Swings and roundabouts

Beef Processor Profitability Index - July 2024 Update

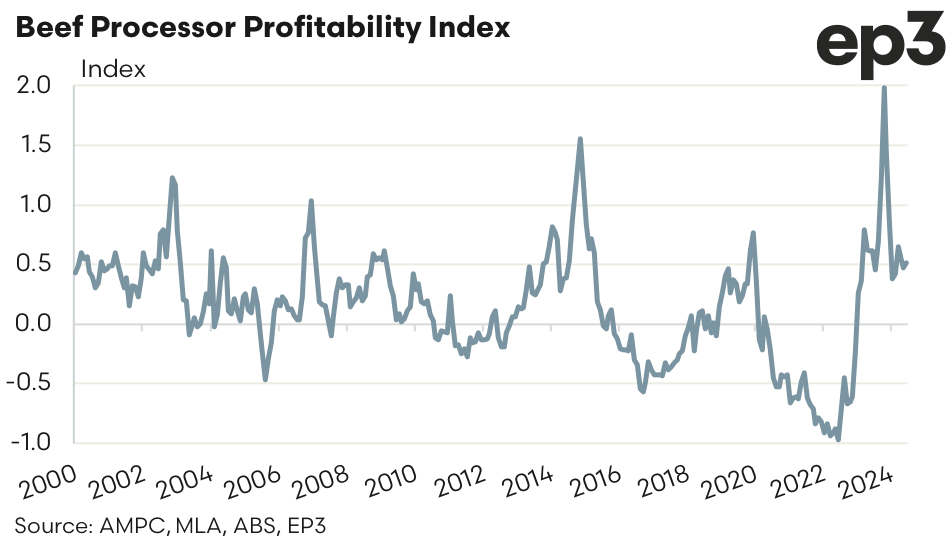

The Beef Processor Profitability Index (BPPI) theoretical model created by Episode 3 continues to show that the current operating environment is favourable for Australian beef processors with the index trekking sideways in profitable territory. Since the last update the BPPI average on an annual basis has climbed marginally from 0.42 to 0.5 as at the end of June 2024.

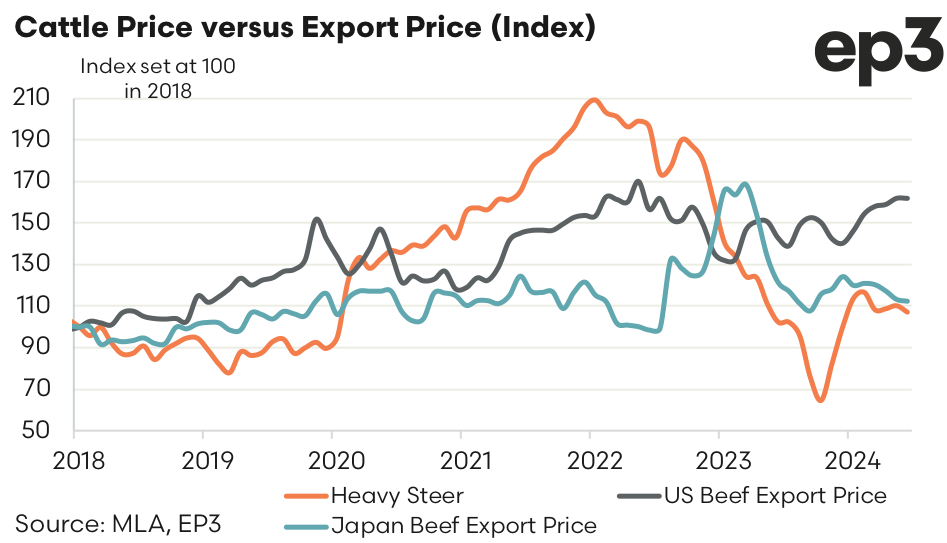

Under-pining the improved circumstances for beef processors has been increasing beef export prices, particularly in the USA since the start of 2024, while cattle prices in Australia have mostly trended sideways in a tight range. An index of average US imported beef prices from Australian sourced products shows that since the end of 2023 the price index has lifted from 140 to 162, a gain of nearly 16%. In contrast, the Australian Heavy Steer index has lifted by just 7% over the same time frame. This demonstrates in a rudimentary manner that processor costs, such as the purchase of stock for processing, hasn’t lifted as much as export receipts during 2024 thereby improving operating margins.

Average beef export values for Australian beef export to Japan haven’t been as robust as the trend displayed in the USA, but currently the USA is top destination for Australian beef exports ahead of Japan as a beef export destination so they are having a greater impact on beef processor profitability this season.

It is important to note at this point that the BPPI calculation is based upon a theoretical processor margin model and is a simple representation of the Australian beef processing sector. A BPPI in negative territory does not suggest that all processors are losing money, similarly a BPPI in positive territory doesn’t suggest that all processors are making money. A more useful reading of the BPPI would be that a negative index suggests a tougher processor trading environment, versus a positive BPPI which is reflective of a more beneficial processor trading environment.

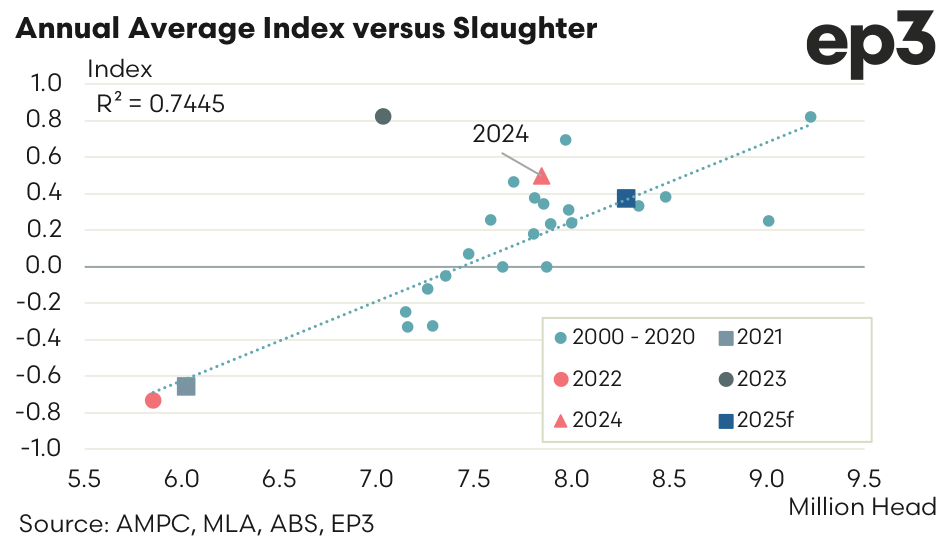

Analysis of the BPPI as an annual average versus annual Australian cattle slaughter volumes shows that tight supply, low slaughter volumes and high cattle prices that are often seen during herd rebuild phases (like during 2020 & 2021) tends to see a more difficult trading environment for the Australian beef processing sector. Meanwhile, abundant supply, high slaughter levels and relative lower cattle prices usually seen during herd liquidation phases (such as the 2014/15 drought and the 2019 season) can see processor profitability improve.

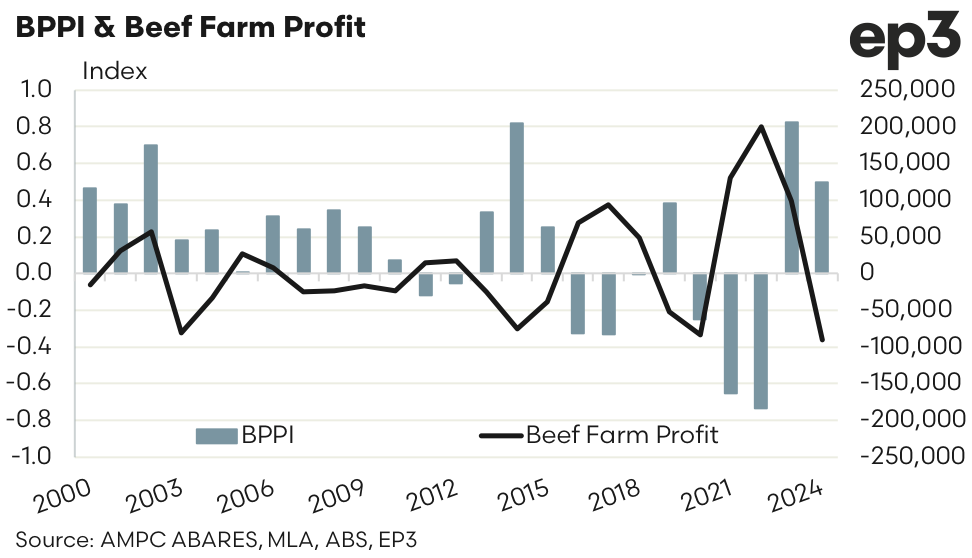

Another interesting comparison for the annual average BPPI is to overlay the index against the annual ABARES beef farm profitability calculations. Since 2000 this highlights that often when beef farmers are making money the beef processing sector is having a hard time. Conversely, when profitability returns to the processing sector we often see beef farm profitability being put under pressure.

Given that beef farms and processors sit at opposite ends of the supply chain, this inverse relationship between the profitability of the two sectors should come as no surprise. One strategy to help smooth out these fluctuations between the two sectors could be the development of a functioning beef/cattle futures market in Australia so that each participant in the sector can manage some of their price and margin risk. An alternative hedging opportunity could be provided by farmer co-operative operated/owned meat works such as the model used in the WA sheep sector for WAMMCO.

Recently WAMMCO announced a $A21.8 million dividend to be paid to farmer shareholders this season, distributing profits back to the farmer during a time when WA sheep & lamb prices have been under pressure and on-farm margins have been very tight.