Joining a pair of tools.

The Snapshot

- The commitment of traders report gives an idea of the sentiment of traders.

- There is a trend of speculator position following price (and vice versa).

- Deciles are a powerful tool for determining where the price is compared to a period of time.

- We have combined these two tools to give an indication of which markets are heavily bought/sold versus pricey/bargain.

- This can be used to get a stronger view of the overall market through combining deciles on price versus deciles of speculator commitment.

The Detail

Speculators, love them or hate them, provide liquidity to the market. We love speculators when they drive the market higher, and we hate them when they drive it lower.

The commitment of traders report which comes out every week provides an insight into their view of the market. At its most basic, if they have bought a lot of contracts, they are ‘betting on the market going higher. Conversely, if they are selling contracts, they are expecting the market to fall.

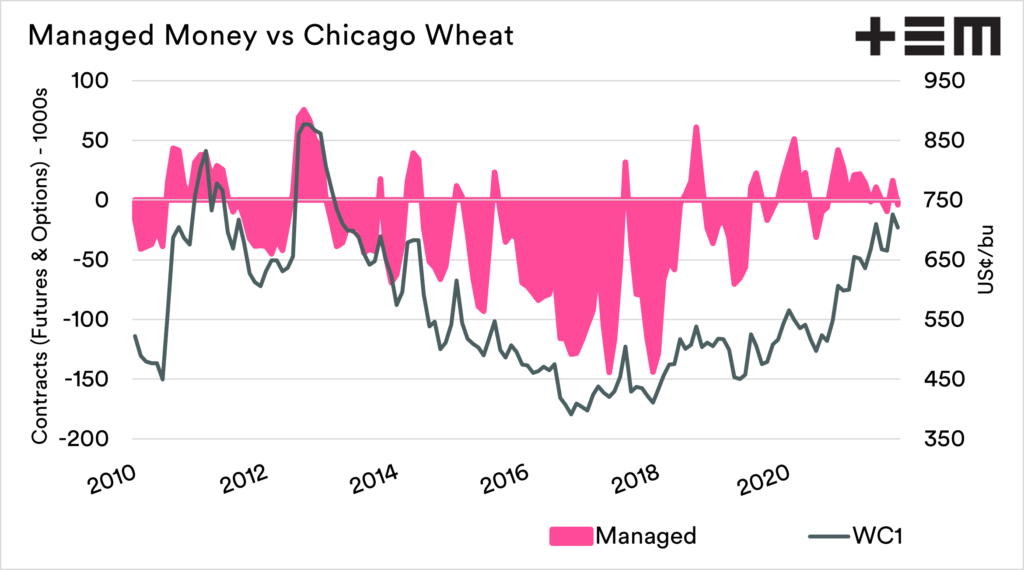

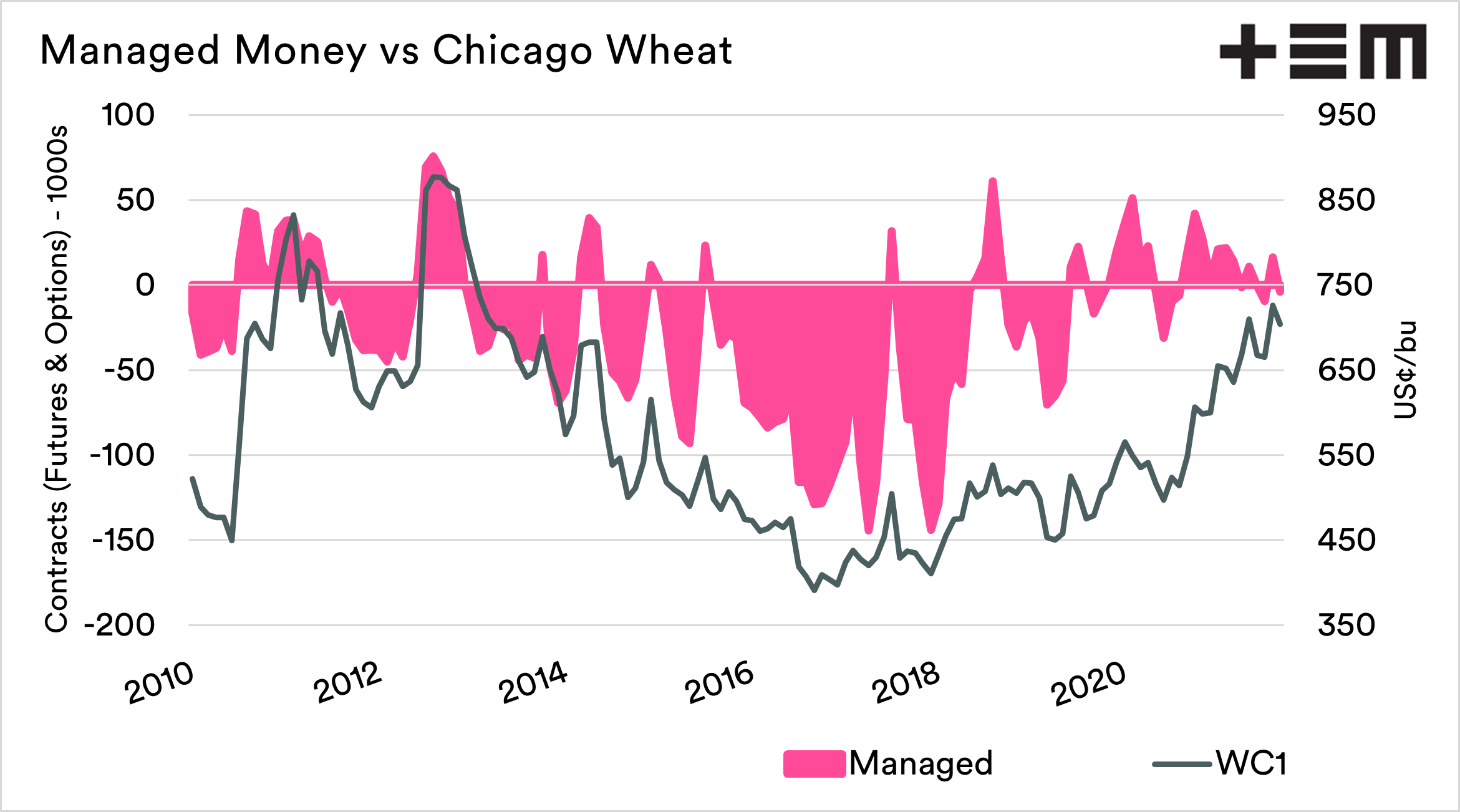

The chart below shows the position of speculators against the Chicago wheat price, on a monthly average. As we can see, there is a similar trend between the two. The monthly correlation is 0.68, with 1 being a perfect correlation and 0 being no correlation.

The commitment of traders report is a handy tool, and I wanted to combine it with another handy tool – deciles.

Deciles are a handy tool, which can be used to get an understanding of how high (or low) the current price is in relation to historical pricing. A decile table measures how often, historically, prices have fallen above (or below) a particular pricing point. You can read our most recent deciles for Australian where here.

So how do we combine these two valuable tools?

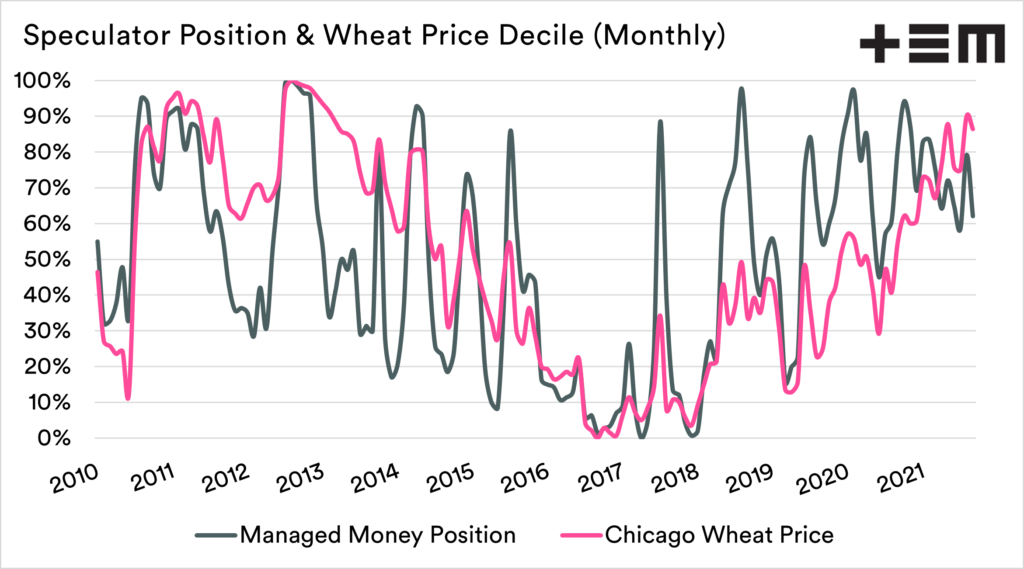

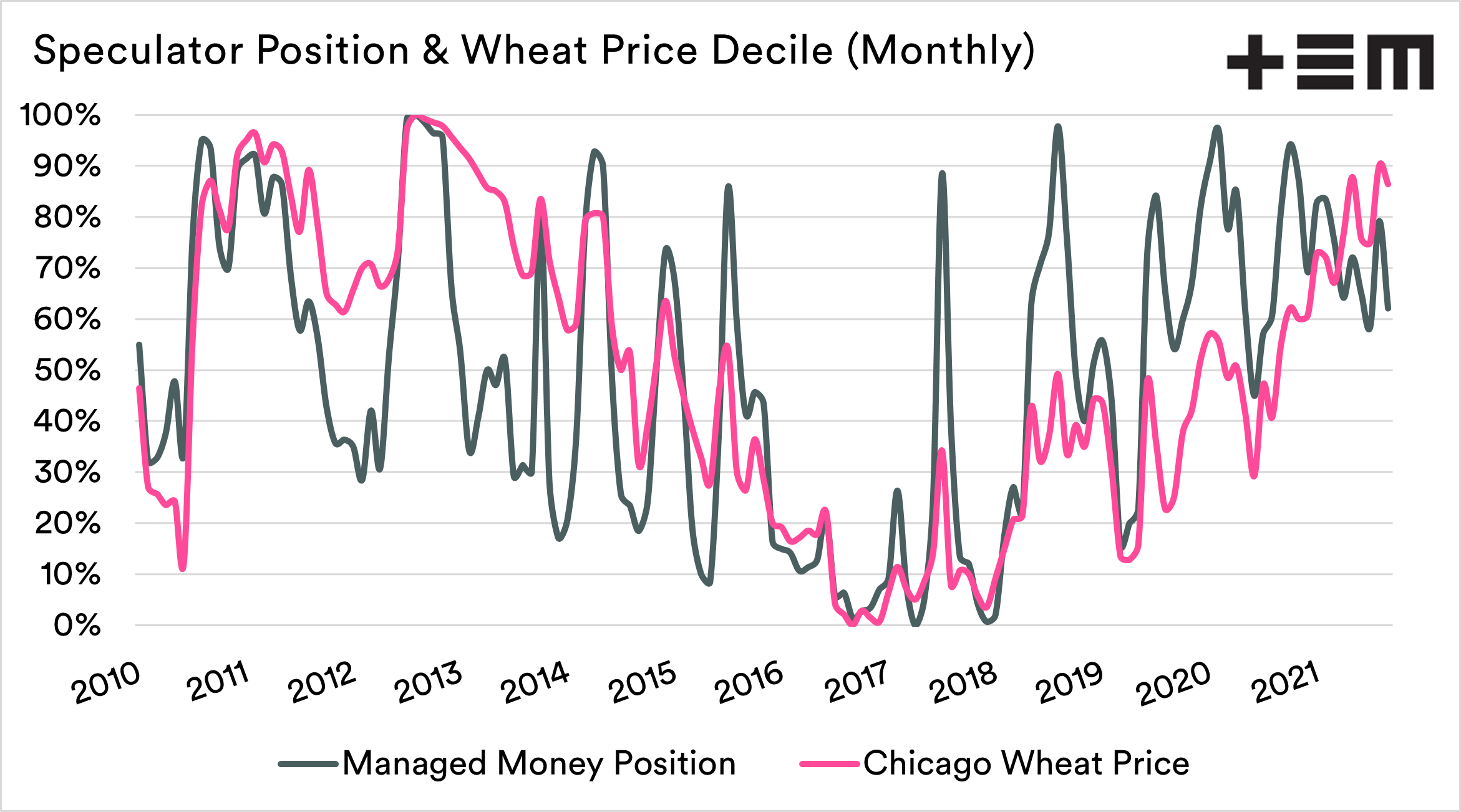

Let’s start with looking at the decile ranking of both speculators position and wheat pricing. This looks at a monthly basis and records where the decile was each month for the time period 2010 to present.

There is quite a tight trend between speculator position and wheat price. The relationship is even more obvious. Speculators have a higher long position when prices are high and vice versa.

Cheap commodities?

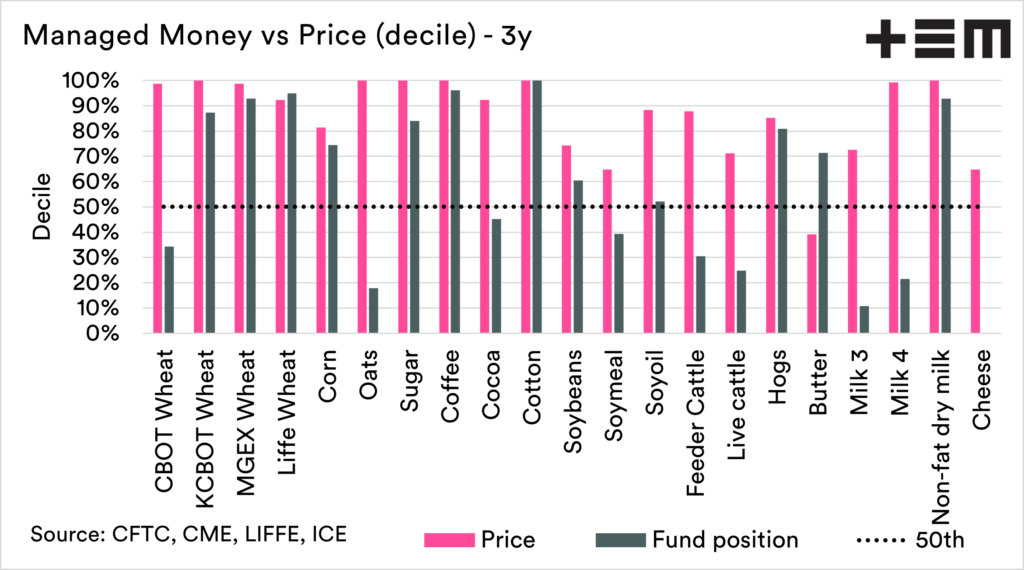

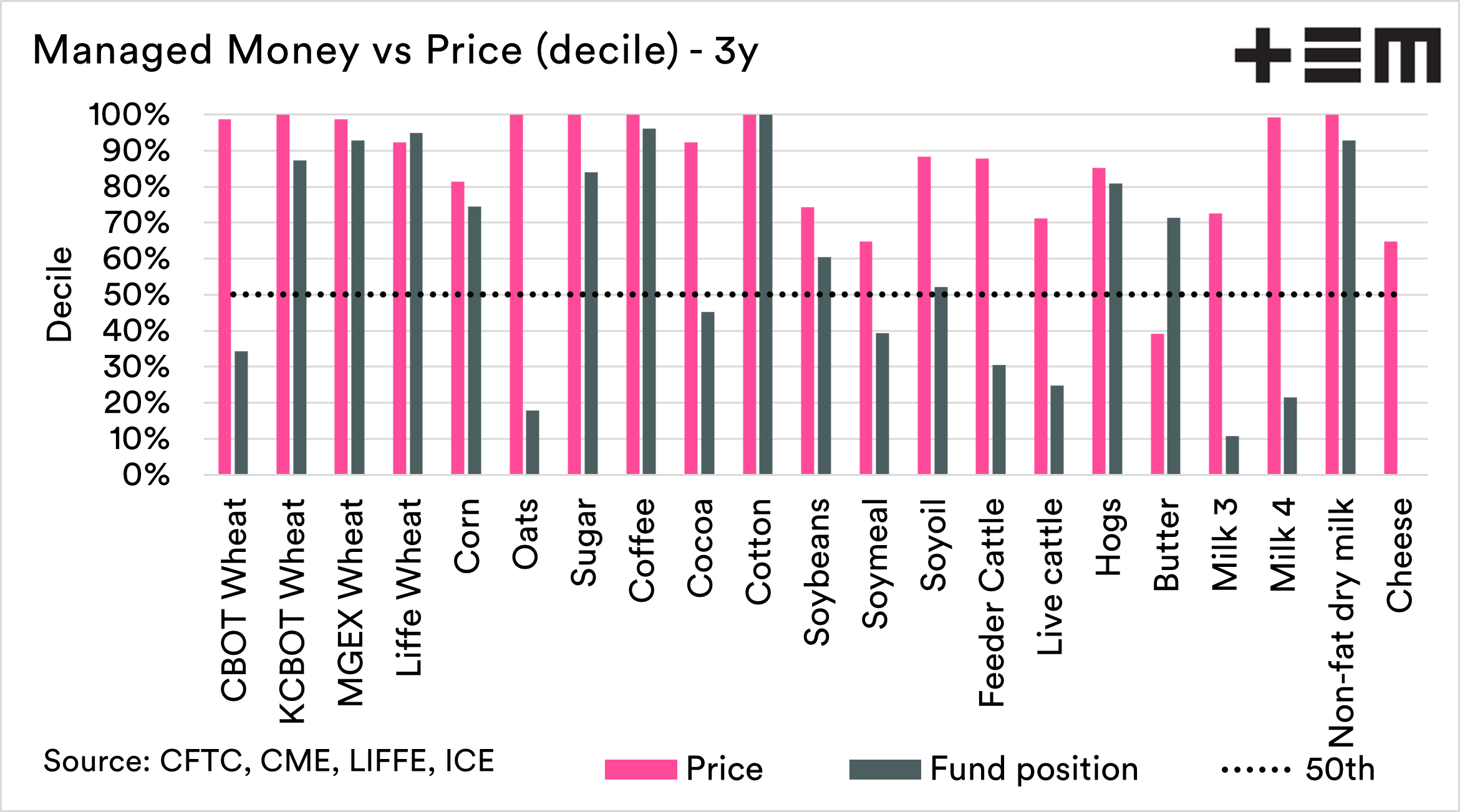

If we are going to look at one commodity, we might as well look at a whole bunch of them. The chart below displays the decile ranking for both the net position of the funds and the underlying commodity price over a 3-year time frame.

By combining deciles on both the price and commitment, we can understand whether a commodity is heavy sold/ heavy bought compared to the price.

Let’s look at a few examples. On cotton, the speculator position is heavily bought, but the price is also high. This could be considered heavy bought/pricey.

Conversely, oats and Chicago wheat are in a similar position to each other, with high prices compared to the past three years, but with low bought positions.

What we can is that the majority of agricultural commodities are in the ‘pricey’, with only butter getting close to the ‘bargain’ level. The speculators, on the other hand, have a few commodities where they are heavy sold.

How can we use this?

We can use this like any other decile table; we can get an idea of how high pricing levels are compared to history. Whilst it’s not a perfect science, it can give an indication of whether we are close to the top (bearing in mind that the top can keep increasing).

Conversely, if the speculators are heavily bought in a position, it could see them move to take profits and close their positions, which can have short term impacts on the pricing. Likewise, if they are heavily sold, they may enter the market.

Through combing two tools, the COT report and deciles, we can get an improved picture of the state of both pricing and sentiment.

If you liked reading this article and you haven’t already done so, make sure to sign up for the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.