Market Morsel: Cotton candy

Market Morsel

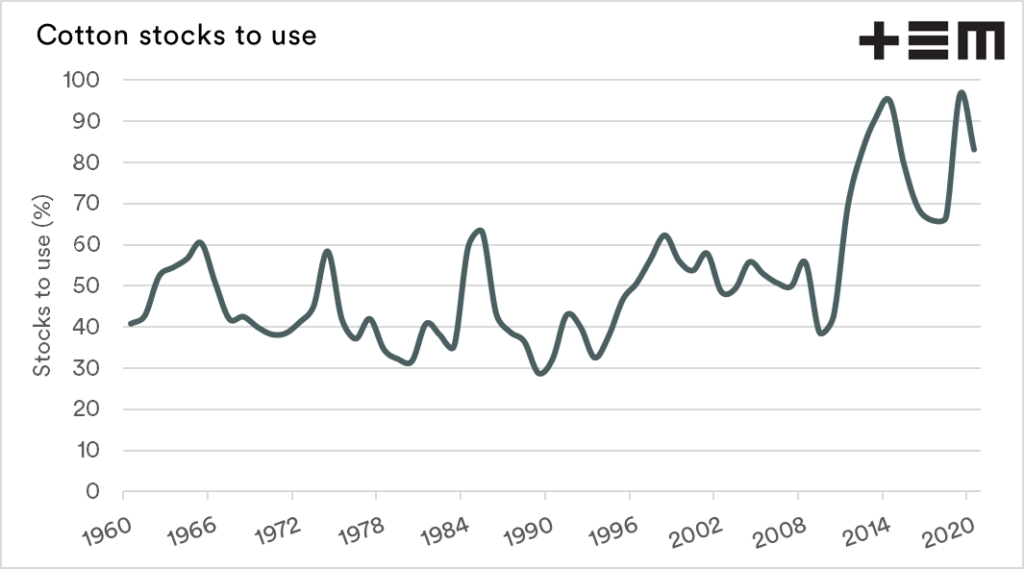

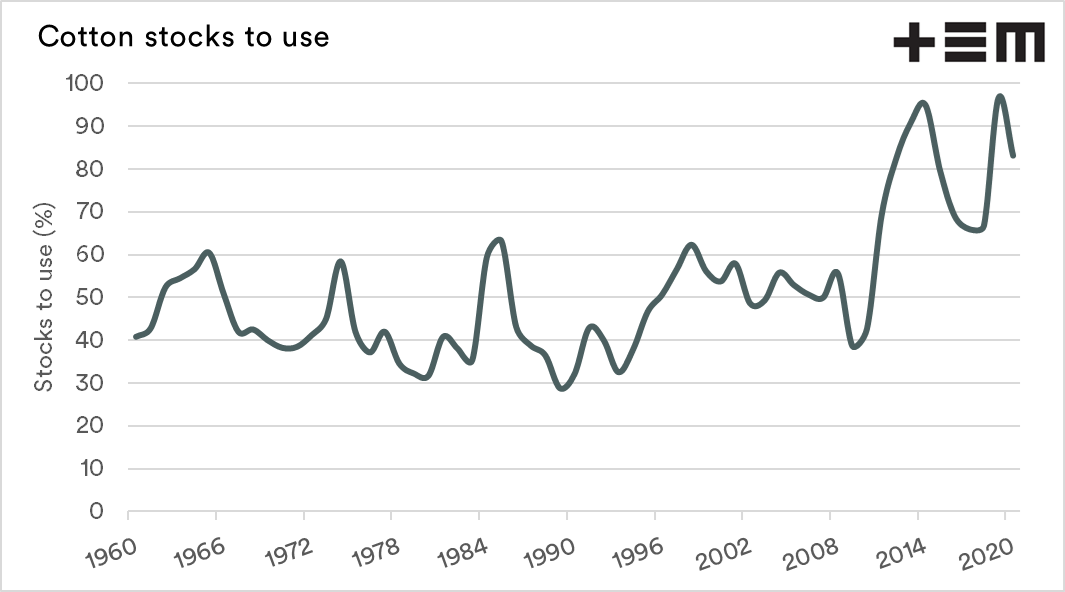

The last time we looked into the stocks to use (STU) of cotton was back in early October (see here), at that point the STU was 88.55%. The global STU has since dropped to 83.23%, as a result of production declines.

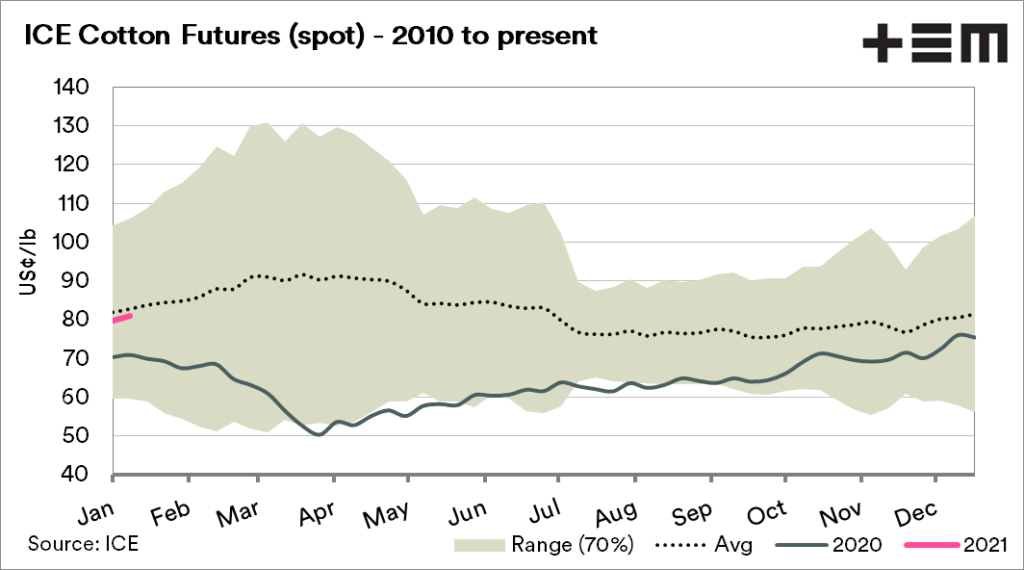

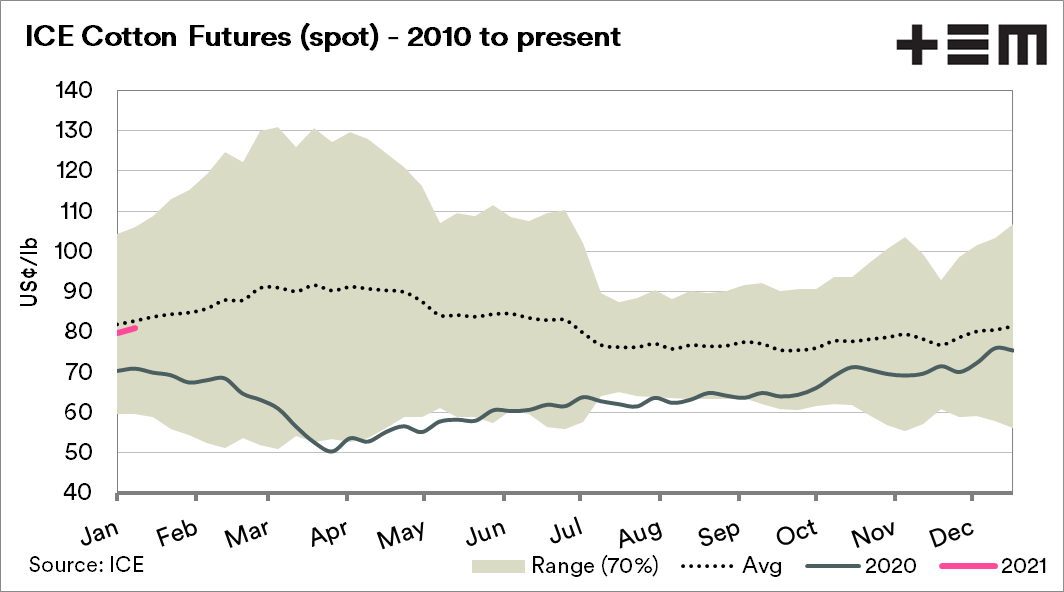

In 2020, we saw the lowest in the decade (ICE futures), when back at the start of April prices fell to 50.24US¢/lb. This was when the economy was at its most concerned about COVID. At this time, COVID had shut down most of China, a huge processor of cotton.

This meant that investments in consumer goods were low, causing all fibres to lose value. The cotton market has since, along with other fibres gained strength (see here for other fibres).

ICE cotton futures, which are representative of global pricing, display a strong seasonality. The first four to five months have a much wider range than the rest of the year.

Whilst we are only two weeks into 2021, the ICE price is currently just below the long term average. This is 14% higher than the same week last year.

Speculators are currently the longest that they have been in cotton since 2018, which is a similar pattern that is being experienced across the entire agricultural portfolio (see here). Whilst speculators are ‘betting’ on higher prices, it is no guarantee that higher prices will come.

At the moment, cotton is in a substantially better position than it has been in recent times. This increased pricing is especially important as Australian production comes back online.