South Steps Up as Northern Turnoff Slows

Market Morsel

Australia’s cattle sector moved through November in a manner that reinforced the increasingly regional nature of supply and processing activity. The transition from late spring into early summer usually brings a clearer picture of cattle flow, yet this year the pattern remains varied across states.

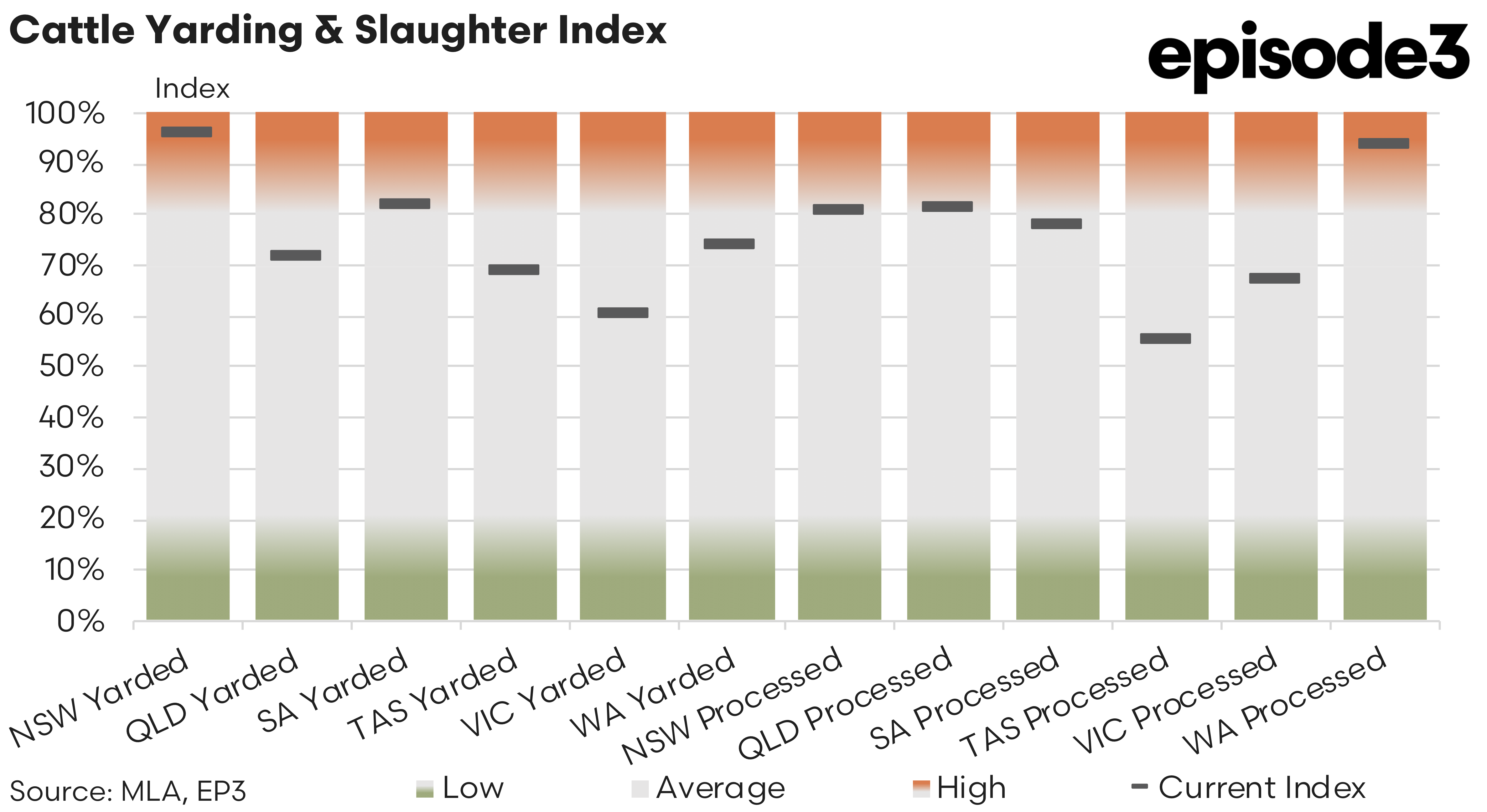

The October to November data for yardings and slaughter indices shows that while some regions are entering a phase of stronger market participation, others are adjusting to tightening availability after a prolonged period of high turnoff. The pricing environment has also shifted over the past four weeks, with the latest MLA indicator values showing a market that is firm but mixed, shaped by both seasonal conditions and a recalibration of processor demand.

New South Wales led the month with the most substantial lift in yardings, rising from 79 percent in October to 96 percent in November. This increase marks one of the clearest signs that the state is moving cattle in greater volumes as conditions improve and producers take advantage of seasonal marketing windows. The corresponding rise in the state’s slaughter index from 62 percent to 81 percent confirms that processors are engaging actively with the increased flow of stock. Queensland also recorded higher yardings, moving from 69 percent to 72 percent, but the lift was comparatively modest. This reflects the reality that the northern spring flush was largely exhausted earlier in the season, leaving processors with a steadier but not expanding pool of cattle heading into summer.

South Australia posted a notable rise in yardings, climbing from 68 percent to 82 percent, supported by improved weather and the return of more finished cattle. Its slaughter index also increased sharply, rising from 67 percent to 78 percent. Tasmania showed one of the most pronounced proportional improvements, with yardings lifting from 49 percent to 69 percent and processing activity increasing from 43 percent to 55 percent. These movements suggest a region that was held back by winter but is now finding its rhythm as pastures recover. Western Australia recorded gains on both measures, with yardings rising from 70 percent to 74 percent and slaughter indices lifting from 87 percent to 94 percent. Victoria was the outlier. Yardings remained unchanged at 60 percent while the slaughter index fell from 81 percent to 67 percent. This points to tighter availability of suitable finished cattle compared with earlier in spring, where processors were able to operate at higher capacity.

These shifts in supply and processing dynamics are reflected in the latest cattle indicator values. The heavy steer sits at roughly 442 cents per kilogram live weight, representing an easing of around 15 cents over the past four weeks. The restocker yearling steer has decreased by about 16 cents over the month to sit at roughly 490 cents. The dairy cow indicator sits near 343 cents per kilogram live weight, down about 24 cents across the month. Processor cows have experienced a slightly softer trend, falling to around 378 cents, which represents a monthly decline of roughly 17 cents. The decline in cow indicators reflects the effect of earlier female turnoff which temporarily created greater availability in this category. The feeder steer indicator is now sitting at around 469 cents, down nearly 12 cent over the past month. Feeder heifers and restocker heifers have eased during the month, with feeder heifers falling roughly 27 cents to about 411 cents and restocker heifers falling a similar amount to around 400 cents. These corrections likely reflect selective buying behaviour as producers weigh pasture growth against upcoming summer conditions.

Overall, the pricing landscape shows a recalibration. Categories linked to heavier cattle have eased lightly over the past four weeks, supported by steady processor demand and a more measured flow of animals into the market. Lighter store cattle, particularly heifers, have softened as buyers exercise greater caution and focus on weight, turnoff timing and the reliability of feed.

Taken together, the October to November shift in both yardings and processing indices reveals a sector that is transitioning into its summer pattern with distinct regional differences. The south and west are showing clear forward momentum, supported by improved supply and strong processor engagement. The north remains steady but constrained by earlier seasonal decisions that brought cattle forward well ahead of the usual timing. As the market moves deeper into summer, the balance between seasonal conditions, producer confidence and processor capacity will continue to shape the flow of cattle and the stability of prices across categories.