Structural issues looming for sheep meat processing

Market Morsel

The east coast lamb market is moving into a very different phase and the implications for processors are becoming clearer with each passing season. A series of structural charts on lamb availability, processing share and processor trading conditions point to a tightening supply environment that is arriving just as processing capacity, particularly in Victoria, has become increasingly dependent on lambs sourced from outside its own borders. When this shift is considered alongside record high lamb prices through calendar 2025, it raises important questions about risk for smaller single species abattoirs heading into the 2026 season.

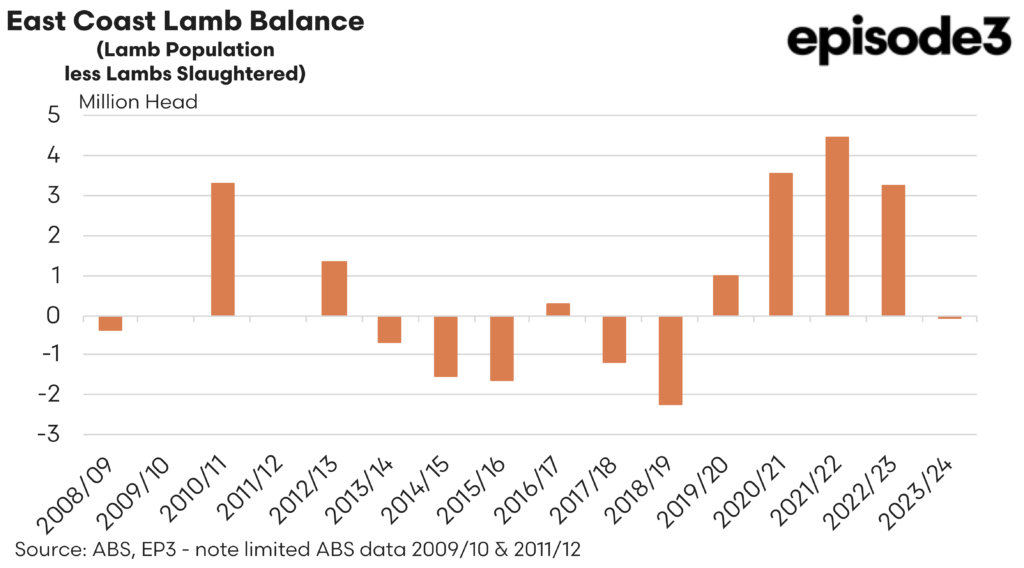

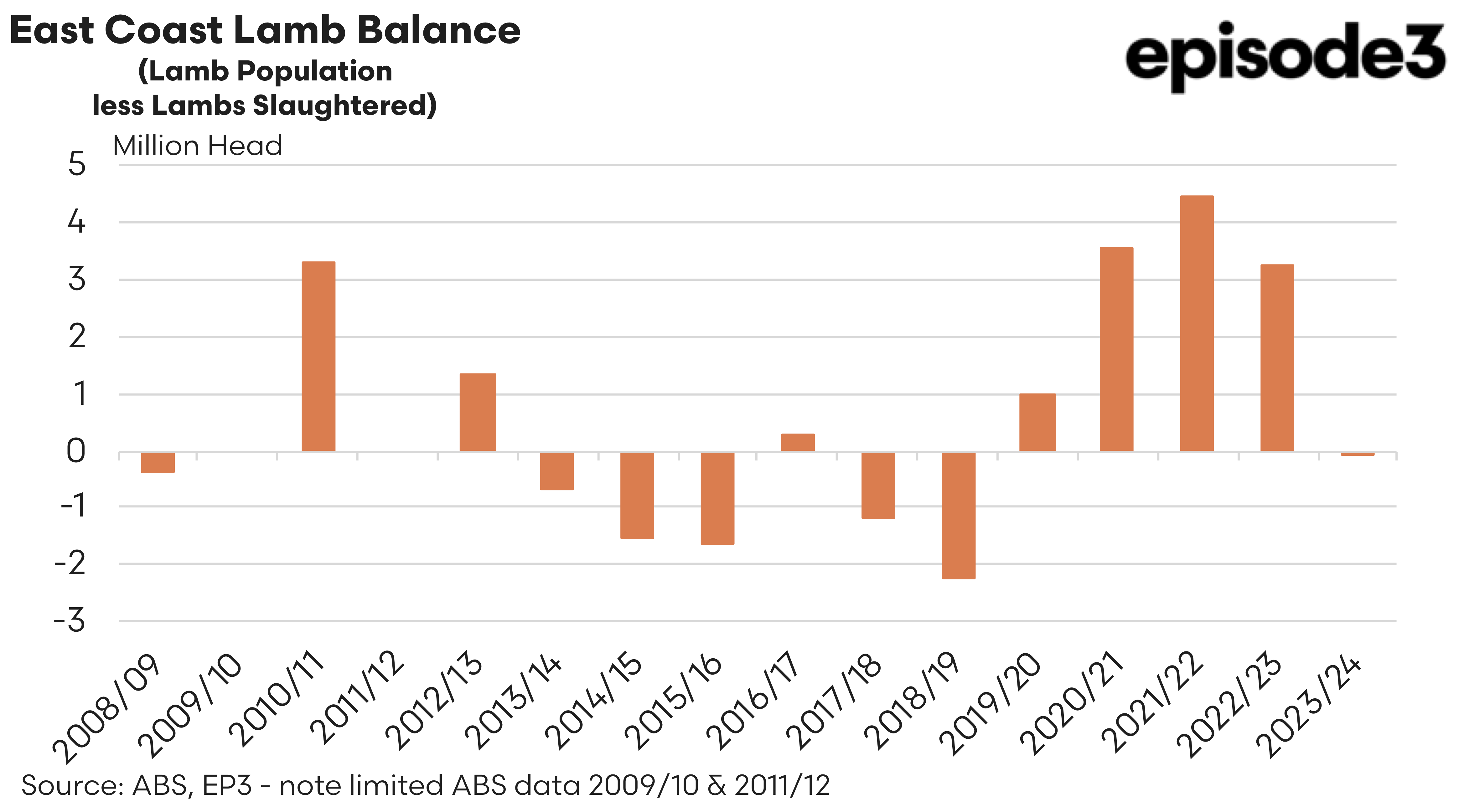

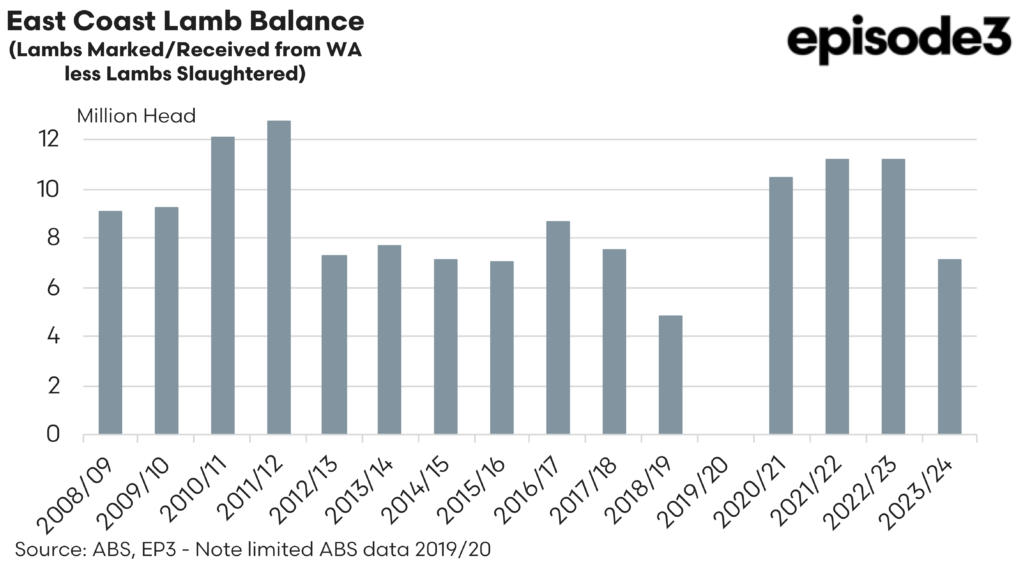

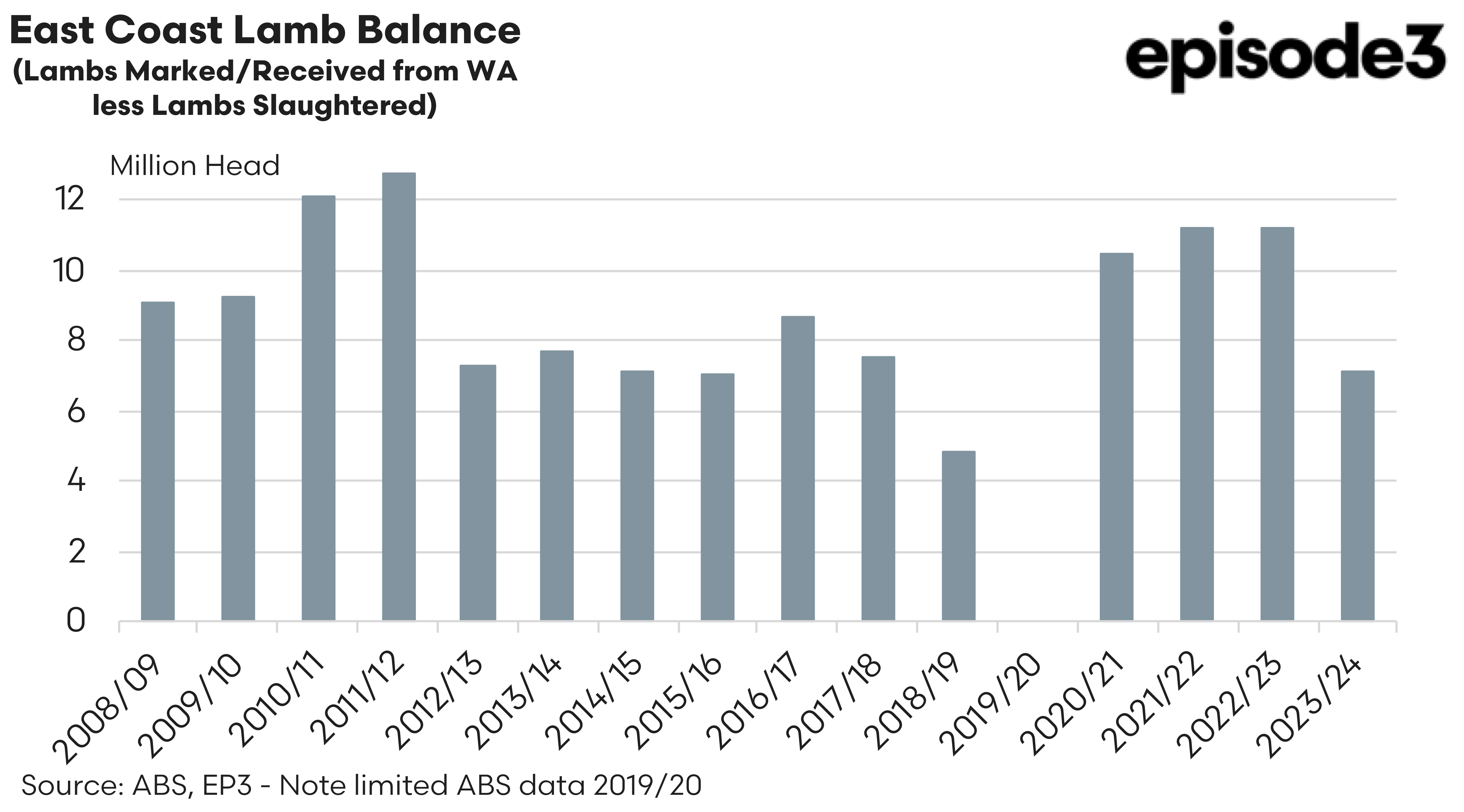

The first set of charts on east coast lamb balance show the direction of supply over time using two different approaches. One compares lambs marked or received from Western Australia against slaughter on the east coast. The other compares lamb population plus interstate inflows against slaughter. Both measures tell a similar story. From the mid 2010s through to around 2019 the balance was tight. Slaughter was running ahead of available supply and the system was drawing down lamb numbers. This period aligned with times of drought, heavy turnoff and very limited spare capacity in the pipeline.

From 2020 through to 2023 the situation reversed. Both charts move strongly into positive territory and remain there for several years. Lamb supply was rebuilding and the east coast had more lambs available than it could process at certain times. Strong seasonal conditions allowed flocks to expand. Western Australian lambs flowed east in large numbers and processors had little difficulty sourcing stock. During this phase yardings were large and prices softened at times because supply was comfortable.

The most recent data show that this rebuild phase has largely run its course. Both measures of lamb balance fall back toward neutral by 2024. The system is no longer carrying the same excess. Slaughter and available supply are much closer to equilibrium. When this tightening supply environment is overlaid with record high lamb prices in calendar 2025, the interpretation becomes more definitive. The surplus lamb cushion that existed earlier in the decade has been worked through and demand is now running closer to or even ahead of available numbers. High prices are the market’s way of signalling that the rebuild has matured and that spare supply is limited.

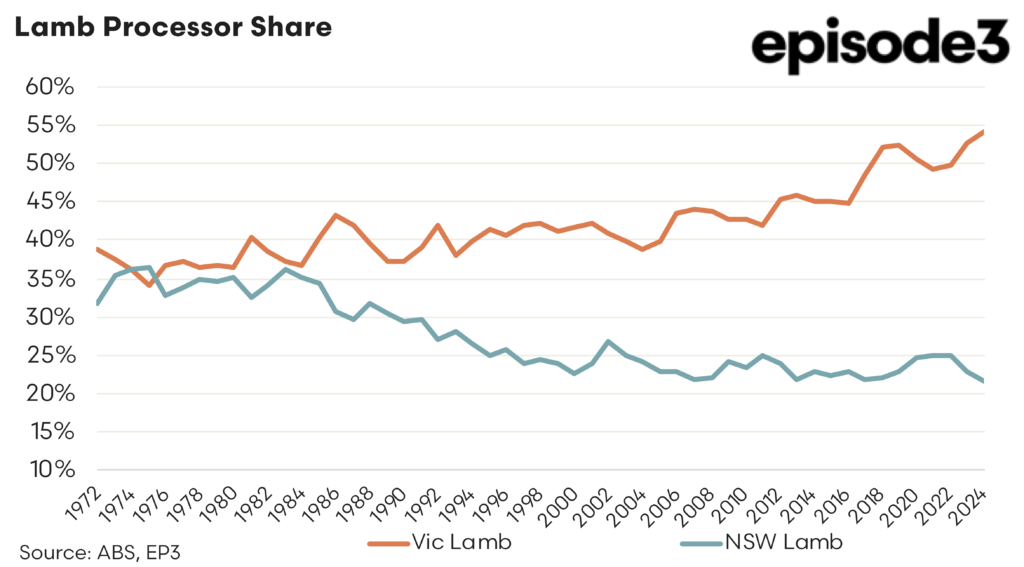

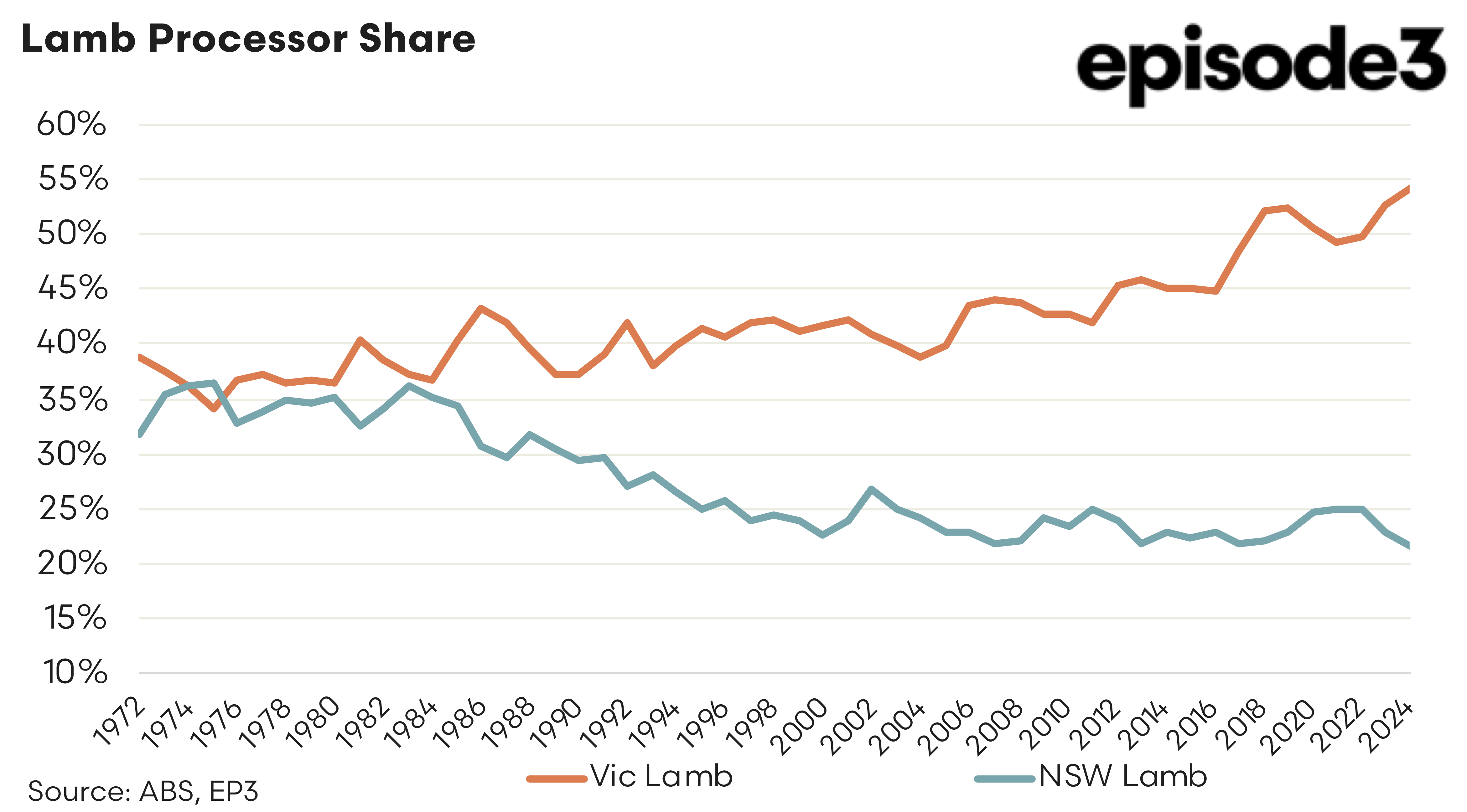

While this shift matters for producers and exporters, it has particularly important implications for processors. The chart showing processor share of lamb slaughter between Victoria and New South Wales highlights a long term structural change. Over several decades Victoria has taken a growing share of national lamb processing while New South Wales has declined. Victoria now accounts for the largest share of lamb slaughter in the country. However Victoria does not produce enough lambs within its own state to sustain this level of processing. It has become structurally reliant on lambs sourced from the other states.

In periods of abundant supply this model functions smoothly. When lamb numbers are high across the east coast and in Western Australia, processors in Victoria can draw in lambs from multiple regions and maintain high throughput. The rebuild years from 2020 to 2023 supported this system well. Large flows of lambs moved across state borders and processing plants operated at strong capacity.

The risk emerges when supply tightens. As the lamb balance charts suggest, the east coast is no longer in a rebuild phase. If availability becomes more constrained and producers begin to reduce turnoff or retain lambs for breeding, competition for stock increases. States tend to prioritise local processing when numbers fall. Interstate flows become less reliable. Plants that rely heavily on purchased lambs rather than captive supply are exposed first. In this context the structural dependence of Victorian processors on lambs from other states becomes a vulnerability.

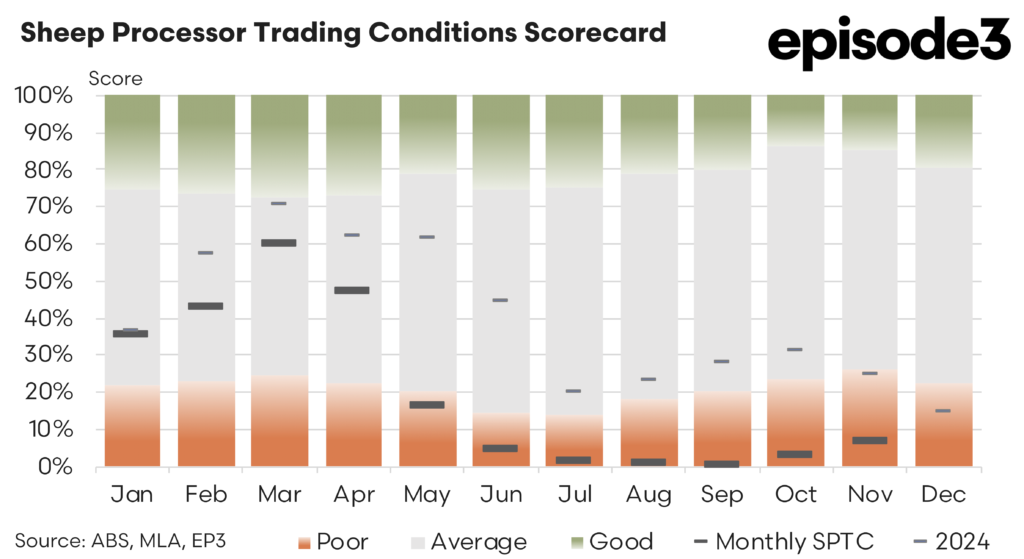

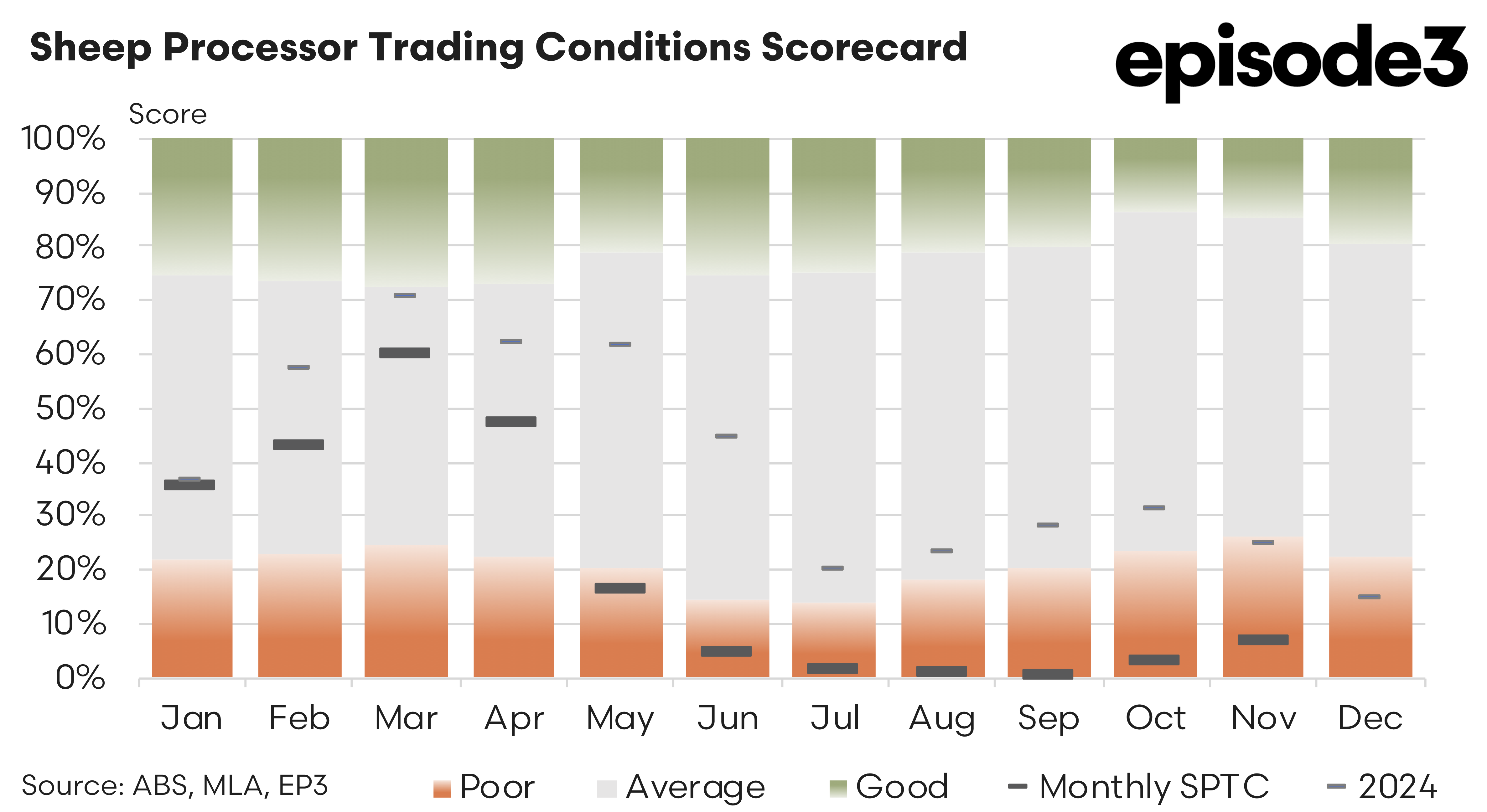

The sheep processor trading conditions scorecard provides further context. It shows that processor margins have been difficult for an extended period. There have been windows of improvement but overall trading conditions have been volatile and often tight. Procurement costs have risen with livestock prices while export returns have not always moved at the same pace. When livestock prices surge as they did in 2025, processors faced a squeeze. They paid more to secure lambs while selling into export markets that may not fully absorb the cost increases.

Large multi species processors with diversified operations and strong balance sheets are better able to manage this volatility. They can spread risk across species and markets and can absorb periods of weak margins. Smaller single species abattoirs have fewer options. They rely heavily on consistent throughput of lambs and on maintaining processing margins that are often thin. When supply tightens and procurement costs rise, their operating model becomes more fragile.

This is particularly relevant in Victoria where the concentration of lamb only plants is high and where reliance on imported lamb flows is significant. If interstate supply becomes less available or more expensive to secure, these plants face a direct risk to throughput. Even a modest reduction in weekly kill numbers can affect labour utilisation, operating efficiency and cost recovery. Plants that cannot secure sufficient numbers may be forced to reduce operating weeks or shorten shifts. In extreme cases prolonged supply shortages can threaten long-term viability.

The combination of tightening east coast supply, record livestock prices and challenging processor margins creates a complex outlook for 2026. It does not necessarily point to widespread closures or a collapse in processing capacity. Demand for Australian lamb remains strong and global markets continue to support exports. However the environment is likely to be more competitive and more volatile than the rebuild years. Processors will need to compete harder for lambs and margins will remain sensitive to procurement costs.

For smaller single species abattoirs the risks are clear. Those with strong supply relationships, efficient operations and access to multiple sourcing regions will be better placed to manage the transition. Those heavily reliant on opportunistic purchases or long distance flows may find the environment more difficult. In Victoria the structural dependence on lambs from other states means that local processing capacity is tied closely to interstate supply dynamics. If those flows tighten, the pressure will be felt quickly and some processor consolidation may be on the cards.