Sheepmeat export update November 2025

November 2025 - Sheep Meat Export Update

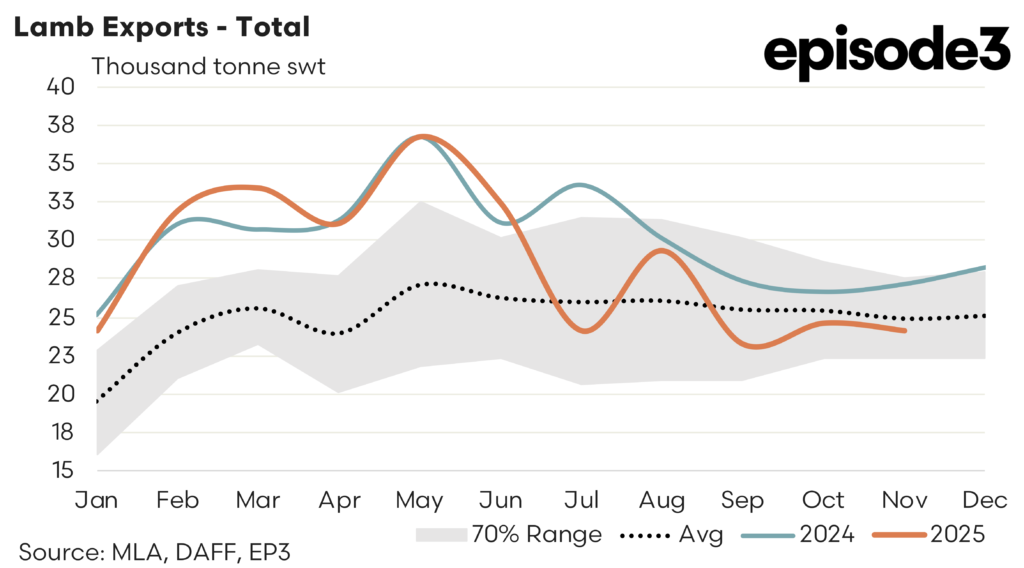

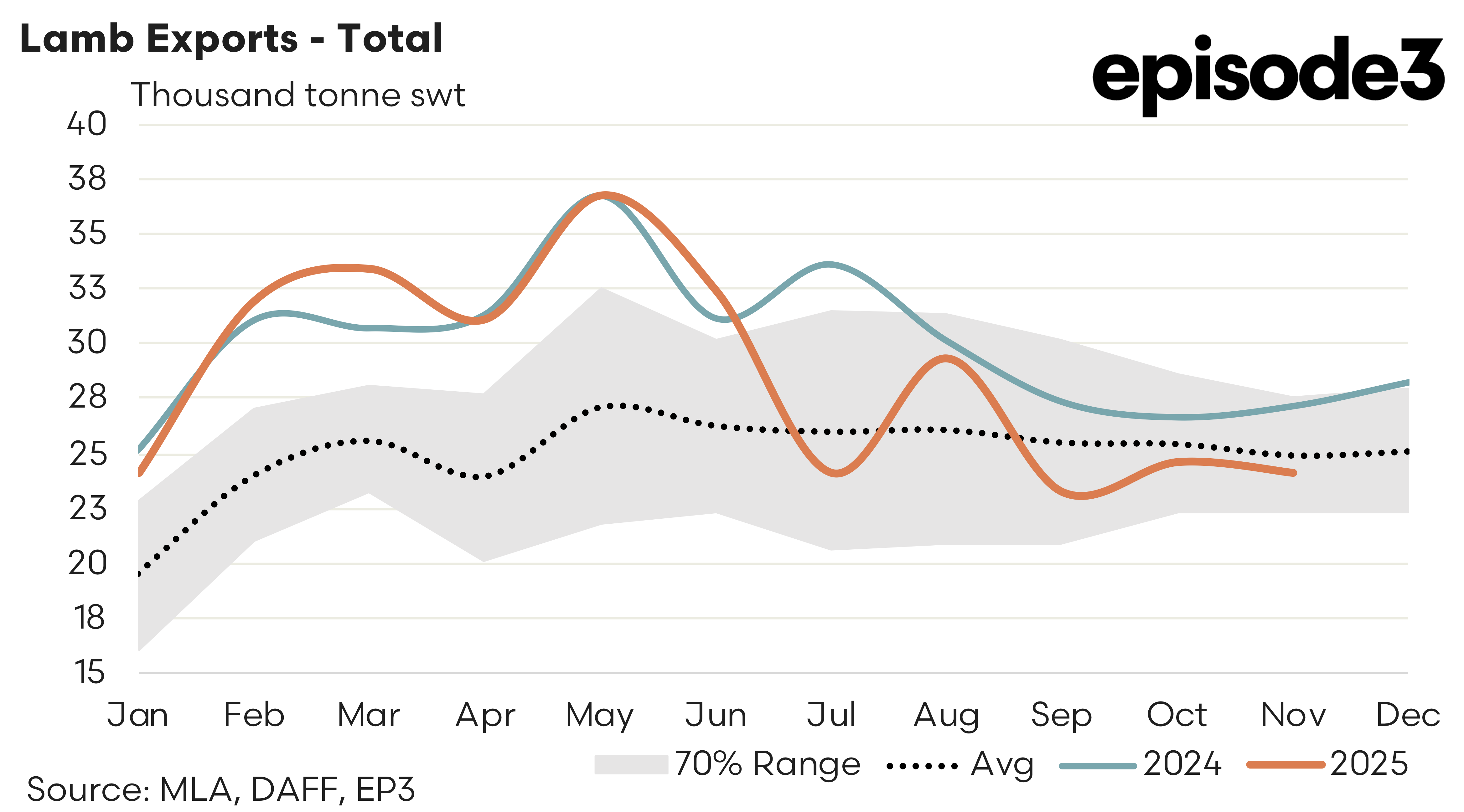

Australian sheepmeat exports in November presented a mixed but broadly stable picture, with lamb volumes easing slightly and mutton recording a solid lift. Total lamb exports declined by 2 percent to 24,177 tonnes. This keeps lamb shipments around 3 percent below the five year average for November and reflects a relatively soft month in several key markets.

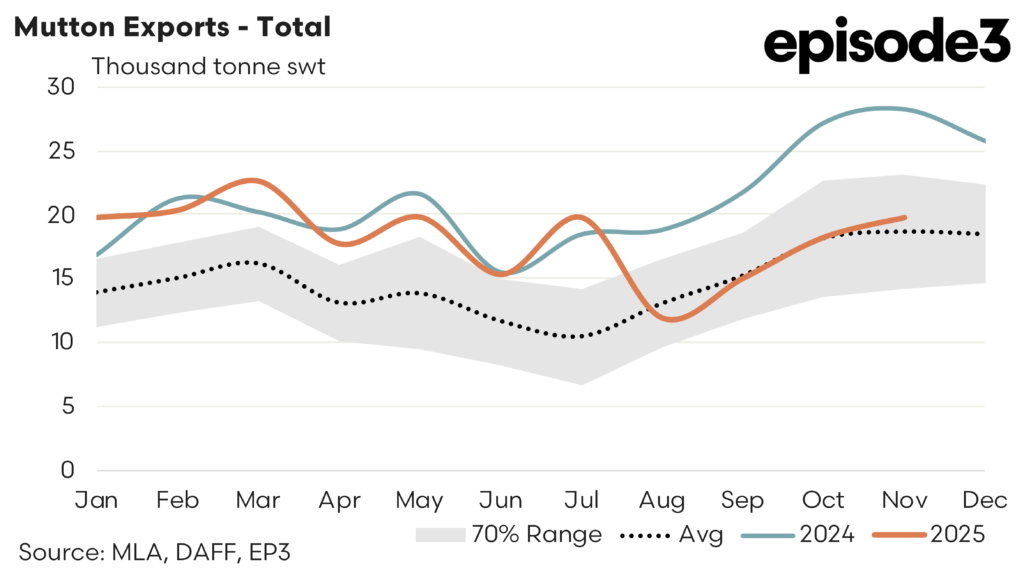

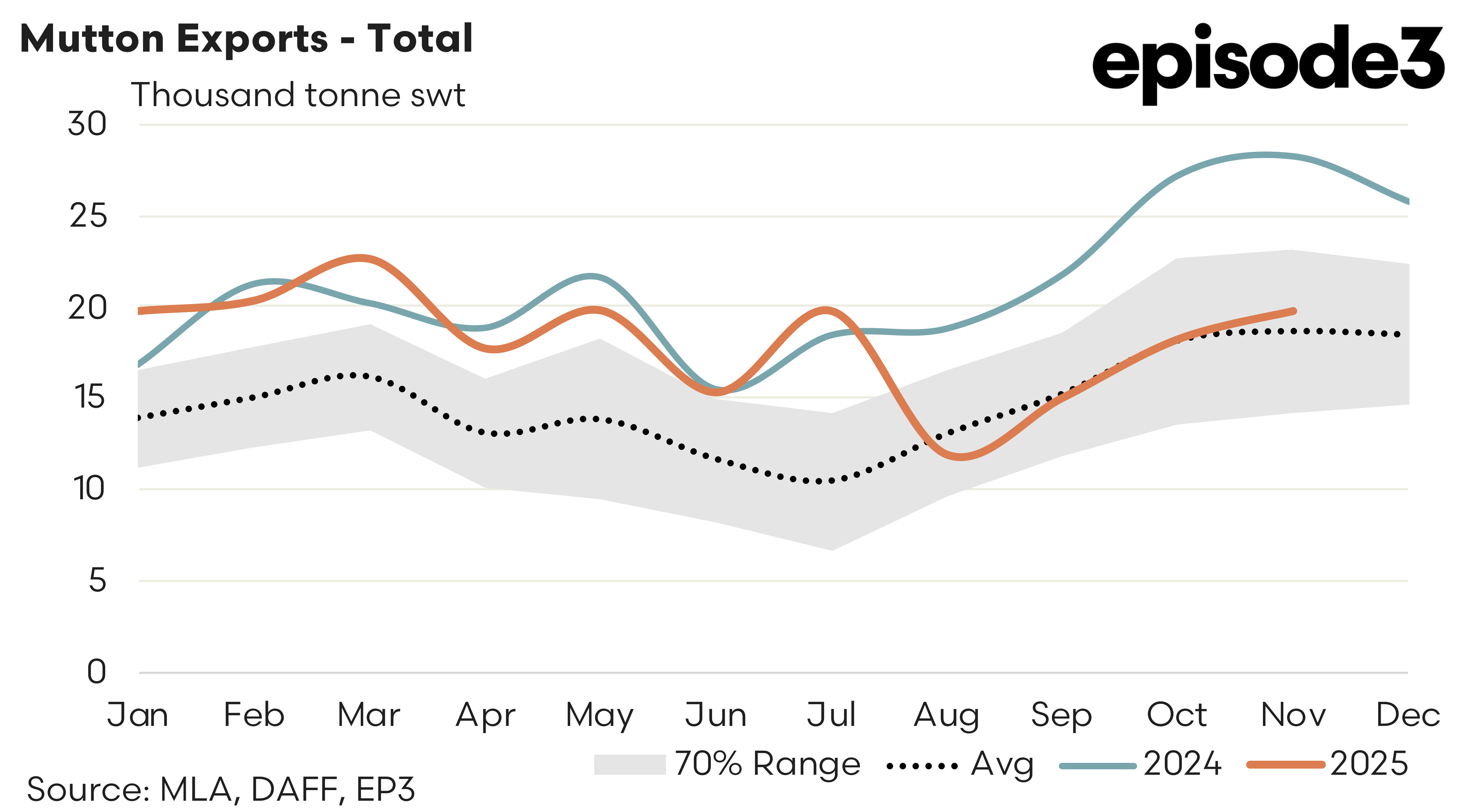

By contrast, mutton exports rose by 8 percent to 19,776 tonnes, placing total mutton flows about 6 percent above the long term November benchmark. The combination of these two product streams meant overall sheepmeat performance through November continued to track close to seasonal expectations.

In terms of the top trade destinations for Australian lamb exports, the following was noted.

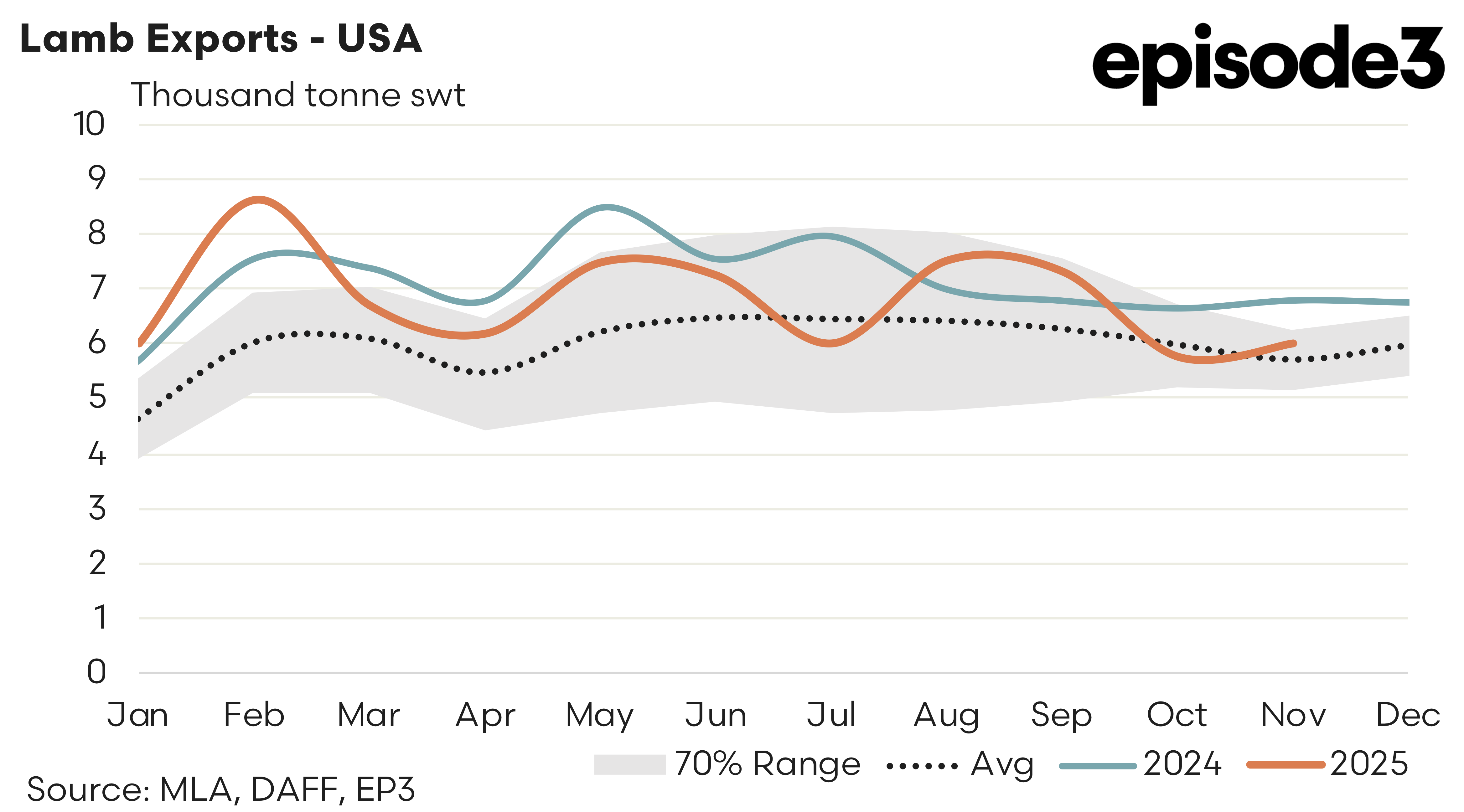

USA – Lamb exports to the United States lifted in November, rising by 4 percent to 6,020 tonnes. This puts American demand at roughly 6 percent above the five year average pattern for this point in the year and makes the United States the standout among major lamb destinations for November. The improvement countered some of the weakness elsewhere in the lamb trade, particularly given that the United States had softened in October. The latest figures show that buyer interest from American importers has stabilised and even strengthened as the year draws to a close.

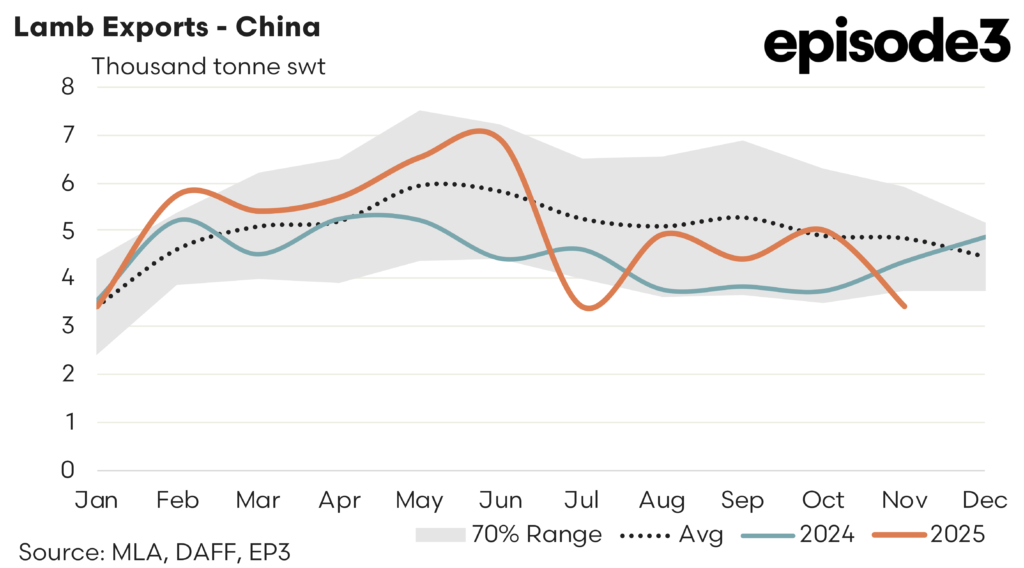

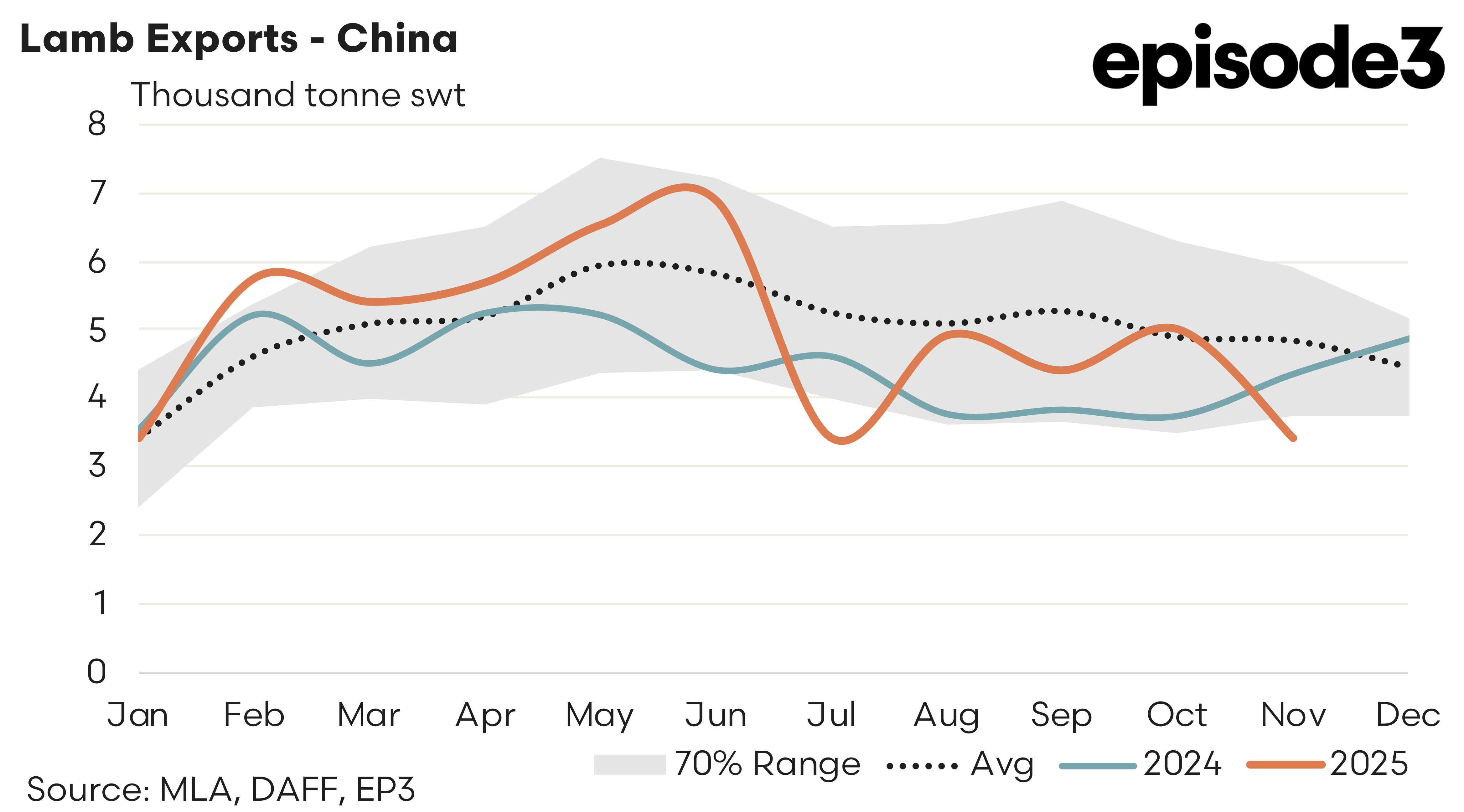

China – China recorded a significant easing in lamb imports, with November volumes falling by 32 percent to 3,414 tonnes. This places Chinese demand for Australian lamb about 29 percent under the typical November level based on the last five years of trade. While China had shown a small improvement in October, the November decline reaffirms the subdued nature of Chinese lamb demand across much of 2025. Fluctuating economic conditions and changes in domestic protein markets appear to be influencing Chinese import behaviour and the November results highlight the degree to which Australian exporters have had to rely on markets outside China to balance their lamb program.

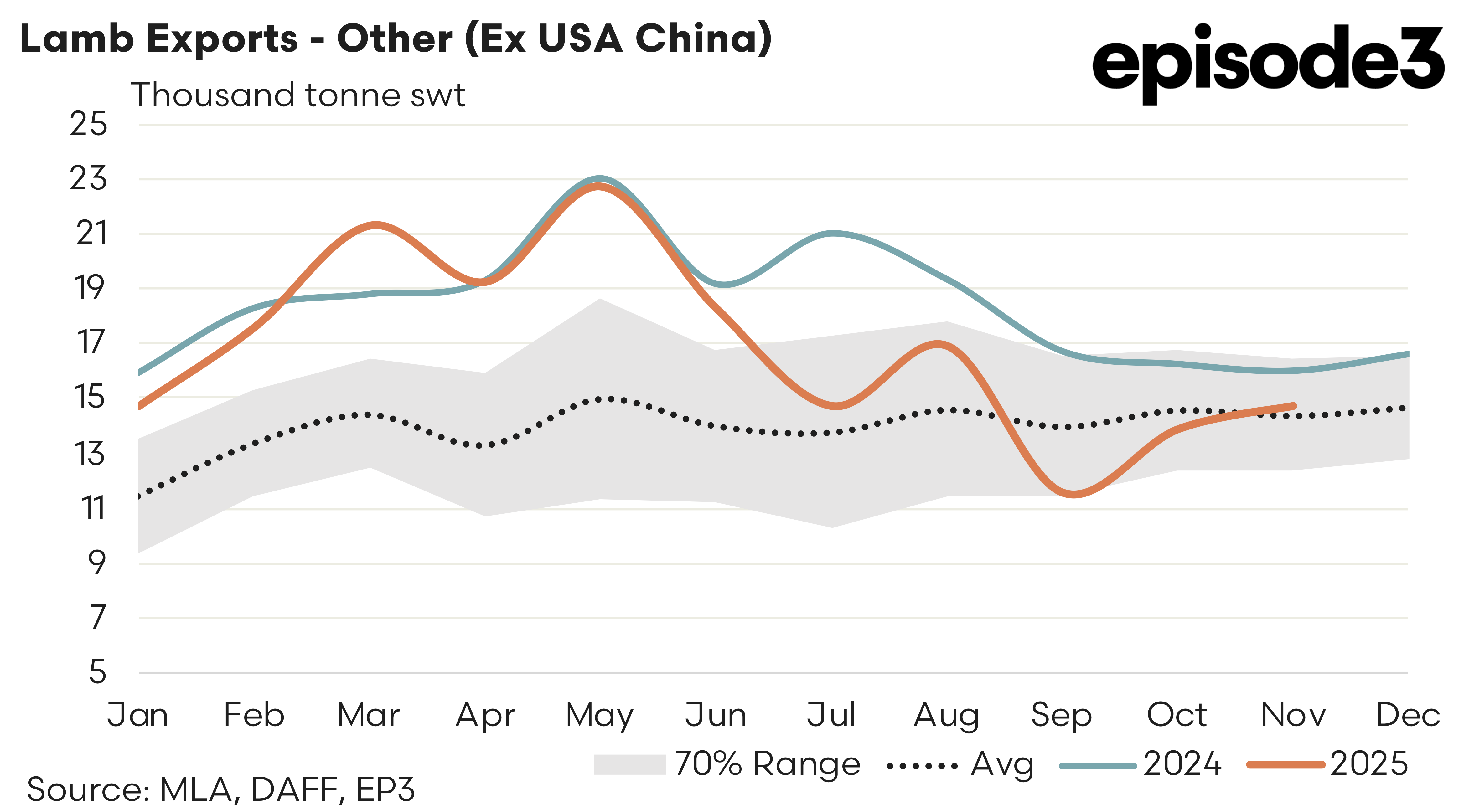

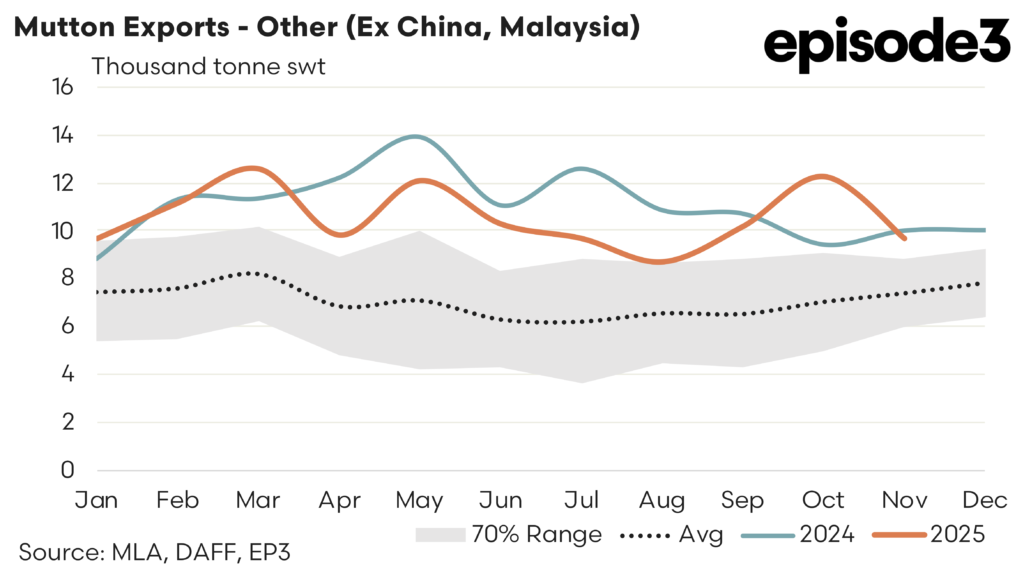

The others – Lamb exports to all other destinations lifted by 6 percent to 14,743 tonnes. These markets now sit around 2 percent above the long term November average. This broad group of destinations has provided important resilience for the lamb sector over the past year. Even as the two largest individual markets experience volatility, the wider network of importers continues to support aggregate lamb flows and helps keep total exports close to seasonal norms.

In terms of the top trade destinations for Australian mutton exports, the following was noted.

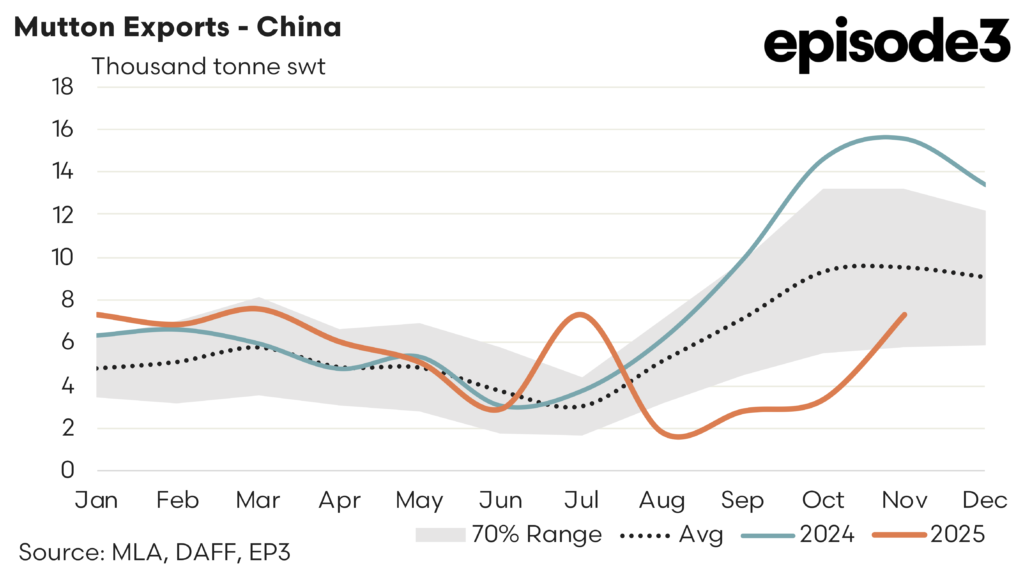

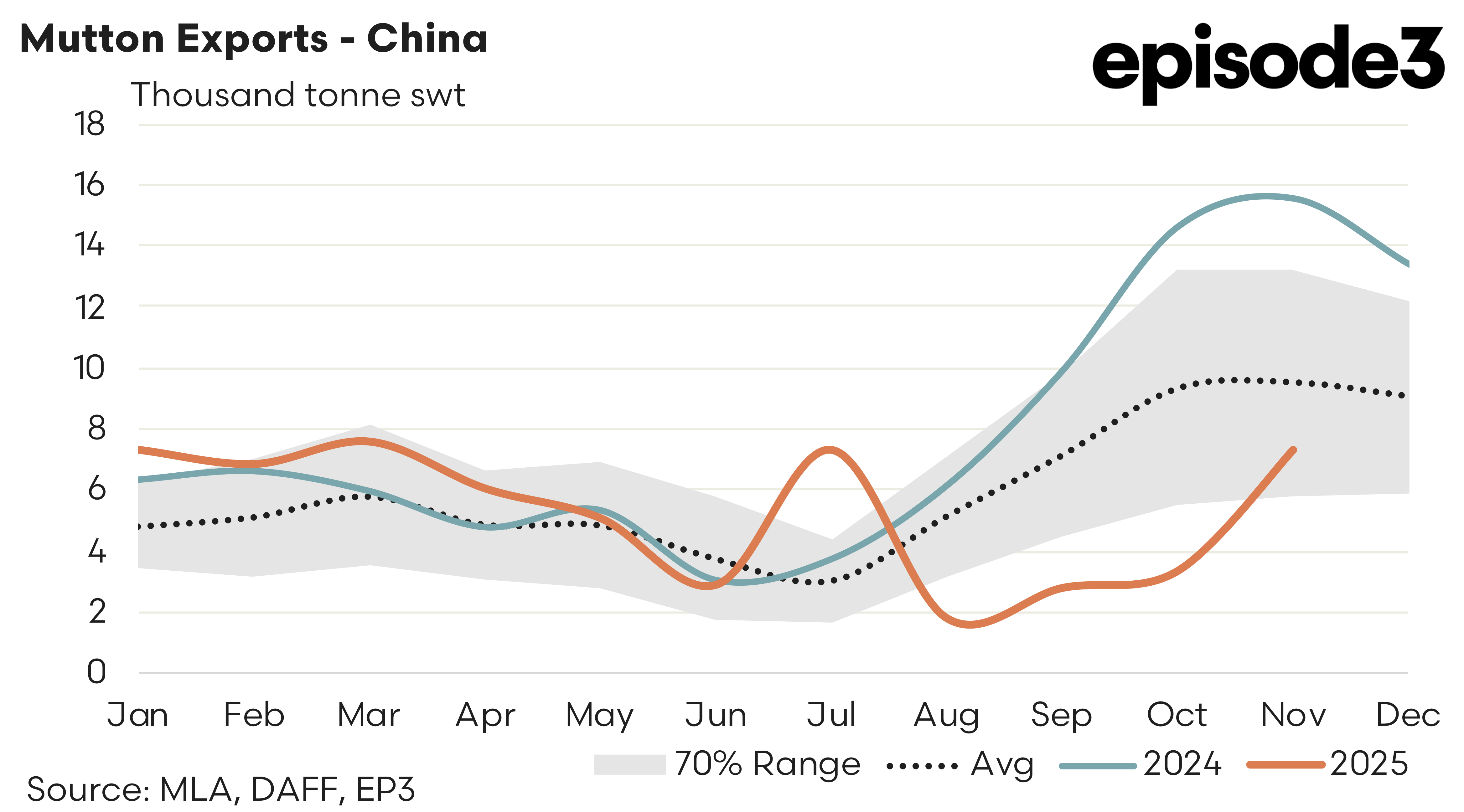

China – China saw a dramatic increase in mutton imports, rising by 120 percent to 7,326 tonnes. This sizeable increase more than offset the drop in lamb volumes to China during the month. However, despite the magnitude of the November lift, Chinese mutton demand remains 23 percent below the five year average for November. This shows that while conditions in the Chinese mutton market have improved, the trade has not yet returned to full strength and may remain inconsistent for some time.

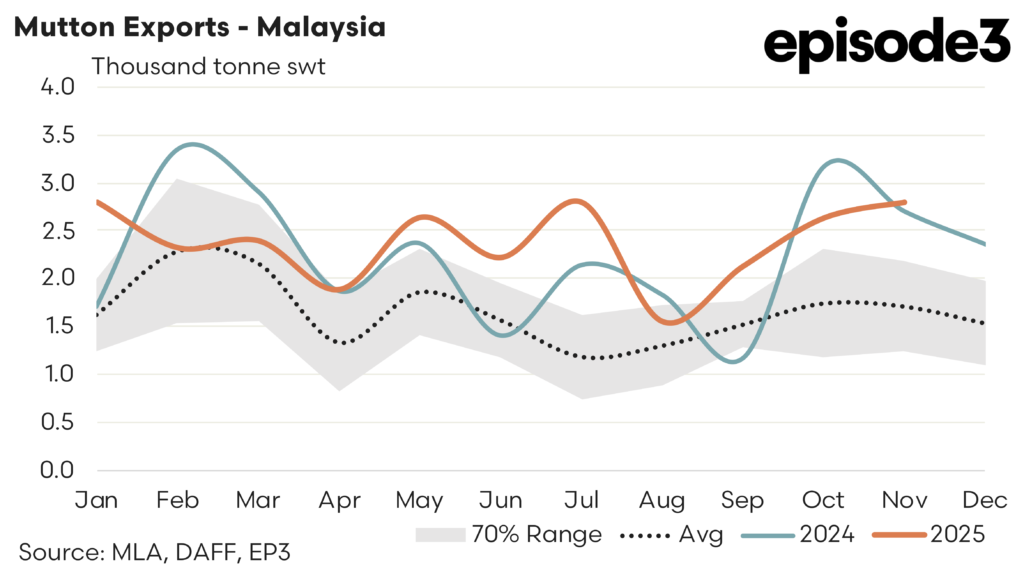

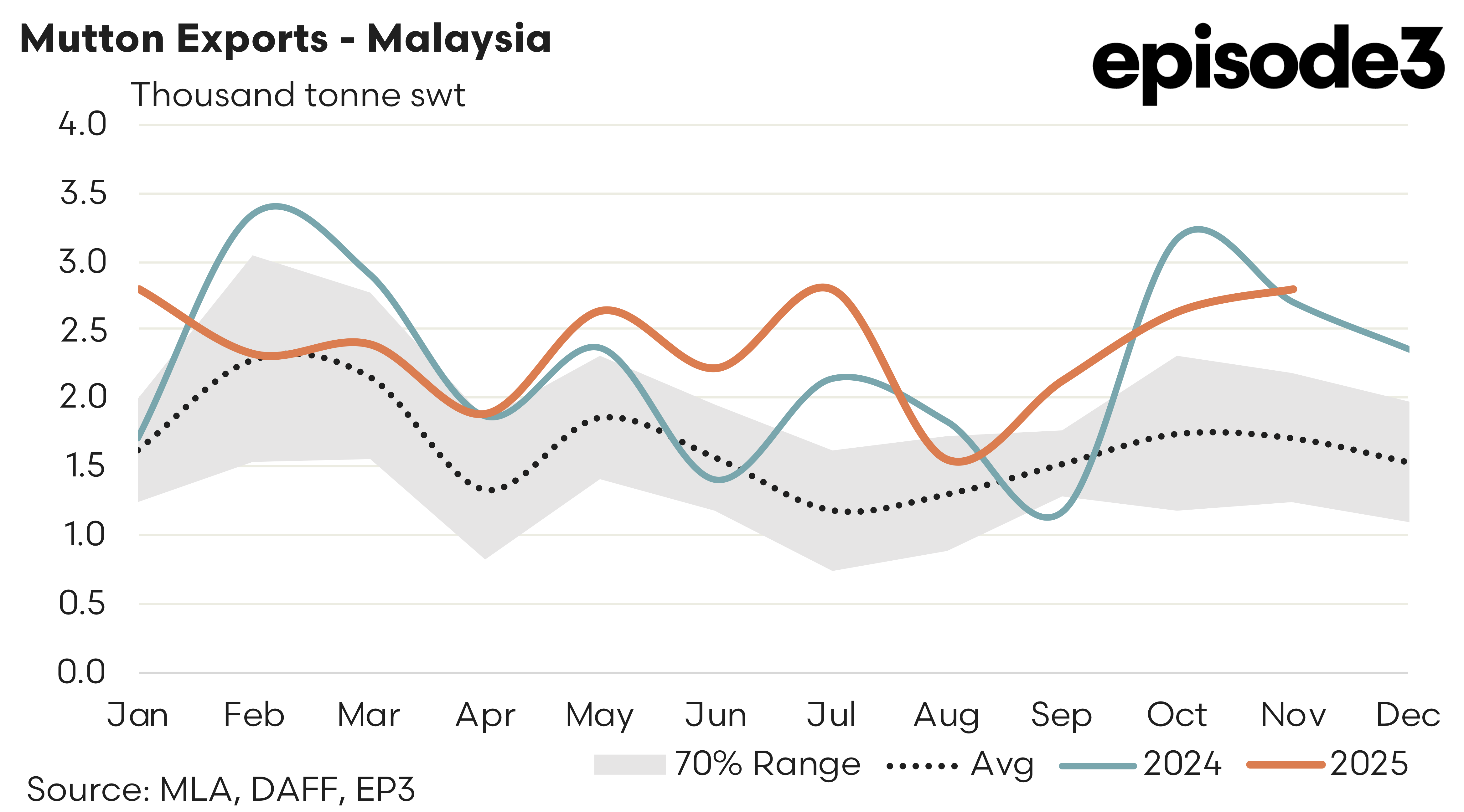

Malaysia – Malaysia recorded another month of firm mutton demand, with November volumes rising by 6 percent to 2,792 tonnes. This places Malaysian mutton imports an impressive 63 percent above the five year average for November and highlights the continued expansion of this market as a reliable buyer of Australian product. Malaysia has emerged as one of the key support markets for mutton in 2025 and November’s figures reinforce its importance in balancing the softness still evident in Chinese demand.

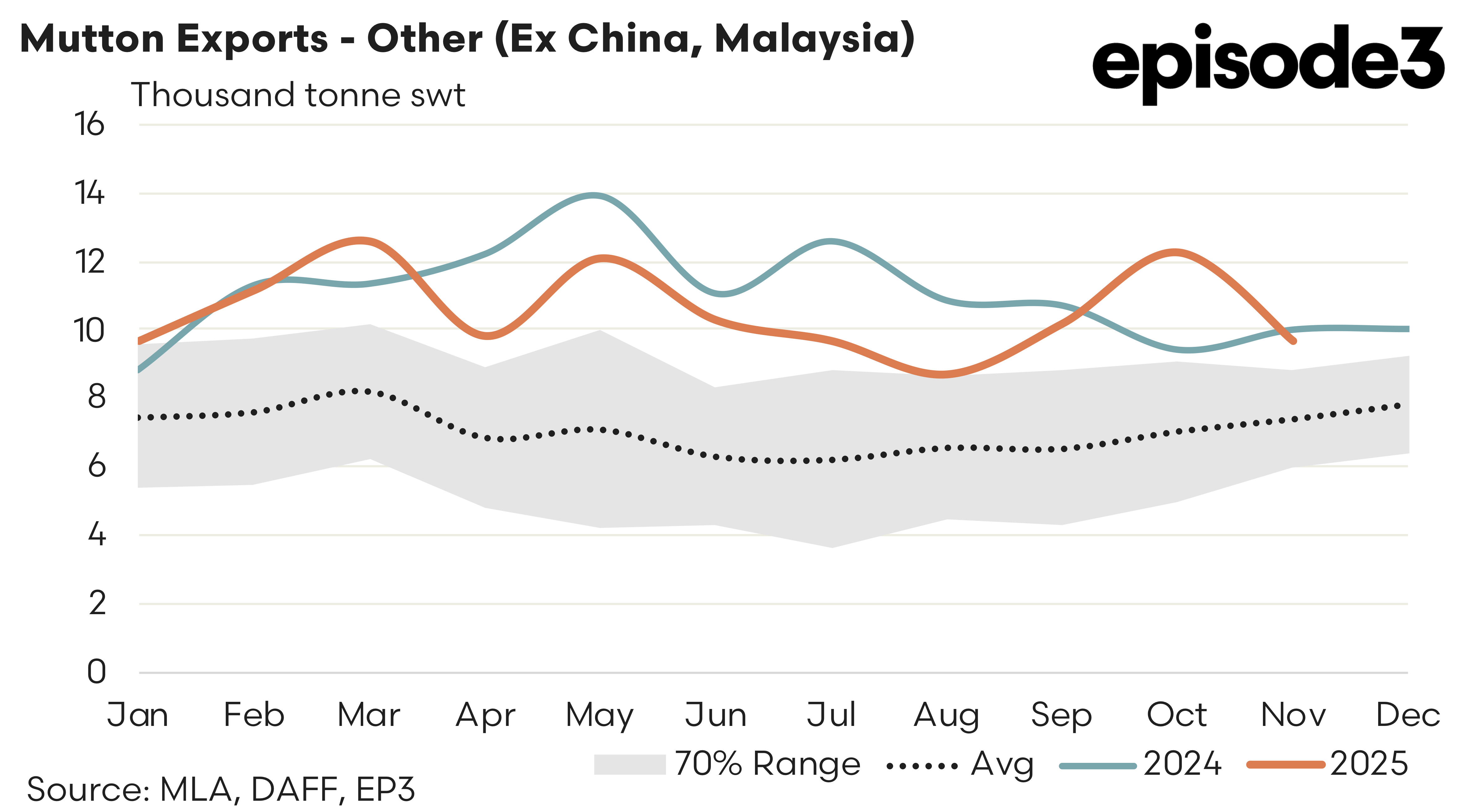

The others – All other mutton destinations combined saw shipments ease by 21 percent to 9,658 tonnes. Even with this decline, these markets remain 30 percent above the long term November average. The year to date pattern shows that non Chinese and non Malaysian buyers have consistently maintained elevated import programs for Australian mutton, helping underpin the overall mutton sector during periods of individual market volatility.