Step by step improvement

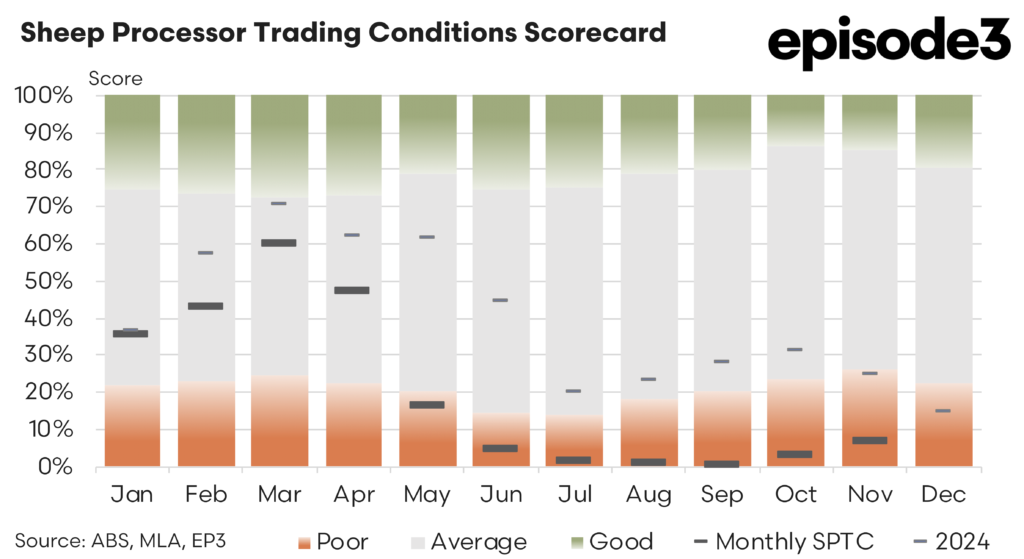

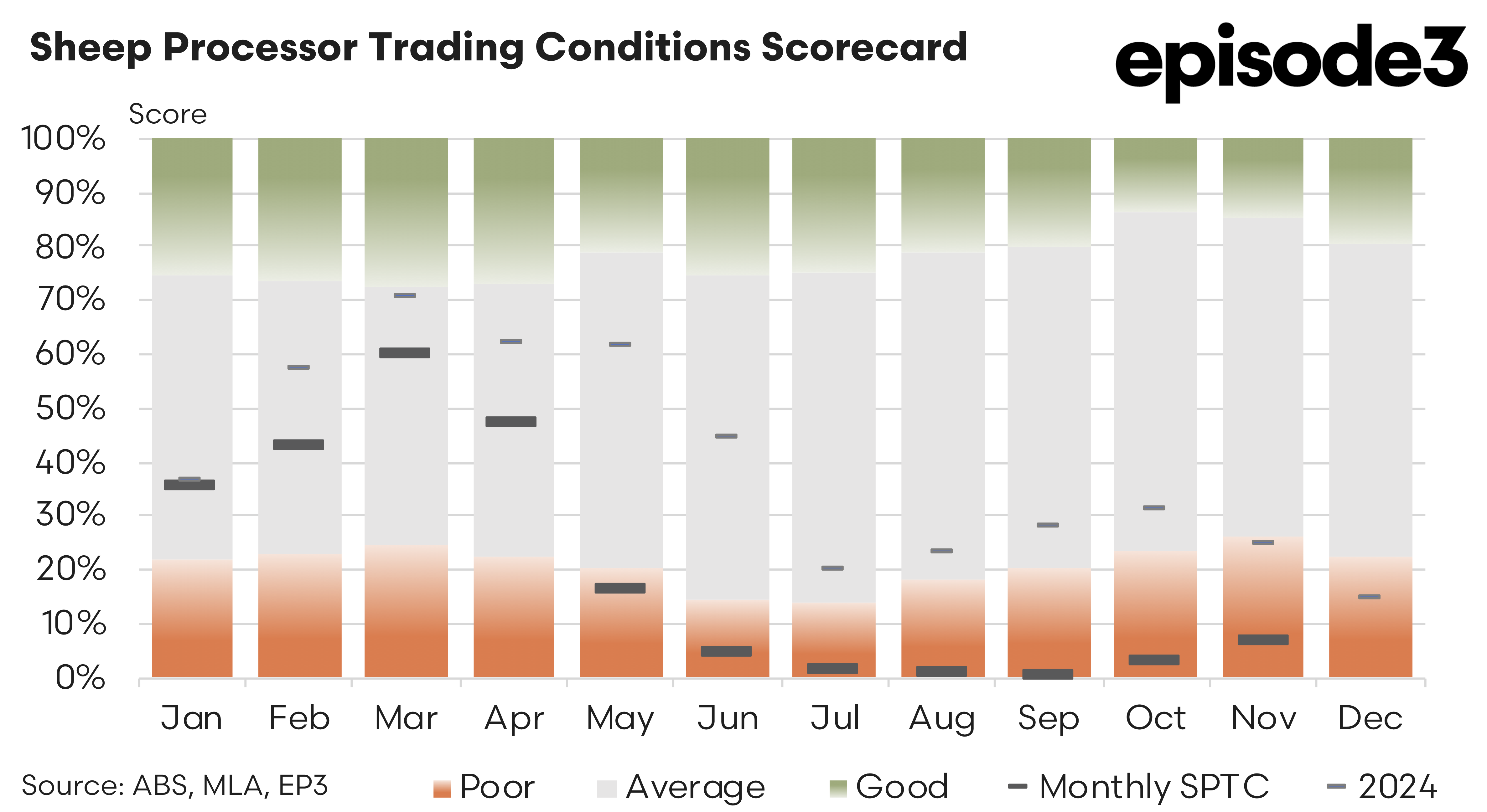

Sheep Processor Trading Conditions Model

Sheep meat processor trading conditions showed a clearer improvement through October and November, marking a notable shift from the marginal gains seen earlier in the year. While margins remain historically compressed, the lift in the Sheep Processor Trading Conditions index across these two months suggests that the sector has moved beyond simple stabilisation and into a period of modest but more tangible recovery, driven primarily by stronger export values and a temporary easing in livestock procurement costs.

In October, the SPTC index rose to 3 percent, a meaningful step up from September’s sub one percent reading. The improvement was underpinned by a combination of softer livestock prices and firmer revenue conditions. Average lamb procurement costs eased by nearly 5 percent over the month, while mutton prices declined by around 2 percent. This reduction in stock costs provided processors with some breathing room after an extended period in which tight lamb supply had consistently pushed livestock prices higher and eroded margins.

At the same time, export market conditions improved materially. Average sheep meat export values across key destinations lifted by close to 4.5 percent in October, with particularly strong performances into Malaysia and China. Export values into Malaysia increased by around 10 percent, while shipments to China saw average values rise by approximately 6 percent. These gains were important not only because of their size, but because they reflected broader strength across multiple markets rather than reliance on a single destination. Improved export pricing helped offset the still elevated cost base and reinforced the importance of diversified market exposure for Australian processors.

Domestic conditions were also mildly supportive during October. Retail lamb prices increased by around 1.6 percent, offering some additional downstream price support, although the pass through of retail price movements to processor margins remains limited and uneven. Nonetheless, the combination of lower livestock costs, stronger export returns and modest domestic price gains was sufficient to lift processor trading conditions to their strongest level in several months.

Momentum continued into November, with the SPTC index rising further to 7 percent. While still well below levels associated with comfortable profitability, this result represents a clear improvement in processor margins relative to much of 2025. Unlike October, the November outcome was achieved despite a renewed increase in livestock procurement costs. Average lamb prices lifted by around 3 percent during the month, while mutton prices rose by approximately 1 percent.

Crucially, however, export markets strengthened sufficiently to compensate for the higher livestock costs. Average sheep meat export values continued to rise, with China and the United States standing out as particularly buoyant destinations. Export values into China increased by around 7 percent in November, reinforcing the market’s role as a key volume outlet with improving price realisation. The United States delivered an even stronger result, with average sheep meat export values gaining close to 10 percent. Given the importance of the US market for higher value cuts, this uplift provided meaningful margin support and was a central driver of the improvement in processor trading conditions.

Domestic retail dynamics moved in the opposite direction during November, as lamb prices eased in the lead up to Christmas discounting. Retail lamb prices declined by around 1.1 percent, reflecting heightened promotional activity and consumer price sensitivity. While this reduced domestic revenue support for processors, the impact was more than offset by the strength in export returns, highlighting once again that export performance remains the dominant driver of processor margins in the current environment.

It is important to note that co product and offal values have not yet been updated beyond September, as the latest data from MLA is still pending. These revenue streams played a significant role in supporting processor margins earlier in the year, and there is a reasonable likelihood that further revisions to the SPTC will occur once updated co product data becomes available. Depending on the direction of those movements, the October and November results could be revised modestly higher or lower, although the underlying trend of improvement is unlikely to change materially.

The October and November results suggest that sheep meat processors are experiencing a small but genuine improvement in trading conditions. The recovery remains fragile and heavily dependent on export market strength, particularly into China and the United States. Livestock procurement costs remain elevated and continue to pose a structural challenge, especially if flock rebuilding begins in earnest into 2026. However, the ability of export values to rise sufficiently to offset higher stock costs in November is an encouraging sign and points to a more balanced revenue cost equation than was evident earlier in the year.