A year in review – Part 1: Grains and EP3

2021

2021 has been another ‘interesting’ year for everyone. It’s the end of the year, a time for reflection on what has happened during the past orbit of the sun. At the end of 2020 there was an expectation that things would return to normal. That clearly hasn’t happened.

Firstly thanks to everyone who has supported the development of EP3. The best way to continue to support is through your retweets, and sharing articles with your friends and family – and encouraging them to register.

That being said, it’s time to do a review on EP3 and the grain market.

So what have we been upto?

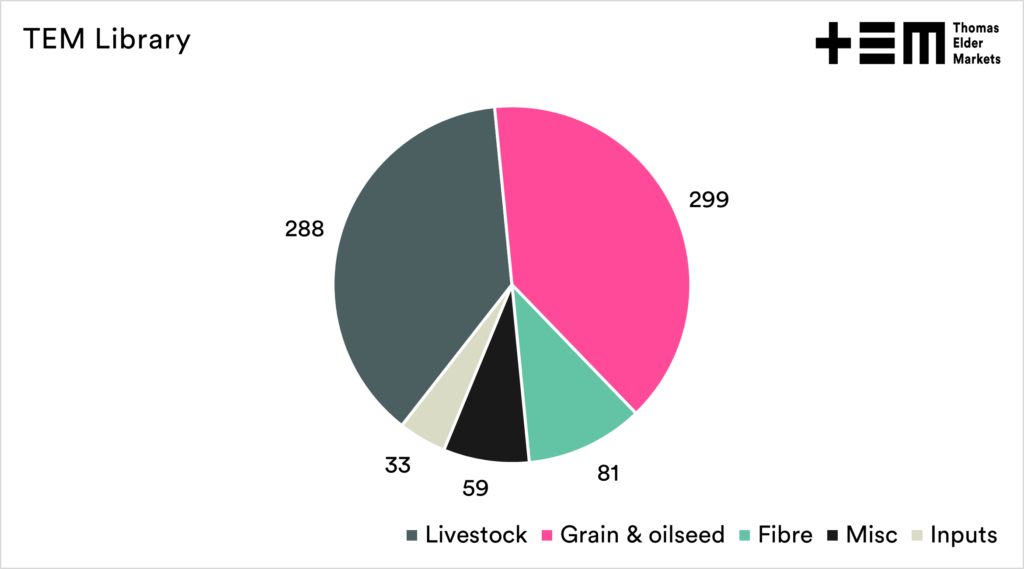

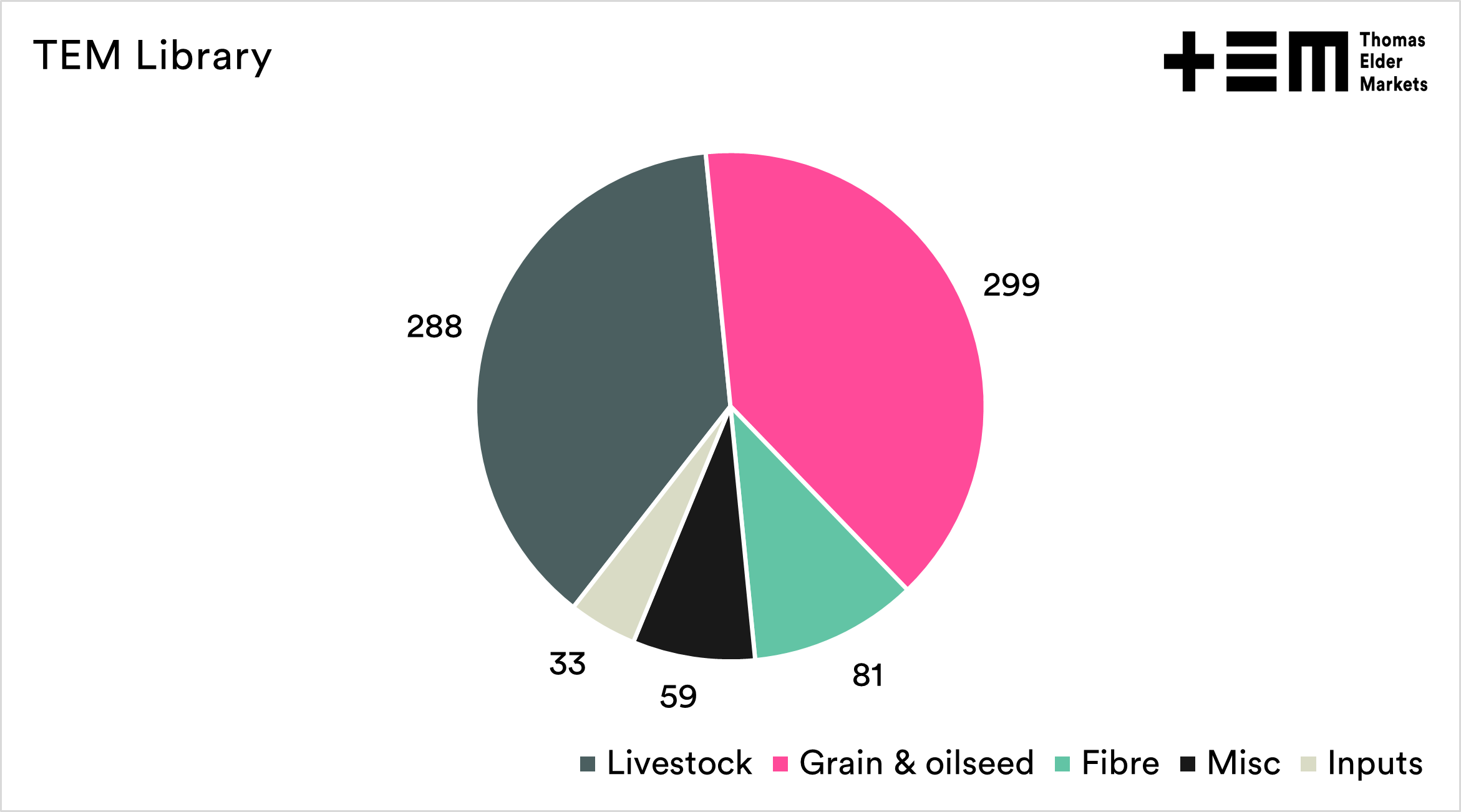

At EP3, we want to change the way agricultural market intelligence is delivered. We want it to be accessible. As of this moment, the website has been running for 505 days. In that time, we have published 760 articles across a wide range of topics.

Our aim is to get relevant, timely, and independent information to you. All our analysis is based on data, and the occasional opinion.

We continue to work with analysts around the world and introduced content on pulses from Guarav Jain, the black sea markets with Andrey Sizov and the wool market with Andrew Woods.

In recent months, we have also partnered with AgFlow, where we will use their data and provide them with articles for their members worldwide. All these partnerships and future ones are in place to improve our offering.

We also have to make a crust, and we do that in separate project work from what you see on the EP3 website. Here are some examples of the work we have done this year:

- Due dilligence on large scale land purchases and agricultural infrastructure.

- Wrote the Australian Pork state of the industry report.

- Advice on markets to a large number of consumers and investors.

- Provision of data for grain state of the industry report.

- Grain marketing guidebook for Grain Producers South Australia.

- Report on the Queensland Sheep Industry.

- Presentations and workshops on markets.

What has the market done?

Energy:

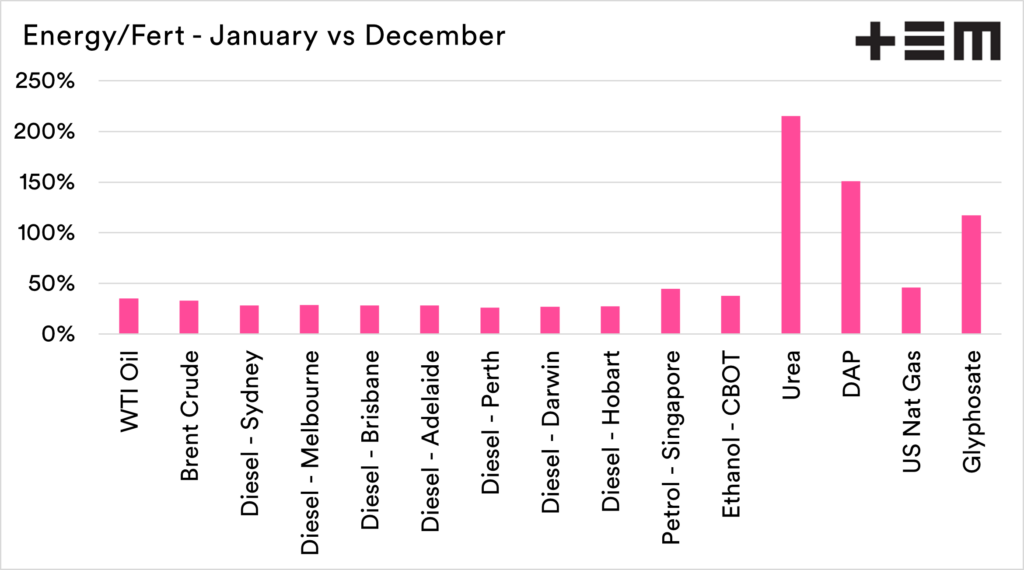

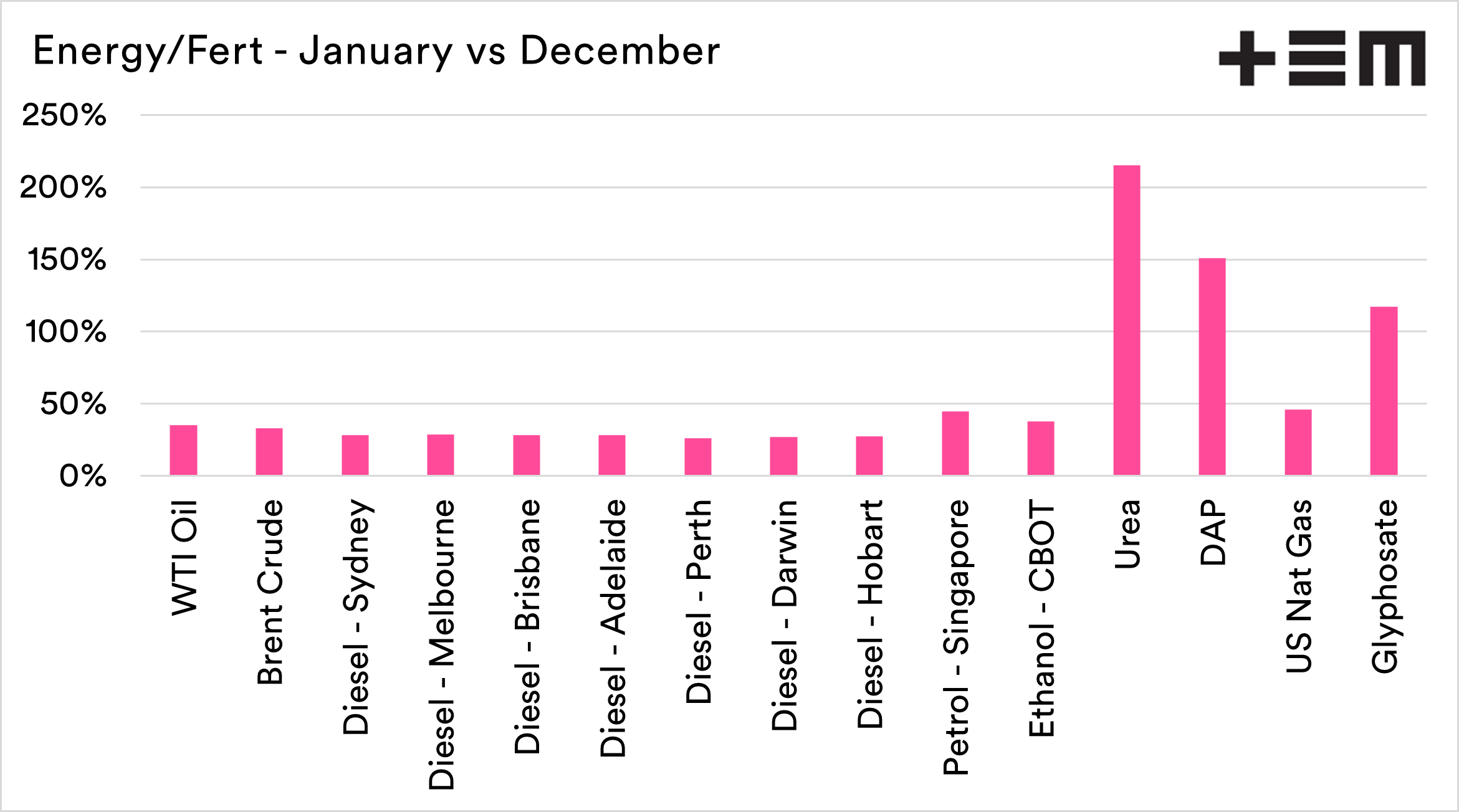

Energy is one of the biggest inputs in agriculture. The obvious uses are fuel for our machinery and also for the logistics to get our commodities to market. A large number of our inputs are also heavily energy-intensive in their production (chemicals and fertilizers).

The chart below shows the percentage change for a range of energy-related resources between January and December. They are all up.

Fuel costs in Australia are up on average 28%, which has increased the cost of operating this harvest. The big-ticket item and one I have discussed throughout the year is fertilizer. Since January, we can see a 215% rise in Urea and a 150% rise in DAP/MAP.

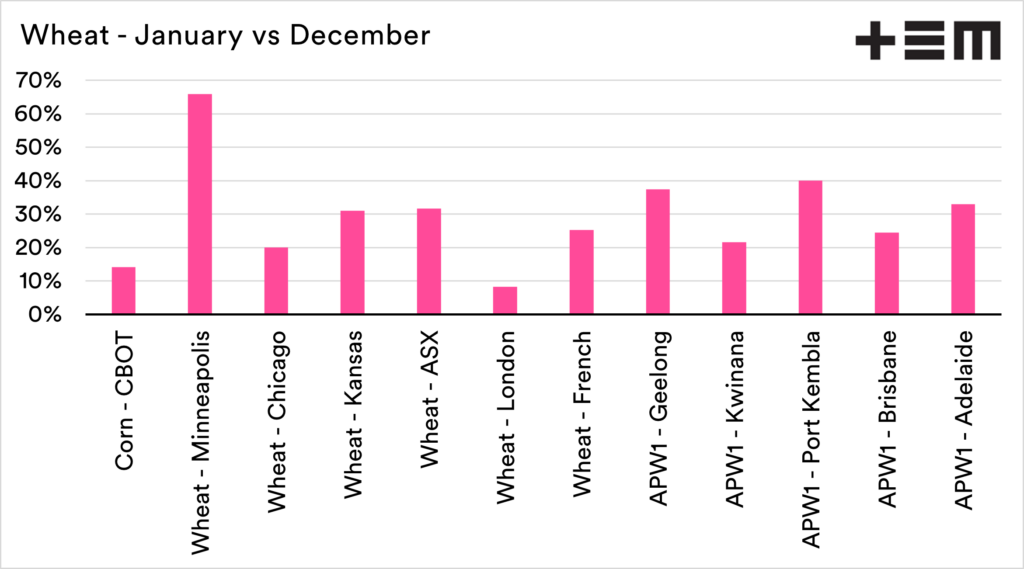

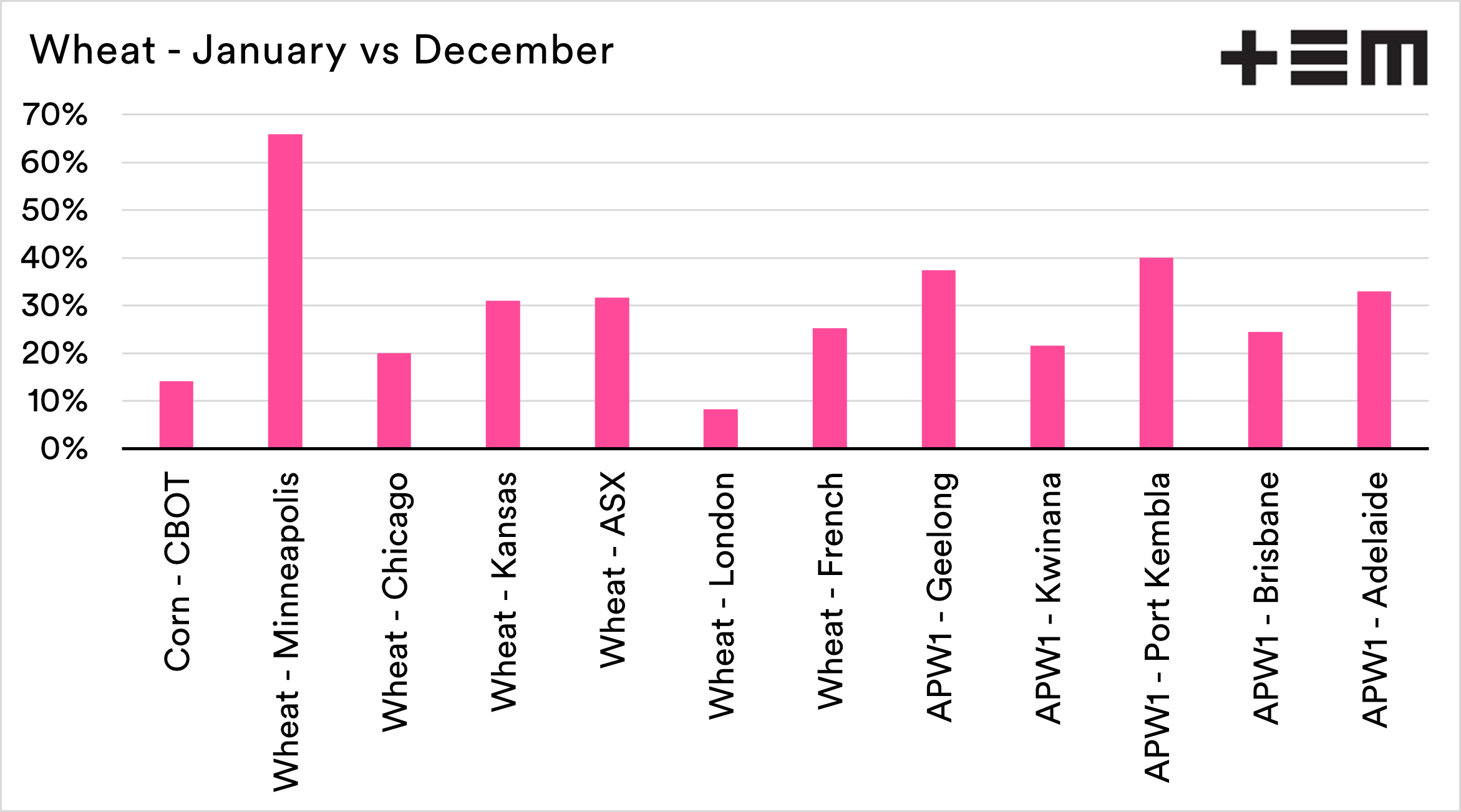

Wheat

A tremendous production year in Australia, with the crop hitting record levels. The wet finish has caused some downgrading of the crop, with discounts to lower grades hitting record levels but overall still a crop that will be profitable.

Two years of large crops in Australia have resulted in our basis levels remaining weak for most of the period.

A new La Nina forming could be beneficial for our crops in the coming year – can we make it three years of large crops in a row?

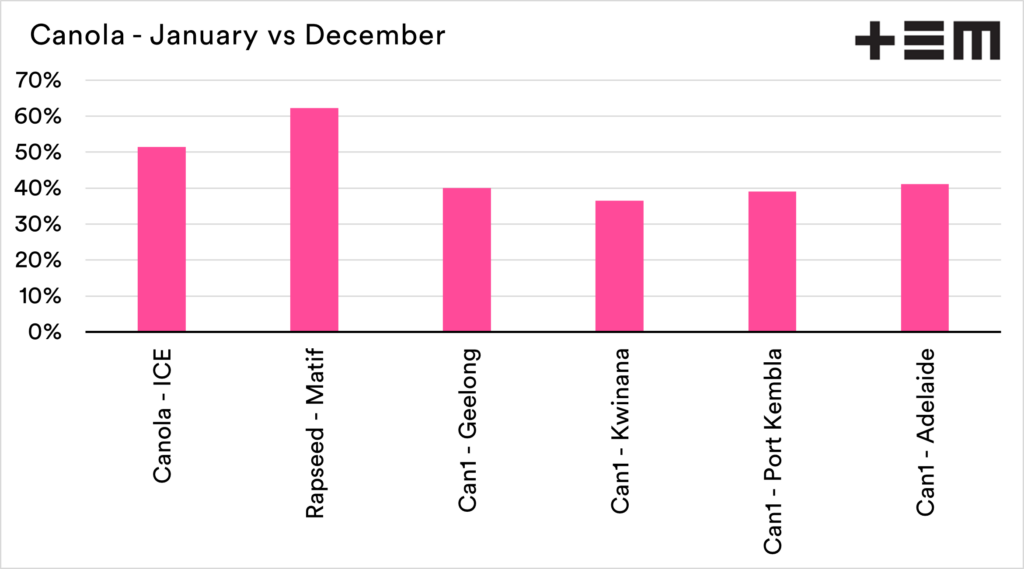

Canola

Canola has been golden this year. A drought in Canada reduced the world trade in canola (see here), and no country could replace the volume lost.

Australia has stepped up with record production and a much larger than average export program. However, it still left a deficit, and global trade in canola is set to be down 3.5mmt.

Our canola price has risen dramatically across the board at a flat price level. Through most of the year, our basis levels have been weak. A weak basis to ICE is expected because it effectively is a ‘drought’ premium in Canada.

The question now is, when stocks start to build up, will Canada get themselves sorted and get back to the high levels of recent years.

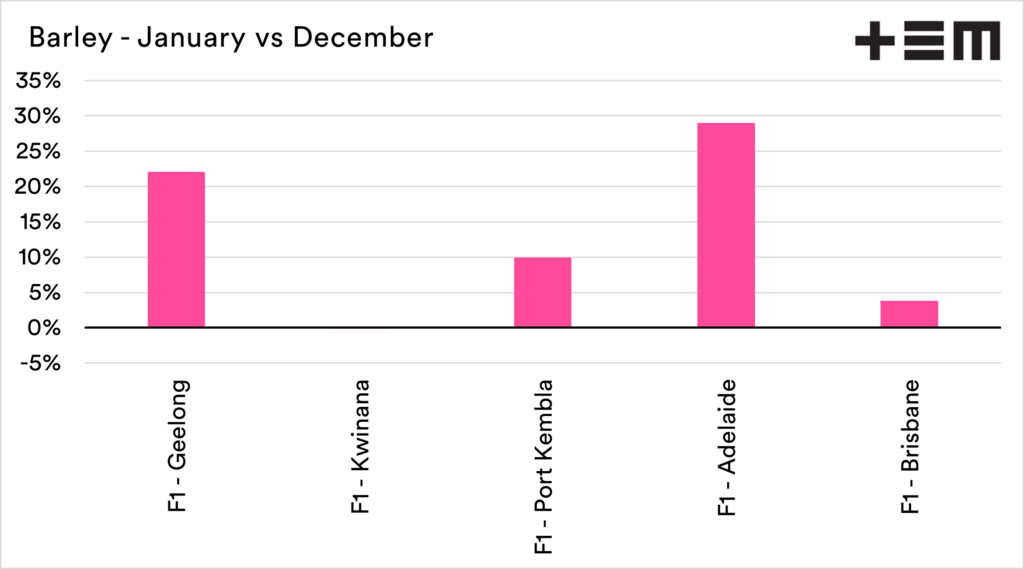

Barley

Barley is still heavily impacted by the trade issues with China. There is a WTO action against the nation, but that may take some time to get a result.

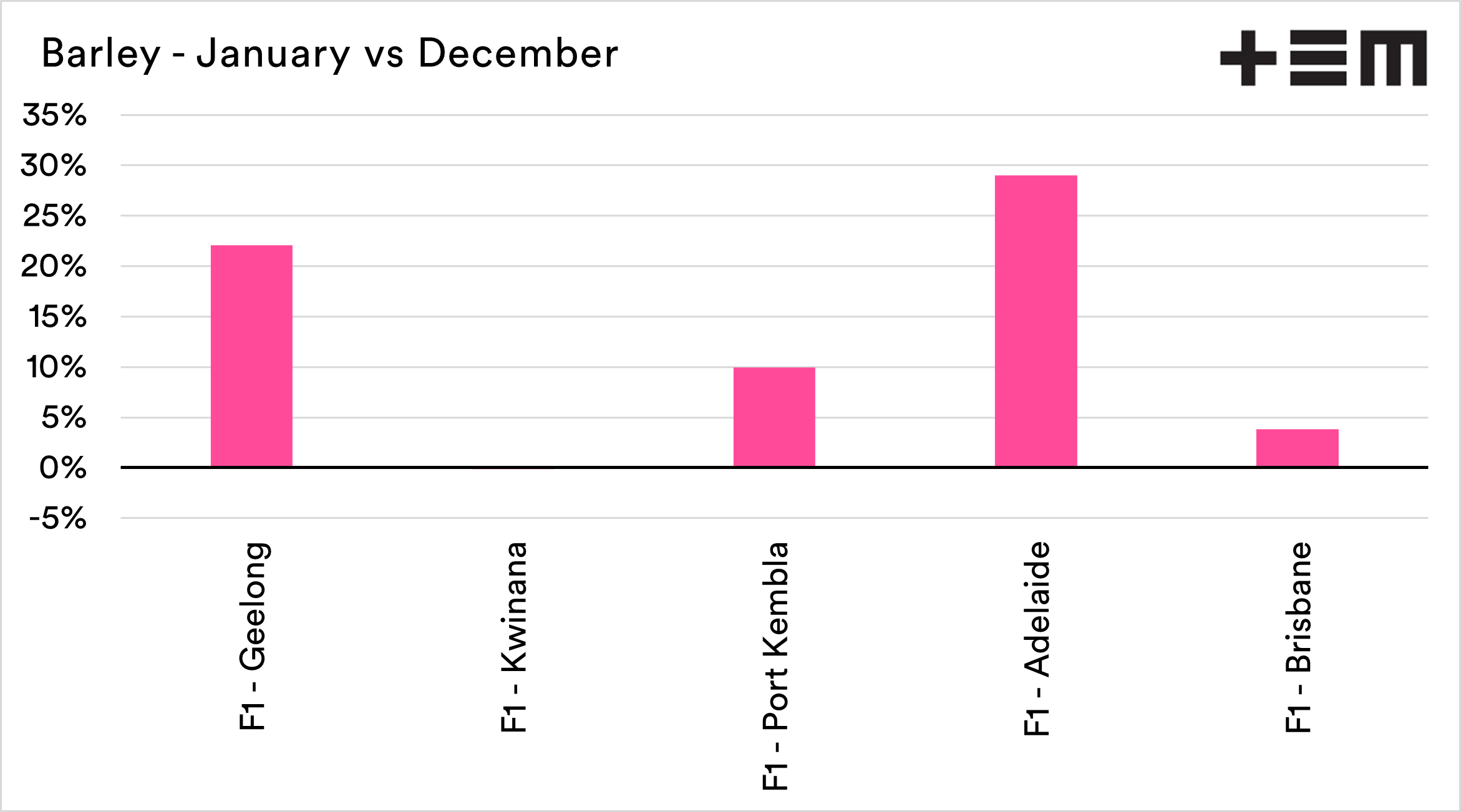

The barley price has been a mixed bag. Adelaide has had a strong performance percentage-wise, whereas Kwinana is largely unchanged.

My big concern with barley is that there is a huge amount of risk. Barley prices have remained relatively strong on a flat price level due largely to events overseas, but we have several years left on this tariff

Final thoughts for 2021 and 2022

2021 has been messed up in many ways and has really caused some major issues around the world with the lingering impacts of COVID-19. Largely though, agriculture hasn’t been impacted, in fact, most of the impacts have been positive in terms of our outputs. 2022 should in theory be a year when the world returns to normal, although I’m not holding my breath.

From an agricultural point of view, let’s hope that a continued La Nina brings decent rainfall around the country, and potentially depletes rainfall in other parts of the world helping drive pricing higher.

Inputs have been a large talking point this year, and one that we have been at the forefront of ensuring that people are informed about. Through our discussions with other fertilizer and energy analysts, we are hopeful for pricing to start declining in the second half of 2022.

My final thought is that whilst these good times are currently rolling, we want to ensure that we are using this time to plan for the future. It won’t always be as good as this.

Merry Christmas to you and yours.