Sheep Live Export – A dying industry?

The Snapshot

- The live export of sheep is set to end, with the government setting up a consultation.

- Sheep live exports have been in decline since the previous government introduced the summer moratorium.

- The destinations which typically take the lion’s share of Australian live sheep have continued to purchase from alternate origins. Many of which with lower animal welfare standards.

- While volumes from Australia have declined, the overall trade in live sheep has been strong on a global level.

- The main buyers (middle east) may continue to purchase live sheep, limiting our ability to market boxed meat to them.

- The sheep live export industry can be shuttered but will require significant structural changes within the Western Australian sheep supply chain.

- Live export of sheep is in terminal decline in Australia, but other parts of the world are advancing this industry – potentially with poorer animal welfare outcomes.

The Detail

The sheep live export industry is back at the forefront of people’s minds, especially in Western Australia, where producers have the most to lose.

As always, we felt the need to look at some of the data behind the industry. The specific question that I want to address is the claim that the live export of sheep is a dead industry.

There are different ways of looking at markets; you can take a close look and focus on a particular set of data. Or you can zoom out and look at it from a holistic perspective. I like to do both. Any competent analyst should be interrogating data from different perspectives.

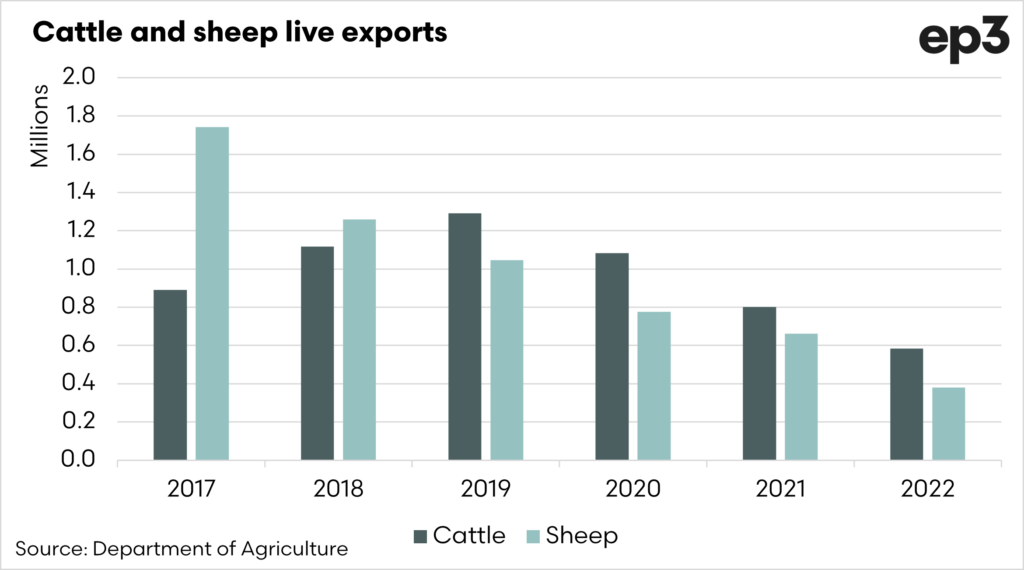

The chart above displays the total annual live export figures for both sheep and cattle. If we focus on sheep, we can see that the sheep volume has been on a slide.

The volume of sheep live export has fallen 78% since 2017, from 1.7m to 380k head. This is a huge fall in a relatively short period of time.

If I was looking at this in isolation, you could say that this was an industry in its death throes. There is no denying that it is declining, but that is not a reason to ban it.

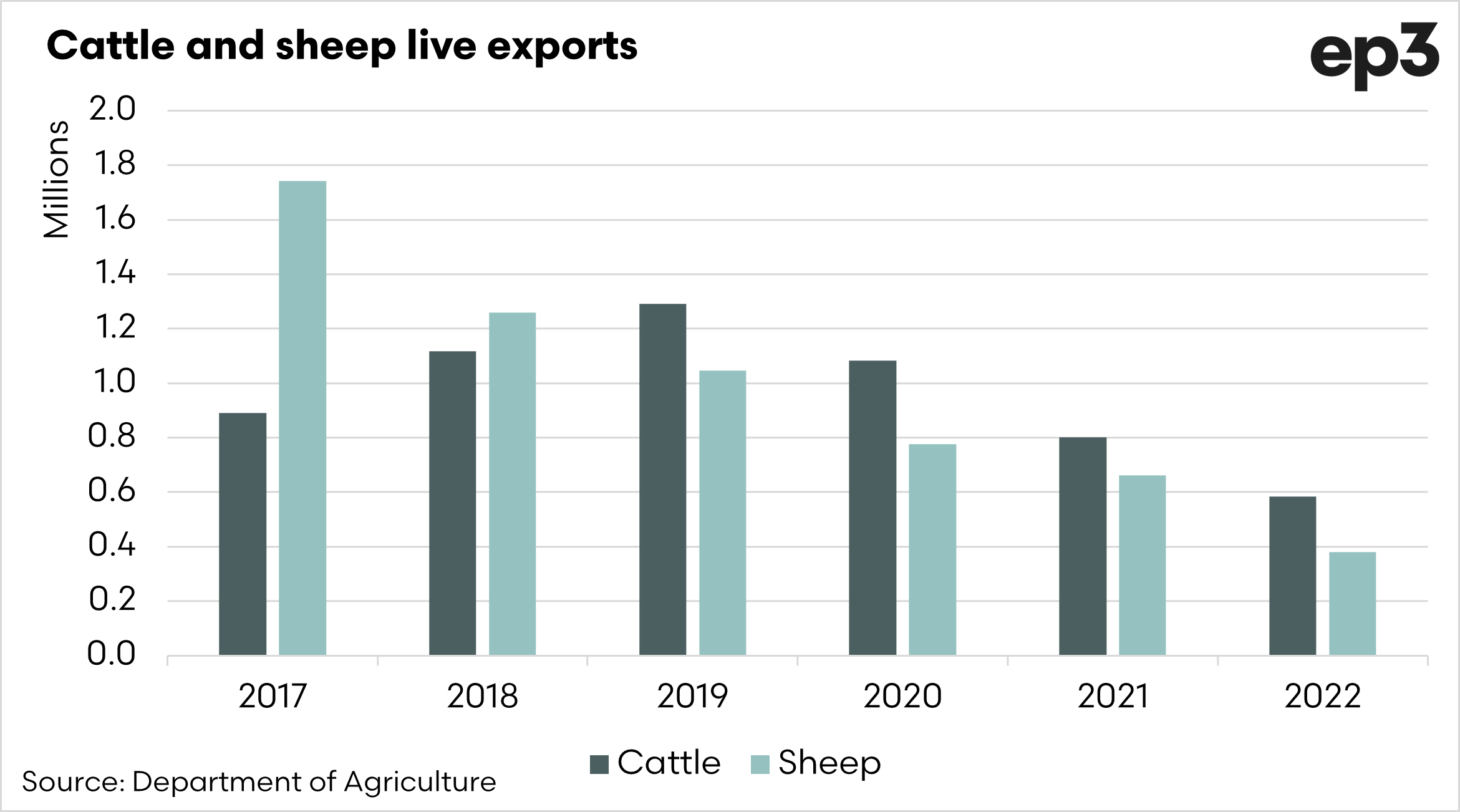

If we were to look at the cattle live export industry, it has also declined over the same period (see chart below). If we ban sheep live export because of its decline, then the same argument could wrongly be used for cattle live exports.

Although as analysts, we understand that changes occur for many reasons. One of the reasons for declining cattle live exports has been the high cost of cattle in Australia, making us less competitive as an origin.

In the case of the terminal decline of sheep, this is a direct result of the moratorium of live sheep exports during the northern hemisphere summer. This is the period of heightened demand by our destination customers. The previous government effectively banning exports during this period has diminished trade.

The main argument used in the debate about banning live sheep exports is that of welfare and that removing Australia will improve animal welfare outcomes. This might be logical, again, only if you examine the argument from a very narrow focus.

It is very Straya-centric to believe that by removing Australian sheep from the equation, destination countries will suddenly stop purchasing sheep live. This is not how markets work, especially when there are alternative origins available.

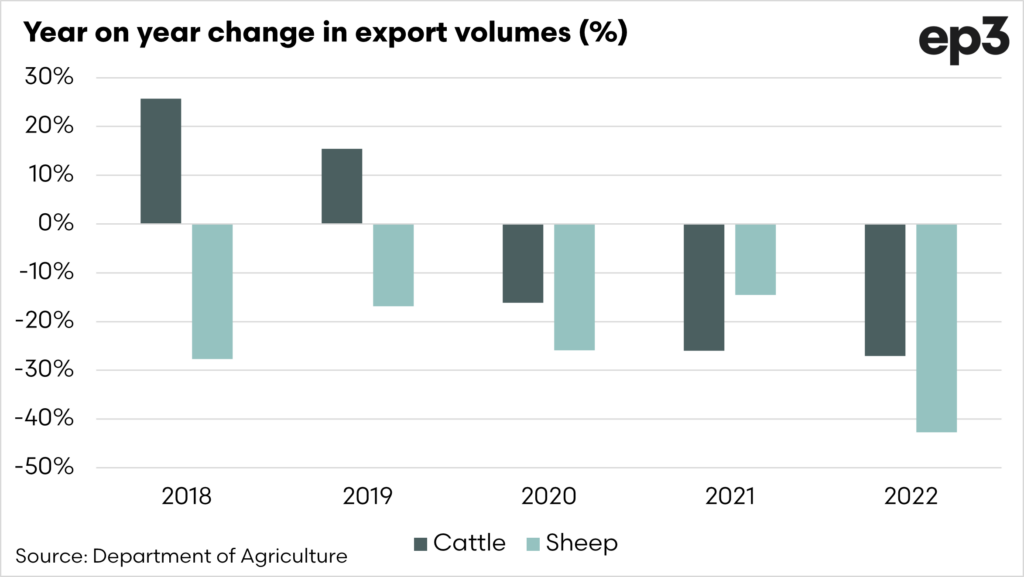

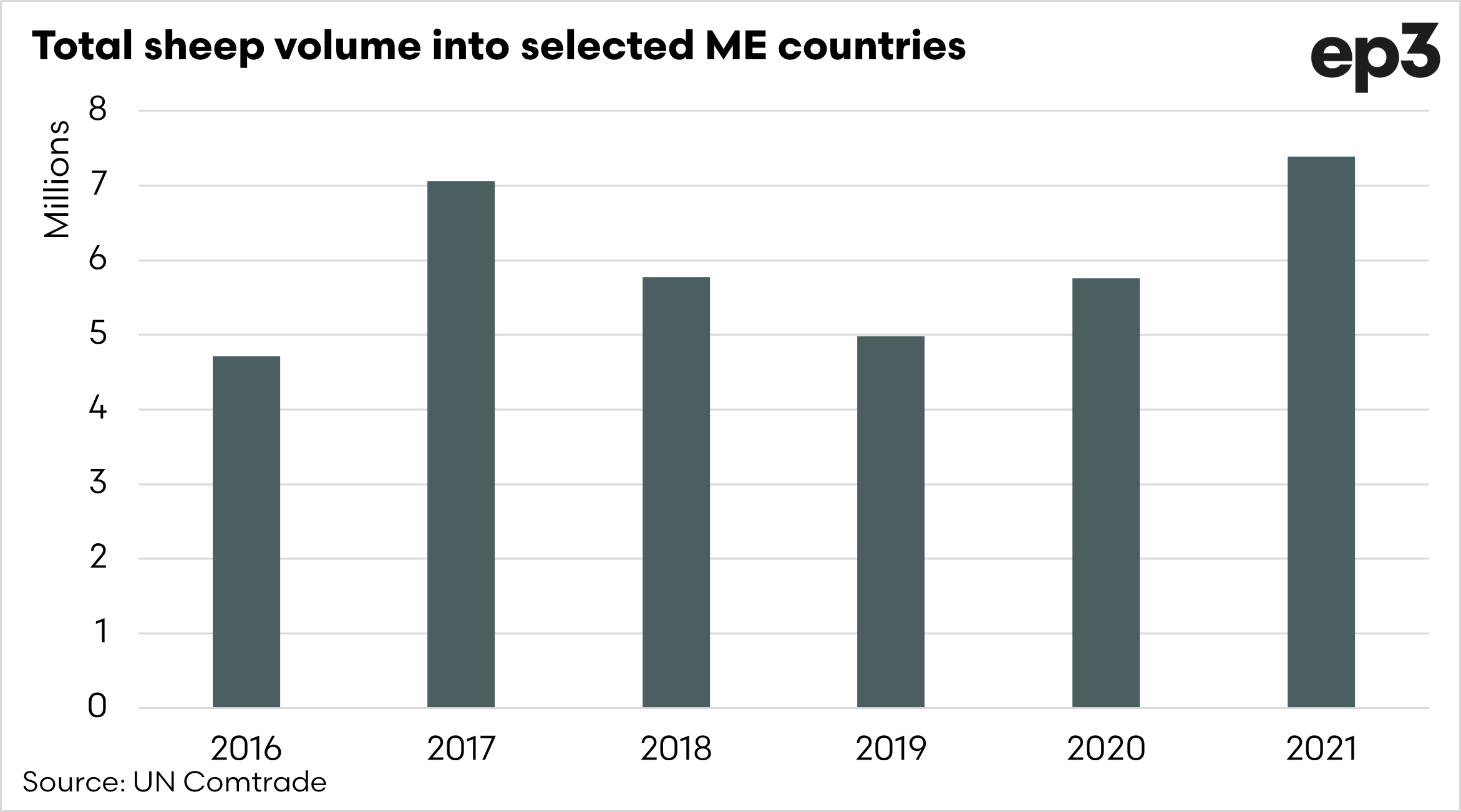

So let’s update on the trade flows into the traditional markets for live sheep. The first chart below looks at the total volume of four countries that have traditionally been prominent sheep importers, especially from Australia. These nations are Jordan, Kuwait, Qatar and UAE.

The total volumes imported are higher than in 2016, with 2021 being an exceptionally strong year of growth.

So where are they getting their sheep from?

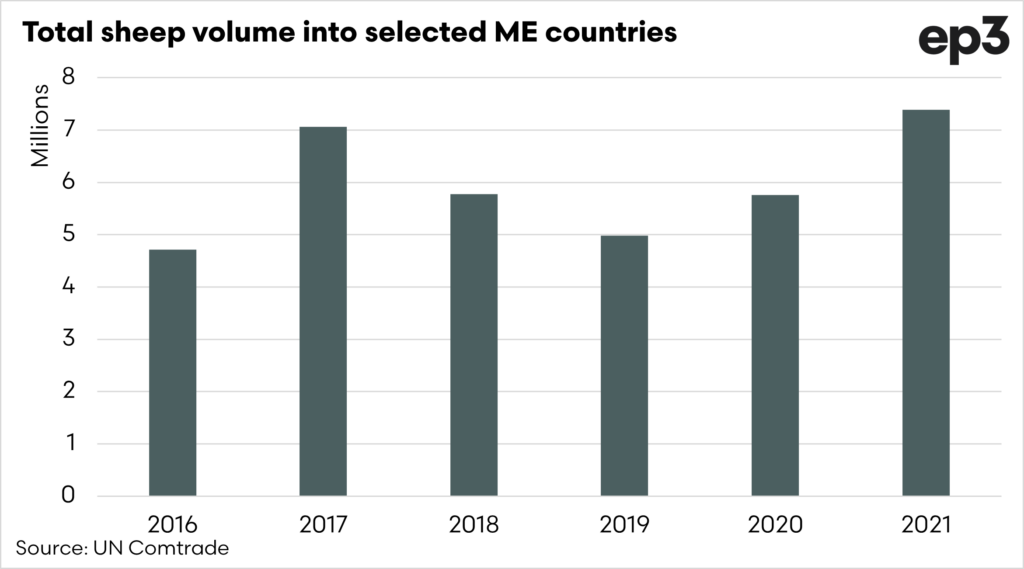

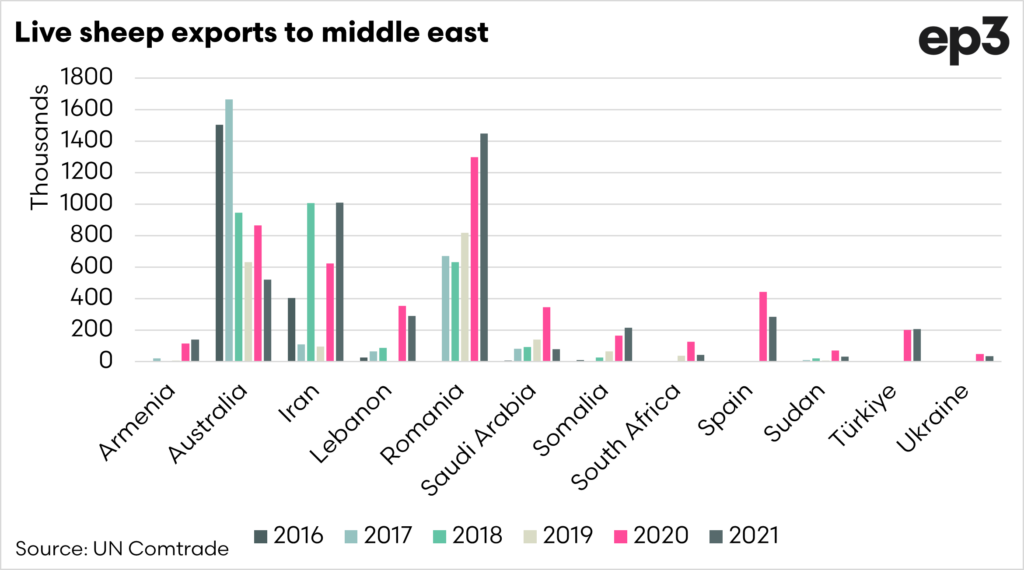

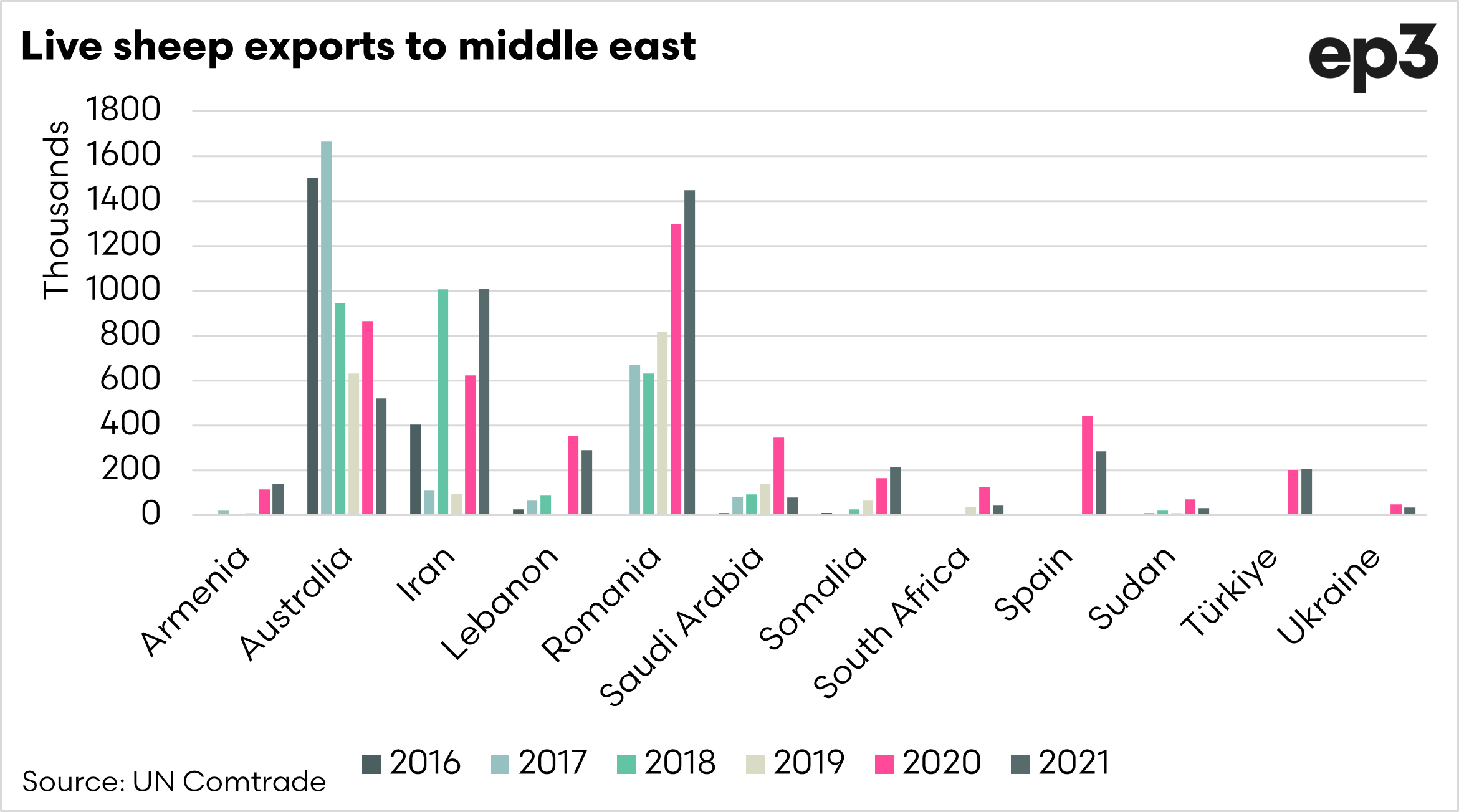

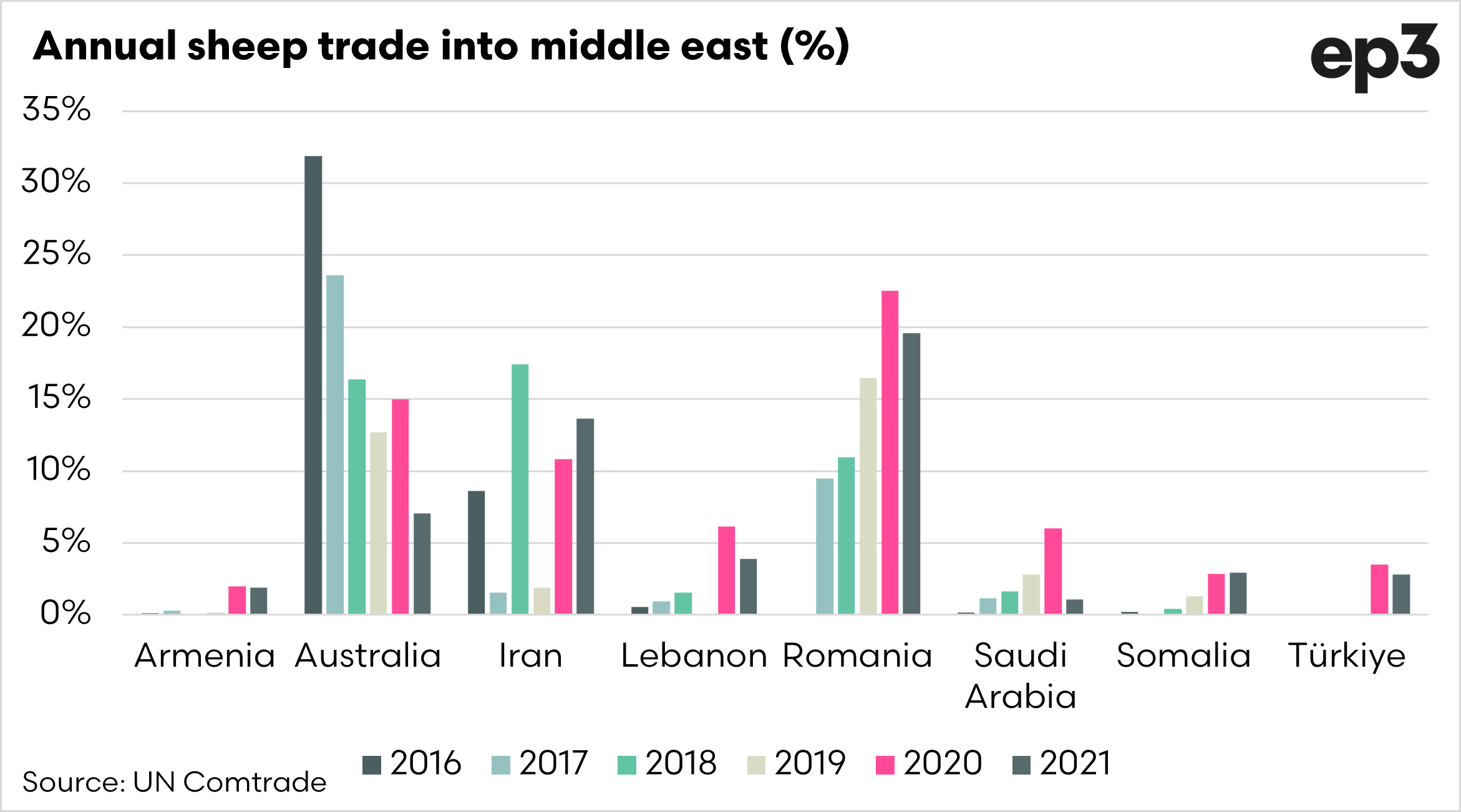

The chart below displays the annual exports of sheep to the aforementioned countries. I have selected the countries that have seen large increases in recent years.

What we can see from this data is that Australian volumes have diminished. At the same time, other origins have seen increased volumes. This could be a coincidence or it could not.

This has included some small players like Armenia, Turkiye and even Ukraine. The biggest winner has been Romania.

Worryingly, countries like Somalia have also experienced growth. This country has been struck with political instability and ongoing conflict for at least two decades. It is generally considered that animal welfare standards within Somalia are poor.

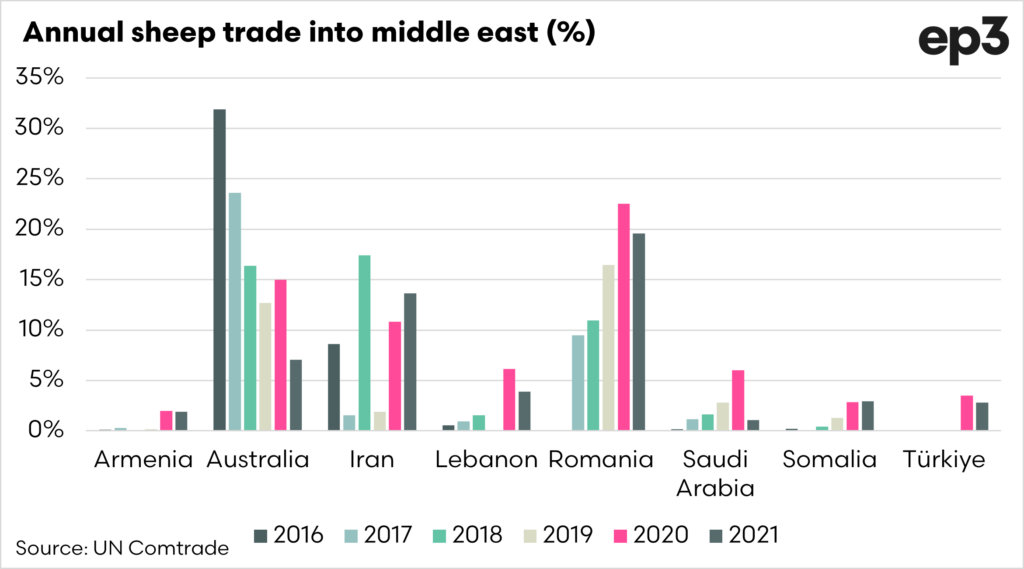

In the next chart below, I have selected some countries that have seen significant volumes into the selected middle eastern countries during the past two years of available data. Australia has moved down from over 30% of the trade into these nations to 7%. On the other hand, Romania moved from zero trade in 2016 to 22% in 2020 and 19.5% in 2021.

‘The customer is always right’, whilst logically flawed, the statement does have merit. If a product becomes unavailable from one supplier, the customer will switch to another.

This is what we see in the change in trade flows. The customer is moving to other suppliers.

So what does it mean?

The ban on sheep live export from Australia does very little to assist in improving global animal welfare standards. The export flows just switch to alternate origins, or at least it has done in recent years.

The sheep live export industry in Australia has been dying, but globally it is still strong.

If these countries continue to prefer fresh meat, which we believe is likely, then that is a barrier. We cannot expect them to switch to boxed meat, meaning we will have to find alternate markets.

It is unlikely that the government is going to turn around their decision to institute a complete ban on sheep live exports. Whilst the industry is campaigning against the ban, it must also be focused on a transition plan. This is especially important to ensure that the industry gets the most out of any agreements.

The government have started a consultation on the phase-out of the industry (see here), which focuses on five main areas:

- How the government should phase out live sheep exports.

- The timeframe for the phase-out.

- How the phase-out will impact the industry.

- Support and adjustment options

- Options to expand domestic processing

In our view, the industry can move away from the live export of sheep. We don’t believe that it will be free from price impacts which we are already being experienced (see here), and we expect many to move away from sheep/wool in the coming years.

There are some caveats to our view that there can be a transition:

- Processing capacity has to increase in Western Australia to meet the demand for kill space.

- Markets for this particular grade of meat must be found.

- The timeframe for the end of the industry must be realistic; new processing and markets will take considerable time to achieve.

The questions remain as to who will add this processing space and where the staff to fill the facilities will come from.

Support EP3

Please note that EP3 are not supported by any sheep industry or live export bodies (although this is the analysis they should be providing). This piece is written of our own volition.

We only write our reports based on the data available, and we thought there would be some interesting insights in the data.

If you want to support the work of EP3, then remember to sign up and forward our articles to your friends, family and other contacts.