What’s in store for 2026?

Red Meat Outlook for 2026

Beef

Looking ahead to 2026, the Australian beef sector faces a year that could be shaped by three major structural forces, each with the potential to reshape supply, demand and global trade flows. The first is the prospect of herd rebuilding in both Australia and the United States, two of the world’s most influential cattle producers. The second is the possibility of a renewed trade agreement between the US and China, reminiscent in form if not detail to the Phase One Deal struck during the first Trump administration. The third is Brazil’s anticipated entry into the Japanese beef market, a development that would alter competitive dynamics in one of Australia’s key export destinations. These themes intersect with climate, geopolitics and shifting consumer markets, and together they form the foundation of what producers, processors and exporters should be monitoring as the sector moves into 2026.

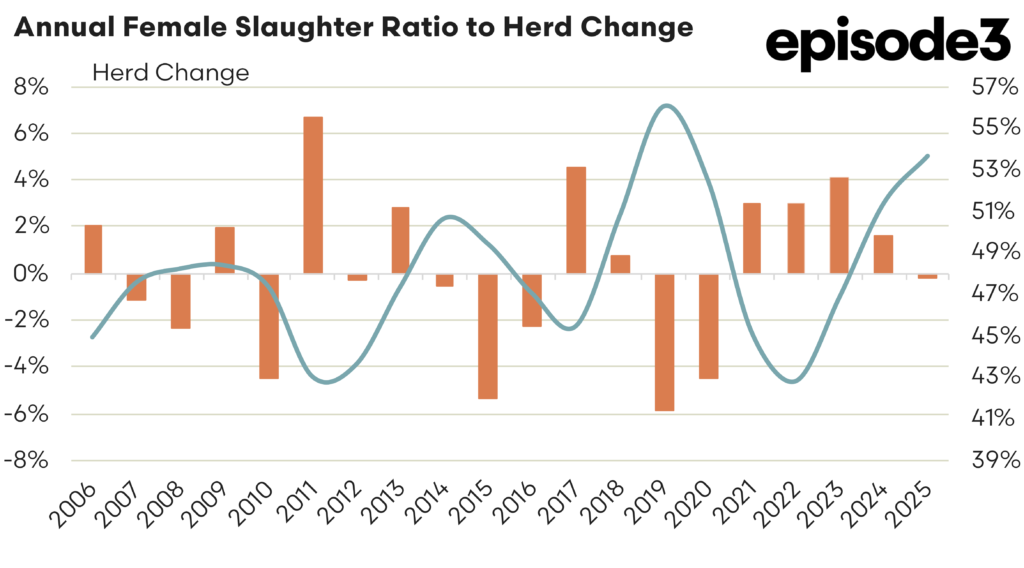

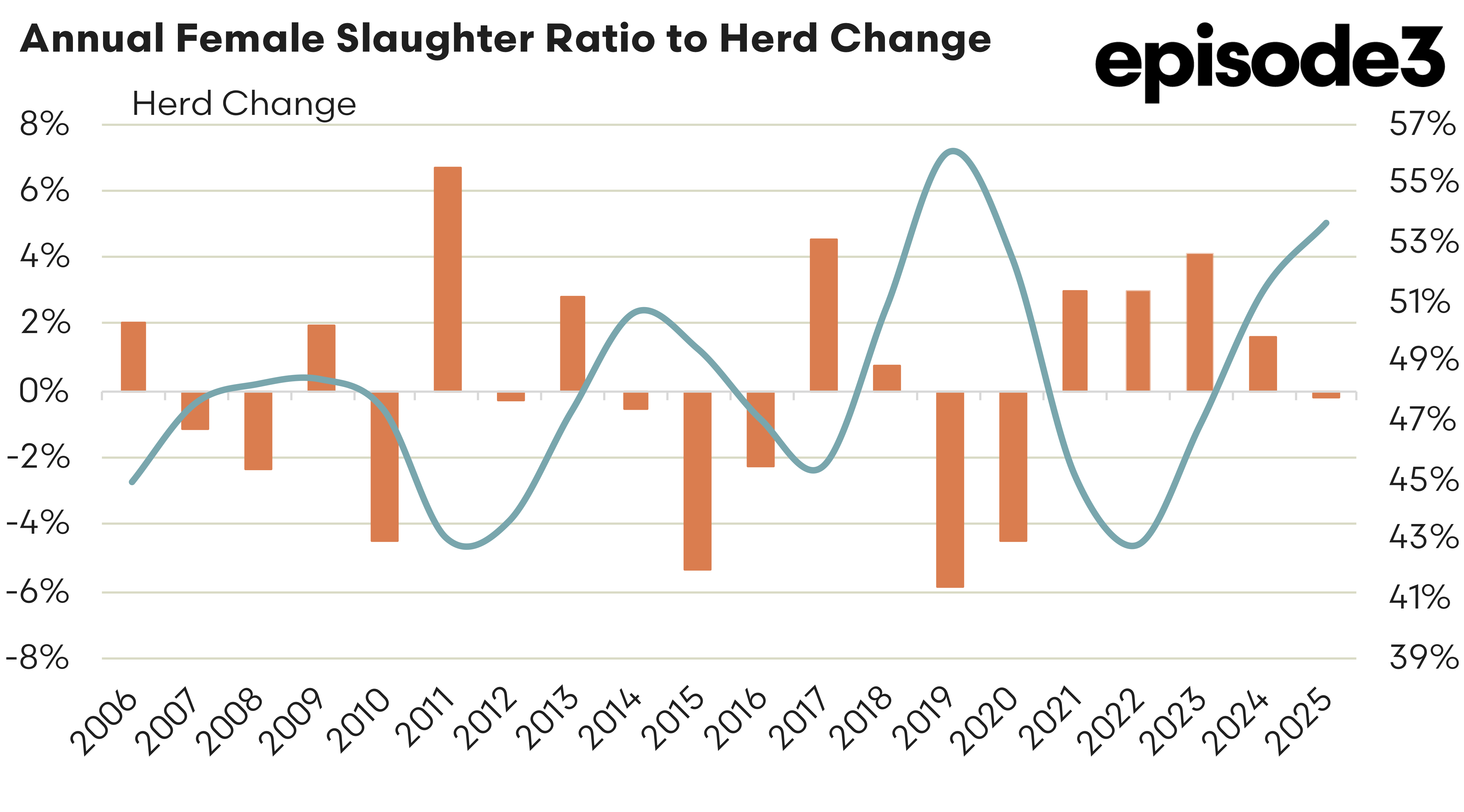

The Australian cattle herd appears to be nearing an inflection point after several years of contraction and elevated slaughter. Indicators such as Female Slaughter Ratio (FSR) already suggest that the broader livestock sector is approaching rebuild territory, and cattle are expected to follow a similar path. The Episode 3 assessment of current herd dynamics points toward a likely shift into a rebuild phase early in 2026, contingent on seasonal conditions and the strength of the autumn break. A fair to good autumn would be enough to trigger producer confidence, particularly in southern regions where rain in late 2025 has already improved pasture conditions. A tightening of supply is the natural consequence of a rebuild, and if producers hold back females or reduce turnoff, slaughter numbers would ease, lifting demand for feeders/young catttle and retaining upward pressure on prices. The supply contraction would not be instantaneous, nor would price rises be uniform, but the underlying conditions are aligned with a more constructive market structure for producers. In essence, 2026 may become the first genuine rebuild year since the last substantial restocking period that followed previous drought cycles.

The United States is on a similar trajectory, although at a more advanced stage of the liquidation cycle. The US has been reducing its herd for six consecutive years, driven by drought, feed costs and tightening margins across cow-calf and feedlot sectors. Episode 3’s analysis suggests liquidation is nearing exhaustion and the signals mirror those seen historically at the end of prolonged downsizing phases. Rebuilding in the US would have consequences that reach far beyond domestic markets. Fewer cattle for slaughter would restrict US beef availability, tightening global supply and reducing US competitiveness in export markets such as Japan, South Korea and China. Australia has already benefited from reduced US competition during 2024 and 2025 and a US rebuild would magnify that effect. In key markets where Australian beef already has a differentiated position, particularly in grass-fed and premium grain-fed categories, a constrained US supply would help sustain price strength. If both Australia and the US enter a rebuild phase simultaneously, global beef supply would be structurally tighter for several years, reinforcing the likelihood of firm pricing across heavy steers and boxed beef.

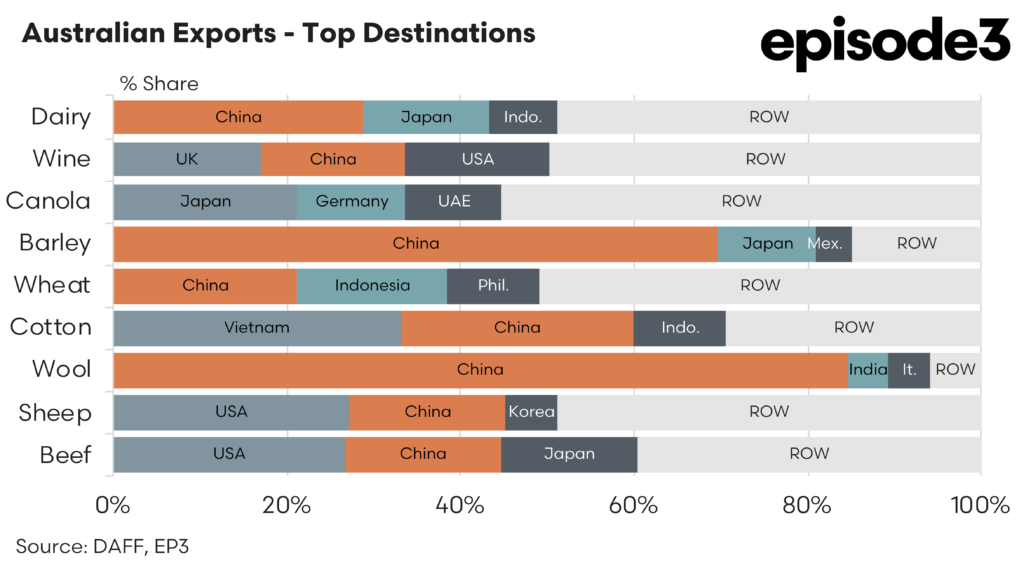

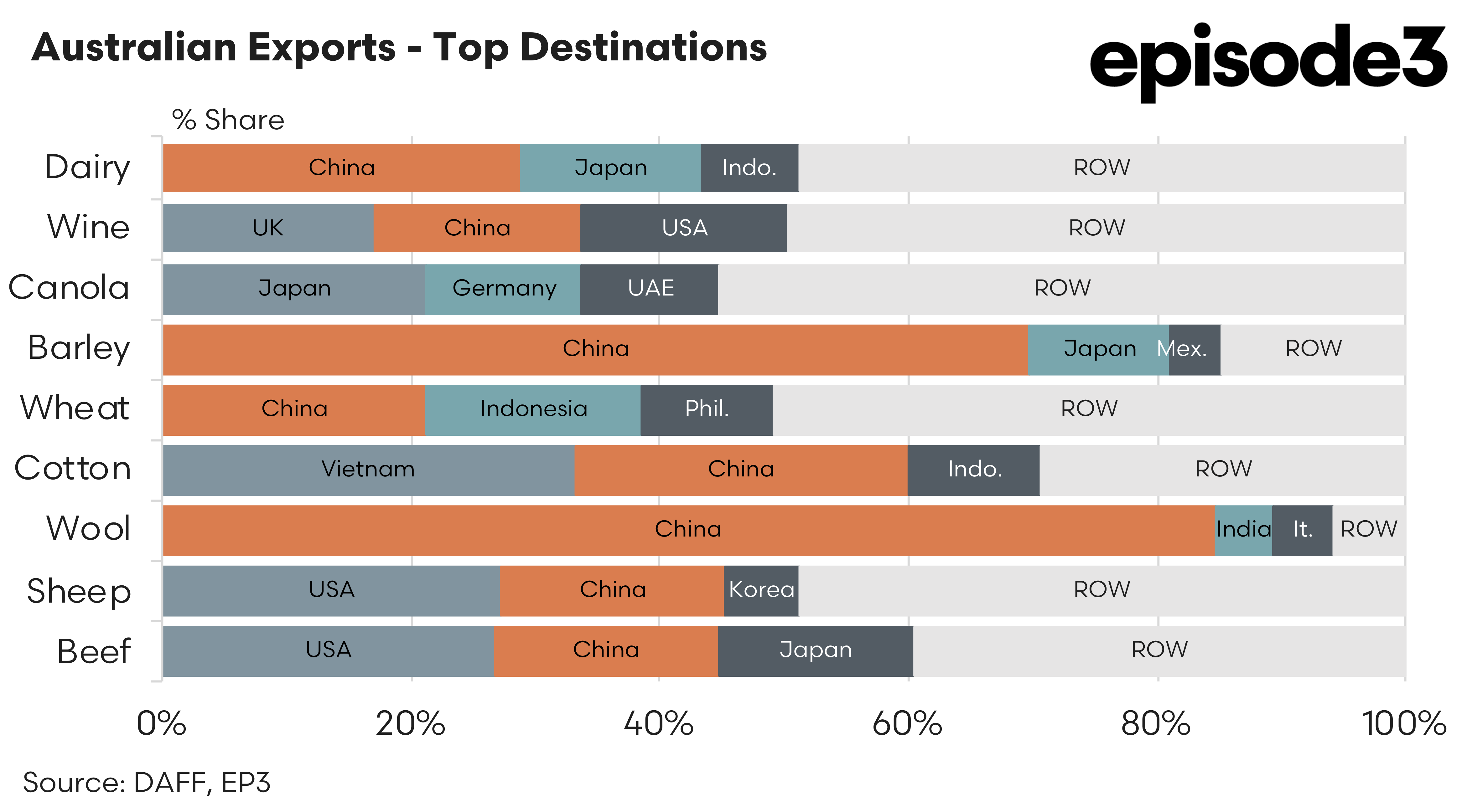

The second major theme for 2026 is trade diplomacy, particularly the prospect of a new agreement between the United States and China. The last time Beijing and Washington reached a major settlement, the outcome was widely viewed as favourable to US exporters. Australian beef, barley, lobster, wine and timber all faced commercial headwinds as China adjusted its import profile to satisfy elements of the Phase One commitments. The present environment is different. The US has spent several years targeting a wide range of trade partners with tariffs and investigations, which has strengthened the global appetite among many countries to diversify away from US dependence. Canada, the EU and the UK have all publicly articulated intentions to deepen trade relationships in Asia and the Pacific. For China, this changes the calculus. A return to favouring the US as disproportionately as in 2020 would undermine its strategic objective of widening its trading base.

Any new agreement between the US and China is therefore unlikely to be as punitive for Australian exporters as the previous iteration. Moreover, if such a deal helps stabilise Chinese GDP growth and lifts consumer confidence, the flow-on effects would be positive for Australia. China remains a cornerstone market for Australian agriculture, from wool and wine to dairy and red meat. Stronger Chinese consumption would translate into firmer demand across these categories, reinforcing Australia’s position as a preferred supplier of high quality, reliable agricultural products.

The third theme is Brazil’s expected access to the Japanese beef market, a development that has generated understandable concern for exporters. Brazil is the world’s largest beef exporter and its low cost of production allows it to trade aggressively in commodity markets. Its entry into Japan would certainly intensify competition in the manufacturing beef segment, particularly lean trimmings for ground beef. However, the effect on Australia’s premium grain-fed trade is likely to be modest. Japanese buyers who rely on Australian grain-fed beef do so because of consistency, quality assurance, food safety frameworks and supply chain alignment. These strengths are difficult for new entrants to replicate quickly. While Brazil will shape the lower end of the market and apply some pressure on commodity pricing, Australia’s differentiated product will remain competitive where quality is essential. The largest impact may be felt in blended product and lower value trimmings, but not in the high-end categories that underpin Australia’s long-term position in Japan.

Taken together, these three themes outline a beef market entering 2026 with tightening supply fundamentals, shifting geopolitical dynamics and evolving competitive structures. A dual rebuild in the US and Australia would compress global production. A US/China agreement would introduce new certainty into key demand channels without the heavy downside risks previously borne by Australian exporters. Brazil’s entry into Japan underscores the need for Australia to maintain its premium value proposition, but it does not threaten the core of that market. For producers and exporters, 2026 is shaping as a year defined not by crisis but by transition, with the potential for favourable market settings if these developments unfold in concert.

Sheep & Lamb

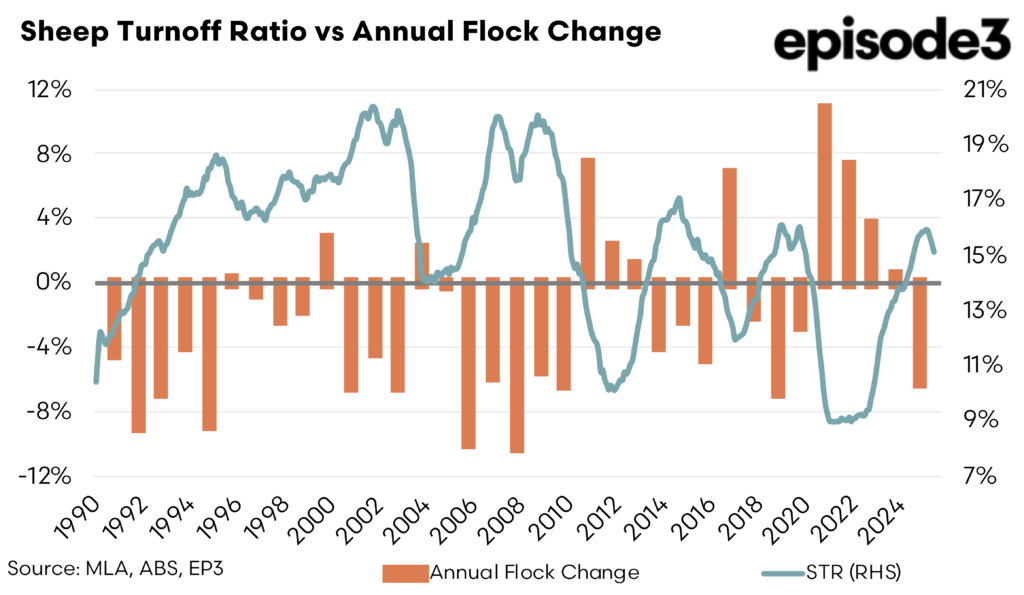

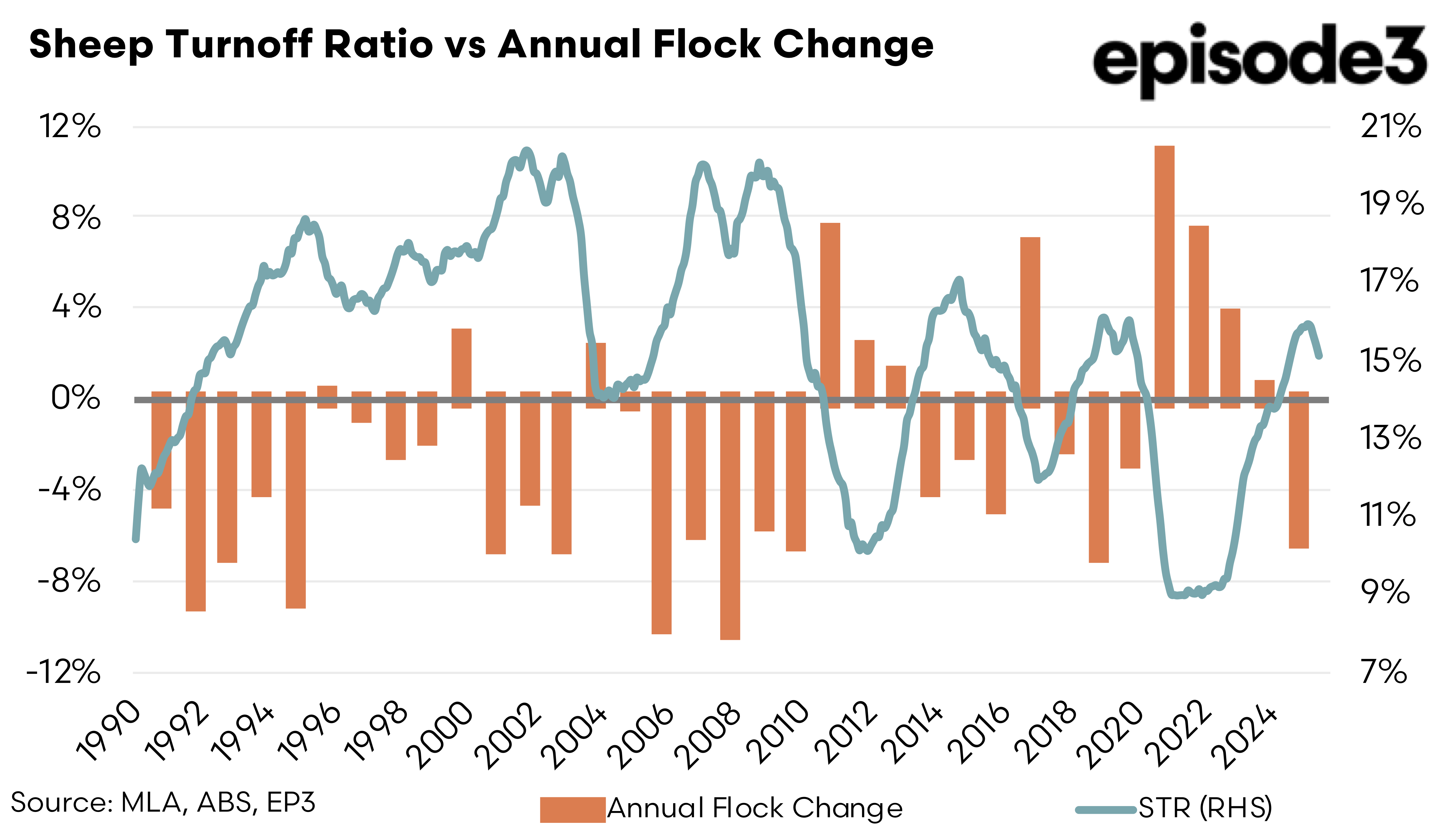

The outlook for Australia’s sheepmeat and lamb sector in 2026 will be shaped by three major developments that are already emerging across global supply and demand channels. The first is the prospect of an Australian flock rebuild, signalled clearly by the recent shift in the Sheep Turnoff Rate, which is now moving back toward rebuild territory after several years of elevated liquidation. The second is the continued contraction of New Zealand’s sheep flock, a long running structural adjustment that is reducing export capacity and creating a clearer runway for Australian exporters in their expansion into key growth markets. The third is the risk of a slowdown in the United States economy. The US remains Australia’s most valuable lamb destination and a recession, or even a recession-adjacent softening in consumer spending, would affect foodservice channels where lamb consumption is concentrated. Together these three themes provide a roadmap for what producers, processors and exporters should monitor as the sector moves into 2026.

The first major development is the likely transition of the Australian flock into a rebuild phase. The Episode 3 analysis of the Sheep Turnoff Rate shows a clear inflection point forming after a prolonged liquidation cycle. The STR has eased from its mid-2025 highs and is now edging closer to the critical fourteen percent threshold that historically marks the beginning of a rebuild. This decline signals that producers are reducing slaughter rates relative to total flock size, with more animals being retained on farm rather than moving into processing. Rainfall across southern Australia during the back half of 2025 has already improved feed availability and has been enough to trigger an uptick in producer sentiment, although a decisive shift toward rebuild will depend on the quality of the 2026 autumn break.

A fair to good start to the season would strengthen confidence further and would likely see increased retention of ewes and ewe lambs, tightening supply of finished lambs as the year progresses. Once the STR heads back toward rebuild thresholds and stays there consistently, market structure begins to tighten and price support follows. For lamb and mutton alike, 2026 is shaping as the first meaningful year of flock expansion since the strong growth phase earlier in the decade and the pricing environment should gradually reflect this shift.

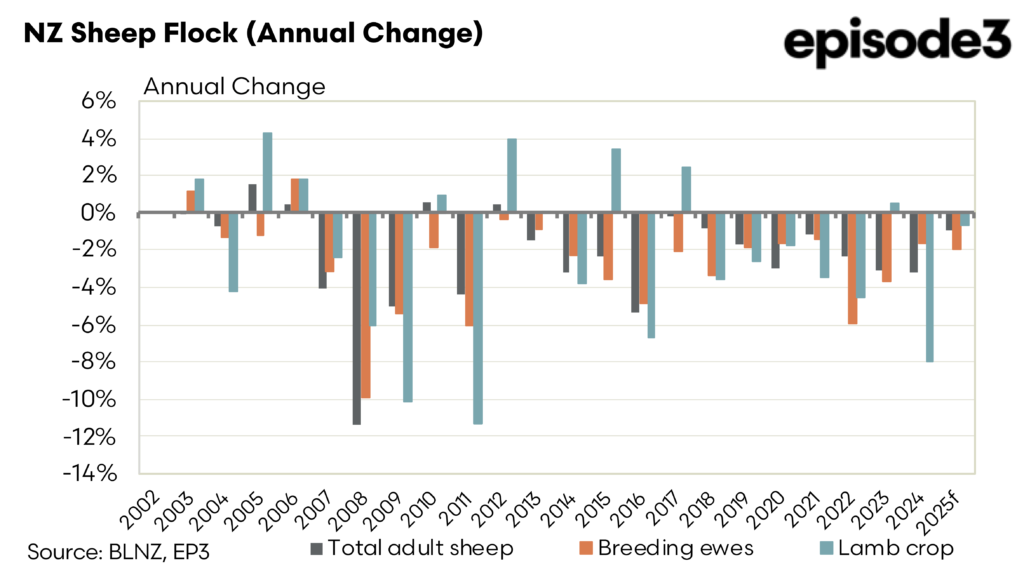

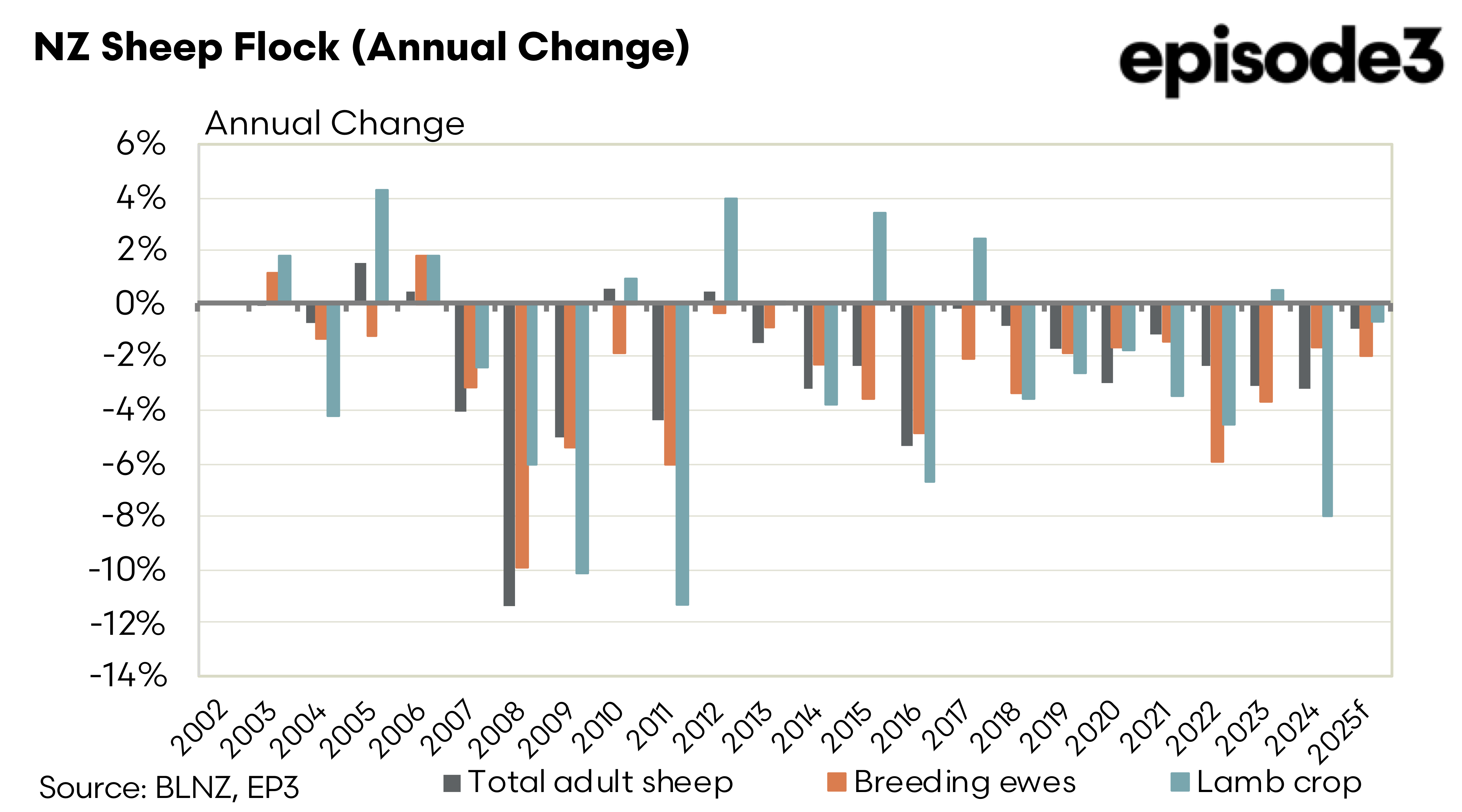

The second key theme is the ongoing structural decline in New Zealand’s sheep flock and the resulting contraction in export supply. New Zealand has long been Australia’s principal competitor in globally traded sheep meat, particularly in premium markets where product quality, branding reputation and long term customer relationships matter. However, the Episode 3 analysis of New Zealand’s flock trajectory shows a multiyear downtrend that is becoming increasingly pronounced. High on-farm costs, competing land use and strategic shifts toward other agricultural enterprises have pushed the national flock to its lowest levels in more than a century.

Export volumes have fallen accordingly and with fewer lambs and sheep available, New Zealand’s ability to service some of the growth markets that have emerged in Asia and North America has diminished. This creates a clear opportunity for Australia. Growth markets that once relied on blended Australian and New Zealand supply are now increasingly turning to Australia alone for year round consistency. The reduction in New Zealand competition does not eliminate all export pressures, but it does provide Australia with a far less congested path to expanding volumes in both established and emerging destinations. Markets such as the United States, China, South Korea, Malaysia and the Middle East have demonstrated strong depth in recent years. With New Zealand’s structural decline continuing, Australia is in a stronger position to secure additional market share and build more resilient long term commercial relationships.

The third and most external theme is the risk of a United States economic downturn. The US economy has been impressively resilient, but more recent data points suggest a cooling labour market, pockets of financial strain and renewed inflationary pressure. If inflation proves persistent, the Federal Reserve may pause its easing cycle or even resume tightening. Either scenario risks tipping the US economy into a recession or at least into a softer growth period.

For the Australian lamb industry this matters profoundly. The US is the number one export destination for Australian lamb by value and much of that product is consumed through high end foodservice channels. Lamb in the US is strongly associated with fine dining, premium restaurants and special occasion meals. These are the sectors most exposed during recessions or periods of reduced discretionary spending. When American consumers tighten their budgets, dining out is one of the first behaviours to change. Even without a formal recession, a period of slower growth combined with stretched household finances can reduce the frequency of restaurant visits. The effect is often magnified for proteins positioned at the premium end of the menu. Australian lamb fits squarely into that category. A softer US economy would not collapse demand, because lamb has an established and loyal consumer base, yet the heat would come out of the market and purchasing patterns would adjust. This could present short term pricing pressure or at least dampen some of the momentum currently present in export returns. The timing of any slowdown also matters. If Australia enters a flock rebuild at the same time US demand softens, margins for processors could tighten before the reduced supply environment begins offering natural price support.

These three developments form the central narrative for the sheepmeat and lamb sector as 2026 approaches. A flock rebuild would tighten Australian supply and improve the medium term price outlook. The sustained contraction of the New Zealand flock gives Australia increasingly unchallenged access to expanding global demand, strengthening its competitive position in both premium and commodity channels. The risk of a US recession sits as a counterweight, reminding the sector that even strong supply side fundamentals can be disrupted by macroeconomic conditions. The combined influence of these forces will define market behaviour throughout the year. Producers, processors and exporters will need to track them closely, not because any single one will determine the market, but because together they shape the strategic landscape. If the seasonal break is favourable, the flock rebuild gains traction and the US avoids a deep downturn, 2026 could become a transitional year where supply tightens at the same time global competition eases. If the US economy weakens more sharply, exporters will need to focus more heavily on diversification and on building resilience into their customer portfolios. Either way, the sector enters 2026 with a clearer structural advantage than in the years immediately prior, with opportunities emerging for those who position early and actively observe these three critical themes.