Us and them

The Snapshot

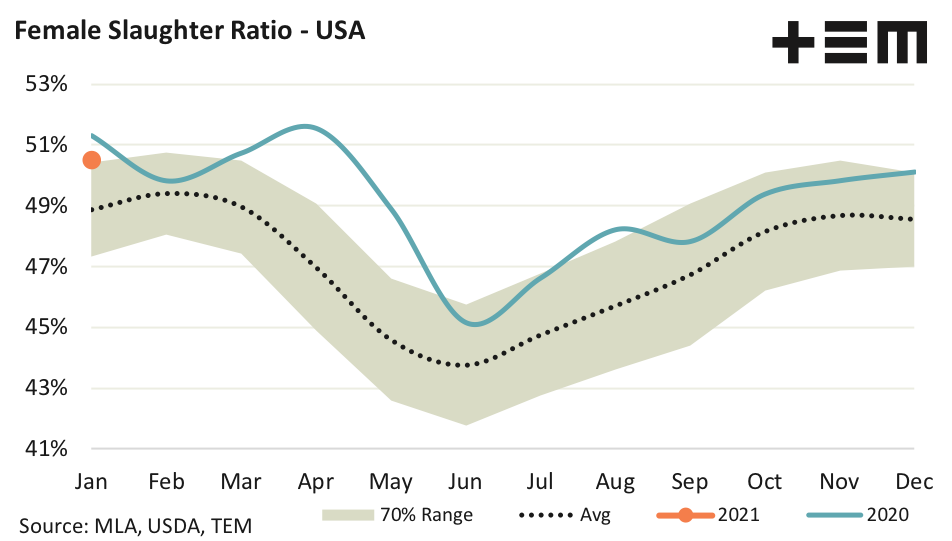

- The US are in their third year of a technical herd liquidation with their female slaughter ratio sitting above 47.5%.

- The 2020 season saw the annual average FSR reach 49.1%, resulting in a 0.4% decline in the US herd.

- January 2021 saw the US FSR open the season at 50.5%, well entrenched in liquidation territory.

- USDA forecasts show a herd increase of 0.6% is expected during 2021, which seems unlikely unless the FSR drops away dramatically in the coming months to average 47% over the 2021 season.

The Detail

US beef markets are a key driver of global beef values. They are especially important to the Australian cattle market because, over the longer term, our prices tend to take the lead from the US. Indeed, the fortunes of the Australian beef sector are inextricably linked to the US as they are our primary competitor into our key beef export markets of Japan and South Korea and they are an important beef export customer, in their own right.

Just as we keep a close eye on the Australian cattle cycle of rebuild and liquidation, via the female slaughter ratio (FSR), we do the same for the US cattle cycle. To recap on how the FSR can be used to determine rebuild/liquidation in Australia and the US have a read of our article on the US FSR from August 2020 and on the Australian FSR update from February 2021.

The 2020 season saw the US FSR finish the year at an average of 49.1%, well above the 47.5% threshold that signifies rebuild or liquidation. Last year the US herd was in liquidation phase (which began in 2019) and the herd eased 0.4% from 94.8 million head to 94.4 million head. January data from the United States Department of Agriculture (USDA) shows that the monthly FSR has come in at 50.5%, at the upper end of the “normal” range that could be expected for January and well entrenched in herd liquidation territory.

While it is early days yet, we can assess the likely outcome for the US herd during 2021 in the event that their FSR remains at the upper end of the 70% range for the season. An FSR that remained at the upper end of the “normal” range would average 48.9% over the year.

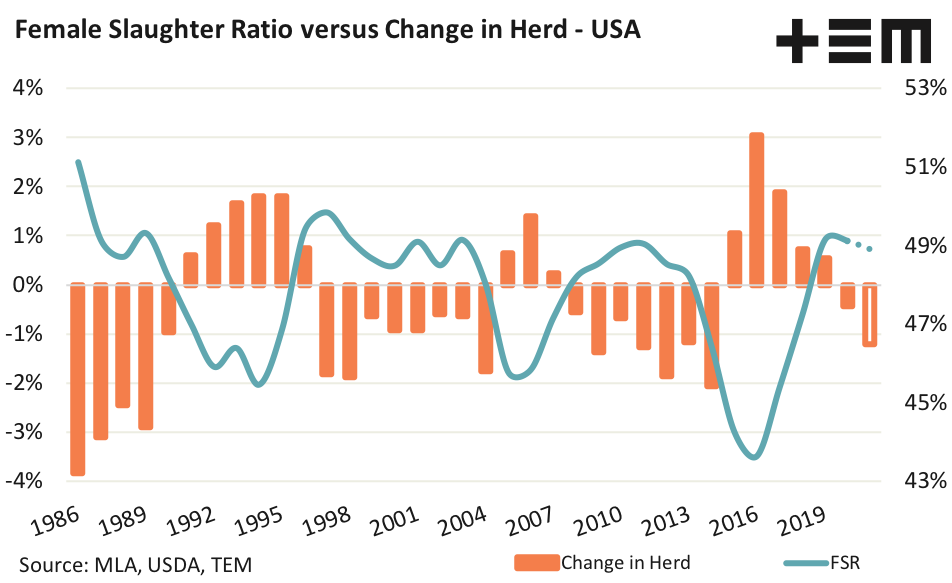

Correlation analysis between the annual average FSR to the annual change in the US herd suggests an FSR of 48.9% would likely see a decline in the herd by 1.2%, taking the US herd to 93.2 million head during 2021. However, USDA baseline forecasts for the 2021 season have the US herd growing by 0.6% this season to reach 95.0 million head.

For the US herd to grow to 95.0 million head by the end of 2021 the FSR would need to be trending at the lower end of the “normal” range for the entire season, averaging an annual figure of 47% and going back into a rebuild phase this season. This seems unlikely, particularly when we assess previous US cattle cycles.

Over the past century there has been eleven cattle cycles of rebuild and liquidation. The average time spent in rebuild was six years, with the most common length of liquidation phase being four years. History suggests that there is at least one more year of liquidation for the US herd beyond 2021, and perhaps up to three more years of liquidation.