Market Morsel: What is the A$ forecast?

Market Morsel

Earlier in September I briefly discussed what some of the main drivers of the Australian dollar in the article ‘For FX sake’. In this article, we take a look at the forecast provided by the banks and examine how accurate they are.

The A$ has a huge impact on Australian agriculture. The worlds commodities are traded in US$, and we export most of our produce. If the A$ increases against the greenback, then our exports become less attractive, the price received in A$ drops to make our exports competitive.

This is all something that you will all be aware of, but how accurate are the banks at forecasting where the A$ will be in the future?

Refinitiv (formerly Reuters) polls each of the major banks on their view of the where the A$ will sit at a future date.

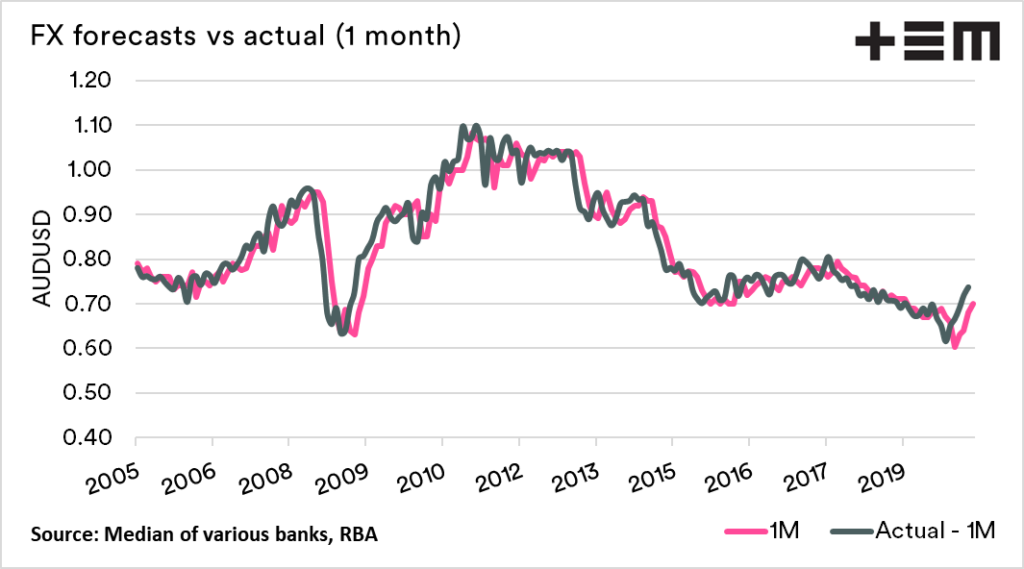

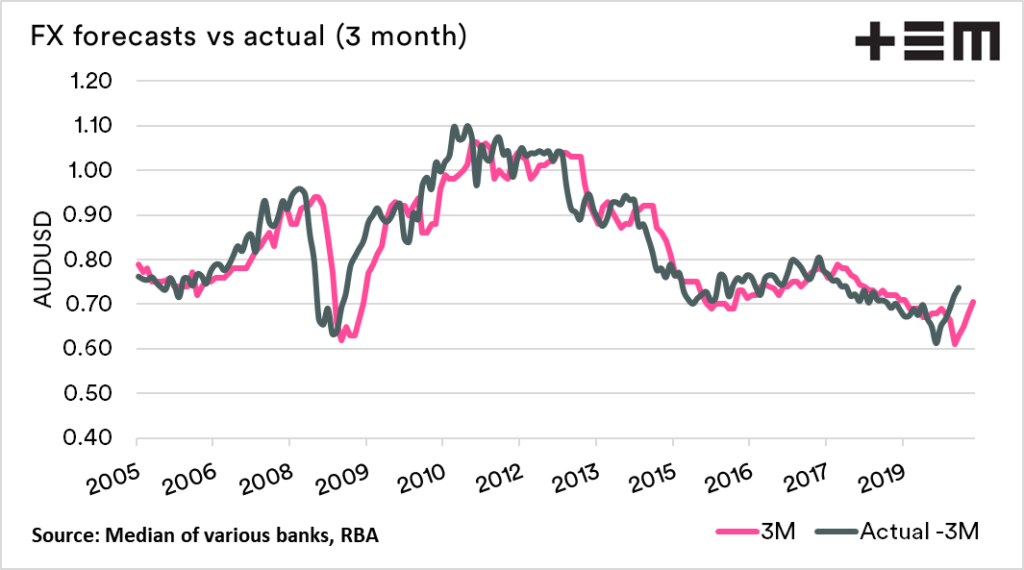

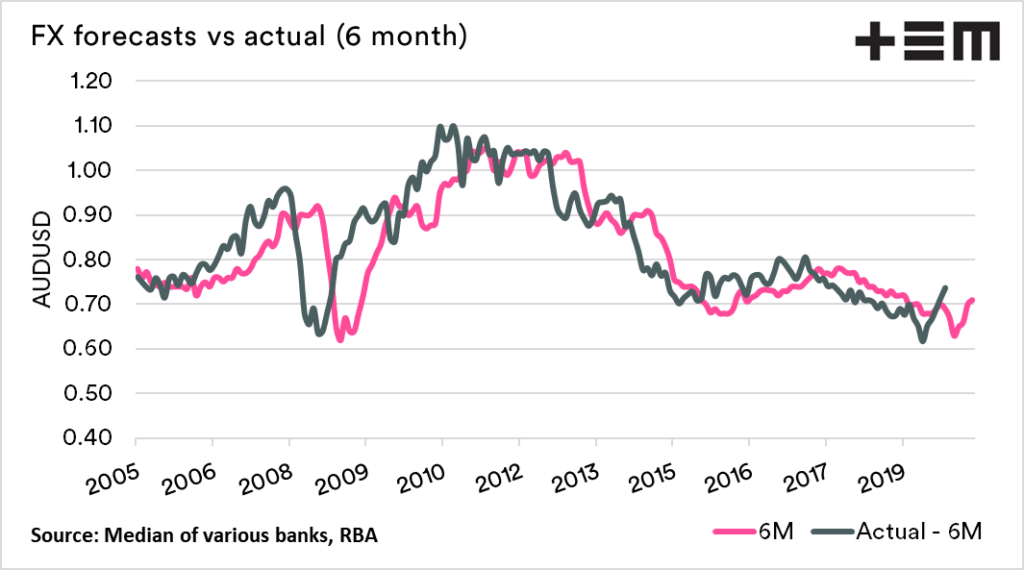

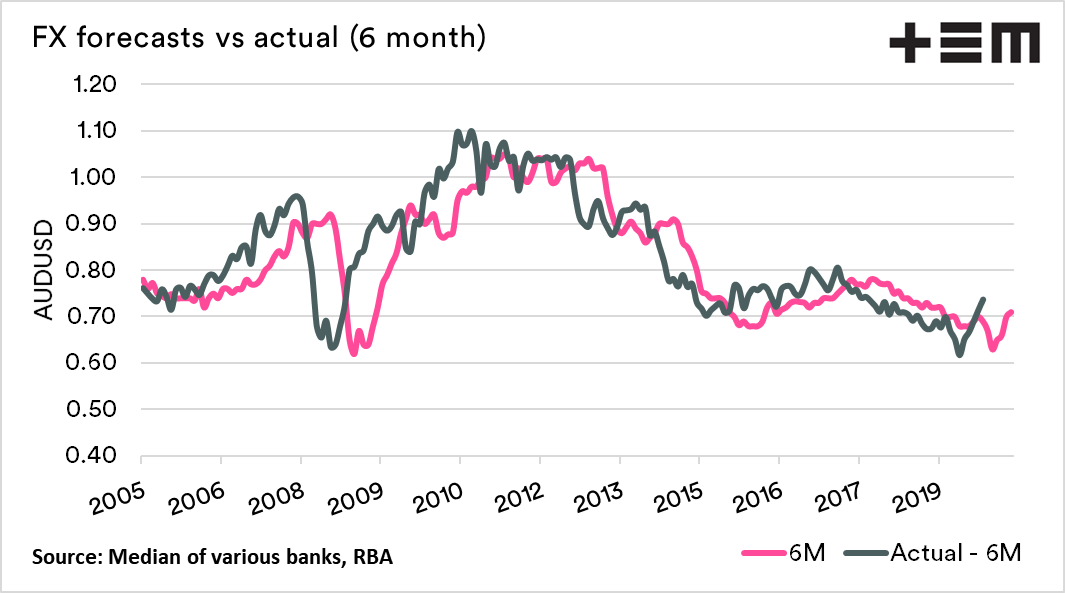

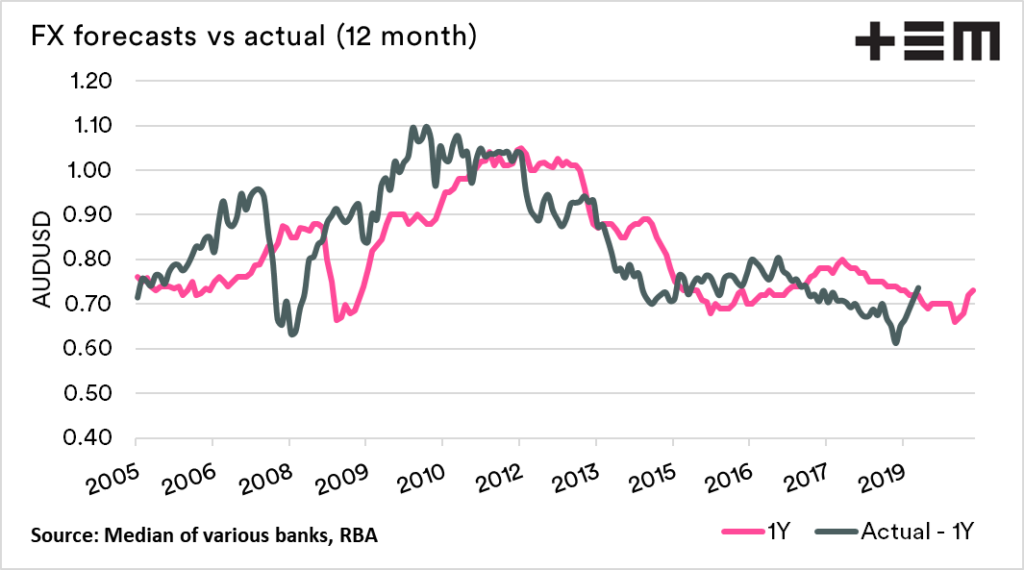

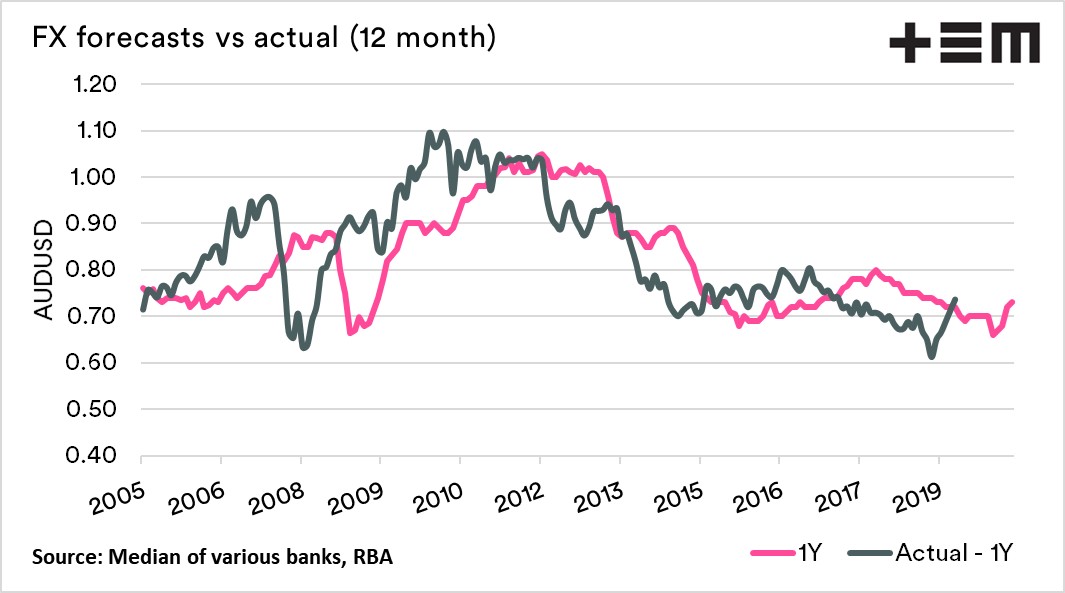

This forecasts we are examining are for where they believe it will end up in 1, 3, 6 & 12 months time. Rather than pick on a couple of banks, I decided to use a median of all the forecasts. The forecasts were then compared against where the actual A$ ended up.

As an example, on the 31/7/2020, the median forecast for the 31/8/2020 was a rate of 68¢. The actual A$ rate on the 31/8/2020 was 74¢. This analysis was repeated for each period of forecasting going back to 2005.

The A$ has periods of volatility, but overall, it is largely quite predictable in the short term. It doesn’t come as a surprise that if you take the median of dozens of forecasters putting their view for a month together, that it actually tracks reasonably well.

As the forecast moves further into the future, the view becomes hazier. The charts below show the relationship between the forecast and actual for the four main periods.

For your info, the current median forecasts as of the start of September are:

- 1m: 70¢

- 3m: 70.5¢

- 6m: 71¢

- 12m: 73¢