Should a trade deal faze Australia?

The Snapshot

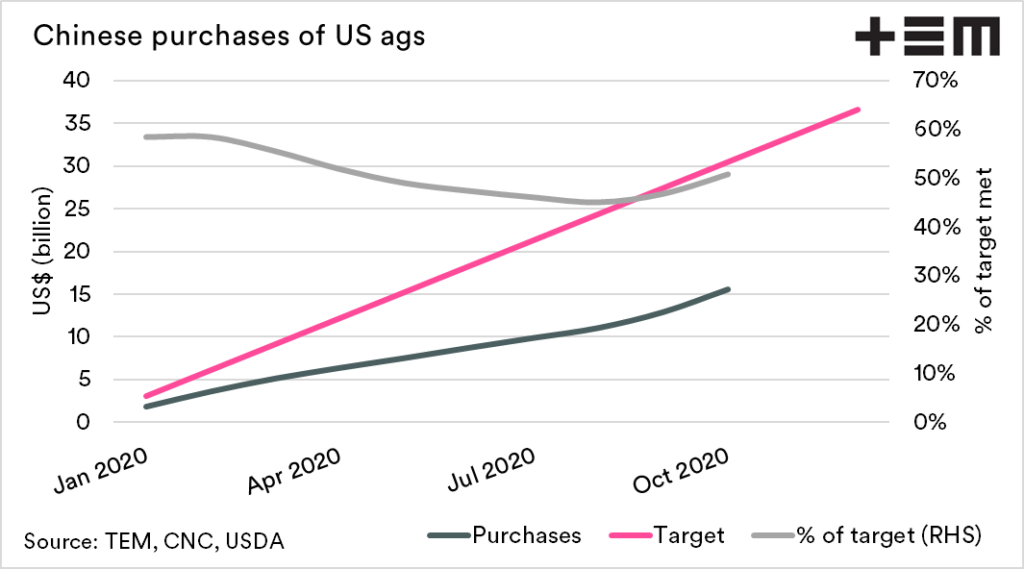

- The phase 1 deal requires China to purchase US$36.5bn of Ag products during 2020.

- This increases to US$43.5 in 2021.

- China will not meet its target during 2020. They are currently at 51% of where they should be, based on an even pace.

- They are unlikely even to meet their pre-tariff import levels.

- The phase 1 deal effectively forces China to preference the US over other origins, to protect its export industries.

- Trade disruptions into China have impacted 5 out of 9 commodities identified as at risk at the start of 2020.

- The big question is how the Biden administration will deal with China. Whilst the deal is in place, Australian commodities are likely to continue to feel pain into China.

The Detail

Trump will be out of the white house by the end of January; his legacy is likely to remain for some time, and it will impact us.

One of the most prominent marks which Trump made on agriculture was the trade war between China and the US. Trump hit out with tariffs against Chinese imports, which resulted in China slapping hefty tariffs on a range of US agri-products.

The result was that a large volume of products usually sourced from the US switched to other origins. The biggest example was the large switch of soybeans from the US to Brazilian.

The two nations got to the negotiating table at the end of 2019, and agreed the phase 1 deal. This was an agreement that China would purchase a large volume of various products in 2020 and 2021.

The area we are focused on is the agreement concerning agricultural commodities. The terms of the deal were that China would purchase US$36.6bn, a significant rise above the US$24.1bn in the pre-tariff year of 2017.

The EP3 team have been discussing the phase 1 deal as a major challenge for Australian agriculture for the past year, as we expect that China will have to preference good from the US in order to protect their export markets.

Has China achieved its target?

The data from this analysis has been taking from the monthly data provided by the Chinese customs authority. To determine the agricultural products, I have selected the import values for a range* of products from January to October.

In recent months China has ramped up their purchases (see here), with US$5.7bn in the period August-October, versus US$3.5 for May-July.

As mentioned, China has a target of us$36.5bn in ag purchases from the US by the end of 2020. On a consistent basis, China should have imported US$30.5bn by the end of October to meet the pace required.

As of the most recent customs data (October), China has imported US$15.5bn. This is 51% of where they should be.

At present they will need to import US$21bn during November and December. Whilst the export program has been ramping up, it will not achieve its target. It is unlikely that they will even hit the 2017 level of US$24.1bn.

How does this affect Australian agriculture?

Earlier in this piece, I mentioned how tariffs against the US resulted in China purchasing soybeans from Brazil. This is the reality of trade when barriers are put in place the flow of commodities changes. We already see this with the change in flows in the barley trade to China (see here).

Our concerns were that this trade deal would discourage Australian purchases. In January, we examined the products which we believed that based on the numbers were at risk of being replaced by US product (see here). The most worrisome commodities were:

- Wood products

- Wine

- Beef

- Milk

- Almonds

- Crustaceans

- Barley

- Skins

- Malt extract

Those following the news will know that wood, wine, beef, crustaceans and barley have all had major issues into China in recent months. That leaves only almonds and milk as the majors from our list not impacted.

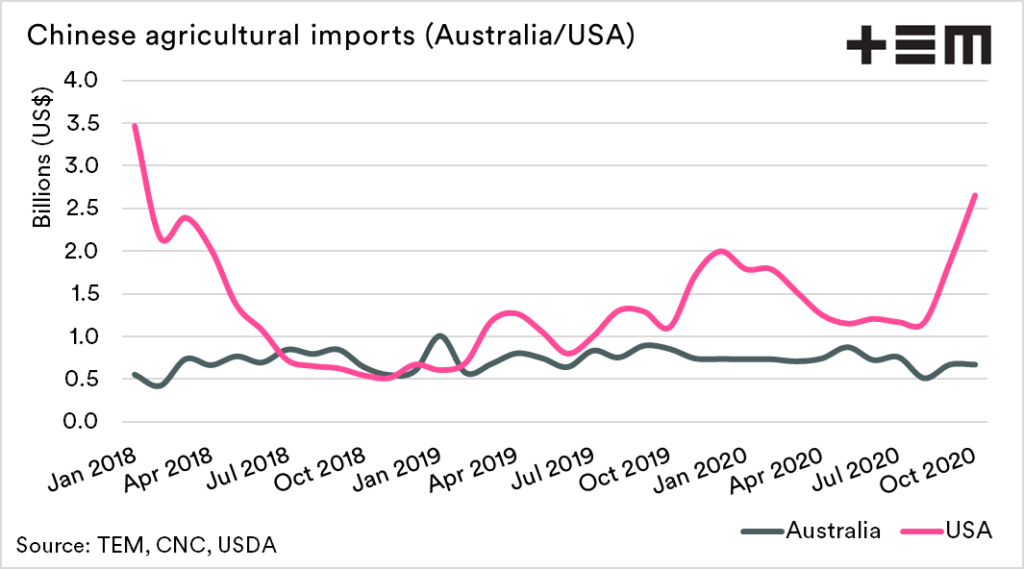

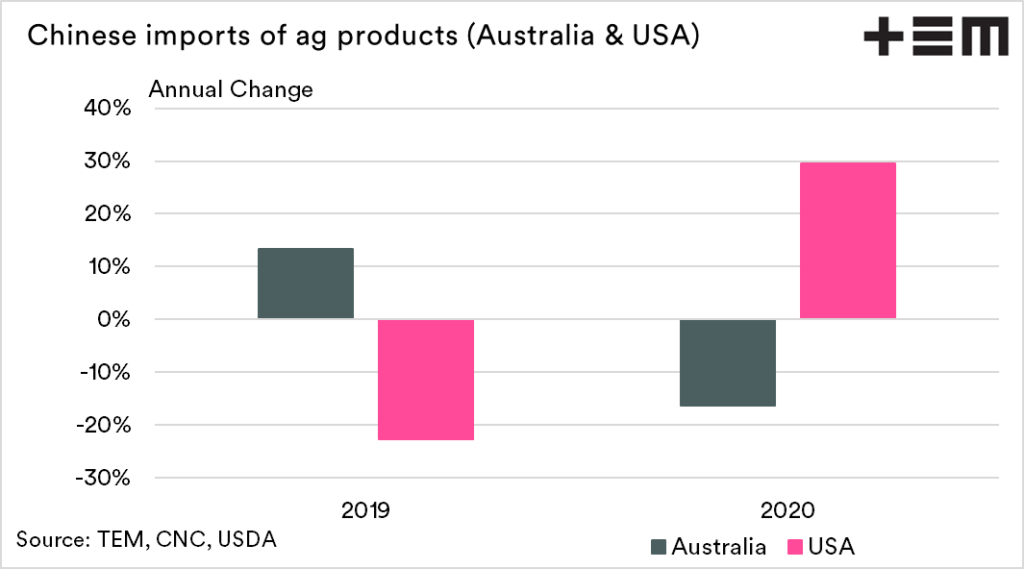

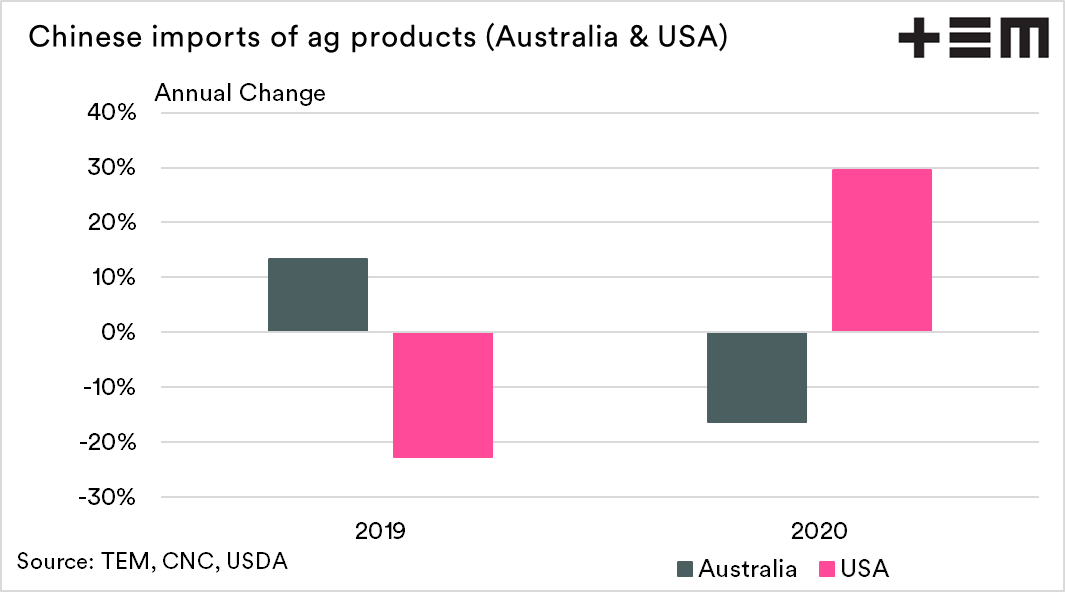

In 2019, Australia experienced a 13% rise in ag trade with China, at a time that the USA fell 23%. During 2020 this has reversed, with 2020 seeing a reduction in trade of 16%, and the USA jumping 30%.

What next?

China will not meet the target set by the US, and in 2021 this target rises from US$36.5 to US$43.5bn. The big question will be whether the relationship between the US and China changes with the new president.

There are expectations that Biden will take a soft approach; however, I do not think sentiment towards China has improved in the US.

If the target remains for 2021, then China will continue to preference US goods. If this eventuates, it wouldn’t be surprising to see more trade pain.