising from 988 tonnes to 4,600 tonnes, it signals significant untapped potential in the UK market. As Australia’s red meat exports benefit from growing quotas and tariff-free access under the FTA, there is substantial room for further growth.

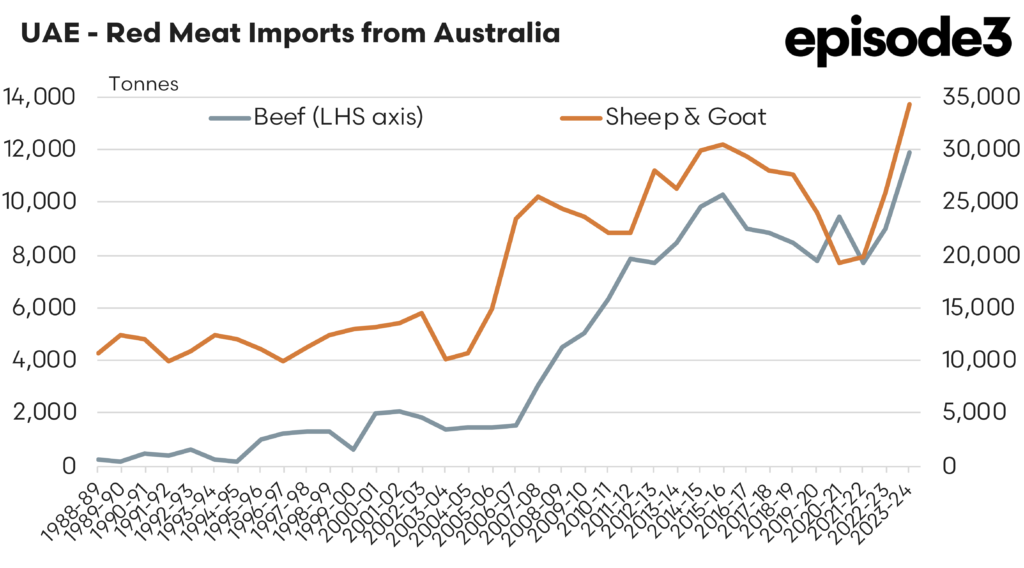

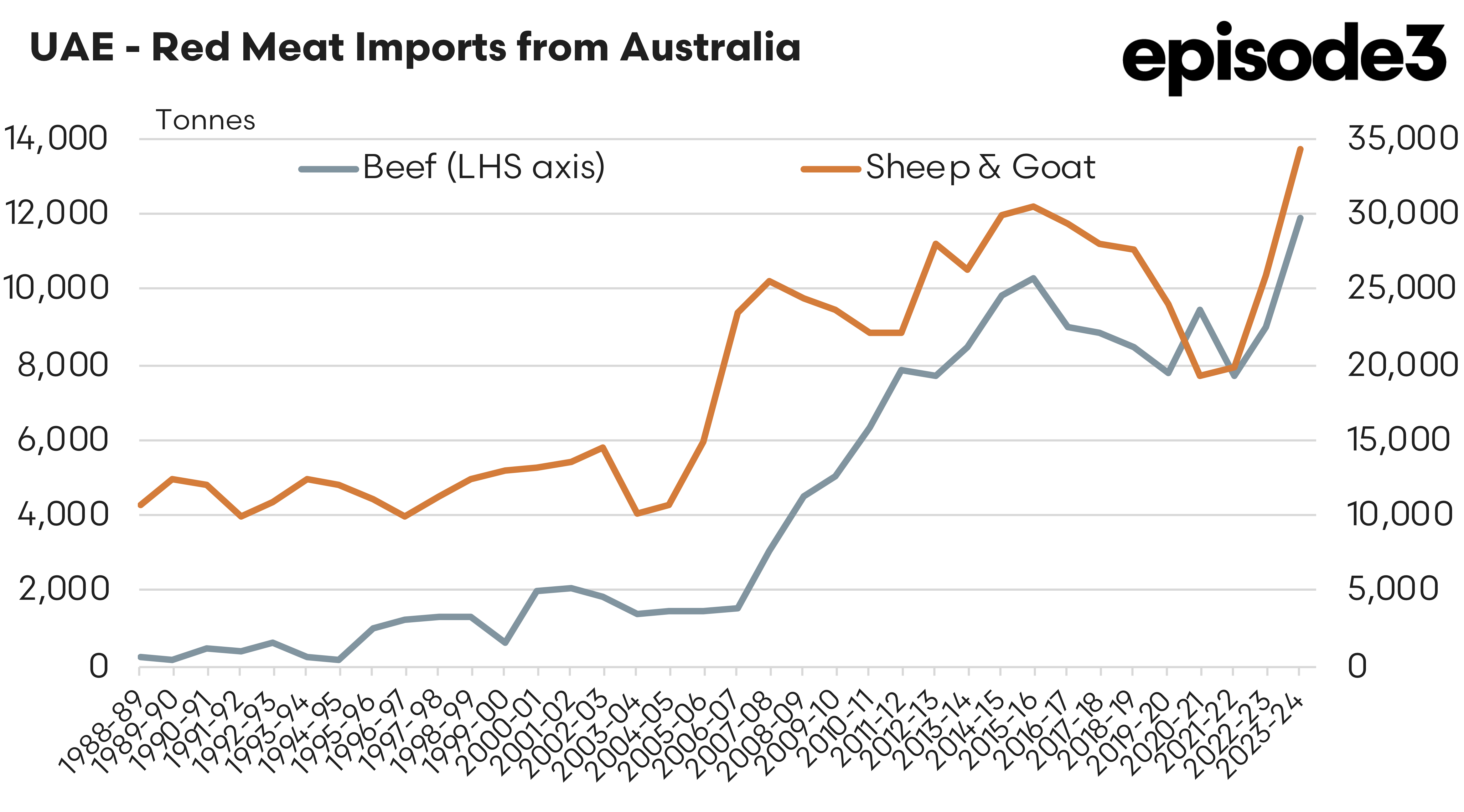

Looking forward, the UAE represents another emerging opportunity for Australian red meat exports, with an FTA set to commence in 2025. Even ahead of the agreement coming into force, Australian exports to the UAE have already increased by 33% in the last year, reflecting strong demand for both sheep meat and beef. Given the UAE’s strategic position as a gateway to the broader Middle East, the new FTA is expected to unlock further growth, particularly as the region’s demand for premium red meat continues to expand.

New Zealand’s declining competitiveness further enhances Australia’s prospects in global sheep meat markets. While New Zealand remains Australia’s closest competitor, with around 38% market share compared to Australia’s 41%, its ability to compete is being undermined by a shrinking sheep flock and falling sheep meat export volumes. Recent trends indicate that New Zealand’s exports are expected to continue declining over the next few years, creating space for Australia to consolidate and grow its dominance, particularly in key markets like China, Malaysia, and the USA. As New Zealand struggles to maintain its supply capabilities, Australia’s stable production and growing market access under FTAs provide a clear advantage.

The combination of tightening global supply, strategic FTAs, and diminishing competition positions Australia’s red meat sector for continued success in 2025 and beyond. The recent growth in export volumes across Indonesia, PNG, India, and the UK demonstrates the tangible benefits of these trade agreements, while the upcoming UAE FTA and ongoing EU negotiations represent further opportunities to expand market access.

The final chart below shows a summary of the growth in red meat exports from Australia to the selected destinations outlined above since their respective FTA deals came into force. In our final piece next week, we take a look at how the looming Trump presidency may impact upon trade with key partners like China as we move into 2025.