The sun also rises in the east

Market Morsel

Reports of the demise of live sheep exports may be a little exaggerated, but it is hard to deny that annual volumes have been weakening over the last few years. For the WA sheep producer the prospect of an end to the live sheep trade is a sobering thought as reliance on this avenue for turnoff is still significant and as has been shown in recent years, particularly during the northern hemisphere summer moratorium WA price spreads compared to the east coast deteriorate when live export buyers are not operating in WA.

Alternatives to live export for the WA sheep producer will be to turnoff into the domestic processing sector in WA, provided they have the capacity and labour force to cope with the additional volumes, or they can look to transport their sheep to the east. However, the eastern states has proven to be a fickle destination.

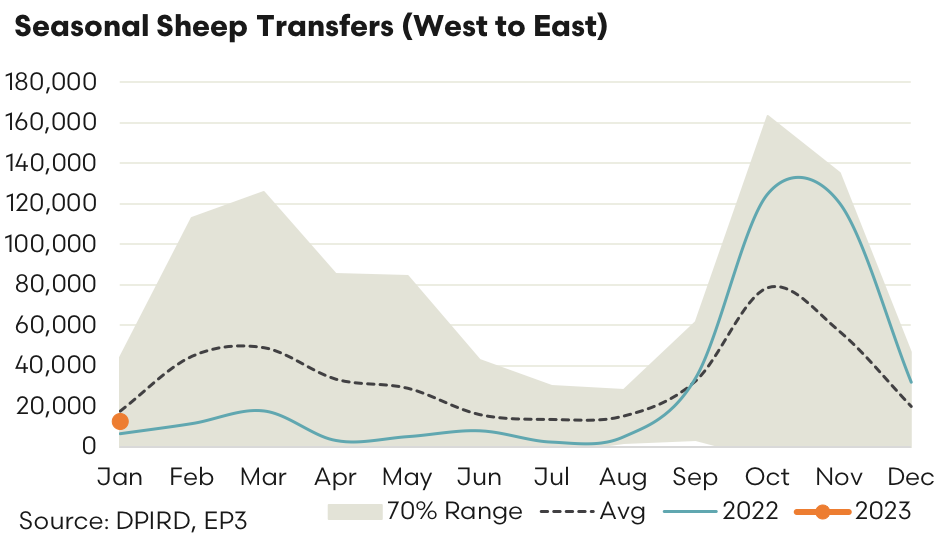

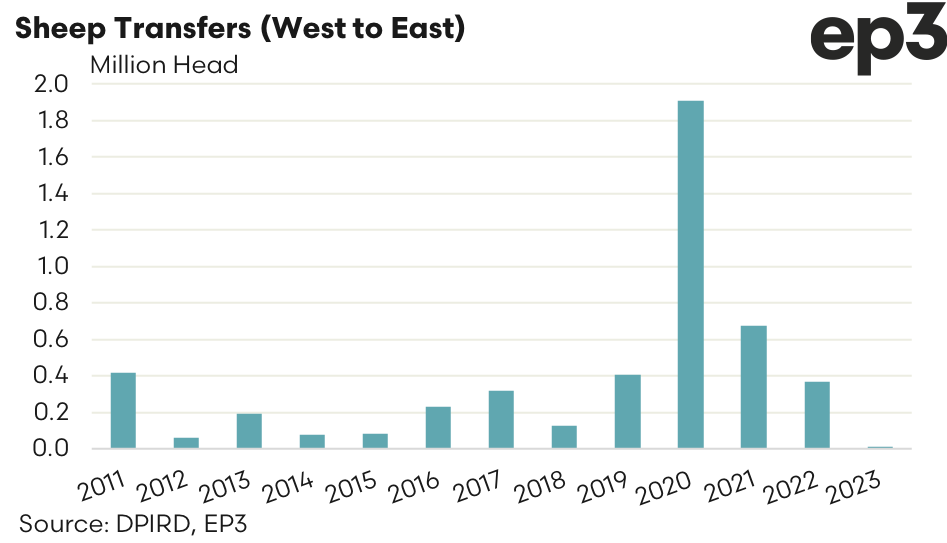

In 2022 the first three quarters of the year saw only 91,000 head of sheep transported from west to east. In the final quarter of the year, mainly in October and November, an additional 277,000 head made their way from west to east as the price discount of western sheep to their eastern counterparts widened significantly, thereby making the transport worthwhile for the eastern buyer.

As at January 2023 there have only been 12,500 head of sheep transferred from west to east, which is about 5,000 head under the average trend for January. For the eastern states to be a viable option for turnoff for the WA sheep producer it has to be available more readily, and not just when the price discount is so punishing for the WA producer.

An eastern states producer facing drought conditions aren’t likely to have strong demand for sheep, even if they are a very cheap option. The 2014 and 2015 season, which were very dry years on the east coast, saw minimal flows of sheep from west to east (of 75,000 and 85,000 sheep, respectively). Nowhere near enough to support the WA producer as a reliable option for turnoff.