Sheepmeat export update December 2025

December 2025 - Sheep Meat Export Update

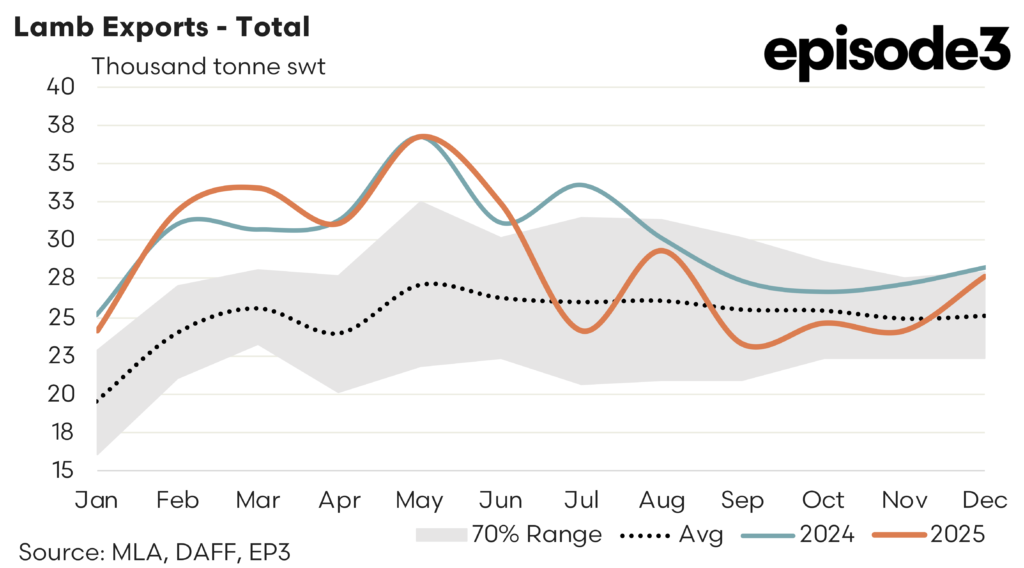

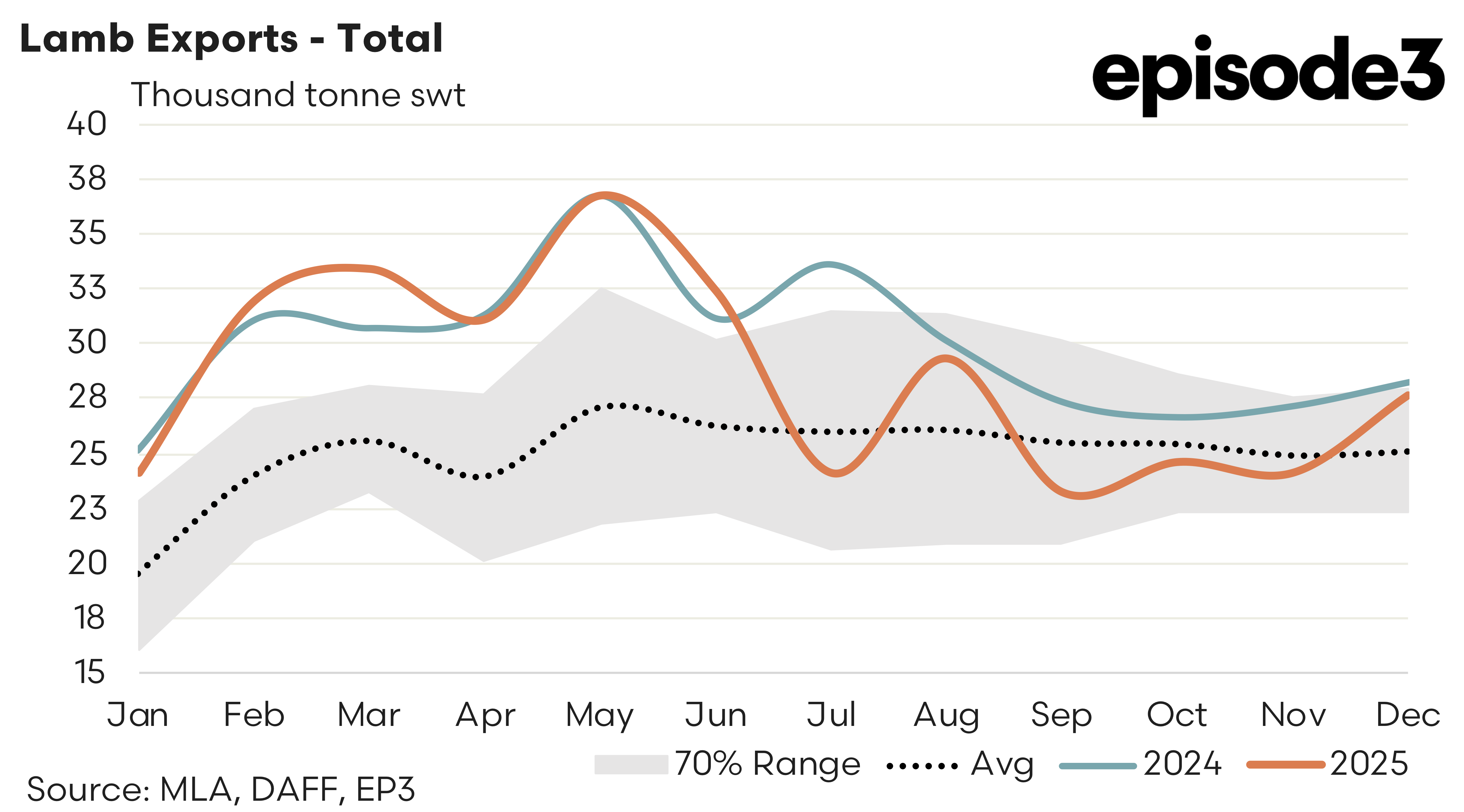

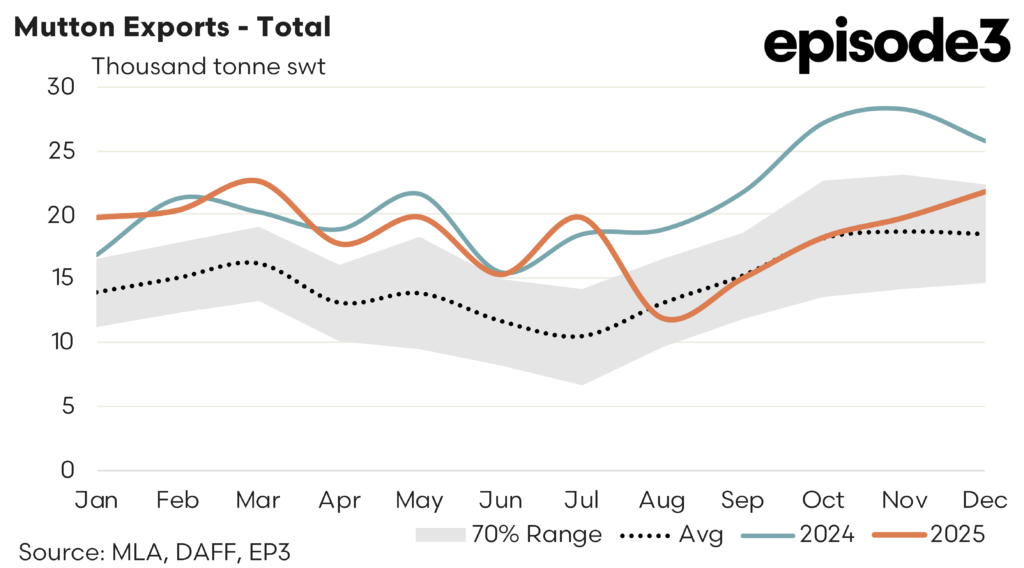

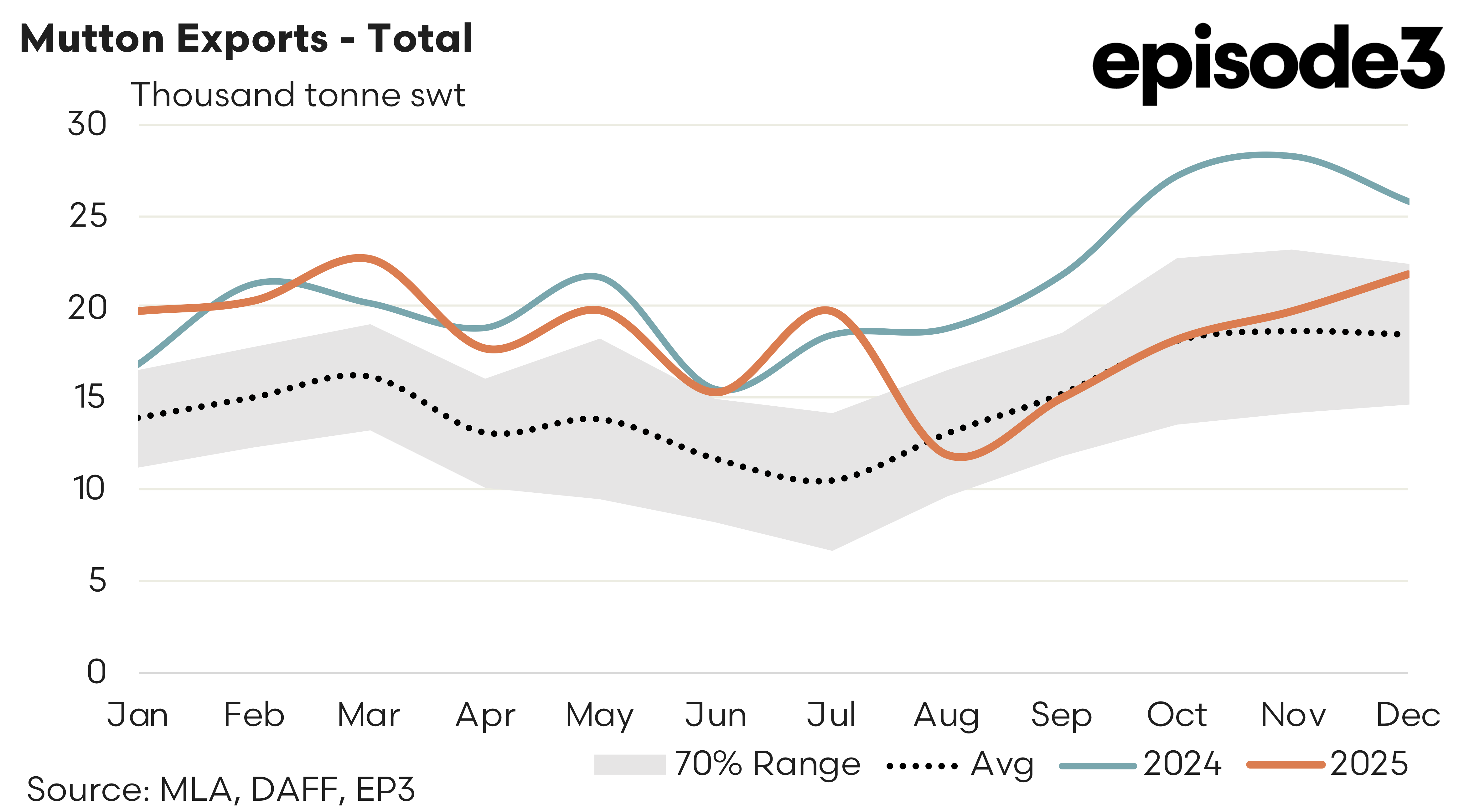

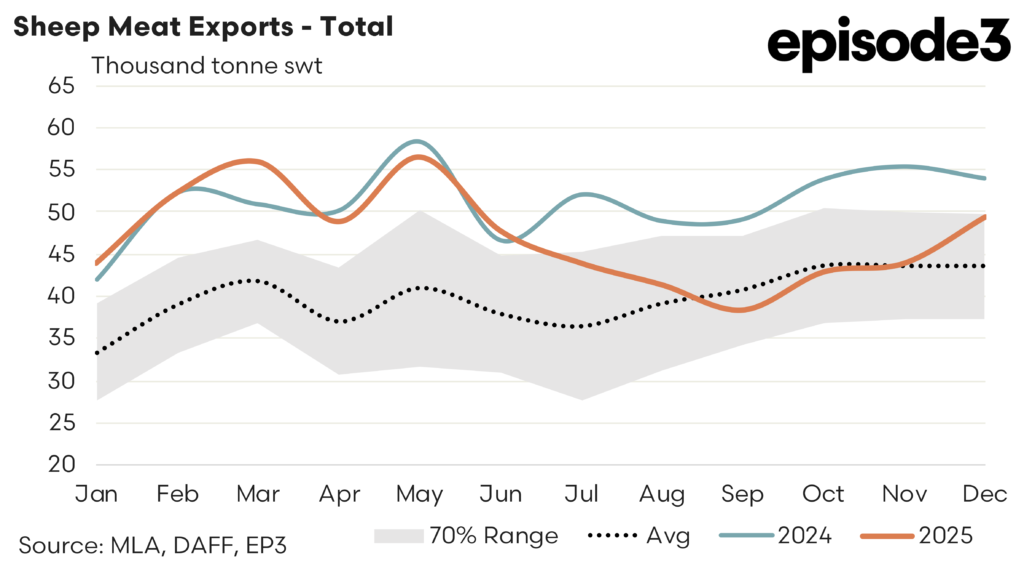

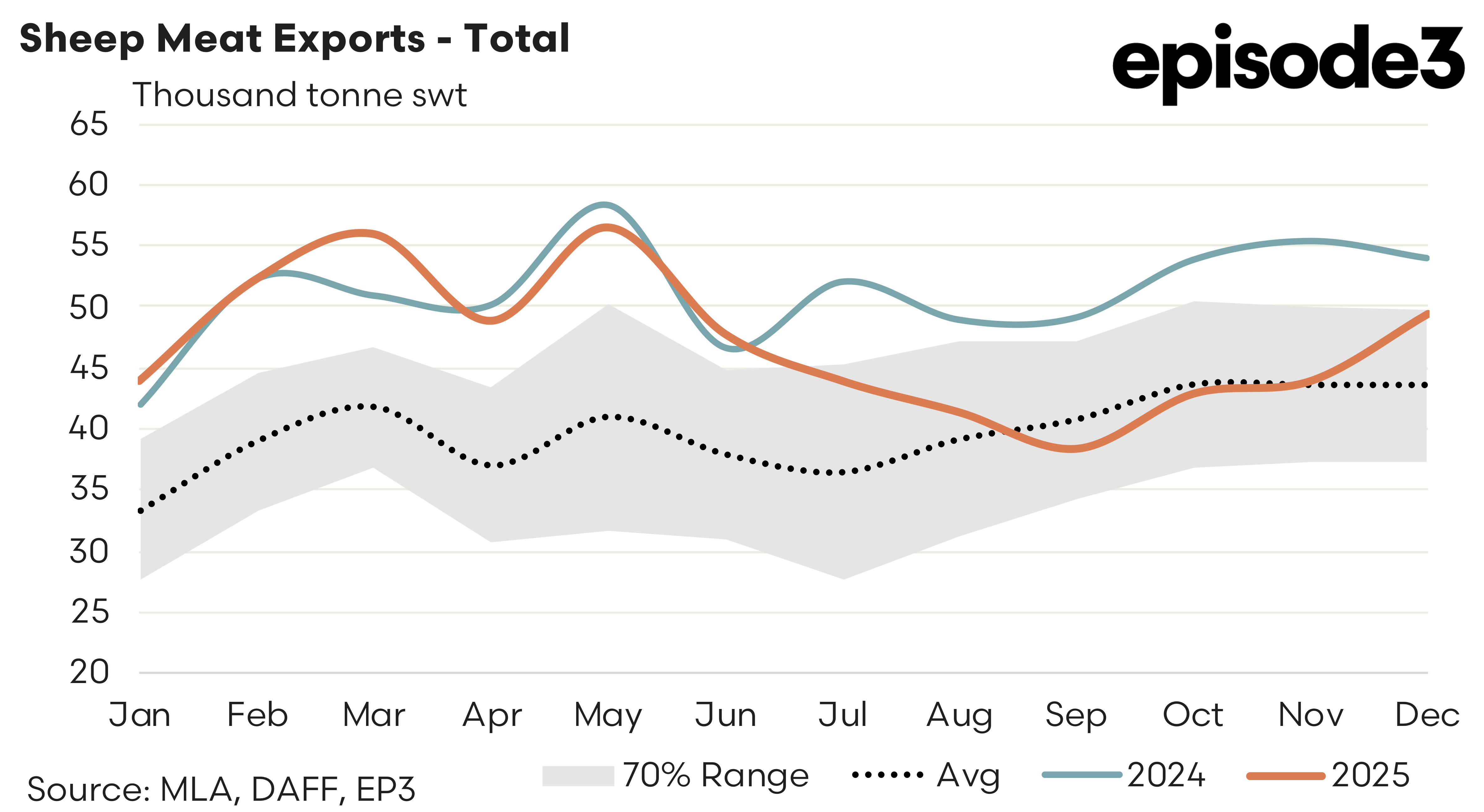

The 2025 sheep meat export season closed with a mixed but still historically strong outcome, characterised by softer year on year volumes but exports that remain well above longer run averages. Total lamb exports for the year reached 434,305 tonnes, sitting 4 percent below 2024 levels but still 15 percent above the five year average, while mutton exports totalled 222,275 tonnes, down 13 percent on the year yet 25 percent higher than the longer term norm.

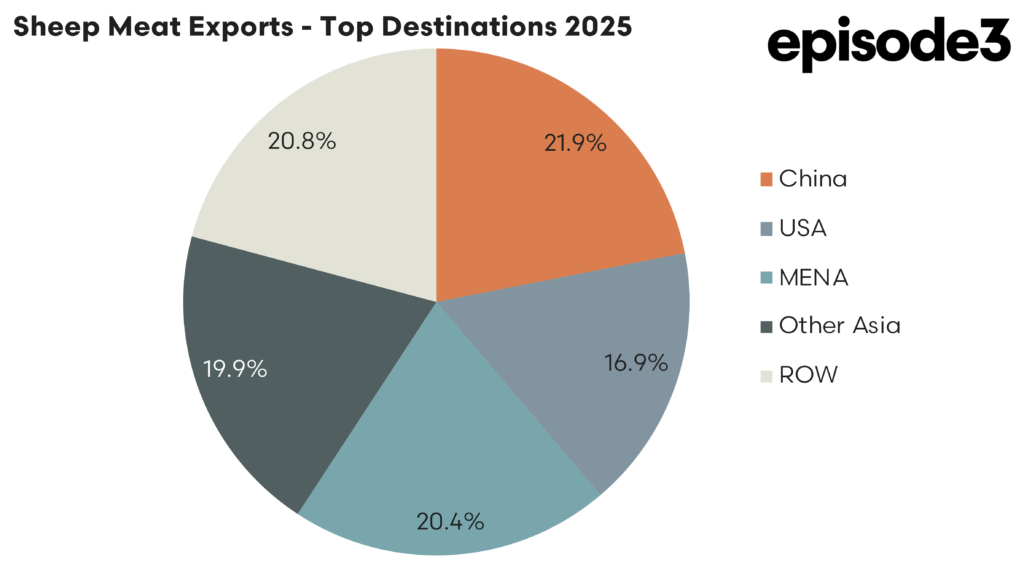

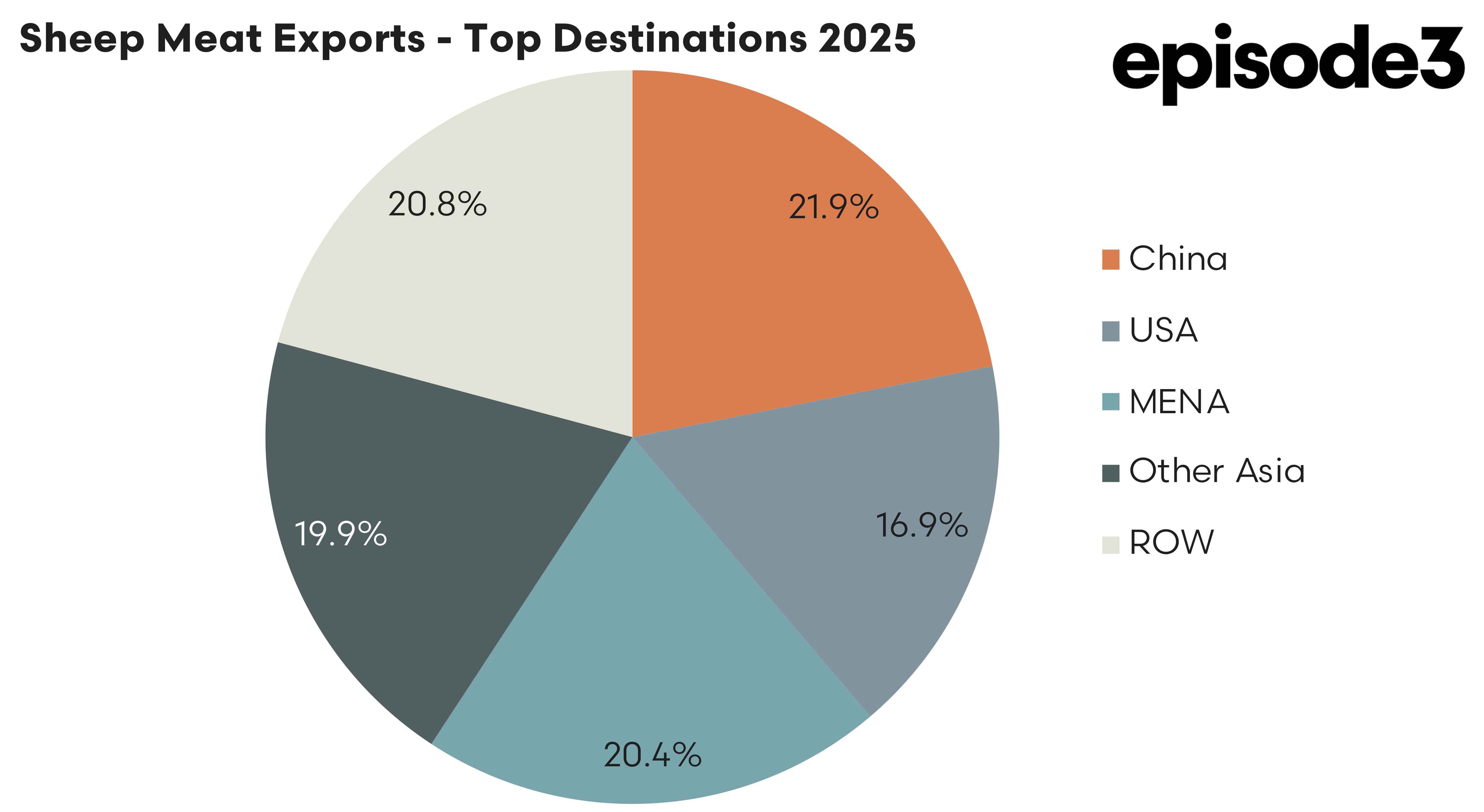

In terms of the top trade destinations for combined quarterly Australian lamb and mutton exports, the following was noted.

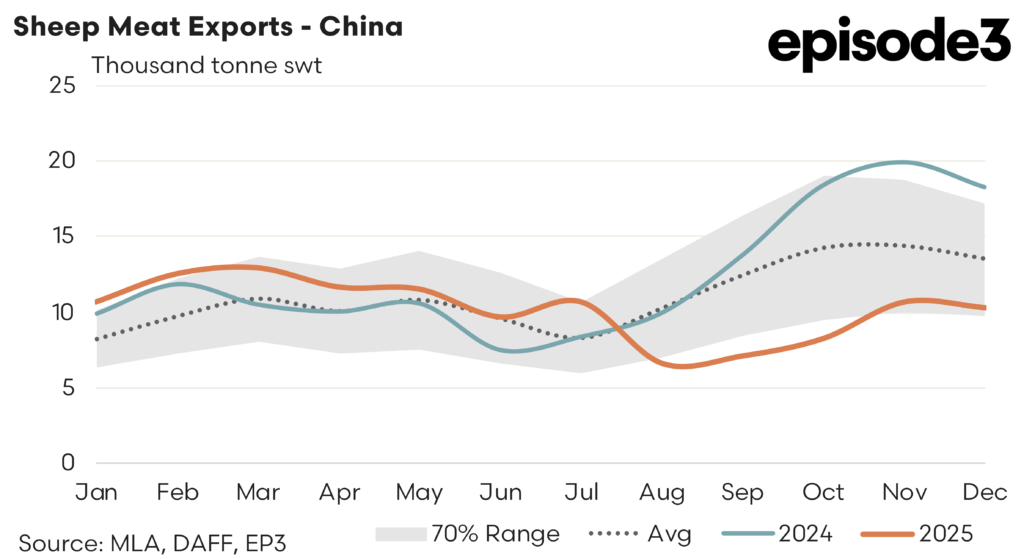

China finished 2025 as the single largest sheep meat destination, accounting for 21.9 percent of total exports. Fourth quarter shipments totalled 29,436 tonnes, marking a sharp seasonal slowdown. Volumes were 48 percent lower than Q4 2024 and 30 percent below the five year average, making China the weakest performer on a late year comparison. This followed a relatively strong September quarter and reflects a pronounced pullback in end of year buying rather than a structural collapse in demand. Even so, China’s full year share highlights its continued importance to the sheep meat complex despite the volatility evident in quarterly flows.

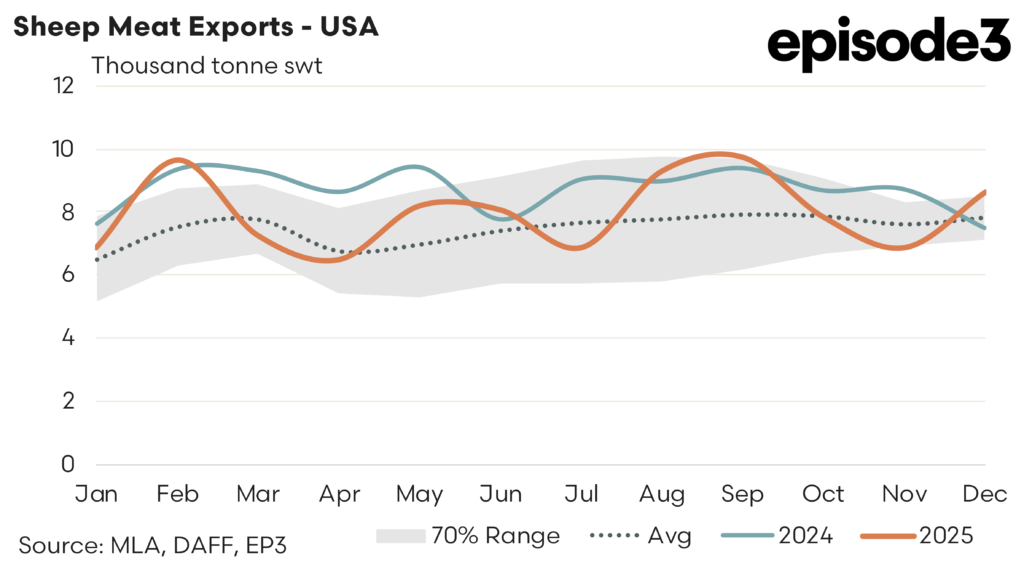

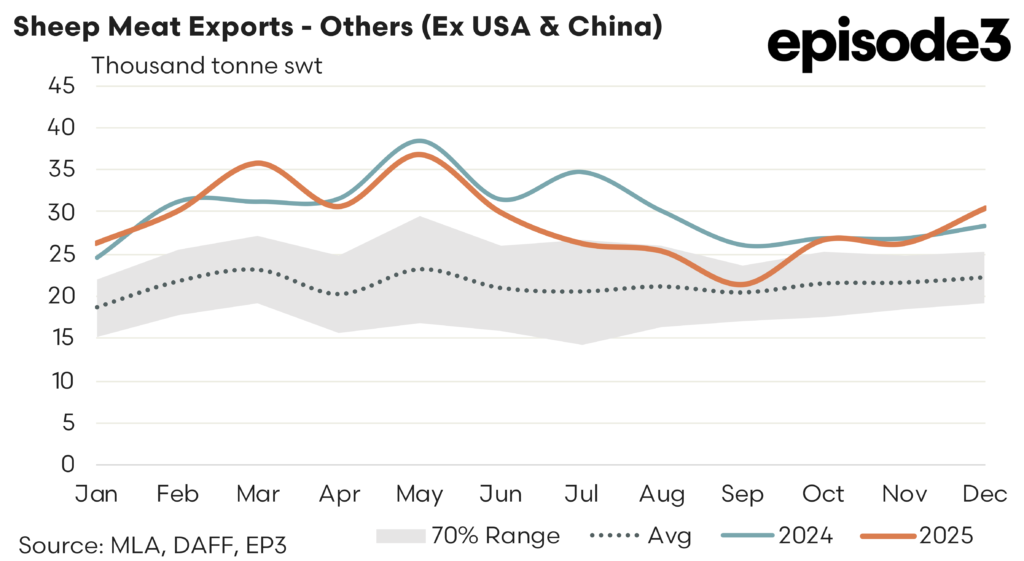

The United States accounted for 16.9 percent of total sheep meat exports in 2025 and remained a relatively stable outlet compared with some Asian markets. Fourth quarter volumes reached 23,357 tonnes. This was 6 percent lower than Q4 2024 but broadly in line with the five year average flows, highlighting a market that has grown steadily but without the extreme swings seen elsewhere. The US market continues to provide consistency for Australian exporters, particularly for lamb, even when seasonal softness emerges late in the calendar year.

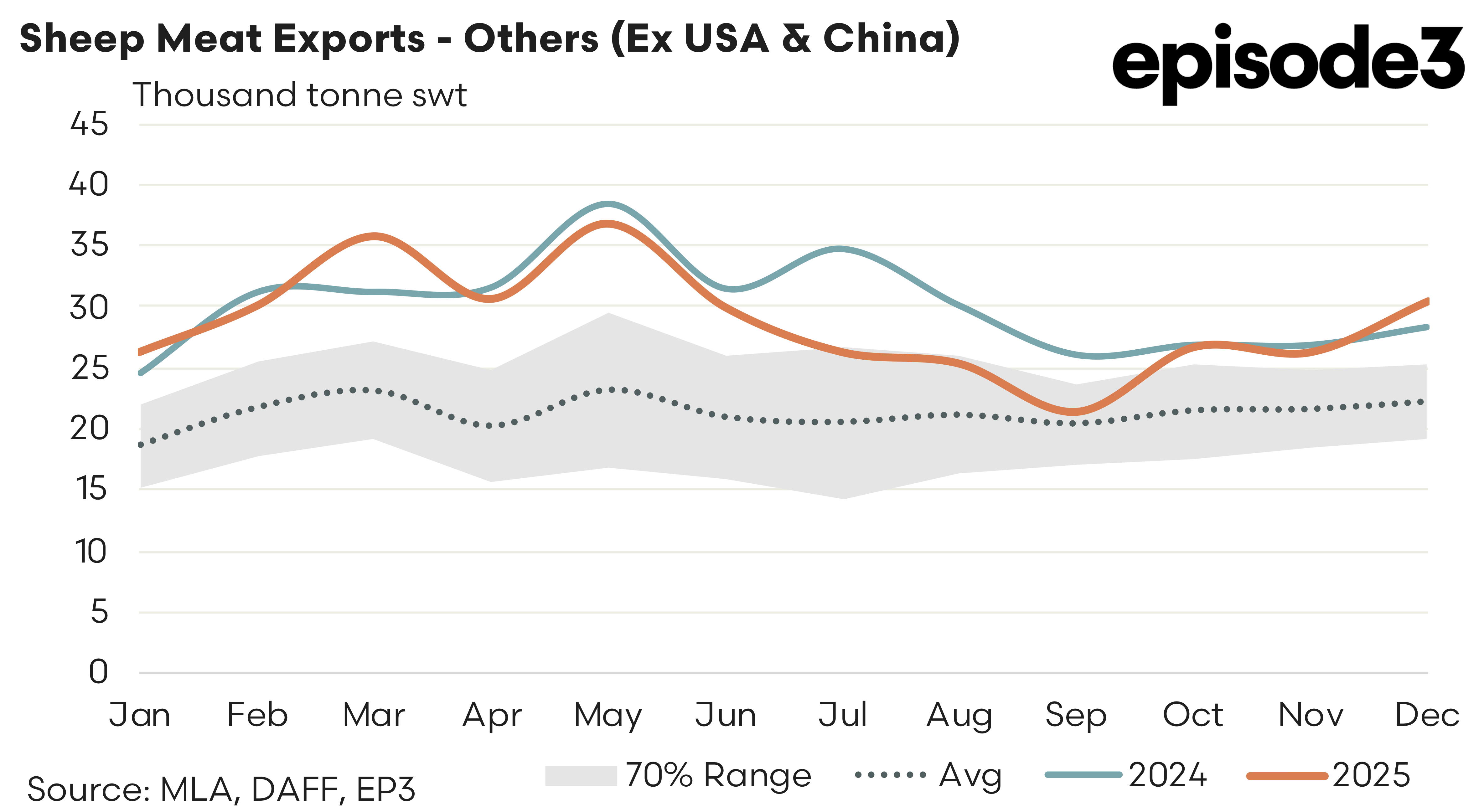

In terms of the other destinations (such as the MENA, other Asia and elsewhere) the Middle East and North Africa region was again a critical pillar of demand, capturing 20.4 percent of total exports in 2025. Meanwhile the other Asian markets collectively accounted for 19.9 percent of exports. The remaining markets grouped as the rest of the world took a 20.8 percent share of exports in 2025.

Fourth quarter shipments to all these other destinations combined reached 83,526 tonnes, effectively flat on Q4 2024 with a 2 percent increase and sitting 28 percent above the five year average. This segment highlights the breadth of Australia’s sheep meat export footprint and the growing contribution of secondary markets to overall volumes.

While annual sheep meat export volumes eased compared with the exceptionally strong 2024 result, exports remained well above historical benchmarks. The December quarter revealed a clear slowdown into China, steadier demand from the United States, and notable resilience across all other markets. The market share split, led narrowly by China and closely followed by MENA, other Asia, the rest of the world and the United States, reinforces how evenly balanced Australian sheep meat exports have become, even as total volumes continue to exceed long run norms.